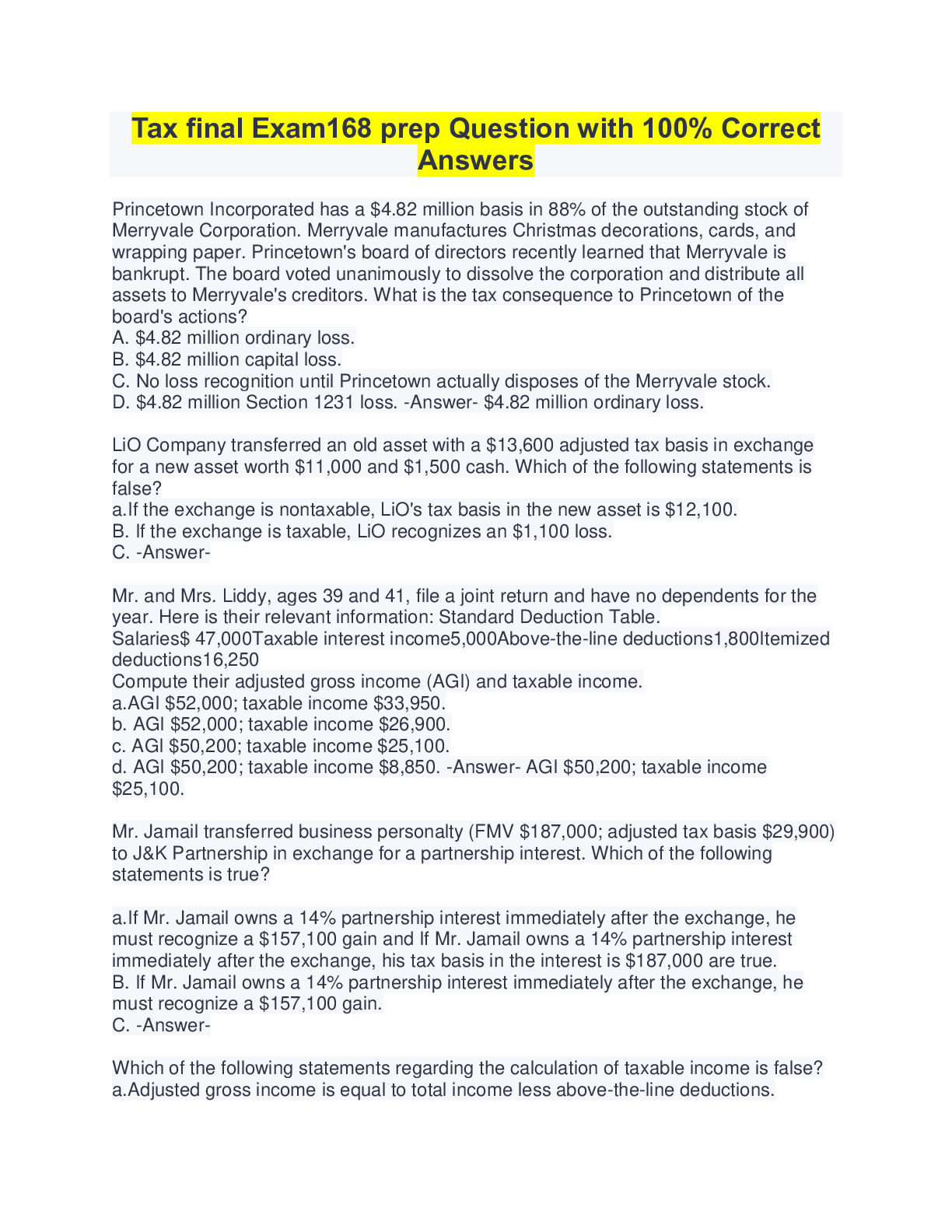

Finance > QUESTIONS & ANSWERS > Tax final Exam168 prep Question with 100% Correct Answers (All)

