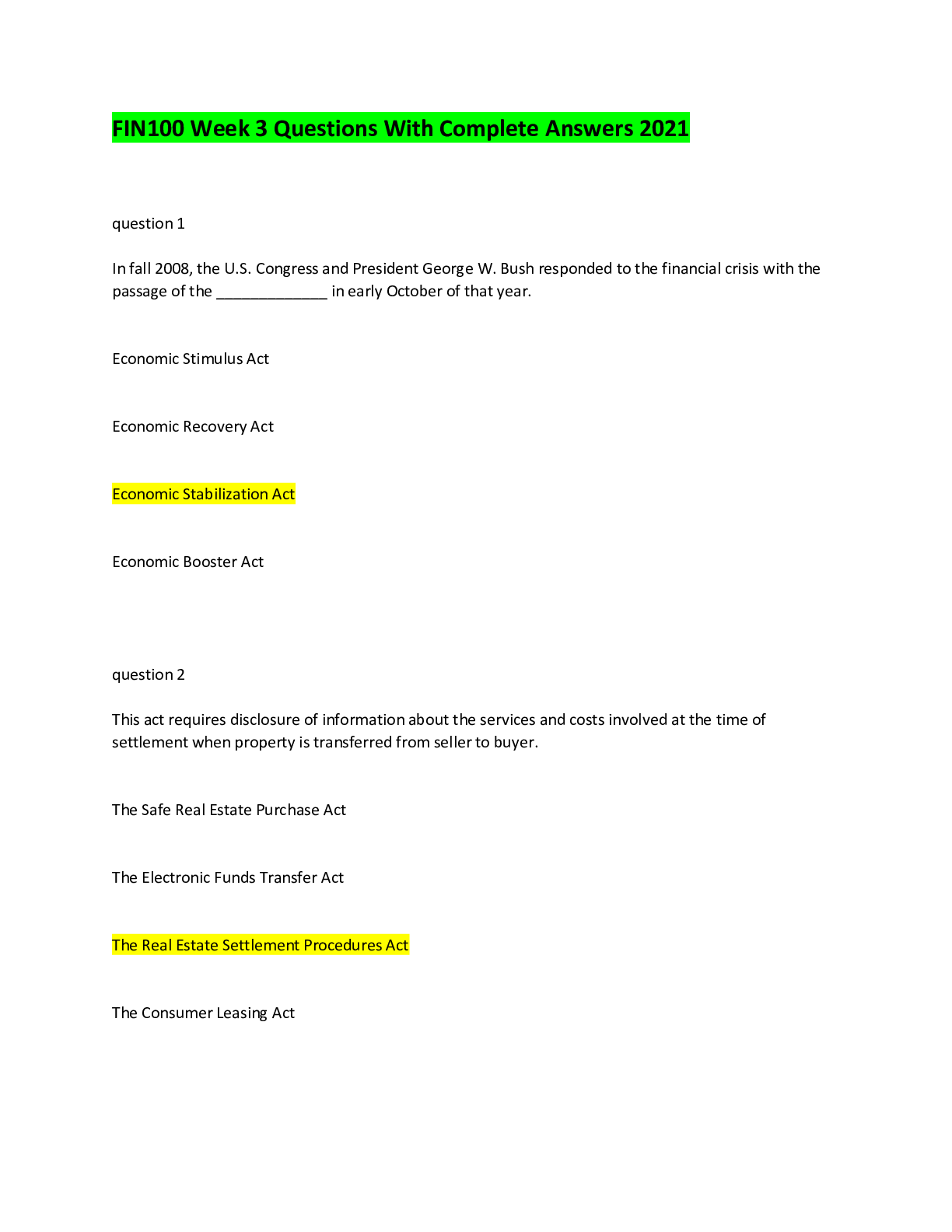

FIN 100 Week 3 Quiz

FIN100 Week 3 Questions With Complete Answers 2021

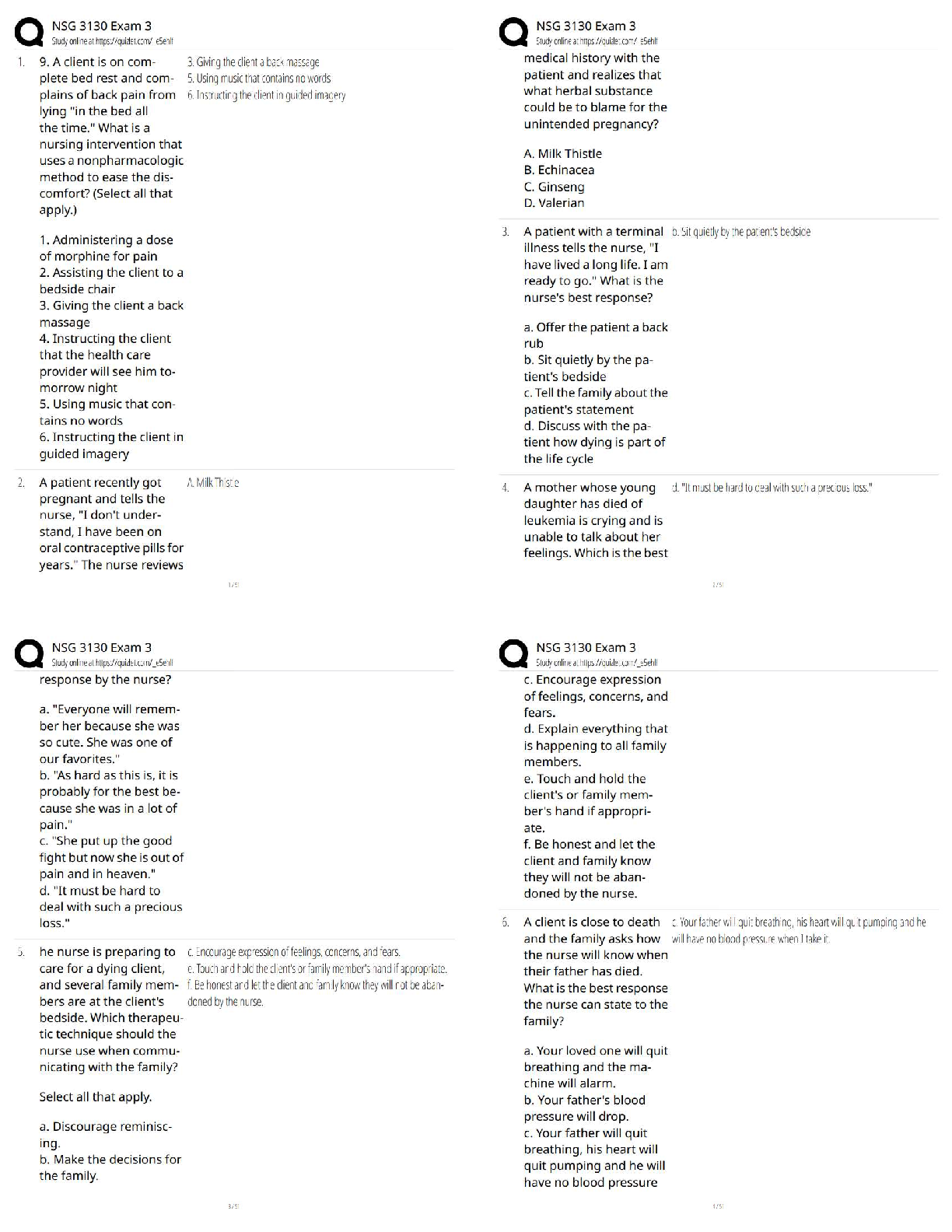

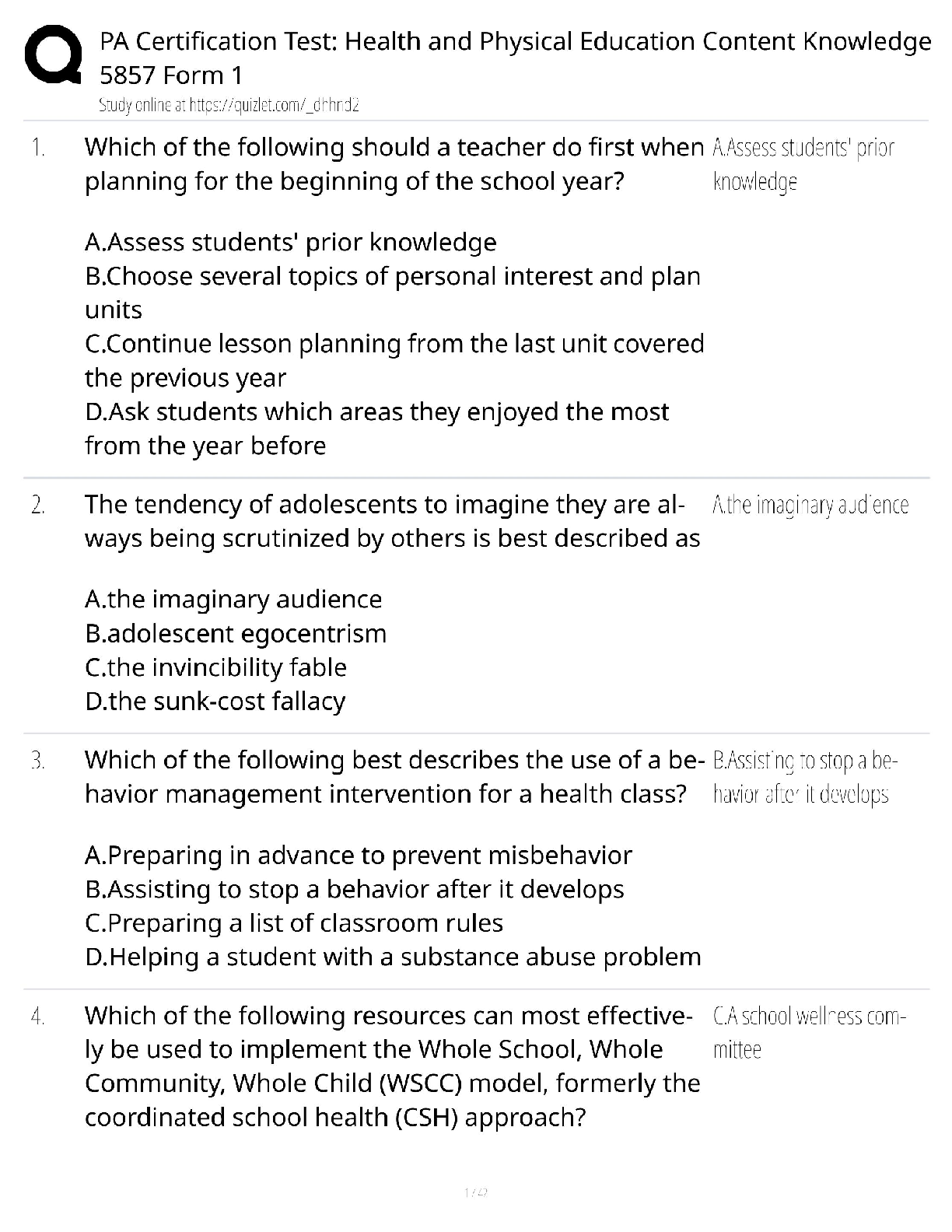

question 1

In fall 2008, the U.S. Congress and President George W. Bush responded to the financial crisis with the passage of the ________

...

FIN 100 Week 3 Quiz

FIN100 Week 3 Questions With Complete Answers 2021

question 1

In fall 2008, the U.S. Congress and President George W. Bush responded to the financial crisis with the passage of the _____________ in early October of that year.

