MBA 101 ASSIGNMENT I

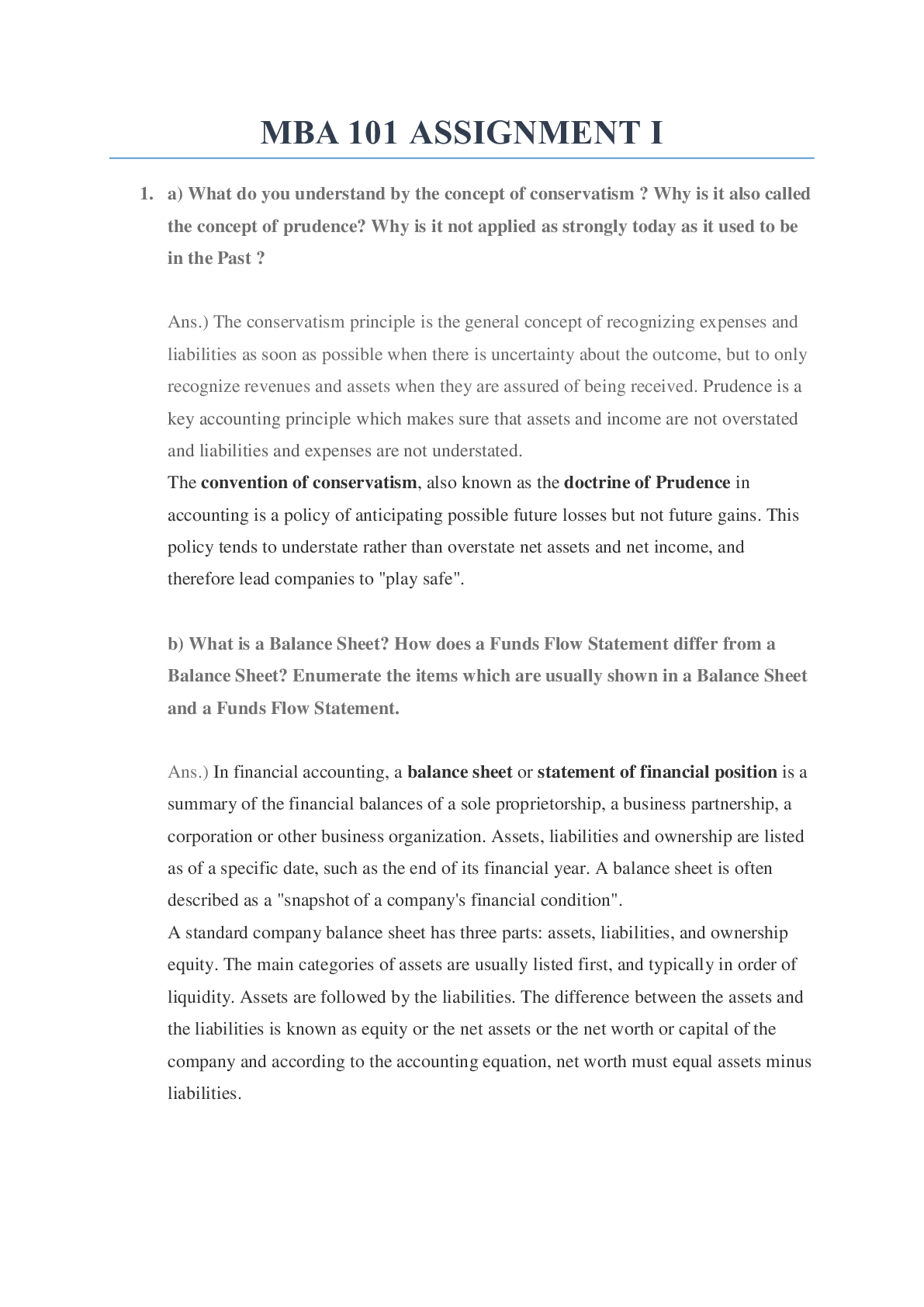

1. a) What do you understand by the concept of conservatism ? Why is it also called the concept of prudence? Why is it not applied as strongly today as it used to be in the Past ?

b) What is a Ba

...

MBA 101 ASSIGNMENT I

1. a) What do you understand by the concept of conservatism ? Why is it also called the concept of prudence? Why is it not applied as strongly today as it used to be in the Past ?

b) What is a Balance Sheet? How does a Funds Flow Statement differ from a Balance Sheet? Enumerate the items which are usually shown in a Balance Sheet and a Funds Flow Statement.

The major differences between Balance Sheet and Fund Flow statement are as below:

The major items shown in a Balance Sheet are Assets, Liabilities and Equity. These are further divided as below:

Current Assets:

Non-Current Assets:

Current Liabilities:

Non-Current Liabilities:

Equity:

The items that are shown in Fund Flow statement are Sources of Funds and Application of Funds.

These are further divided as below:

a. Sources of Fund

b. Application of funds

2. Discuss the importance of ratio analysis for inter-firm and intra-firm comparisons including circumstances responsible for its limitations .If any

(b) Why do you understand by the term ‘pay-out ratio’?

3. From the ratios and other data given below for Bharat Auto Accessories Ltd. indicate your interpretation of the company’s financial position, operating efficiency and profitability.

4. Bose has supplied the following information about his business to Summary of Cash book for the year ended 31st March, 2004 is as follows :

Discount allowed totaled Rs.7,000 and discount received was Rs.4,000. Bad debts written off were Rs.

8,000.

Depreciation was written off on furniture @5% per annum and machinery @10% per annum under the

straight line method of depreciation. The office expenses included Rs.5,000 paid as insurance premium for

the year ending 30th June, 2004. Wages amounting to Rs.20,000 were still due on 31st March, 2004.

Prepare trading and profit and loss account for the year ended 31sl March, 2004 and the

balance sheet as on that date.

5. What procedure would you adopt to study the liquidity of a business firm?

Who are all the parties interested in knowing this accounting information?

What ratio or other financial statement analysis technique will you adopt for this.

Dividends on shares Rs. 4,500 were collected by the bankers directly, for which Priya & Co. did not have any information

A company manufactures a single product in its factory utilizing 600% of its capacity.

The selling price and cost details are given below:

6. A company manufactures a single product in its factory utilizing 600% of its capacity. The selling price and cost details are given below:

It is expected that 2,000 units of the new product can be sold at a price of Rs. 60 per unit. The fixed factory overheads are expected to increase by 10%, while fixed selling and distribution expenses will go up by Rs. 12,500 annually. Administrative overheads remain unchanged.

However, there will be an increase of working capital to the extent of Rs. 75,000, which would take the total cost of the project to Rs. 8.75 lakh.

You are required to

(a) Decide whether the new product be introduced.

(b) Make any further observation/recommendations about profitability of the company on the basis of the above data , after making assumption that the present investment is Rs. 8 lakh

7. (a) What is Master Budget? How it is different from Cash Budget?

(c) What are the various methods of inventory valuation? Explain the effect of inventory valuation methods on profit during inflation. What are the provisions of Accounting Standard 2 (AS-2) with regards to inventory valuation?

b) Following are the various methods of inventory valuation and effect of inventory valuation methods on profit during inflation:

(a) First-in, First-out (FIFO):

(b) Last-in, First-out (LIFO):

(c) Weighted Average:

As per the definition of inventory or closing stock it includes following things;

Raw material which is not even issued for production while valuation of closing stock or inventory. It also includes consumable stores item.

AS-2 is not applicable to following cases.

[Show More]