Social Sciences > EXAMs > UBS Exam 2022 Questions and Answers (All)

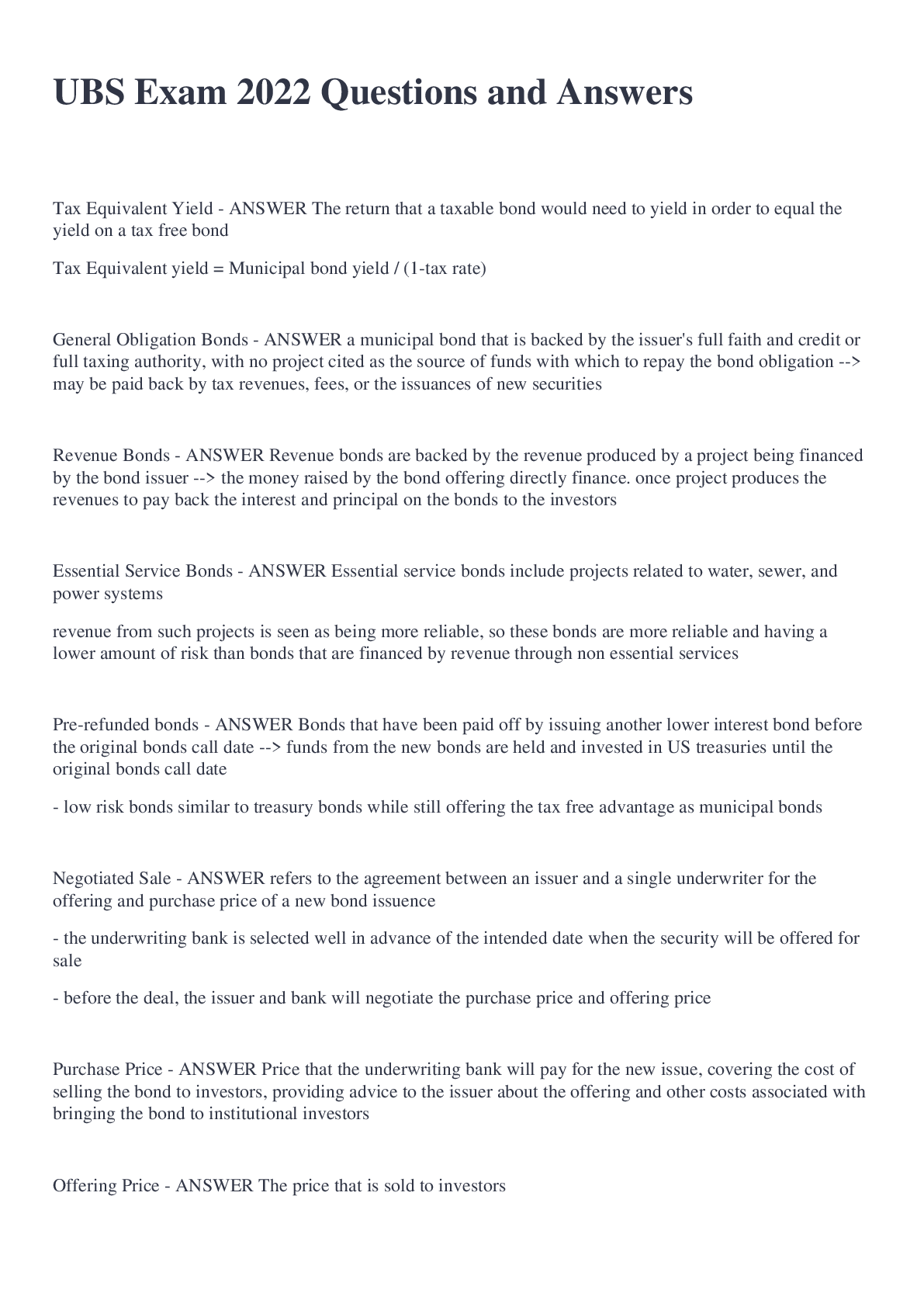

UBS Exam 2022 Questions and Answers

Document Content and Description Below

Tax Equivalent Yield - ANSWER The return that a taxable bond would need to yield in order to equal the yield on a tax free bond Tax Equivalent yield = Municipal bond yield / (1-tax rate) General O ... bligation Bonds - ANSWER a municipal bond that is backed by the issuer's full faith and credit or full taxing authority, with no project cited as the source of funds with which to repay the bond obligation --> may be paid back by tax revenues, fees, or the issuances of new securities Revenue Bonds - ANSWER Revenue bonds are backed by the revenue produced by a project being financed by the bond issuer --> the money raised by the bond offering directly finance. once project produces the revenues to pay back the interest and principal on the bonds to the investors Essential Service Bonds - ANSWER Essential service bonds include projects related to water, sewer, and power systems revenue from such projects is seen as being more reliable, so these bonds are more reliable and having a lower amount of risk than bonds that are financed by revenue through non essential services Pre-refunded bonds - ANSWER Bonds that have been paid off by issuing another lower interest bond before the original bonds call date --> funds from the new bonds are held and invested in US treasuries until the original bonds call date - low risk bonds similar to treasury bonds while still offering the tax free advantage as municipal bonds Negotiated Sale - ANSWER refers to the agreement between an issuer and a single underwriter for the offering and purchase price of a new bond issuence - the underwriting bank is selected well in advance of the intended date when the security will be offered for sale - before the deal, the issuer and bank will negotiate the purchase price and offering price Purchase Price - ANSWER Price that the underwriting bank will pay for the new issue, covering the cost of selling the bond to investors, providing advice to the issuer about the offering and other costs associated with bringing the bond to institutional investors Offering Price - ANSWER The price that is sold to investors Underwriting spread - ANSWER difference between what the investment bank gets from selling securities to public investors and what they pay to the issuing firm Competitive Bonds - ANSWER When a government agency or business wants to issue bonds, it pits out a request for proposal that includes the terms of sale and the terms of the bond - bonds are awarded the the bank that offers the lowest interest cost Muni-Treasury Ratio - ANSWER Compares the municipal bonds with those of the US Treasury - helps decide which is a better purchase at a given time - Muni treasury ratio = Muni Yield/Treasury Yield - Ratio averaged 80-90%, anything higher means that munis are performing well - To see what is better, multiply treasury yield by (1-t) Debt Service requirement - ANSWER The sum of all interest due or to become due at a date plus all principal installments due or to become due Principal - ANSWER Amount of money that must be paid when the bond matures, exclusive of any coupon Coupon Rate - ANSWER Largely affected by the government - of the interest rates are set to six percent, then no investor will accept a coupon payment for lower than this - higher the coupon rate, the smaller the price movements will be for a given security Use of Proceeds Statements - ANSWER A snap shot at what a company aims to do with the secured capital Current yield of a bond - ANSWER the annual coupon divided by the current price of the bond Yield to Maturity - ANSWER The yield to maturity (YTM) is the rate of return on a bond if it is purchased today for its current price, held through its maturity date and is paid off in full at maturity. {(Coupon + Face Value - Price of Bond)/ Years to Maturity}/{(Face value + Price)/2} Bond Prices and Interest rates - ANSWER inverse relationship - bonds pay a fixed interest rate, so if interest rates fall - these bonds become more attractive, raising their prices -The reason why is because when rates go down the new bonds are not as attractive as your old bonds, so your old bond goes up in value. If someone wants