IFRS Questions Exam 1

IFRS stands for:

(a) International Federation of Reporting Services.

(b) Independent Financial Reporting Standards.

(c) International Financial Reporting Standards.

(d) Integrated Financial Rep

...

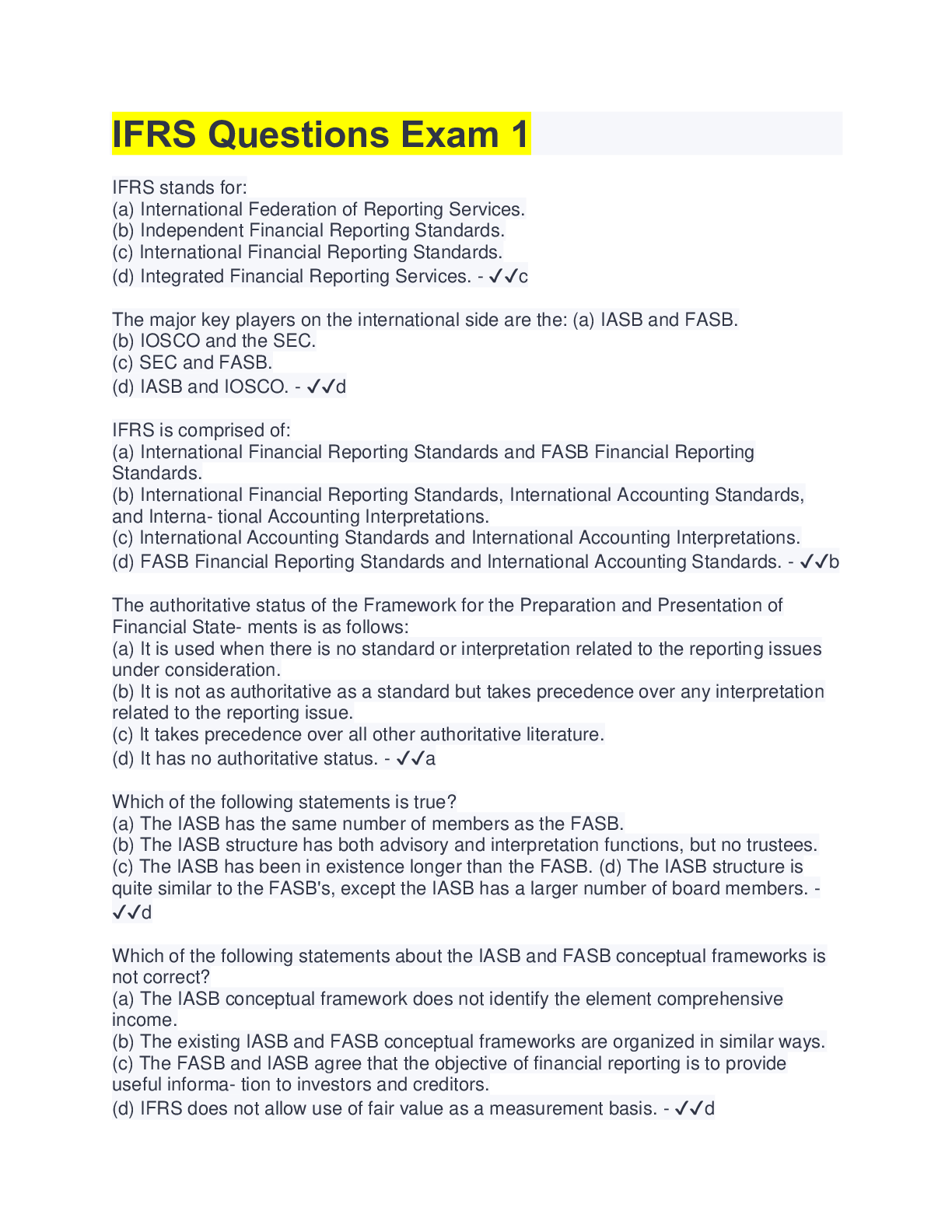

IFRS Questions Exam 1

IFRS stands for:

(a) International Federation of Reporting Services.

(b) Independent Financial Reporting Standards.

(c) International Financial Reporting Standards.

(d) Integrated Financial Reporting Services. - ✔✔c

The major key players on the international side are the: (a) IASB and FASB.

(b) IOSCO and the SEC.

(c) SEC and FASB.

(d) IASB and IOSCO. - ✔✔d

IFRS is comprised of:

(a) International Financial Reporting Standards and FASB Financial Reporting

Standards.

(b) International Financial Reporting Standards, International Accounting Standards,

and Interna- tional Accounting Interpretations.

(c) International Accounting Standards and International Accounting Interpretations.

(d) FASB Financial Reporting Standards and International Accounting Standards. - ✔✔b

The authoritative status of the Framework for the Preparation and Presentation of

Financial State- ments is as follows:

(a) It is used when there is no standard or interpretation related to the reporting issues

under consideration.

(b) It is not as authoritative as a standard but takes precedence over any interpretation

related to the reporting issue.

(c) It takes precedence over all other authoritative literature.

(d) It has no authoritative status. - ✔✔a

Which of the following statements is true?

(a) The IASB has the same number of members as the FASB.

(b) The IASB structure has both advisory and interpretation functions, but no trustees.

