Financial Accounting > QUESTIONS & ANSWERS > WGU C213 Accounting for Decision Makers ABCD (All)

WGU C213 Accounting for Decision Makers ABCD

Document Content and Description Below

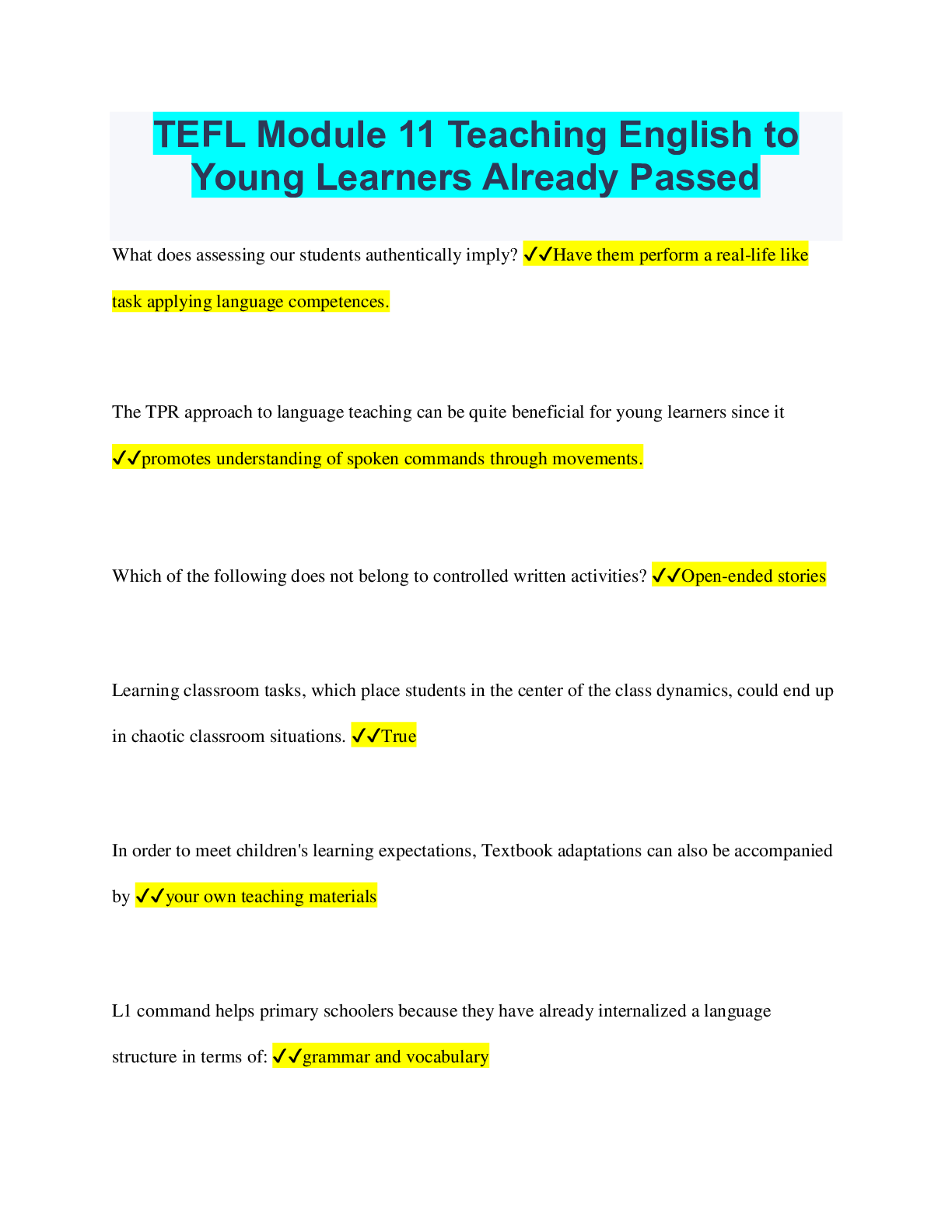

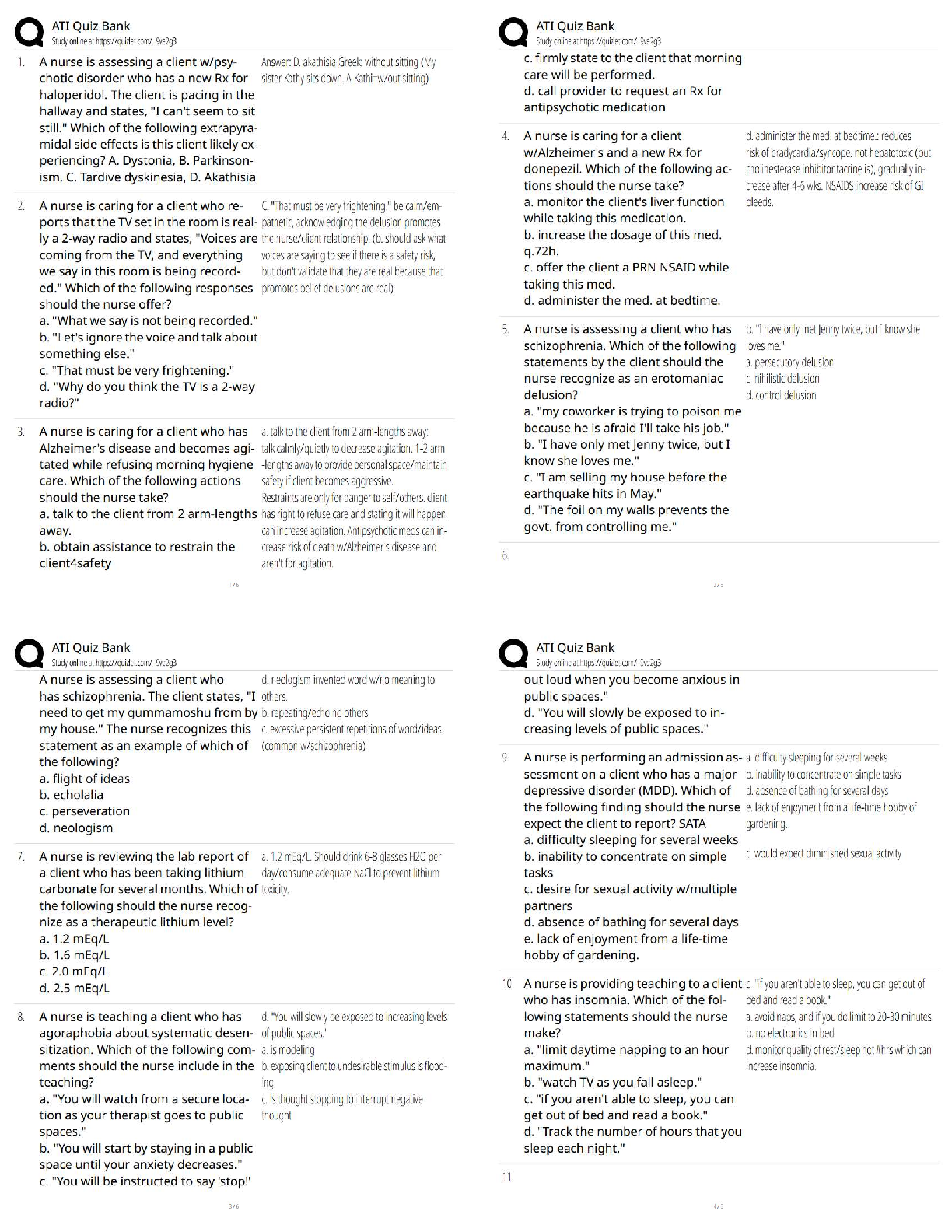

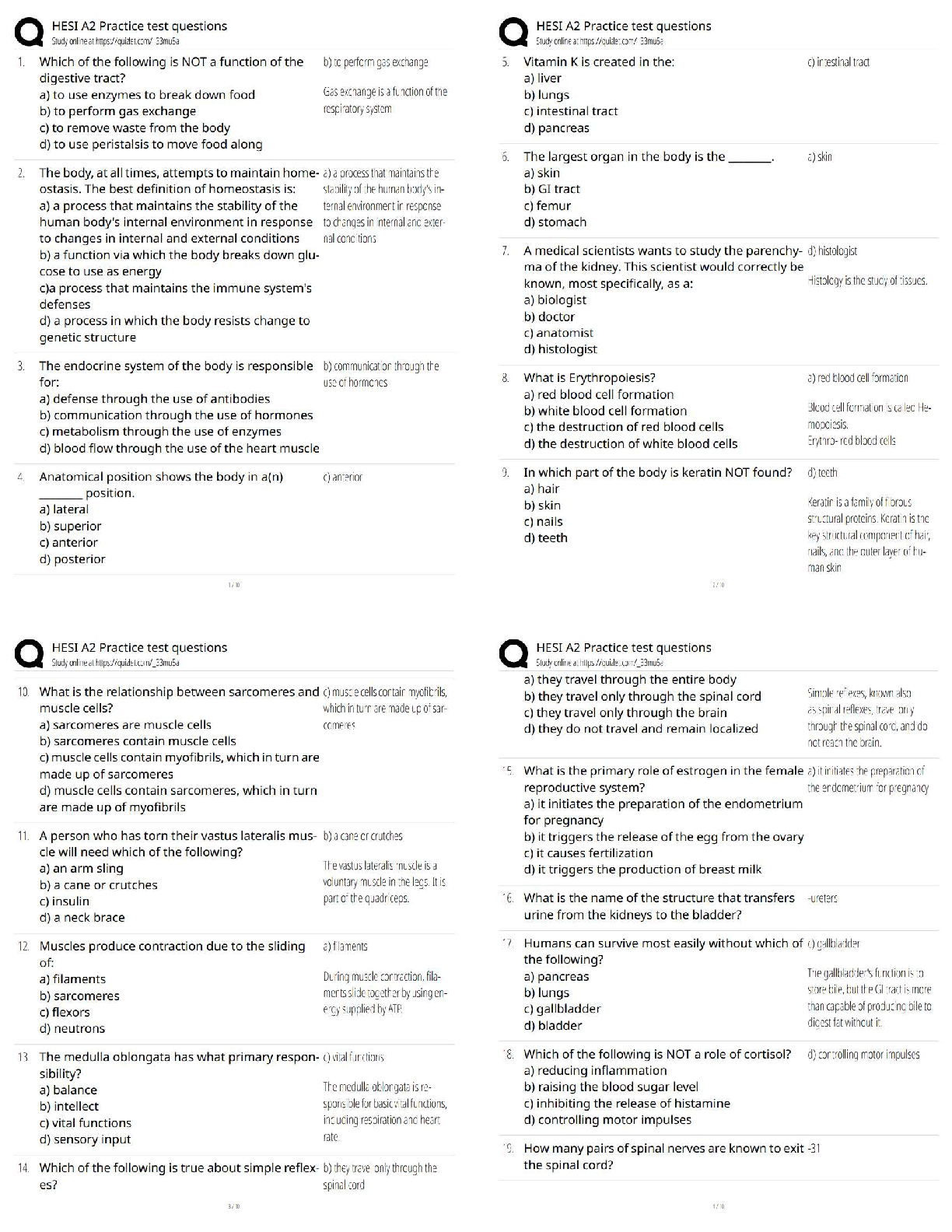

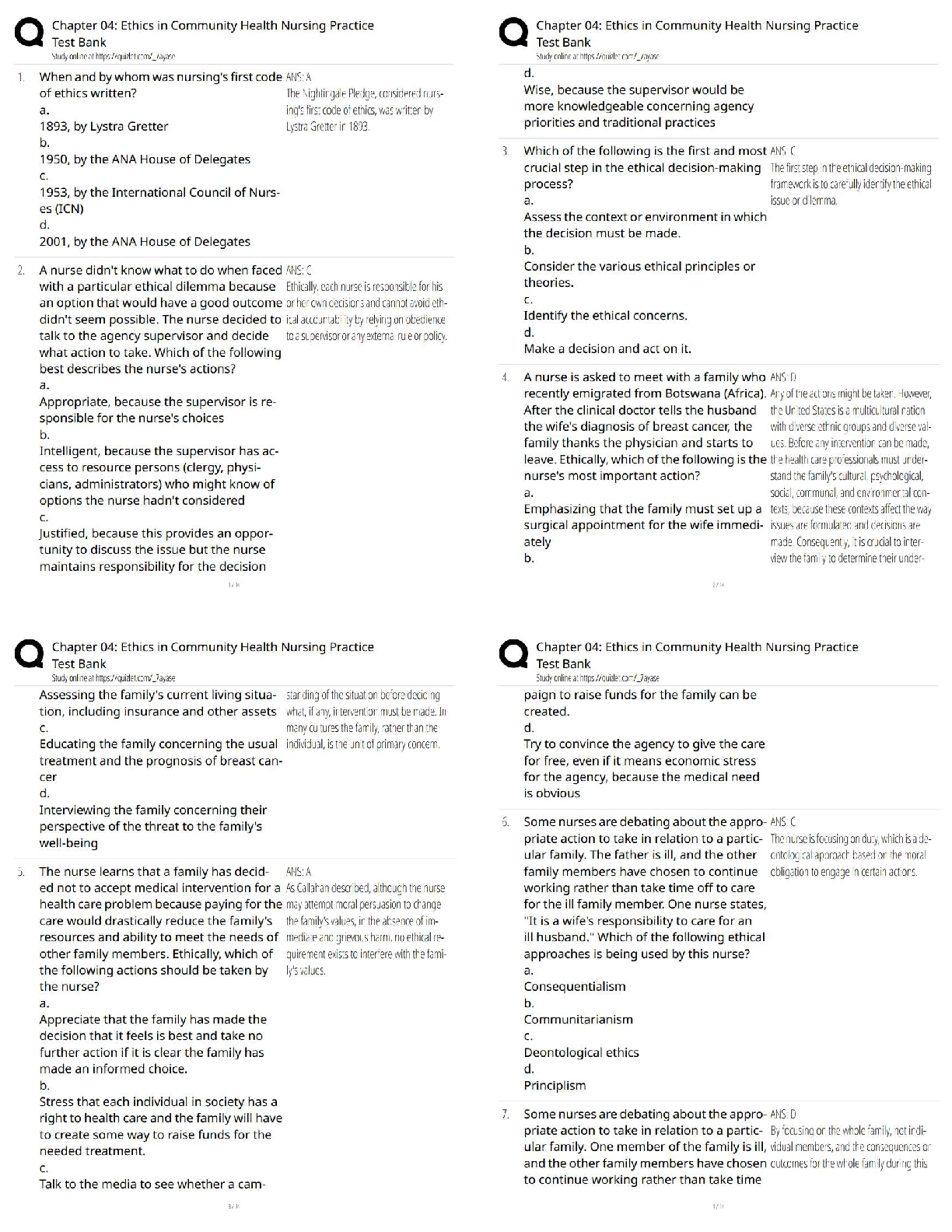

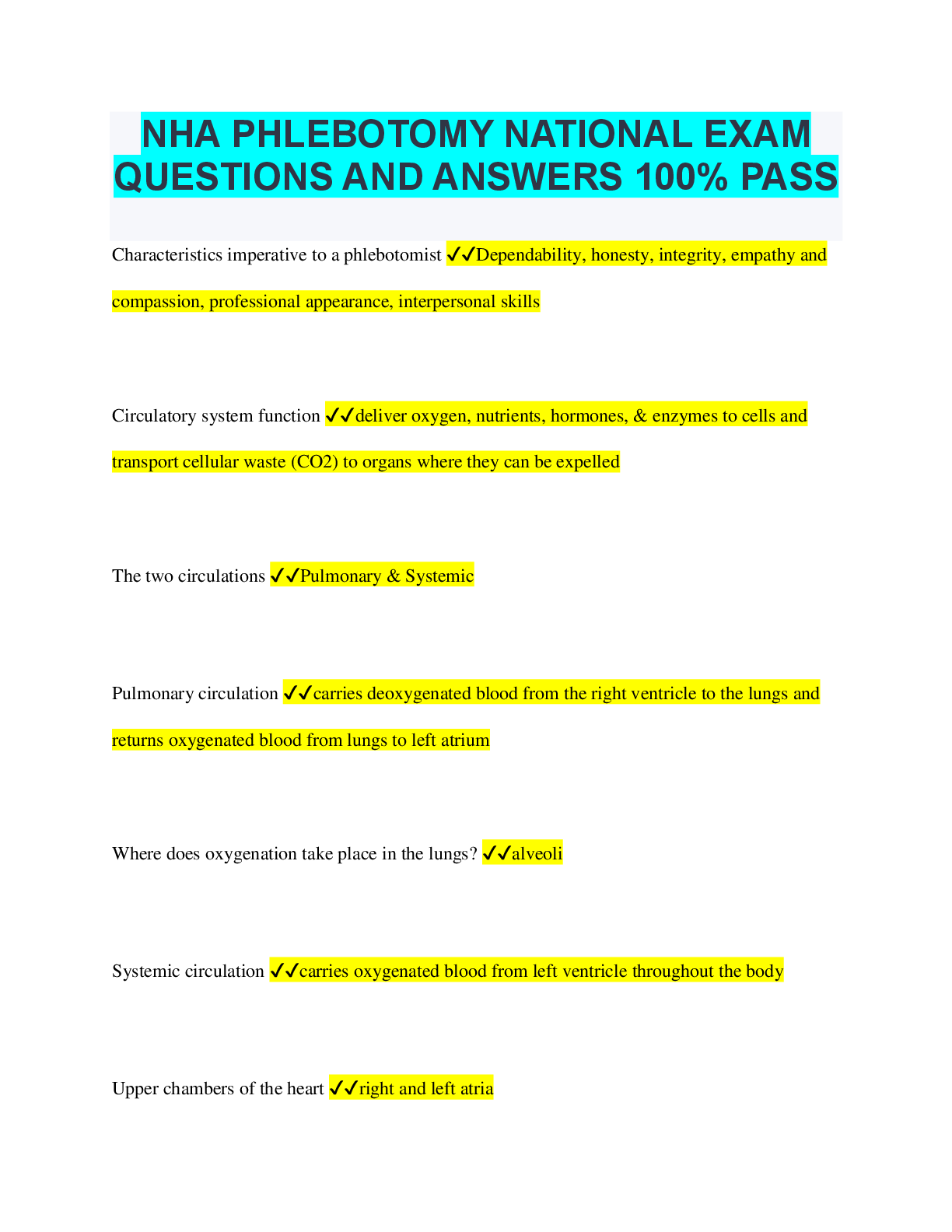

WGU C213 Accounting for Decision Makers ABCD Accounting ✔✔the recording of the day-to-day financial activities of a company and the organization of that information into summary reports used to ... evaluate the company's financial status Bookkeeping ✔✔the preservation of a systematic, quantitative record of an activity accounting system ✔✔used by a business to handle