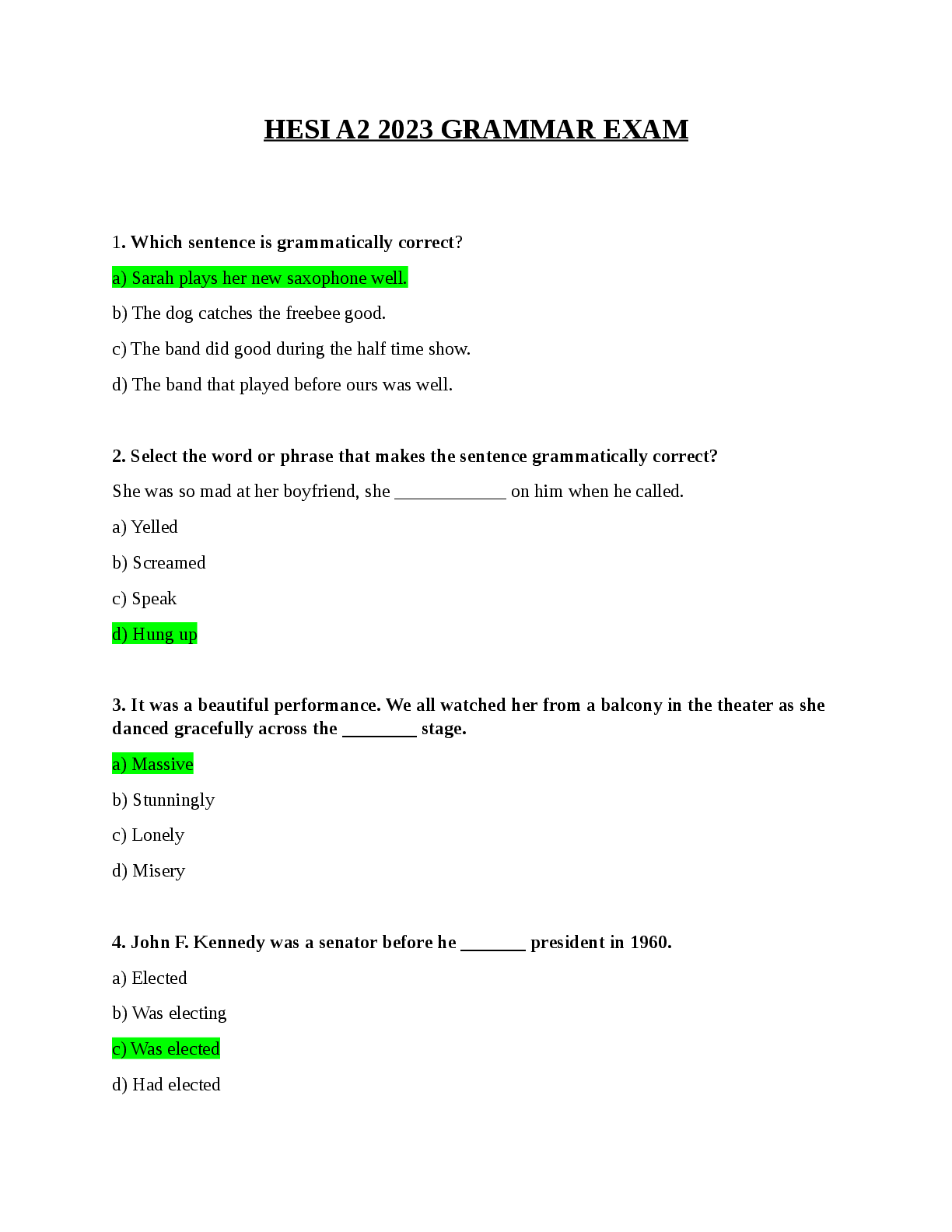

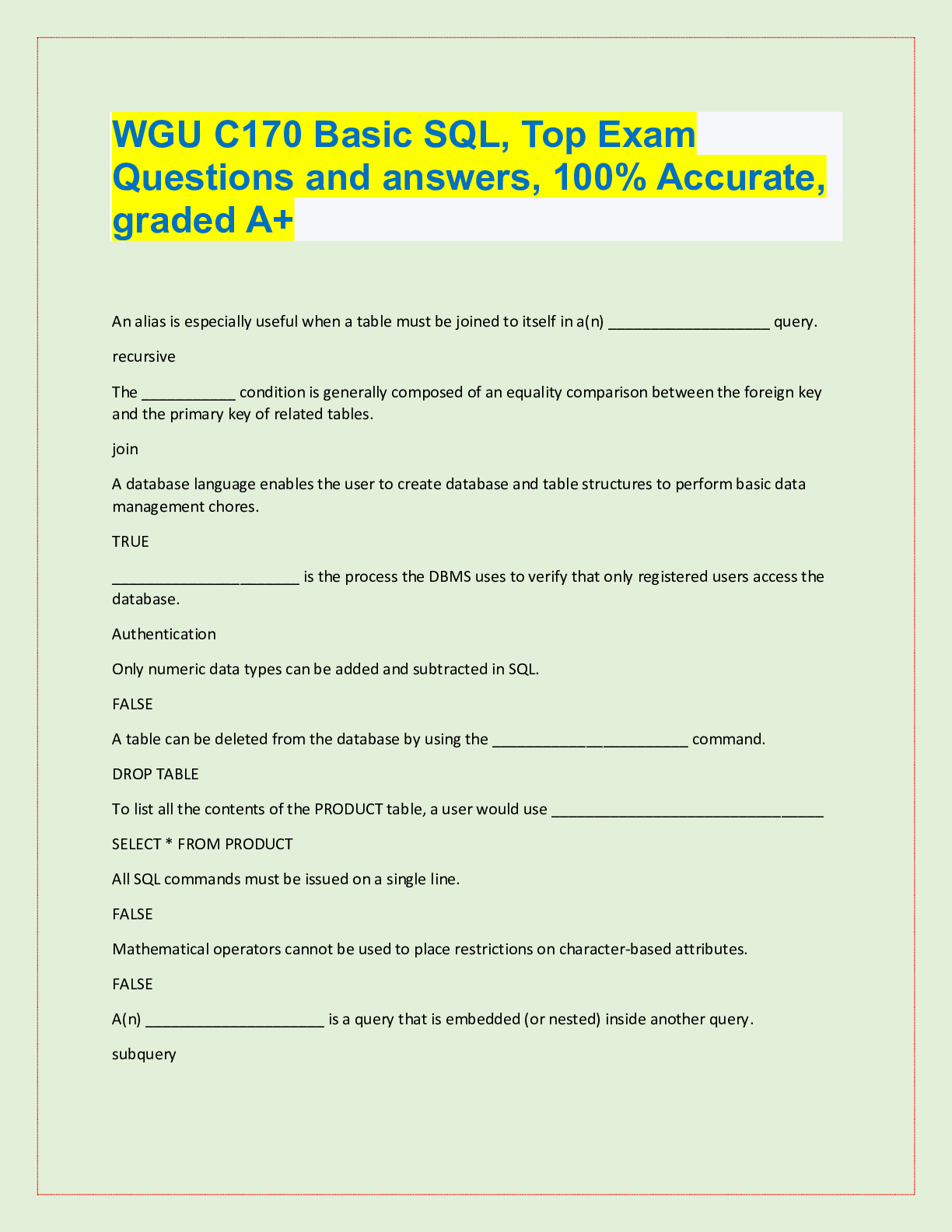

WGU C170 Basic SQL | 99 Questions And Answers

$ 10

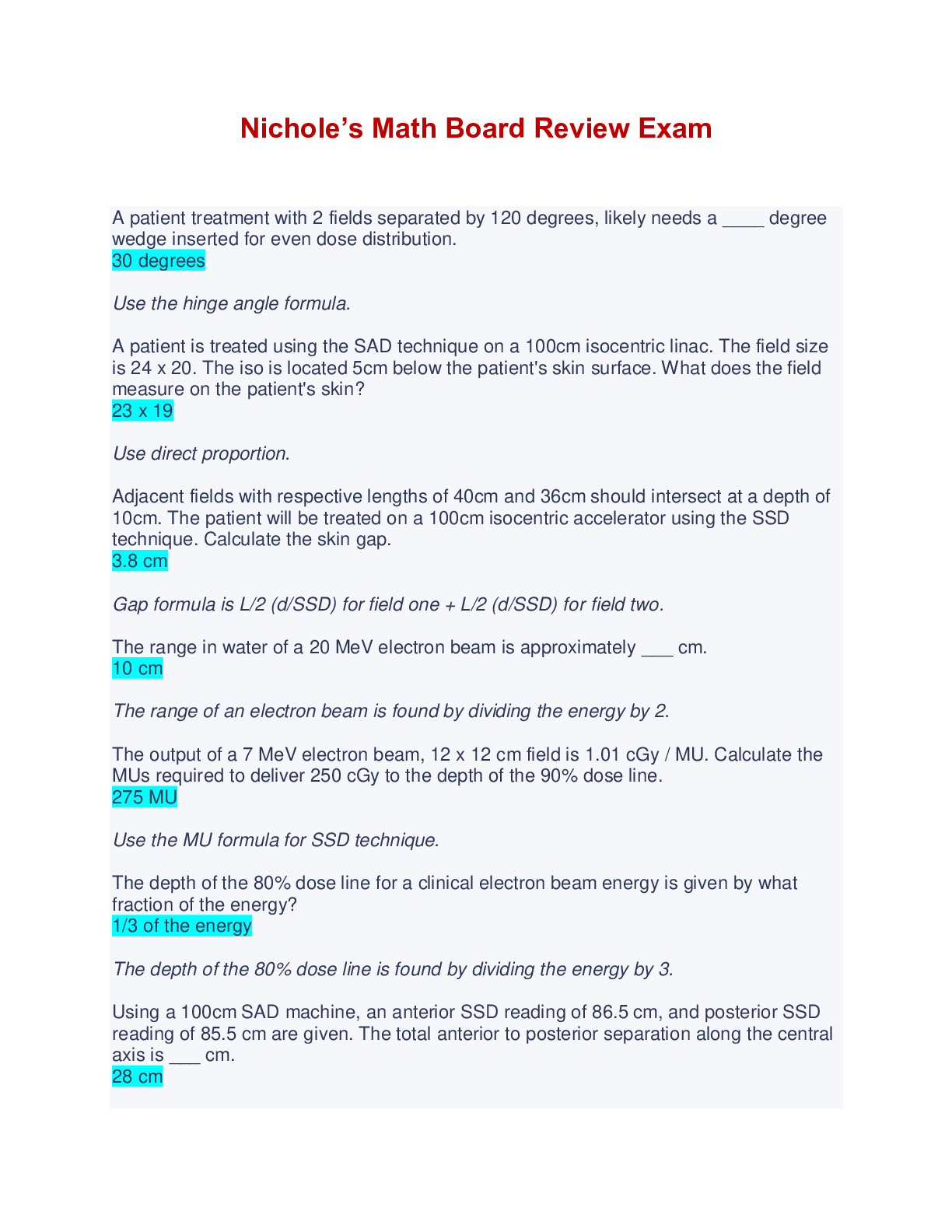

