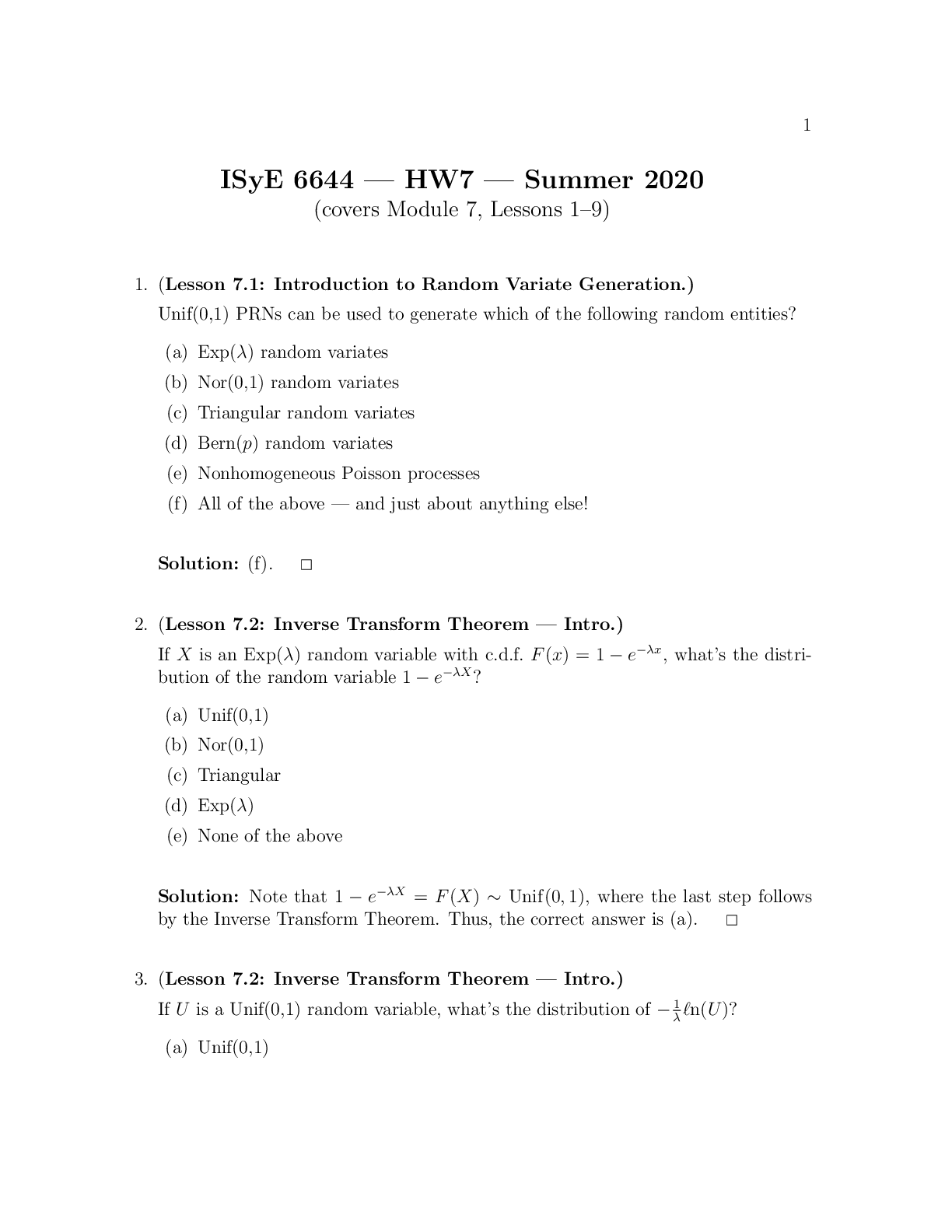

Financial Accounting > QUESTIONS & ANSWERS > CHAPTER 7 CASH AND RECEIVABLES IFRS questions are available at the end of this chapter WITH CORRECT (All)

CHAPTER 7 CASH AND RECEIVABLES IFRS questions are available at the end of this chapter WITH CORRECT ANSWERS

Document Content and Description Below

7. All claims held against customers and others for money, goods, or services are reported as current assets. Ans: F, LO: 2, Bloom: C, Difficulty: Moderate, Min: 1, AACSB: Analytic, AICPA BB: None, ... AICPA FN: Reporting, AICPA PC: Communication, IMA: Reporting, IFRS: None 8. Trade receivables include notes receivable and advances to officers and employees. Ans: F, LO: 2, Bloom: K, Difficulty: Easy, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Reporting, AICPA PC: Communication, IMA: Reporting, IFRS: None 9. Trade discounts are used to avoid frequent changes in catalogs and to alter prices for different quantities purchased. Ans: T, LO: 2, Bloom: C, Difficulty: Easy, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 10. In the gross method, sales discounts are reported as a deduction from sales. Ans: T, LO: 2, Bloom: K, Difficulty: Easy, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 11. The net amount reported for short-term receivables is not affected when a specific account receivable is determined to be uncollectible. Ans: T, LO: 3, Bloom: C, Difficulty: Moderate, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 12. The percentage-of-receivables approach of estimating uncollectible accounts emphasizes matching over valuation of accounts receivable. Ans: F, LO: 3, Bloom: K, Difficulty: Easy, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 13. The percentage-of-receivables approach requires companies to set up an aging schedule of accounts receivable. Ans: F, LO: 3, Bloom: K, Difficulty: Easy, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 7 - 7 Test Bank for Intermediate Accounting, Sixteenth Edition 14. Companies value and report short-term receivables at net realizable valuethe net amount they expect to receive in cash. Ans: T, LO: 3, Bloom: K, Difficulty: Easy, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 15. The percentage-of-receivables approach is used for impairment measurement and reporting. Ans: F, LO: 3, Bloom: K, Difficulty: Moderate, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 16. Companies record and report long-term notes receivable at the present value of the cash they expect to collect. Ans: T, LO: 4, Bloom: K, Difficulty: Easy, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 17. When the stated rate of interest exceeds the effective rate, the present value of the note receivable will be less than its face value. Ans: F, LO: 4, Bloom: C, Difficulty: Moderate, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 18. The FASB believes that historical cost for financial instruments provides more relevant and understandable information than fair value. Ans: F, LO: 5, Bloom: C, Difficulty: Moderate, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 19. Recognition of a recourse liability will make a loss on sale of receivables larger than it would otherwise have been. Ans: T, LO: 6, Bloom: C, Difficulty: Moderate, Min: 1, AACSB: Analytic, AICPA BB: None, AICPA FN: Measurement, AICPA PC: Problem Solving, IMA: Reporting, IFRS: None 20. When buying receivables wi [Show More]

Last updated: 3 years ago

Preview 1 out of 55 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$12.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Sep 04, 2022

Number of pages

55

Written in

All

Additional information

This document has been written for:

Uploaded

Sep 04, 2022

Downloads

0

Views

43