to buy your old bond, that bond is yielding higher than the new bonds, therefore a premium will be paid. Conversely, when rates go up, the price of old bonds naturally go down because now I can buy bonds at a higher yield so I would pay a discount on Going rates on Bonds - ANSWER Recent news on Munis - ANSWER What happens to munis with fluctuations to the market? - ANSWER When interest rates fall, newly issued bonds will pay a lower yield than existing issues, which makes the older bonds more attractive. Investors who want the higher yield may be willing to pay more to get it.Likewise, if interest rates rise, newly issued bonds will pay a higher yield than existing issues. Investors who buy the older issues are likely to do so only if they get them at a discount. Where are we in fed cycle - ANSWER there is expectation of a recession which would potentially reduce government initiatives and projects Bond Duration - ANSWER Measures the sensitivity of a bond's price to interest rate movements. The approximate percentage the value of the bond will fall for each 1% increase in market interest rate What is a request for proposal (RFP)? - ANSWER A request for proposal (RFP) is a business document that announces and provides details about a project, as well as solicits bids from contractors who will help complete the project. Considerations in Bond Pricing/Issuances - ANSWER Prevailing interest rates - Higher rates will lower prices (issuers less willing to issue bonds)* Credit ratings - Higher credit rating leads to lower yields, higher prices* Call options* Political considerations bond discount - ANSWER the difference between the amount you pay for the bond and its face value Understand the general economy, interest rates (where do you think they're going in the next 6 months and why? Brush up on your basic econ (understand basic monetary policy....why is the fed is going to tighten monetary policy in the next few months? Know basics about overseas interest rates, why negative or near-zero interest rates are a thing. How do Munis track treasuries? How are treasuries affected by the overall economy, both domestic and abroad. - ANSWER Refinancing - ANSWER term to maturity - ANSWER Longer term to maturity, the more susceptible to changes in price due to changes in interest rates. Understand the math behind this. • Short term securities - will trade closer to Par (investor will receive full amount sooner). Par Bond - ANSWER When the bond's coupon rate equals the market yield; Bonds are typically issued near par value Callable Bond - ANSWER Bonds that can be paid off by an issuer prior to the maturity date (payment is face value plus any incurred interest) Typically have higher coupons Offers the opportunity to refund at a lower rate in the future (refinance). Muni Bond Risks - ANSWER Muni bonds are not risk free - Credit Risk: Issuer will not be able to make interest payments or may default. Reflected in the bond rating - Event Risk: Unanticipated risks (catastrophic events) - Political risks: Climate in state and local governments (Tax-limitations, voter rejections of bonds) - Market Risk: Interest rate Risk (Potential prices changes due to changes in interest rates) - Inflation Risk( Bond's value will diminish if there is overall inflation) - Liquidity risk (May have less demand, unable to sell) - Reinvestment Risk Implications affecting Municipal issuances - ANSWER Political pressures (anything that could decrease taxes could decrease the relative attractiveness of municipals to normal bonds - why do you think this is the case?...political backdrop politicians less willing to raise taxes...voter sentiment on General Obligation bonds - how will voters vote on a referendum? Gridlock in state and local legislatures...Increase in federal mandates and decreases in federal funding resources...Municipality's willingness vs. ability to make full debt payments) Current Muni Climate - ANSWER There has been tightening monetary policy in attempt to control inflation. it is expected that the Fed will continue to raise rates into 2023 - this rate raise has increased the demand for municipal bonds, yet the new issuances were lower in July of 2022 than in July 2021 and 2020- there is more demand and less supply - The governments push toward infrastructure, like their infrastructure bill from