Nichole’s Math Board Review Exam - Questions, Answers and Explanations

$ 18

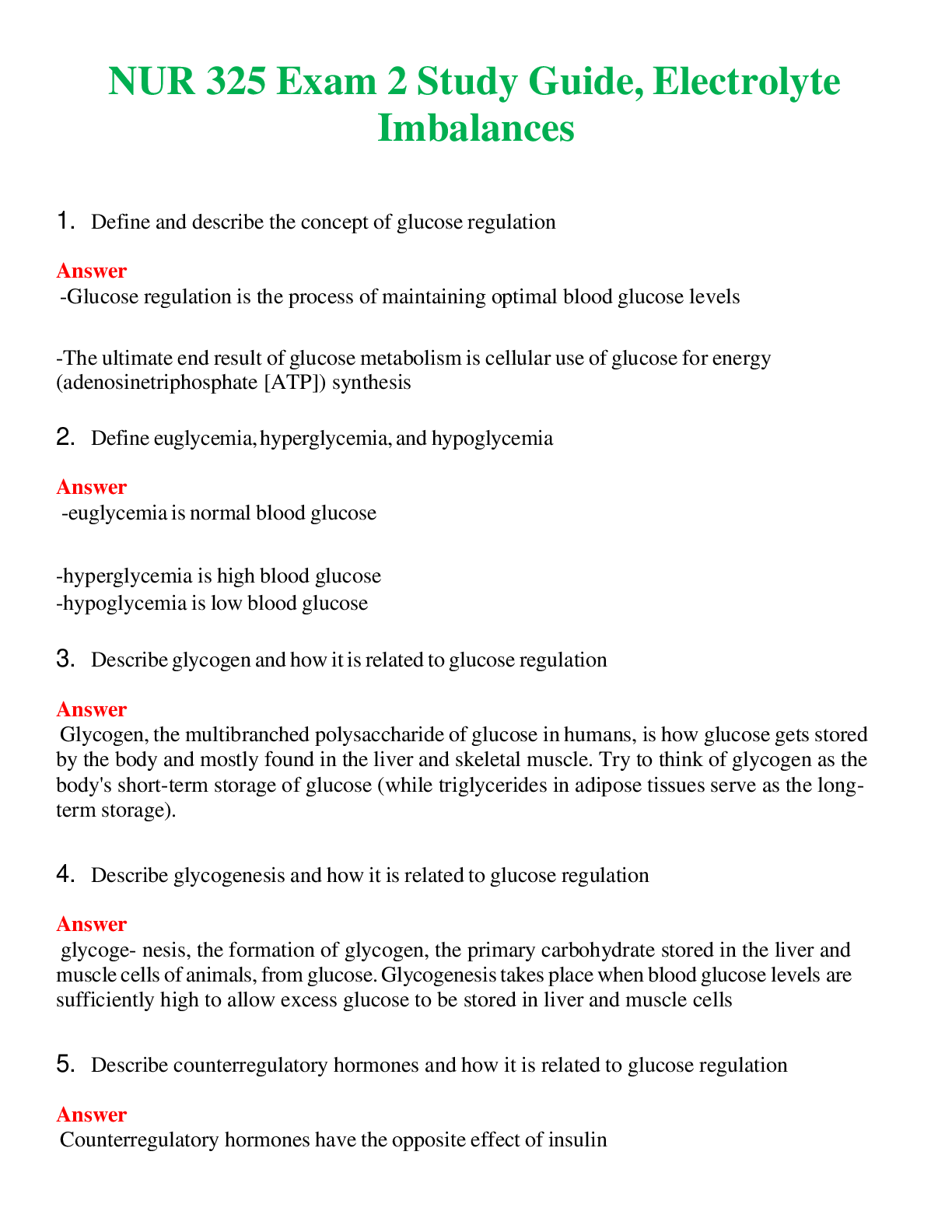

NUR 325 EXAM 2 STUDY GUIDE, ELECTROLYTE IMBALANCES | COMPLETE ANSWERS 100% CORRECT