(c) The IASB has been in existence longer than the FASB. (d) The IASB structure is

quite similar to the FASB's, except the IASB has a larger number of board members. -

✔✔d

Which of the following statements about the IASB and FASB conceptual frameworks is

not correct?

(a) The IASB conceptual framework does not identify the element comprehensive

income.

(b) The existing IASB and FASB conceptual frameworks are organized in similar ways.

(c) The FASB and IASB agree that the objective of financial reporting is to provide

useful informa- tion to investors and creditors.

(d) IFRS does not allow use of fair value as a measurement basis. - ✔✔d

Which of the following statements is false?

(a) The monetary unit assumption is used under IFRS. (b) Under IFRS, companies may

use fair value for property, plant, and equipment.

(c) The FASB and IASB are working on a joint conceptual framework project.

(d) Under IFRS, there are the same number of financial statement elements as in

GAAP. - ✔✔d

Companies that use IFRS:

(a) must report all their assets on the statement of financial position (balance sheet) at

fair value.

(b) may report property, plant, and equipment and natural resources at fair value.

(c) may refer to a concept statement on estimating fair values when market data are not

available.

(d) may only use historical cost as the measurement basis in financial reporting. - ✔✔b

The issues that the FASB and IASB must address in developing a common conceptual

framework include all of the following except:

(a) should the characteristic of relevance be traded-off in favor of information that is

verifiable?

(b) should a single measurement method such as historical cost be used?

(c) should the common framework lead to standards that are principles-based or rulesbased?

(d) should the role of financial reporting focus on internal decision-making as well as

providing information to assist users in decision-making? - ✔✔d

With respect to the converged FASB/IASB conceptual framework:

(a) work is being conducted on the framework as a whole, and it will not be issued until

all parts are completed.

(b) work on the framework has a higher priority than projects on revenue and leases.

(c) work is being conducted on the framework in phases, and completed parts will be

issued as completed.

(d) the framework will not address measurement issues. - ✔✔c

Which statement is correct regarding IFRS?

(a) IFRS reverses the rules of debits and credits, that is, debits are on the right and

credits are on the left.

(b) IFRS uses the same process for recording transactions as GAAP.

(c) The chart of accounts under IFRS is different because revenues follow assets.

(d) None of the above statements are correct. - ✔✔b

Information in a company's first IFRS statements must: (a) have a cost that does not

exceed the benefits.

(b) be transparent.

(c) provide a suitable starting point.

(d) All the above. - ✔✔d

The transition date is the date:

(a) when a company no longer reports under its national standards.

(b) when the company issues its most recent financial statement under IFRS.

(c) three years prior to the reporting date.

(d) None of the above. - ✔✔d

When converting to IFRS, a company must:

(a) recast previously issued financial statements in accordance with IFRS.

(b) use GAAP in the reporting period but subsequently use IFRS.

(c) prepare at least three years of comparative statements.

(d) use GAAP in the transition year but IFRS in the reporting year. - ✔✔a

The purpose of presenting comparative information in the transition to IFRS is:

(a) to ensure that the information is a faithful representation.

(b) in accordance with the Sarbanes-Oxley Act.

(c) to provide users of the financial statements with information on GAAP in one period

and IFRS in the other period.

(d) to provide users of the financial statements with information on IFRS for at least two

periods. - ✔✔d

Which of the following is not reported in an income statement under IFRS?

(a) Discontinued operations.

(b) Extraordinary items.

(c) Cost of goods sold.

(d) Income tax. - ✔✔b

Which of the following statements is correct regarding income reporting under IFRS?

(a) IFRS does not permit revaluation of property, plant, and equipment, and intangible

assets.

(b) IFRS provides the same options for reporting comprehensive income as GAAP.

(c) Companies must classify expenses by nature.

(d) IFRS provides a definition for all items presented in the income statement. - ✔✔b

Which statement is correct regarding IFRS?

(a) An advantage of the nature-of-expense method is that it is simple to apply because

allocations of expense to different functions are not necessary.

(b) The function-of-expense approach never requires arbitrary allocations.

(c) An advantage of the function-of-expense method is that allocation of costs to the

varying func- tions is rarely arbitrary.

(d) IFRS requires use of the nature-of-expense approach. - ✔✔a

The non-controlling interest section of the income statement is:

(a) required under GAAP but not under IFRS.

(b) required under IFRS but not under GAAP.

(c) required under IFRS and GAAP.

(d) not reported under GAAP or IFRS. - ✔✔c

Which of the following is not an acceptable way of displaying the components of other

comprehensive income under IFRS?

(a) Within the statement of retained earnings.

(b) Second income statement.

(c) Combined statement of comprehensive income.

(d) All of these choices are acceptable. - ✔✔a

Which of the following statements about IFRS and GAAP accounting and reporting

requirements for the balance sheet is not correct?

(a) Both IFRS and GAAP distinguish between current and non-current assets and

liabilities.

(b) The presentation formats required by IFRS and GAAP for the balance sheet are

similar.

(c) Both IFRS and GAAP require that comparative information be reported.

(d) One difference between the reporting requirements under IFRS and those of the

GAAP balance sheet is that an IFRS balance sheet may list long-term assets first. -

✔✔b

Current assets under IFRS are listed generally:

(a) by importance.

(b) in the reverse order of their expected conversion to cash.

(c) by longevity.

(d) alphabetically. - ✔✔b

Companies that use IFRS:

(a) may report all their assets on

[Show More]