Tax final Exam168 prep Question with 100% Correct Answers

Document Content and Description Below

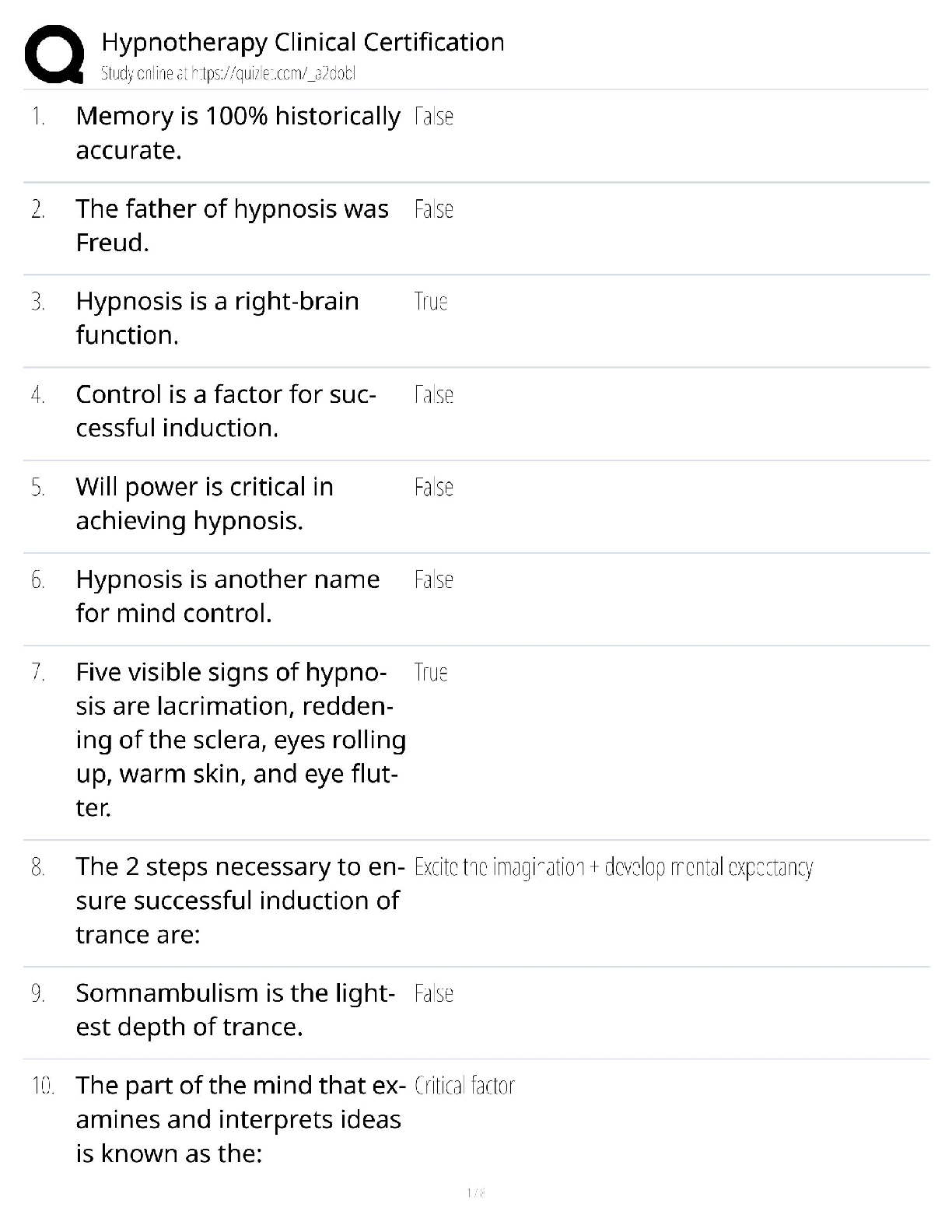

Tax final Exam168 prep Question with 100% Correct Answers Princetown Incorporated has a $4.82 million basis in 88% of the outstanding stock of Merryvale Corporation. Merryvale manufactures Christma ... s decorations, cards, and wrapping paper. Princetown's board of directors recently learned that Merryvale is bankrupt. The board voted unanimously to dissolve the corporation and distribute all assets to Merryvale's creditors. What is the tax consequence to Princetown of the board's actions? A. $4.82 million ordinary loss. B. $4.82 million capital loss. C. No loss recognition until Princetown actually disposes of the Merryvale stock. D. $4.82 million Section 1231 loss. -Answer- $4.82 million ordinary loss. LiO Company transferred an old asset with a $13,600 adjusted tax basis in exchange for a new asset worth $11,000 and $1,500 cash. Which of the following statements is false? a.If the exchange is nontaxable, LiO's tax basis in the new asset is $12,100. B. If the exchange is taxable, LiO recognizes an $1,100 loss. C. -AnswerMr. and Mrs. Liddy, ages 39 and 41, file a joint return and have no dependents for the year. Here is their relevant information: Standard Deduction Table. Salaries$ 47,000Taxable interest income5,000Above-the-line deductions1,800Itemized deductions16,250 Compute their adjusted gross income (AGI) and taxable income. a.AGI $52,000; taxable income $33,950. b. AGI $52,000; taxable income $26,900. c. AGI $50,200; taxable income $25,100. d. AGI $50,200; taxable income $8,850. -Answer- AGI $50,200; taxable income $25,100. Mr. Jamail transferred business personalty (FMV $187,000; adjusted tax basis $29,900) to J&K Partnership in exchange for a partnership interest. Which of the following statements is true? a.If Mr. Jamail owns a 14% partnership interest immediately after the exchange, he must recognize a $157,100 gain and If Mr. Jamail owns a 14% partnership interest immediately after the exchange, his tax basis in the interest is $187,000 are true. B. If Mr. Jamail owns a 14% partnership interest immediately after the exchange, he must recognize a $157,100 gain. C. -AnswerWhich of the following statements regarding the calculation of taxable income is false? a.Adjusted gross income is equal to total income less above-the-line deductions.B. Taxpayers are allowed to deduct the greater of itemized deductions or above-the-line deductions in calculating taxable income C. The first step in the calculation of taxable income is determining the taxpayer's total income. D. Adjusted gross income can be reduced by the greater of the standard deduction or itemized deductions. -Answer- Taxpayers are allowed to deduct the greater of itemized deductions or above-the-line deductions in calculating taxable income In 2021, Mary recognized a $45,000 gain on the sale of Section 1231 property. Over the previous five-year period, Mary recognized the following net Section 1231 gains and (losses): 2020 ($28,000) 2019 $16,000 2018 ($30,000) Mary's 2021 gain is characterized as a.$28,000 ordinary gain and $17,000 capital gain B. $42,000 ordinary gain and $3,000 capital gain C. $45,000 capital gain D.$45,000 ordinary gain -Answer- $42,000 ordinary gain and $3,000 capital gain Delour Incorporated was incorporated in 2015 and adopted a calendar year. Here is a schedule of Delour's net Section 1231 gains and (losses) reported on its tax returns through 2020. 201520162017201820192020$(4,900)$-0-$-0-$-0-$(12,000)$-0- In 2021, Delour recognized a $50,000 gain on the sale of business land. How is this gain characterized on Delour's tax return? a.$16,900 ordinary gain and $33,100 Section 1231 gain.