Economic Stimulus Act

Economic Recovery Act

Economic Stabilization Act

Economic Booster Act

question 2

This act requires disclosure of information about the services and costs involved at the time of settlement when property is transferred from seller to buyer.

The Safe Real Estate Purchase Act

The Electronic Funds Transfer Act

The Real Estate Settlement Procedures Act

The Consumer Leasing Act

question 3

Automatic stabilizers include all of the following except

unemployment insurance

social security

welfare

pay-as-you-go tax system

question 4

Amount by which a depository institution’s bank reserves are less than required reserves.

Required reserves

Deficit reserves

Bank reserves

Excess reserves

question 5

When the Federal Reserve System was created, it was thought that its most important influence over monetary conditions would be

lending to banks to bolster their reserve positions.

quantitative easing.

the issuance of Federal Reserve notes.

the changing of reserve requirements.

question 6

__________________ become the most important and effective means of monetary and credit control.

Changing reserve requirements has

Changing the discount rate has

Open market operations has

Changing the Treasury bill rate has

question 7

The Federal Open Market committee

establishes and administers protective consumer finance regulations.

furnishes currencies.

handles U.S. government debt and cash balances.

buys and sells securities.

question 8

Created to issue its own debt securities to obtain funds that are invested in mortgages made to low to moderate income home purchasers

Government National Mortgage Association

Federal National Mortgage Association

Federal Home Loan Mortgage Corporation

Federal Reserve System

question 9

In our financial system, the money multiplier

is not affected by the Federal Reserve

can fluctuate over time

is not affected by the nonbank public

is not affected by the U.S. Treasury

question 10

This is the study of how growth driven, performance focused, early stage firms raise financial capital and manage operations and assets.

Corporate finance

Business finance

Entrepreneurial finance

Personal finance

None of the above

question 11

Primary groups of policy makers that are actively involved in achieving U.S. economic policy objectives include which of the following?

Commercial banks

The president

State legislatures

Foreign governments

question 12

Our country’s economic policy actions are directed toward all of the following goals except

balance in the federal budget.

high employment.

price stability.

economic growth.

uestion 13

Formed to support mortgage markets by purchasing and holding mortgage loans,

Government National Mortgage Association

Federal National Mortgage Association

Federal Home Loan Mortgage Corporation

Federal Reserve System

question 14

The members of the Fed Board of Governors are

elected by the member banks.

appointed by the President of the United States with the advice and consent of the Senate.

appointed by the Secretary of the Treasury.

appointed by each of the Federal Reserve banks.

question 15

In an effort to stimulate economic activity, Congress and the president passed the $787 billion _________________________________ in February, 2009 with the funds to be used to provide tax relief, appropriations, and direct spending.

American Reconstruction and Reconfiguration Act of 2009

American Real Estate and Reconstruction Act of 2009

American Real Estate Reinvestment Act of 2009

American Recovery and Reinvestment Act of 2009

question 16

Involves evaluating credit applications and collecting amounts owed by credit customers.

Cash management analyst

Capital expenditures analyst

Credit analyst

Cost analyst

Tax analyst

question 17

The Fed discount rate is

the rate charged a bank’s best customers.

the rate paid by large business with good credit.

the rate a bank must pay to borrow from the Fed.

the rate one bank loans to another bank.

question 18

Amount by which a depository institution’s bank reserves are greater than required reserves.

Required reserves

Deficit reserves

Bank reserves

Excess reserves

question 19

Currently, the backing for Federal Reserve’s notes is primarily in the form of

gold certificates.

gold bullion.

eligible paper (business notes and drafts).

the credit of the Federal Reserve.

question 20

Assume that a banking system must keep reserves of 20% against deposits. The bank receives a primary deposit of $20,000. What would be the maximum amount of loan that could be made by the system?

$16,000

$40,000

$80,000

$100,000

[Show More]

.png)

.png)

.png)