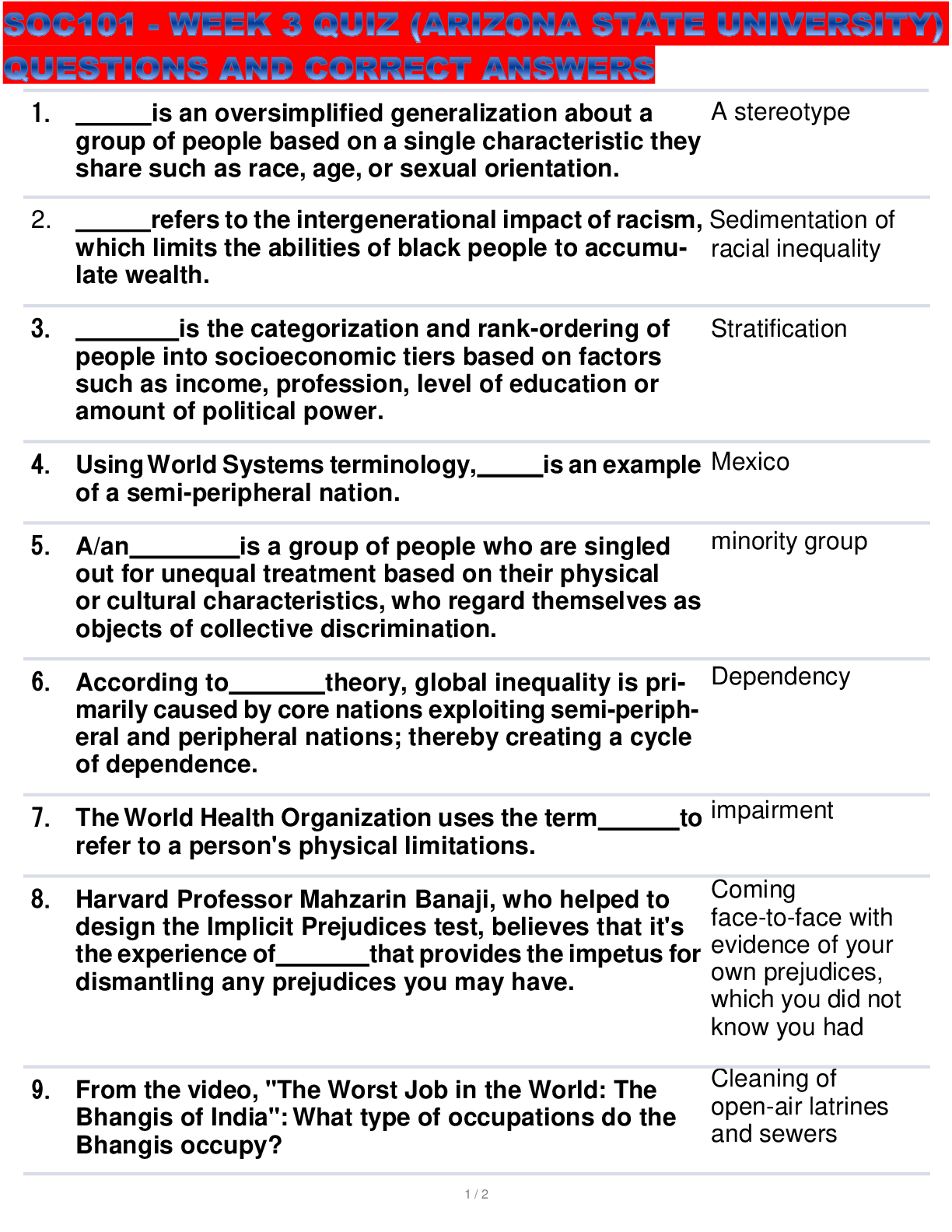

Question

1

Marks: 1

Mr. Wingate is a newly enrolled Medicare Part D beneficiary and one of your clients. In addition to drugs on his plan’s formulary he takes several other medications. These include a prescription dr

...