** B. $12,000 ordinary gain and $38,000 Section 1231 gain. C. $50,000 ordinary gain.** D. $50,000 Section 1231 gain. -Answer- $12,000 ordinary gain and $38,000 Section 1231 gain. Nixon Incorporated transferred Asset A to an unrelated party in exchange for Asset Z and $15,750 cash. Nixon's tax basis in Asset A was $400,000, and Asset Z had a $510,000 appraised FMV. Which of the following statements is true? a.If Asset A and Asset Z are like-kind property, Nixon recognizes a $15,750 gain and takes a $415,750 basis in Asset Z. B. If Asset A and Asset Z are like-kind property, Nixon recognizes a $15,750 gain and takes a $400,000 basis in Asset Z. C. If Asset A and Asset Z are not like-kind property, Nixon recognizes a $110,000 gain and takes a $510,000 basis in Asset Z. D. If Asset A and Asset Z are like-kind property, Nixon recognizes a $15,750 gain and takes a $415,750 basis in Asset Z.If Asset A and Asset Z are like-kind property, Nixon recognizes no gain and takes a $400,000 basis in Asset Z. -Answer- If Asset A and Asset Z are like-kind property, Nixon recognizes a $15,750 gain and takes a $400,000 basis in Asset Z.Jackie contributed $60,000 in cash to a partnership for a 50% interest. This year, the partnership earned $200,000 ordinary business income, made a $20,000 contribution to the United Way, and distributed $25,000 cash to Jackie. Her tax basis in the partnership at year end is: a.$85,000 b. $110,000 c.$215,000 D.$125,000 -Answer- $125,000 Slipper Corporation has book income of $500,000. Book income includes a $50,000 gain on the sale of equipment. The equipment originally cost $110,000 and was sold for $75,000. Accumulated book depreciation was $85,000; accumulated MACRS depreciation was $90,000. Based only on these items, compute Slipper's taxable income. a. $445,000 B. $555,000 C. $505,000 D. $495,000 -Answer- $505,000 Which of the following statements regarding a partner's tax basis in a partnership interest is true? a. Partnership tax basis is increased annually by cash distributions from the partnership. b. Partnership tax basis is reduced by the partner's share of nontaxable partnership income. C. -AnswerIn 2021, Mike Elfred received a $165,000 salary from his employer and generated $39,000 net earnings from self-employment from his small business. Which of the following statements is true? A. Mike owes both the Medicare and Social Security tax portions of self-employment tax on his $39,000 earnings from his small business. B. Mike does not owe any self-employment tax because his salary exceeded the 2021 base amount ($142,800) for federal employment tax. C. -AnswerMrs. Raines died on June 2, 2020. Mr. Raines has not remarried and has no children or other dependents. What is his filing status for 2020 and 2021? A.Married filing jointly for 2020; surviving spouse for 2021. B.Surviving spouse for 2020 and 2021. C. Married filing jointly for 2020; single for 2021. D. Surviving spouse for 2020; single for 2021. -AnswerMr. Quick sold marketable securities with a $112,900 tax basis to his 100% owned corporation for $95,000 cash. Which of the following statements is true?A. The corporation's tax basis in the securities is $112,900. b. None of these choices are true. c. If Mr. Quick can offer evidence that the FMV of the securities is $95,000, he can recognize his $17,900 realized loss. d. If Mr. Quick and his corporation negotiated the terms of the sale at arm's length, Mr. Quick can recognize his $17,900 realized loss. -Answer- None of these choices are true. [Show More]

Last updated: 3 years ago

Preview 1 out of 38 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$11.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 30, 2022

Number of pages

38

Written in

All

Additional information

This document has been written for:

Uploaded

Aug 30, 2022

Downloads

0

Views

99