$ 17.5

BIOS 256 Question Quiz #2

$ 13

Stahl’s Essential Psychopharmacology 5th Edition Test Bank

$ 6.5

eBook Water Resources Management 2nd Edition By Robert C.Brears

$ 30

HESI RN COMPREHENSIVE PREDICTOR EXAM

$ 9

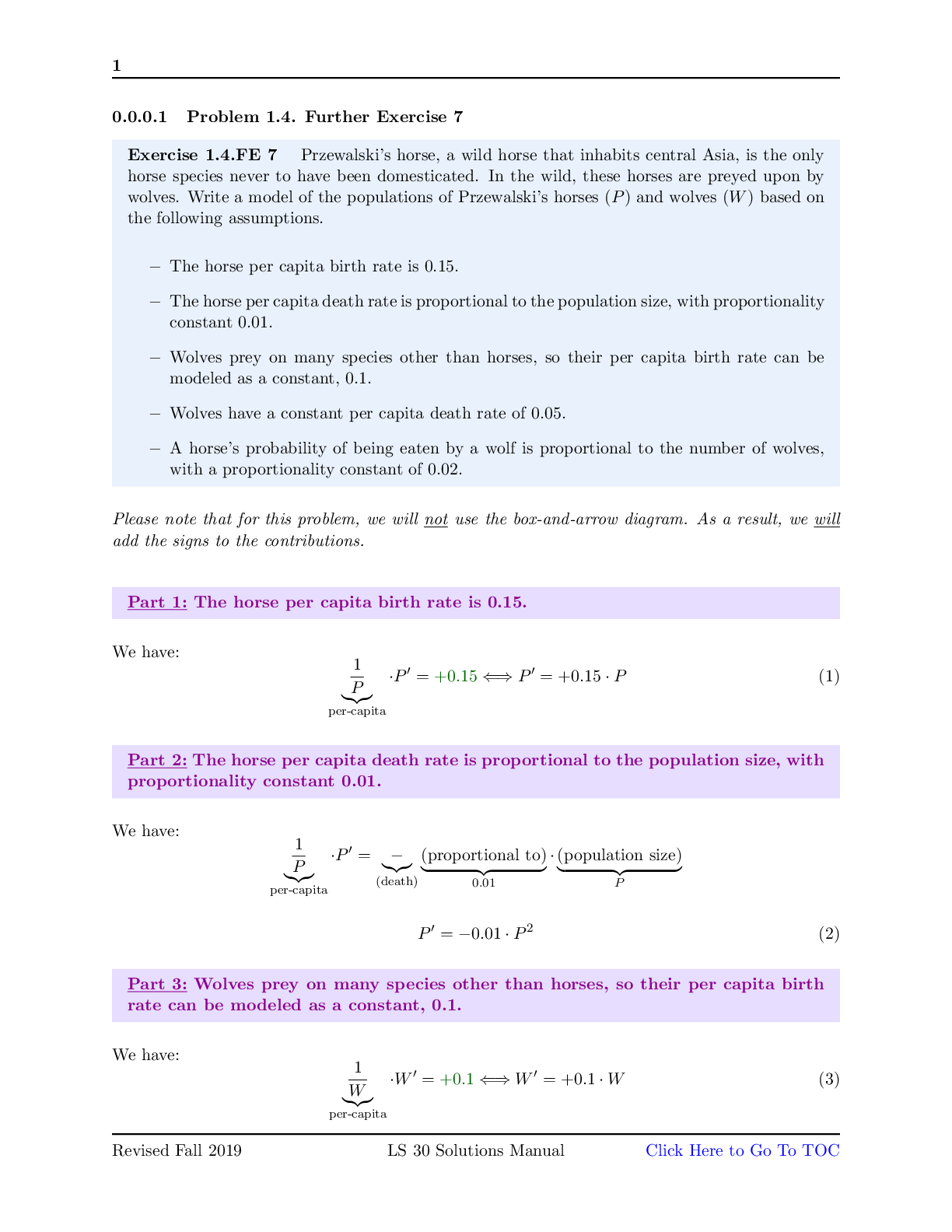

University of California, Los Angeles LIFESCIENC 30A. Homework 4 solutions

$ 9

NUR 2092 exam #2 study guide

$ 6

ATI Pediatrics - Study Guide Latest 2021 (Complete Solution)

$ 12.5

Huether & McCance: Understanding Pathophysiology, 6th Edition