Question

1

Marks: 1

Mr. Wingate is a newly enrolled Medicare Part D beneficiary and one of your clients. In addition to drugs on his plan’s formulary he takes several other medications. These include a prescription drug not on his plan’s formulary, over-the-counter medications for colds and allergies, vitamins, and drugs from an Internet-based Canadian pharmacy to promote hair growth and reduce joint swelling. His neighbor recently told him about a concept called TrOOP and he asks you if any of his other medications could count toward TrOOP should he ever reach the Part D catastrophic limit. What should you say?

Choose one answer.

a. The cost of the prescription drugs that are not on his plan’s formulary as well as the cost of the drug(s) to reduce joint swelling from the Canadian pharmacy will count toward TrOOP but the other medications in question will not

count toward TrOOP.

b. None of the costs of Mr. Wingate’s other medications would currently count toward TrOOP but he may wish to ask his plan for an exception to cover the prescription not on

its formulary. Correct: None of the costs of Mr. Wingate’s other medications would currently count toward TrOOP but he may wish to ask his plan for an exception to cover the prescription not on its formulary. If he receives an exception under which the plan covers the drug, it could count toward TrOOP.

c. The cost of all medications bought within the United States not covered by his plan would count toward TrOOP. The cost of the Canadian bought medications would not

count toward TrOOP.

d. The cost of the prescription drug that is not on his plan’s formulary will count toward TrOOP but the other medications in question will not

count toward TrOOP.

Source: Module 3, Slide – True Out-of-Pocket Counts? (TrOOP): What Counts, Slide - True Out-of-Pocket Costs (TrOOP): What is Excluded? Correct

Marks for this submission: 1/1.

Question

2

Mar

Mr. Shapiro gets by on a very small amount of fixed income. He has heard there may be extra help paying for Part D prescription drugs for Medicare beneficiaries with limited income. He wants to know whether he might qualify. What should you tell him?

Choose one answer.

a. The extra help is available only to Medicare beneficiaries who are enrolled in Medicaid. He should apply for coverage under his state’s Medicaid program to access the extra

help with his drug costs.

b. The government pays a per-beneficiary dollar amount to the Medicare Part D prescription drug plans, to offset premiums for their low- income enrollees in accordance with the plan’s set criteria. Mr. Shapiro should check with his plan to

see if he qualifies.

c. He must apply for the extra help at the same time he applies for enrollment in a Part D plan. If he missed this opportunity, h

Correct: If a beneficiary has limited income and resources, they may qualify for a low-income subsidy (LIS) to cover all or part of the Part D plan premium and cost-sharing.

Beneficiary income may not exceed 150 percent of the Federal Poverty Level (FPL). Assets may not exceed a limited amount also specified by the government.

Source: Module 3, Slide - Help for Individuals with Limited Income and Limited Resources and Slide - Encourage Individuals with Limited Income/Resources to Apply to the State Medicaid Office

Correct

Marks for this submission: 1/1.

Question

3

Marks: 1

Mrs. Quinn has just turned 65, is in excellent health and has a relatively high income. She uses no medications and sees no reason to spend money on a Medicare prescription drug plan if she does not need the coverage. She currently does not have creditable coverage. What could you tell her about the implications of such a decision?

Choose one answer.

a. If she does not sign up for a Medicare prescription drug plan as soon as she is eligible to do so, and if she does sign up at a later date, she will have to pay a one-time penalty equal to 10% of the

annual premium amount. Incorrect: The premium penalty exists as long as the enrollee has Part D coverage, and the premium penalty amount is 1% of the national average premium for each month the individual does not have Part D coverage.

b. If she does not sign up for a Medicare prescription drug plan as soon as she is eligible to do so, and if she does sign up at a later date, she will be required to pay a higher premium during the first year that she is enrolled in the Medicare prescription drug program. After that point, her premium will return to the

normal amount.

c. If she does not sign up for a Medicare prescription drug plan as soon as she is eligible to do so, and if she does sign up at a later date, her premium will be permanently increased by 1% of the national average premium for every

month that she was not covered.

d. If she does not sign up for a Medicare prescription drug plan, she will incur no penalty, as long as she can demonstrate that she was in good health and did not

take any medications.

Source: Module 3, Slide -Part D Late Enrollment Penalty, Slide – Part D Late Enrollment Penalty Examples

[Show More]