eBook Marketing for Hospitality and Tourism 8e Philip Kotle, John Bowen, Seyhmus Baloglu

$ 29

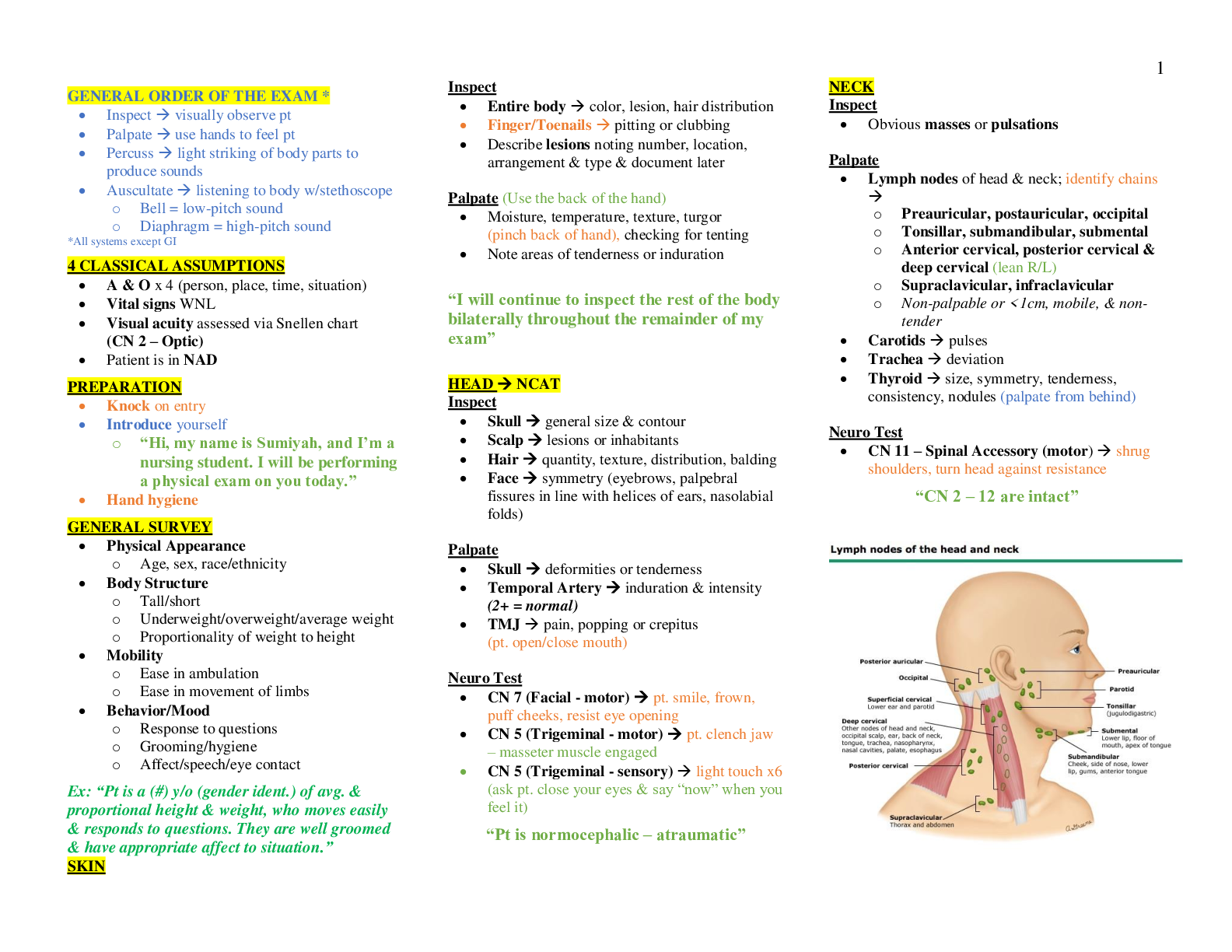

Complete Head-to-Toe Physical Assessment Script

$ 10

Invitation to the Life Span, 5th Edition by Kathleen Stassen Berger | Test Bank

