Business > TEST BANKS > CHAPTER 7 Equity Markets and Stock Valuation (questions with 100% verified correct answers) (All)

CHAPTER 7 Equity Markets and Stock Valuation (questions with 100% verified correct answers)

Document Content and Description Below

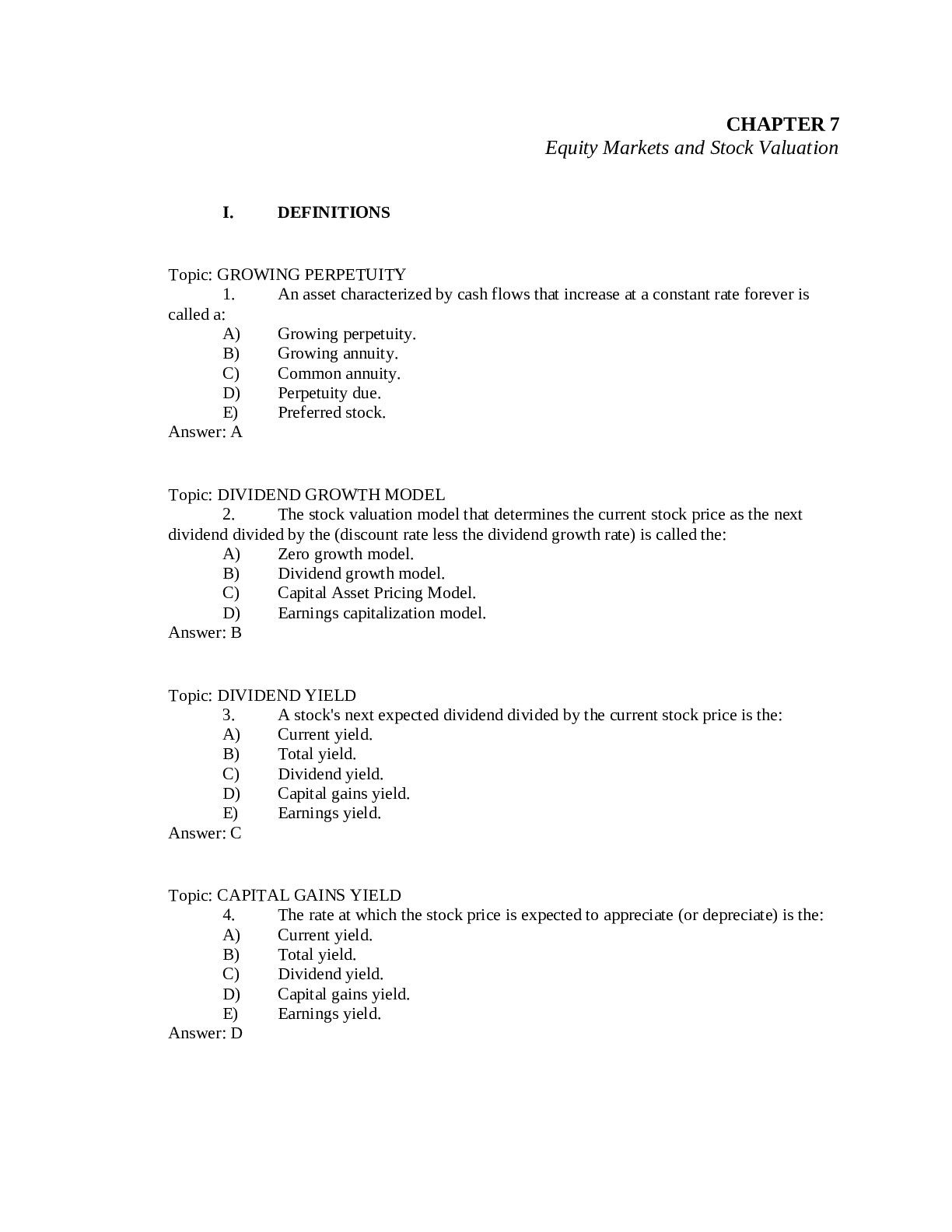

CHAPTER 7 Equity Markets and Stock ValuationI. DEFINITIONS Topic: GROWING PERPETUITY 1. An asset characterized by cash flows that increase at a constant rate forever is called a: A) Growing perpe... tuity. B) Growing annuity. C) Common annuity. D) Perpetuity due. E) Preferred stock. Answer: A Topic: DIVIDEND GROWTH MODEL 2. The stock valuation model that determines the current stock price as the next dividend divided by the (discount rate less the dividend growth rate) is called the: A) Zero growth model. B) Dividend growth model. C) Capital Asset Pricing Model. D) Earnings capitalization model. Answer: B Topic: DIVIDEND YIELD 3. A stock's next expected dividend divided by the current stock price is the: A) Current yield. B) Total yield. C) Dividend yield. D) Capital gains yield. E) Earnings yield. Answer: C Topic: CAPITAL GAINS YIELD 4. The rate at which the stock price is expected to appreciate (or depreciate) is the: A) Current yield. B) Total yield. C) Dividend yield. D) Capital gains yield. E) Earnings yield. Answer: D [Show More]

Last updated: 2 years ago

Preview 1 out of 43 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$11.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Sep 23, 2022

Number of pages

43

Written in

Additional information

This document has been written for:

Uploaded

Sep 23, 2022

Downloads

0

Views

51

.png)

.png)