IFRS Exam 1 Questions & Answers

IFRS stands for:

(a) International Federation of Reporting Services.

(b) Independent Financial Reporting Standards.

(c) International Financial Reporting Standards.

(d) Integrated Fin

...

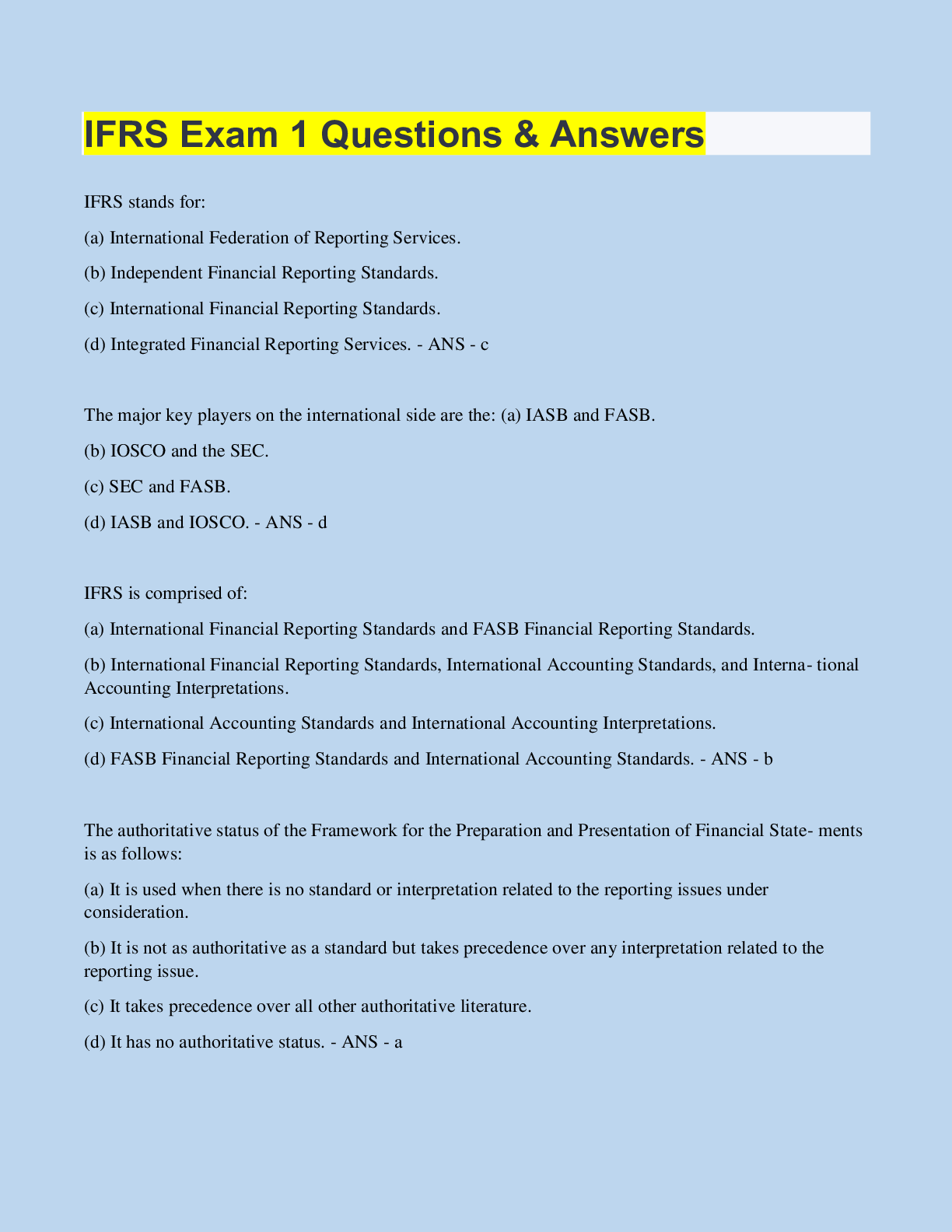

IFRS Exam 1 Questions & Answers

IFRS stands for:

(a) International Federation of Reporting Services.

(b) Independent Financial Reporting Standards.

(c) International Financial Reporting Standards.

(d) Integrated Financial Reporting Services. - ANS - c

The major key players on the international side are the: (a) IASB and FASB.

(b) IOSCO and the SEC.

(c) SEC and FASB.

(d) IASB and IOSCO. - ANS - d

IFRS is comprised of:

(a) International Financial Reporting Standards and FASB Financial Reporting Standards.

(b) International Financial Reporting Standards, International Accounting Standards, and Interna- tional

Accounting Interpretations.

(c) International Accounting Standards and International Accounting Interpretations.

(d) FASB Financial Reporting Standards and International Accounting Standards. - ANS - b

The authoritative status of the Framework for the Preparation and Presentation of Financial State- ments

is as follows:

(a) It is used when there is no standard or interpretation related to the reporting issues under

consideration.

(b) It is not as authoritative as a standard but takes precedence over any interpretation related to the

reporting issue.

(c) It takes precedence over all other authoritative literature.

(d) It has no authoritative status. - ANS - a

Which of the following statements is true?

(a) The IASB has the same number of members as the FASB.

(b) The IASB structure has both advisory and interpretation functions, but no trustees.

(c) The IASB has been in existence longer than the FASB. (d) The IASB structure is quite similar to the

FASB's, except the IASB has a larger number of board members. - ANS - d

Which of the following statements about the IASB and FASB conceptual frameworks is not correct?

(a) The IASB conceptual framework does not identify the element comprehensive income.

(b) The existing IASB and FASB conceptual frameworks are organized in similar ways.

(c) The FASB and IASB agree that the objective of financial reporting is to provide useful informa- tion

to investors and creditors.

(d) IFRS does not allow use of fair value as a measurement basis. - ANS - d

Which of the following statements is false?

(a) The monetary unit assumption is used under IFRS. (b) Under IFRS, companies may use fair value

for property, plant, and equipment.

(c) The FASB and IASB are working on a joint conceptual framework project.

(d) Under IFRS, there are the same number of financial statement elements as in GAAP. - ANS - d

Companies that use IFRS:

(a) must report all their assets on the statement of financial position (balance sheet) at fair value.

(b) may report property, plant, and equipment and natural resources at fair value.

(c) may refer to a concept statement on estimating fair values when market data are not available.

(d) may only use historical cost as the measurement basis in financial reporting. - ANS - b

The issues that the FASB and IASB must address in developing a common conceptual framework

include all of the following except:

(a) should the characteristic of relevance be traded-off in favor of information that is verifiable?

(b) should a single measurement method such a

[Show More]

.png)