$ 25

Virginia Medication Aide Prep with complete solution

$ 8

MC CANCE Huether Pathophysiology 7TH AND 9TH EDITION TEXT BANK

$ 12.5

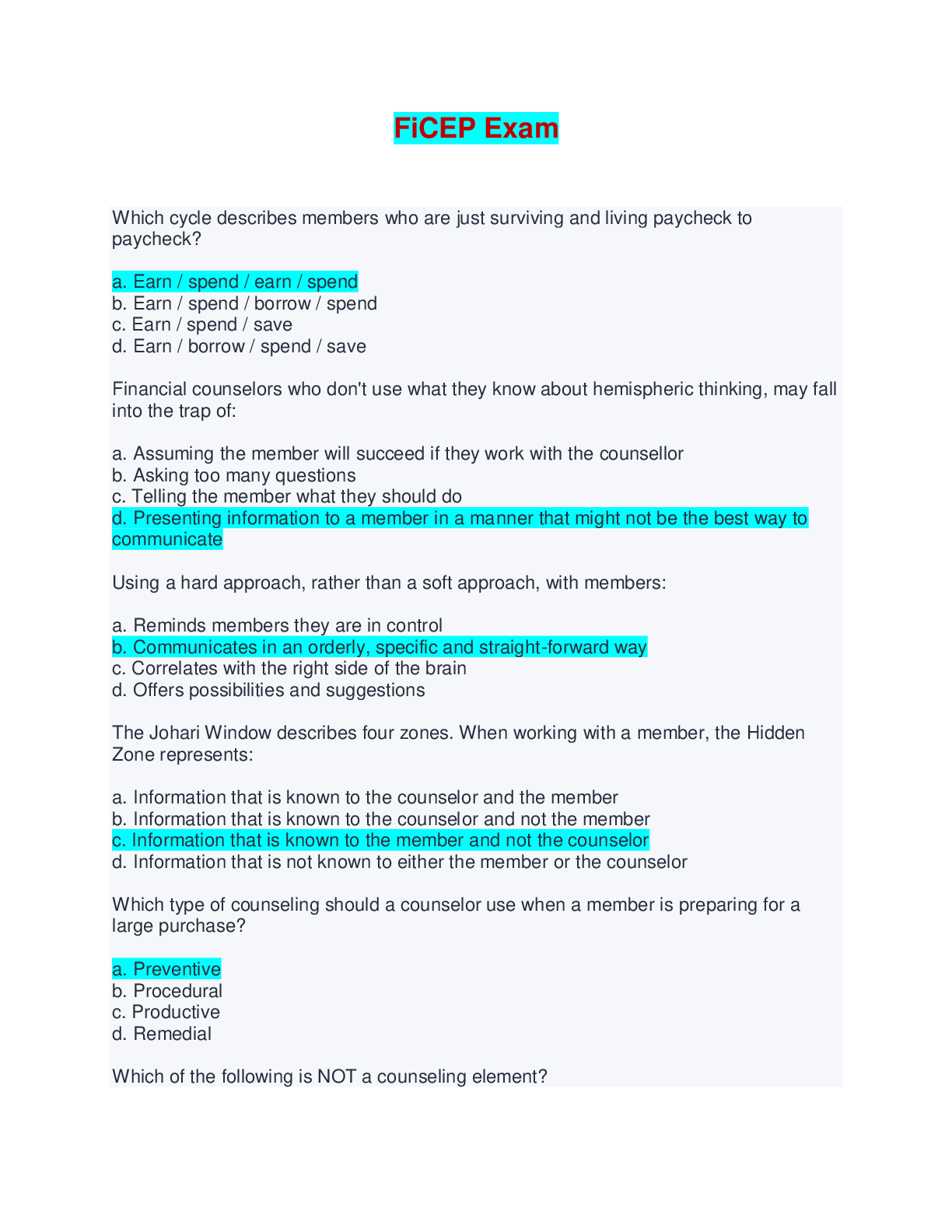

2024/2025 FiCEP Exam - Questions with 100% Correct Answers

$ 15

.png)

