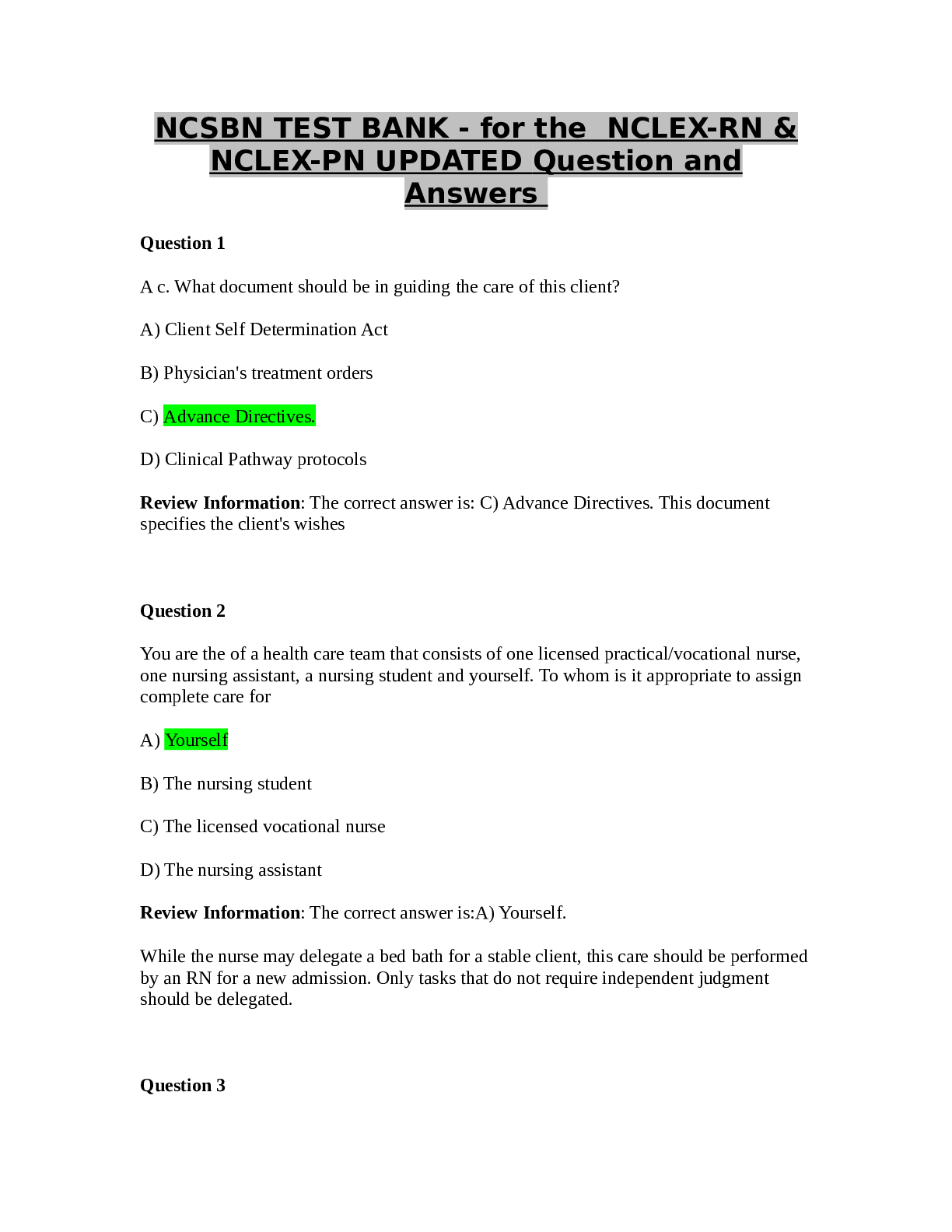

NURS 101 NCSBN QUESTION BANK OVER 500 QUESTIONS WITH ANSWERS AND REVIEW INFORMATION

Financial Accounting > QUESTIONS & ANSWERS > 1ST-GRADING-EXAM_KEY-ANSWERS: INTERMEDIATE ACCOUNTING 2 FIRST GRADING EXAMINATION (All)

