Finance > QUESTIONS & ANSWERS > CFP Practice Questions - Investment Planning (All)

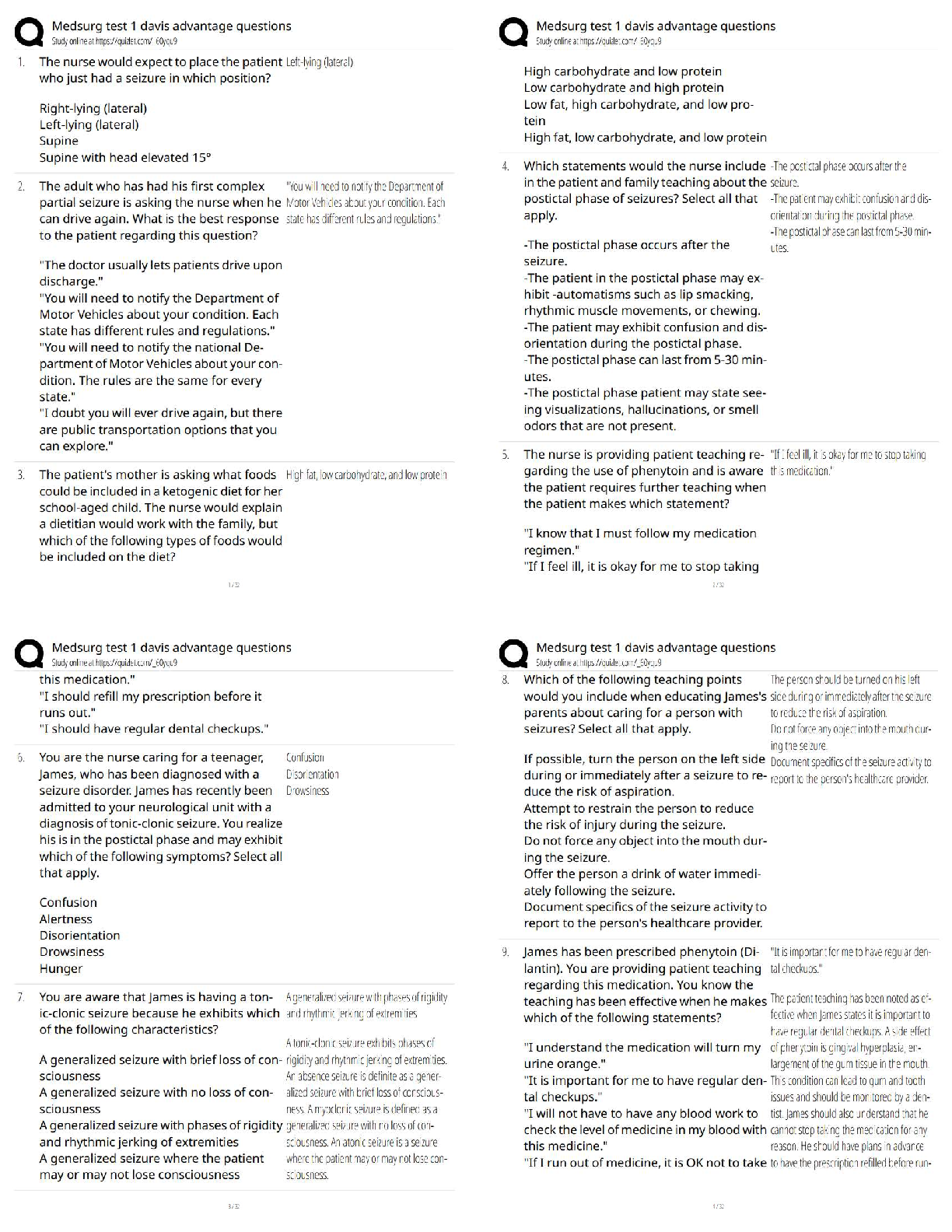

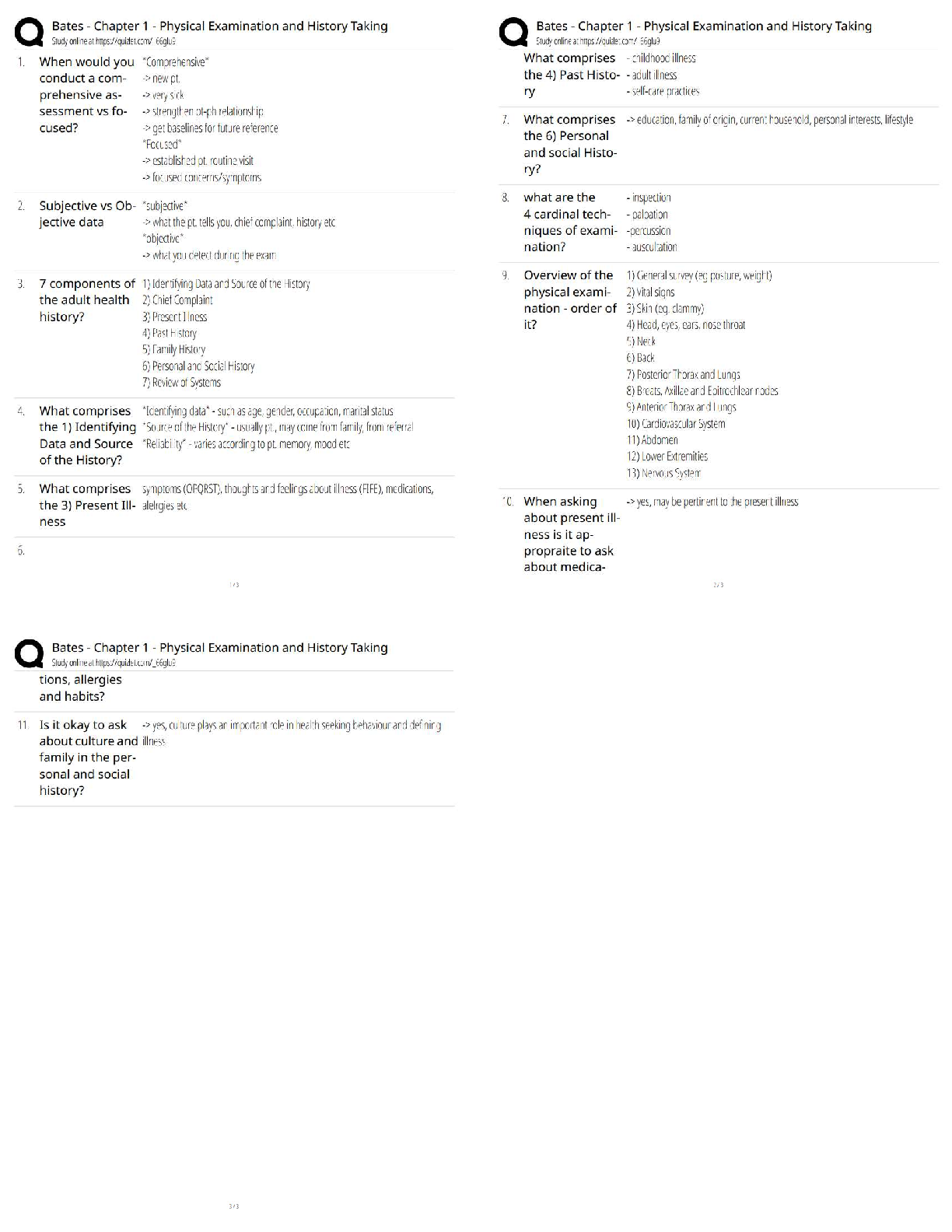

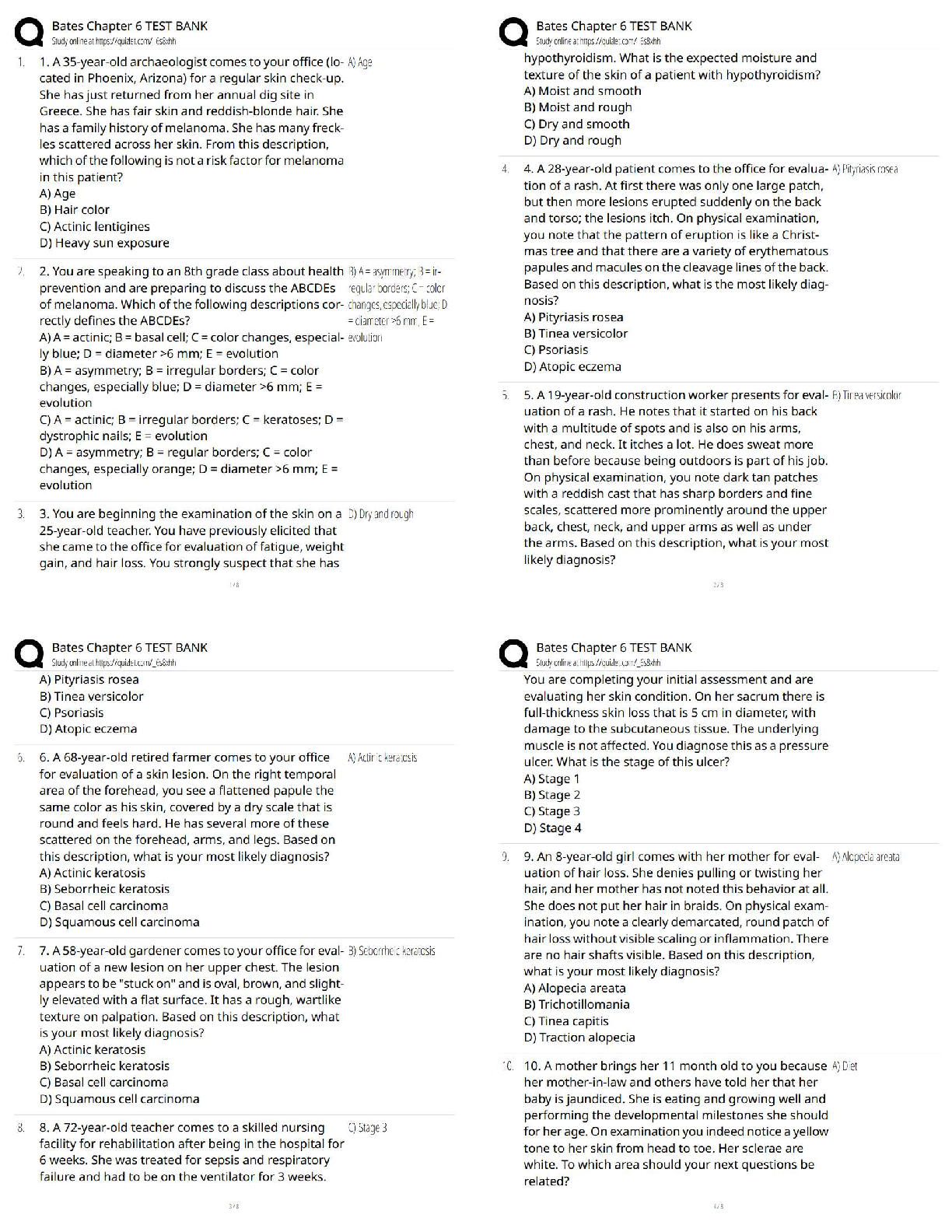

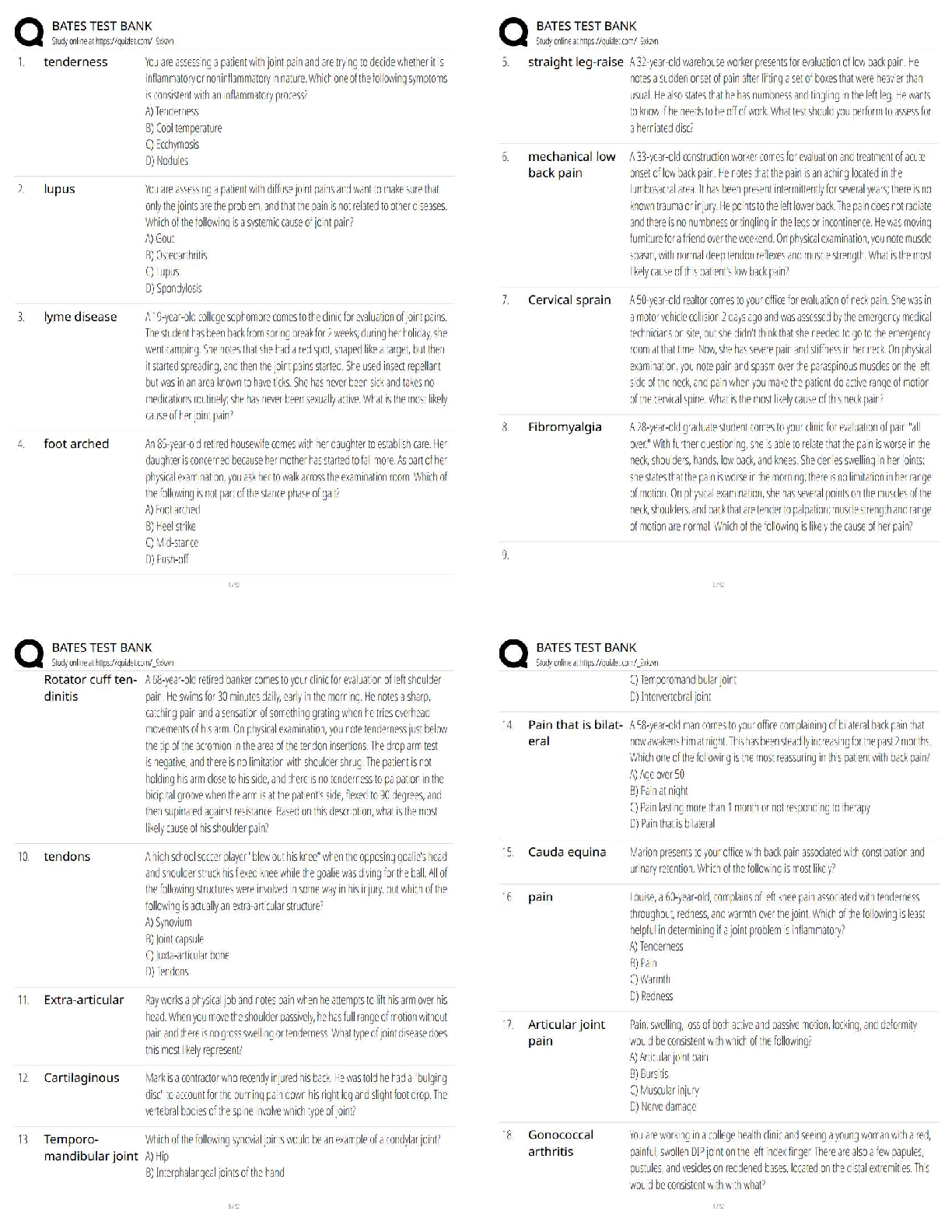

CFP Practice Questions - Investment Planning

Document Content and Description Below

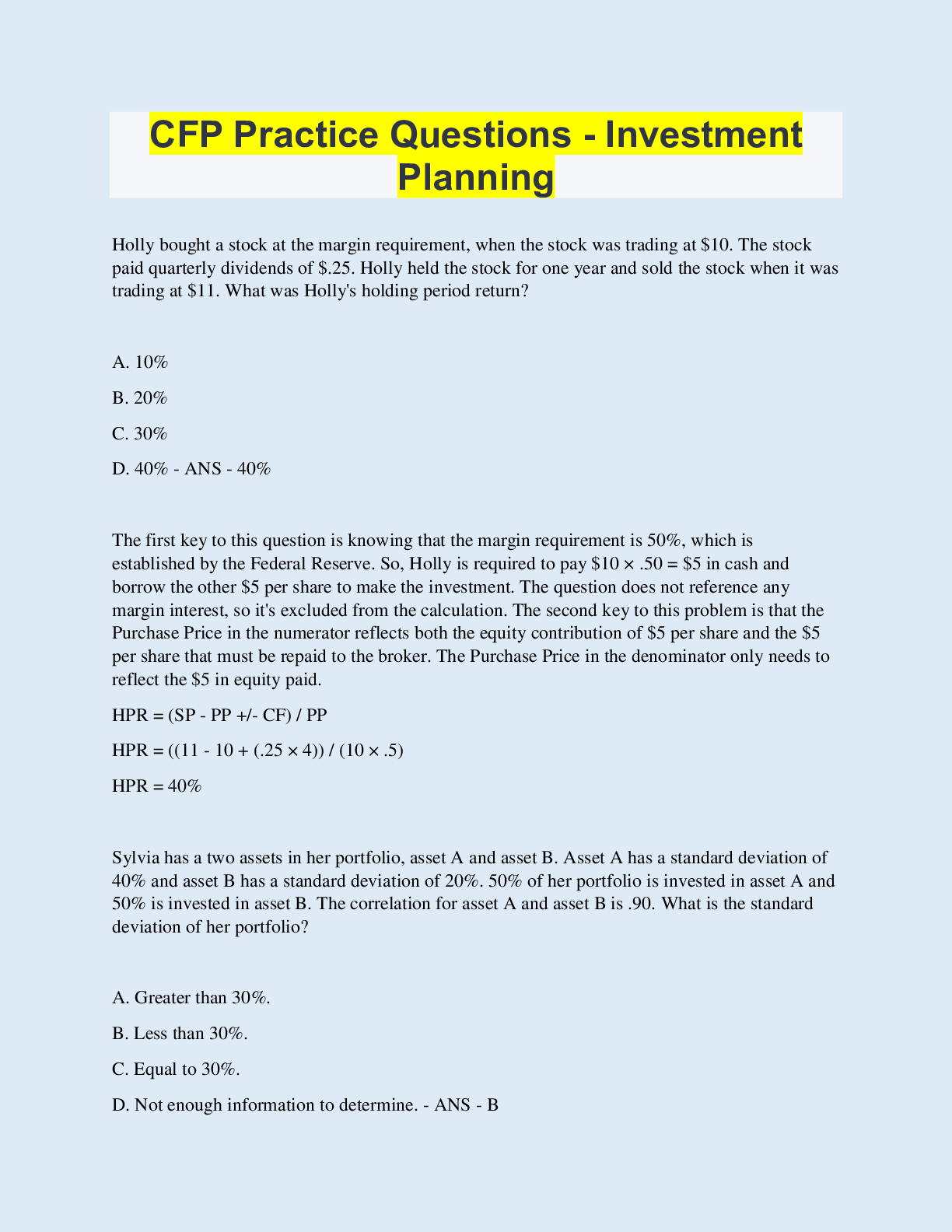

CFP Practice Questions - Investment Planning Holly bought a stock at the margin requirement, when the stock was trading at $10. The stock paid quarterly dividends of $.25. Holly held the stock for ... one year and sold the stock when it was trading at $11. What was Holly's holding period return? A. 10% B. 20% C. 30% D. 40% - ANS - 40% The first key to this question is knowing that the margin requirement is 50%, which is established by the Federal Reserve. So, Holly is required to pay $10 × .50 = $5 in cash and borrow