routine bookkeeping tasks and to structure the information so it can be used to evaluate the performance and financial status of the business Accounting information ✔✔Info that is intended to be useful in making decisions about the future. The balance sheet, the income statement, and the statement of cashflows ✔✔What are the three primary financial statements? External Users ✔✔Who is financial accounting information primarily prepared for and used by? Managerial Accounting ✔✔the name given to accounting systems designed for internal users Balance Sheet ✔✔Reports a company's assets, liabilities, and owners' equity Income Statement ✔✔reports the amount of net income earned by a company during a period Net income ✔✔the excess of a company's revenues over its expenses statement of cash flows ✔✔reports the amount of cash collected and paid out by a company in the following three types of activities: operating, investing, and financing FASB ✔✔Which private body establishes accounting rules in the U.S.? Financial Accounting Standards Board (FASB) ✔✔a private body established and supported by the joint efforts of the U.S. business community, financial analysts, and practicing accountants The Securities and Exchange Commission (SEC) ✔✔the organization that regulates U.S. stock exchanges and seeks to create a fair information environment in which investors can buy and sell stocks without fear that companies are hiding or manipulating financial data American Institute of Certified Public Accountants (AICPA) ✔✔the professional organization of certified public accountants (CPAs) in the United States Public Company Accounting Oversight Board (PCAOB) ✔✔the organization that inspects the audit practices of registered audit firms and has statutory authority to investigate questionable audit practices and to impose sanctions such as barring an audit firm from auditing SEC-registered companies Internal Revenue Service (IRS) ✔✔Gov't agency that establishes rules to define exactly when income should be taxed. It has no role in setting financial accounting rules; and a company's financial statements are not used in determining how much tax the company must pay The International Accounting Standards Board (IASB) ✔✔Organization that was formed to develop a common set of worldwide accounting standards. Its standards are increasingly accepted worldwide, but FASB rules are still the standard in the United States. 1. Rapid Advancements in the IT field 2. the international integration of worldwide business 3. Increased scrutiny associated with large corpora [Show More]

Last updated: 3 years ago

Preview 1 out of 20 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

.png)

WGU C213 BUNDLED EXAM QUESTIONS AND ANSWERS ALREADY PASSED

WGU C213 BUNDLED EXAM QUESTIONS AND ANSWERS ALREADY PASSED

By Nutmegs 3 years ago

$20

10

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Sep 03, 2022

Number of pages

20

Written in

All

Additional information

This document has been written for:

Uploaded

Sep 03, 2022

Downloads

1

Views

204

.png)