INTERMEDIATE ACCOUNTING 2 FIRST GRADING EXAMINATION 1. The accounting standards used in the Philippines are adapted from the standards issued by the a. Federal Accounting Standards Board (FASB). ... b. International Accounting Standards Board (IASB). c. Philippine Institute of Certified Public Accountants (PICPA). d. Democratic People's Republic of Korea Accounting Standards Committee (DPKRASC). 2. The PFRSs consist of all of the following except a. PFRSs. b. PASs. c. Interpretations. d. Conceptual Framework. 3. The issuance of financial reporting standards in the Philippines is the responsibility of the a. PICPA b. FRSC c. AASC d. CPE Council 4. On November 1, 20x1, a company purchased a new machine that it does not have to pay for until November 1, 20x3. The total payment on November 1, 20x3, will include both principal and interest. Assuming interest at a 10% rate, the cost of the machine would be the total payment multiplied by what time value of money concept? a. PV of annuity of ₱1. c. FV of annuity of ₱1. b. PV of ₱1. d. FV of ₱1. 5. Interest payment dates of a bond issue are March 1 and September 1, 20x1. The bond was issued on June 1, 20x1. Interest expense for the year ended December 31, 20x1 would be for: a. four (4) months c. seven (7) months b. six (6) months d. ten (10) months 6. When a note payable is issued for property, goods, or services, the note is initially measured at a. the fair value of the property, goods, or services. b. the fair value of the note. c. using an imputed interest rate to discount all future payments on the note. d. choice (a) except when this is not determinable, in which case, whichever is the more clearly determinable between (b) and (c). 7. When a note payable is exchanged for property, goods, or services, the stated interest rate is presumed to be fair unless a. no interest rate is stated. b. the stated interest rate is unreasonable. P a g e | 2 c. the stated face amount of the note is materially different from the current cash sales price for similar items or from current market value of the note. d. any of these. 8. When debt is issued at a discount, interest expense over the term of the debt equals the cash interest paid: a. Minus discount. c. Plus discount. b. Minus discount minus face amount. d. Plus discount plus face amount. 9. Which of the following statements is true? a. A noninterest-bearing note sometimes is called a discounted note because the cash received is more than the face amount of the note. b. A debtor’s December 31, 20x1 statement of financial position is to be published on March 31, 20x2. An obligation with a due date of December 31, 20x6 is also due on demand by the creditor. At December 31, 20x1, there is no indication that the creditor intends to call in the debt. The obligation is a current liability. c. The market rate of interest is the interest rate used to determine the amount of cash interest that will be paid on the principal. d. A debtor’s December 31, 20x1 statement of financial position is to be published on March 31, 20x2. An obligation due December 31, 20x6 has a due date which can be accelerated by the creditor to the present date if the current ratio falls below 2:1. The current ratio on December 31, 20x1 is 2.2:1. The obligation is a current liability. 10. A short-term note payable may include all of the following except: a. trade notes payable. c. unearned revenue. b. nontrade notes payable. d. a current maturity of a longterm liability. 11. Interest expenses are a. incurred only on interest-bearing obligations b. incurred due to passage of time. c. not incurred on redeemable preference shares issued d. incurred only when the effective interest rate is stated in the instrument 12. Which of the following is not true about the discount on short-term notes payable? a. The Discount on Notes Payable account has a debit balance. b. The Discount on Notes Payable account should be reported as an asset on the balance sheet. c. When there is a discount on a note payable, the effective interest rate is higher than the stated discount rate. d. All of these are true. 13. Which of the following statements is not correct? a. The principal amount of a debt is the cash or cash equivalent amount borrowed. b. When a noncash asset is acquired and the stated rate of interest is different from the current market rate of interest, the cost of the asset is the present value of the future cash payments discounted at the current market rate of interest rather than at the stated interest rate. c. A company that receives cash in an amount less than the face amount of a noninterest-bearing note payable should record the note at its discounted present value. P a g e | 3 d. The carrying amount of a noninterest-bearing note payable due in lump sum will decrease as time goes by. Use the following information for the next five questions: On January 1, 20x1, ABRIDGE TO SHORTEN Company issued a 4-year, ₱1,000,000 noninterest bearing note payable due in four equal annual installments. The effective interest rate is 12%. ABRIDGE prepared the following pro-forma amortization table on an electronic spreadsheet: A B C D E 1 Date Cash paid Interest expense Amortization Present value 2 Jan. 1, 20x1 3 Dec. 31, 20x1 4 Dec. 31, 20x2 5 Dec. 31, 20x3 6 Dec. 31, 20x4 14. The amount to be placed on cell E2 is a. (1M ÷ 4 x PV of ordinary annuity of ₱1 @ 12%, n=4) b. (1M x PV of ₱1 @12%, n=4) c. (1M x PV of ordinary annuity of ₱1 @12%, n=4) d. (1M x PV of ₱1 @12%, n=4) + (1M x 10% x PV of ordinary annuity of ₱1 @ 12%, n=4) 15. The amount to be placed on cell E6 is a. (1M ÷ 4 x PV of ordinary annuity of ₱1 @ 12%, n=4) c. 1M b. (1M x PV of ₱1 @12%, n=4) d. 0 16. Interest expense recognized in 20x2 is computed as a. 12% x E3 c. C4 – D4 b. 12% x E4 d. 1M x 12% 17. The carrying amount of the note payable on December 31, 20x2 is equal to a. E3 – D4 c. E4 – D4 b. E3 + D4 d. 1M 18. The value placed in cell B4 is equal to a. 1M x 12% c. 1M – D3 b. 250,000 d. E4 – D5 19. The current portion of the note payable as of December 31, 20x2 is equal to a. D4 c. D5 b. D3 d. E5 20. The noncurrent portion of the note payable as of December 31, 20x2 is equal to a. E4 c. E3 b. D5 d. E5 Use the following information for the next nine questions: On January 1, 20x1, HEARTEN ENCOURAGE CHEER Company issued a 4-year, ₱1,000,000, noninterest-bearing note due on December 31, 20x4. The effective interest rate is 12%. HEARTEN prepared the following pro-forma amortization table on an electronic spreadsheet: [Show More]

Last updated: 3 years ago

Preview 1 out of 18 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Can't find what you want? Try our AI powered Search

Connected school, study & course

About the document

Uploaded On

Sep 04, 2022

Number of pages

18

Written in

All

This document has been written for:

Uploaded

Sep 04, 2022

Downloads

0

Views

179

Scholarfriends.com Online Platform by Browsegrades Inc. 651N South Broad St, Middletown DE. United States.

We're available through e-mail, Twitter, Facebook, and live chat.

FAQ

Questions? Leave a message!

Copyright © Scholarfriends · High quality services·