the other $5 per share to make the investment. The question does not reference any margin interest, so it's excluded from the calculation. The second key to this problem is that the Purchase Price in the numerator reflects both the equity contribution of $5 per share and the $5 per share that must be repaid to the broker. The Purchase Price in the denominator only needs to reflect the $5 in equity paid. HPR = (SP - PP +/- CF) / PP HPR = ((11 - 10 + (.25 × 4)) / (10 × .5) HPR = 40% Sylvia has a two assets in her portfolio, asset A and asset B. Asset A has a standard deviation of 40% and asset B has a standard deviation of 20%. 50% of her portfolio is invested in asset A and 50% is invested in asset B. The correlation for asset A and asset B is .90. What is the standard deviation of her portfolio? A. Greater than 30%. B. Less than 30%. C. Equal to 30%. D. Not enough information to determine. - ANS - B It's not necessary to use the standard deviation of a two asset portfolio formula to answer this question. Since there's a 50/50 weighting for each asset, simply take a simple average of the standard deviations (.40 + .20) ¸ 2 = .30. Since the correlation is less than 1, the standard deviation for the portfolio will be less than the simple average. If correlation was equal to 1, then the standard deviation would be equal to 30%. The lowest bond rating that can still be considered investment grade debt is: A. A B. Baa C. BB D. Caa - ANS - B Baa is the lowest bond rating in Moody's Rating System, while BBB is the lowest investment grade in the S&P bond rating system. Which one of the following types of investor benefits most from the tax advantage of preferred stocks? A. Government. B. Individual. C. Corporate. D. Mutual funds. - ANS - C The corporate dividend-received deductions are