last year helped fund large capital projects and provided stability to public finance sectors - The new reconciliation bill will be interesting to watch because the affects on munis are unknown, yet there is a mandatory 15% corporate tax and focus on climate and energy provisions - I know that many projects and governments have been refinancing, yet with the rising interest rates government's are no longer going to be able to do this Almeda County - ANSWER Muni Bond Yields - ANSWER 1 year: +1.56% 5 Year: +1.87% 10 Year: +2.27% Treasury: 5 year --> 2.96% 10 year --> 2.83% Affects on Treasury Bonds - ANSWER When gov lowers its key interest rate, the demand for treasuries increase because other fixed income investments become less attractive - if investors believe they can gain a high yield elsewhere they will Why UBS? - ANSWER Positioning of the bank Firstly, UBS is a forward thinking and progressive bank which differentiates itself from many of the other bulge bracket banks UBS is number one for sustainable and impact investment. I read that in 2020, UBS was the first financial institution to make sustainable investments their preferred solution for all their global private clients As a woman, equal opportunity is extremely important to me while looking for a job. UBS's commitment to increase the number of women in leadership roles to 30% by 2025 is really exciting to me Secondly, after speaking with multiple bankers at UBS, I understand the unique techniques UBS utilizes with their clients. UBS is a bulge bracket bank but is much more advisory driven than capital. UBS is investing to improve their advisory processes and becoming even more capital light. I want to be a part of a skilled firm with an exceptional reputation - working and advising selective clients on how to be innovative in their needed projects and being a part of the change that UBS is facilitating through their advisory process. UBS is especially known for their wealth management branch of the bank. Although I am applying for a position in the investment banking branch, UBS is unique in the fact that it encourages interaction between their investment bank, wealth management and asset management divisions which exposes the public finance department to a much larger pool of capital UBS is known for their training program. I read that in 2021, UBS spent over $70 million on training for their employees. I want to be a part of a firm that is dedicated to their employees' careers and facilitating a corporate culture of inclusivity and diversity. Why Public Finance - ANSWER The day-to -day activities of working in IB are extremely attractive to me, specifically the aspect of working on a team. I am very analytically focused and love working on a team. I was the captain of two sports teams in high school and have had great experiences working with my peers to solve problems. Owen Hopkins emphasized the excellent culture within the public finance group - he explained to me that it is a collaborative culture and that the team gets a long really well I am majoring in international political economies and business in the McDonough School of Business which gives me a dual education in politics and business. I have always been extremely interested in working on the finance side of politics and helping governments finance their projects. My financial education has given me exceptional analytical skills and my classes in politics and economics have given me the ability to understand how the economy is affected by the political climate. This year, specifically, in my international business class we studied how the monetary and fiscal policies implemented by the federal reserve impacts the way businesses operate. I am working in private equity this summer which has given me the chance to observe deals from the buy side yet I would like to see the full life of a transaction and working in investment banking would allow me to see the transaction all the way through Current Interest rate - ANSWER 2.25%-2.50% [Show More]

Last updated: 3 years ago

Preview 1 out of 6 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$8.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 13, 2022

Number of pages

6

Written in

All

Additional information

This document has been written for:

Uploaded

Oct 13, 2022

Downloads

0

Views

59