based on ownership. TCJA of 2017 updated the amounts. If a corporation owns 20% or less, they have a DRD of 50%. If 20% or more (and less than 80%) of the corporation paying the dividend is owned by the company receiving the dividends, then up to 65% of the dividend is tax free. If ownership is greater than 80% (affiliated corporations) the DRD is 100%. Company A has 60% debt and 40% equity; Company B has 20% debt and 80% equity. Assume both companies have the same dollar amount of assets and net income before interest and taxes. Which one of the following statements is true? A. The unsystematic risk for the two companies is about equal. B. Company A's tax obligation will exceed Company B's. C. The company with the higher return on equity should be purchased by a risk-averse investor. D. The return on equity for Company A can be expected to exceed the return on equity for Company B. - ANS - D Company A has a smaller amount of its assets financed by equity, therefore, with the same earnings in net income as Company B, the level of return on the equity of Company A would be greater. Purely for EXAMPLE (net income is provided, not calculated): A: Assets $10M; Liabilities $6M; Equity $4M; EBIDTA = $1M; I/Y = 5% Net Income = $700K; ROE = $700,000 ÷ $4M = 17.5% B: Assets $10M; Liabilities $2M; Equity $8M; EBIDTA = $1M; I/Y = 5% Net Income = $900K; ROE = $900,000 ÷ $8M = 11.25% Your client holds a diversified equity portfolio, and has asked for your opinion on what is the most important factor to consider as he p [Show More]

Last updated: 3 years ago

Preview 1 out of 9 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 11, 2022

Number of pages

9

Written in

All

Additional information

This document has been written for:

Uploaded

Oct 11, 2022

Downloads

0

Views

196

.png)