Wastewater Treatment Operator Certification Test #1 Rated A+

$ 10

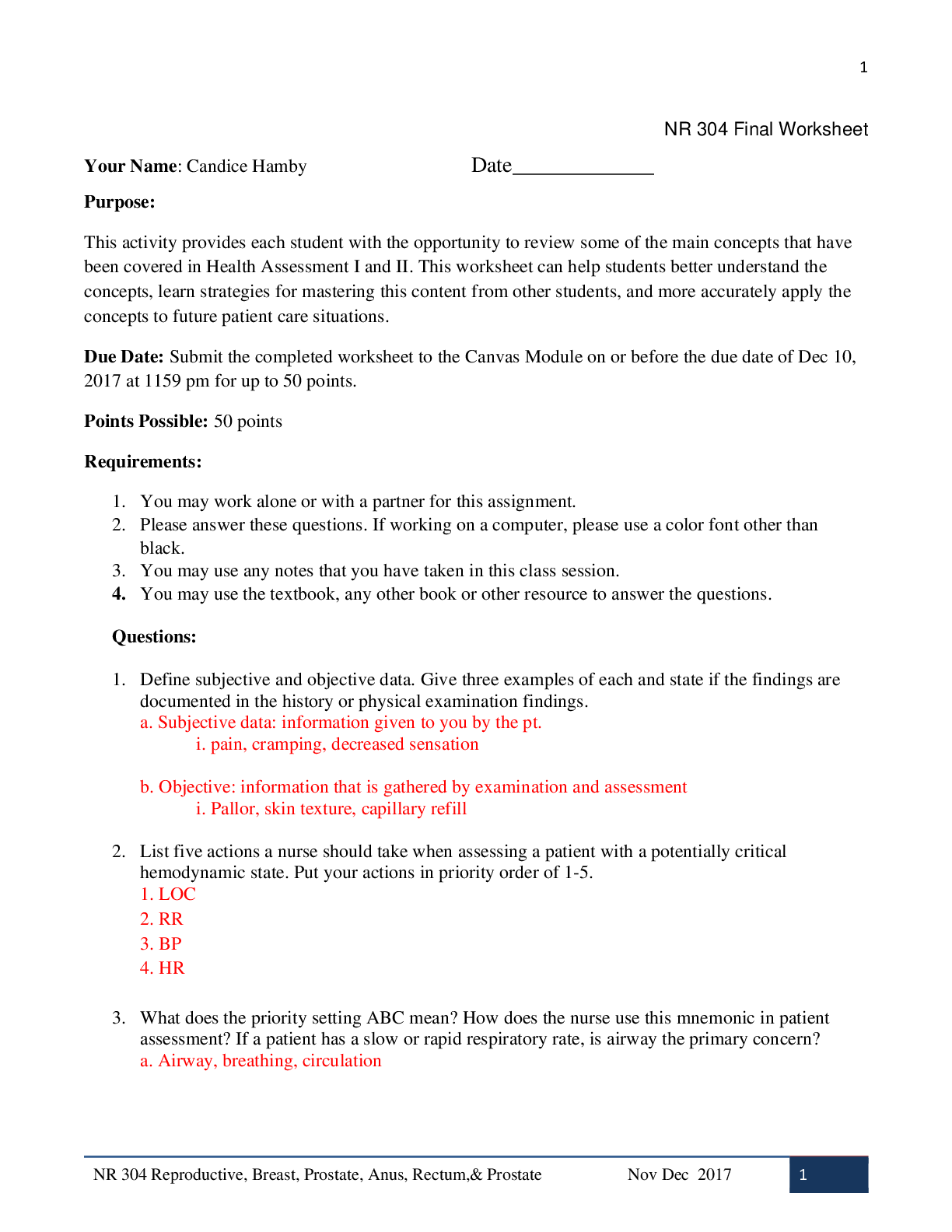

NR 304 Week 7 FINAL ATI Worksheet Candice Hamby

$ 15

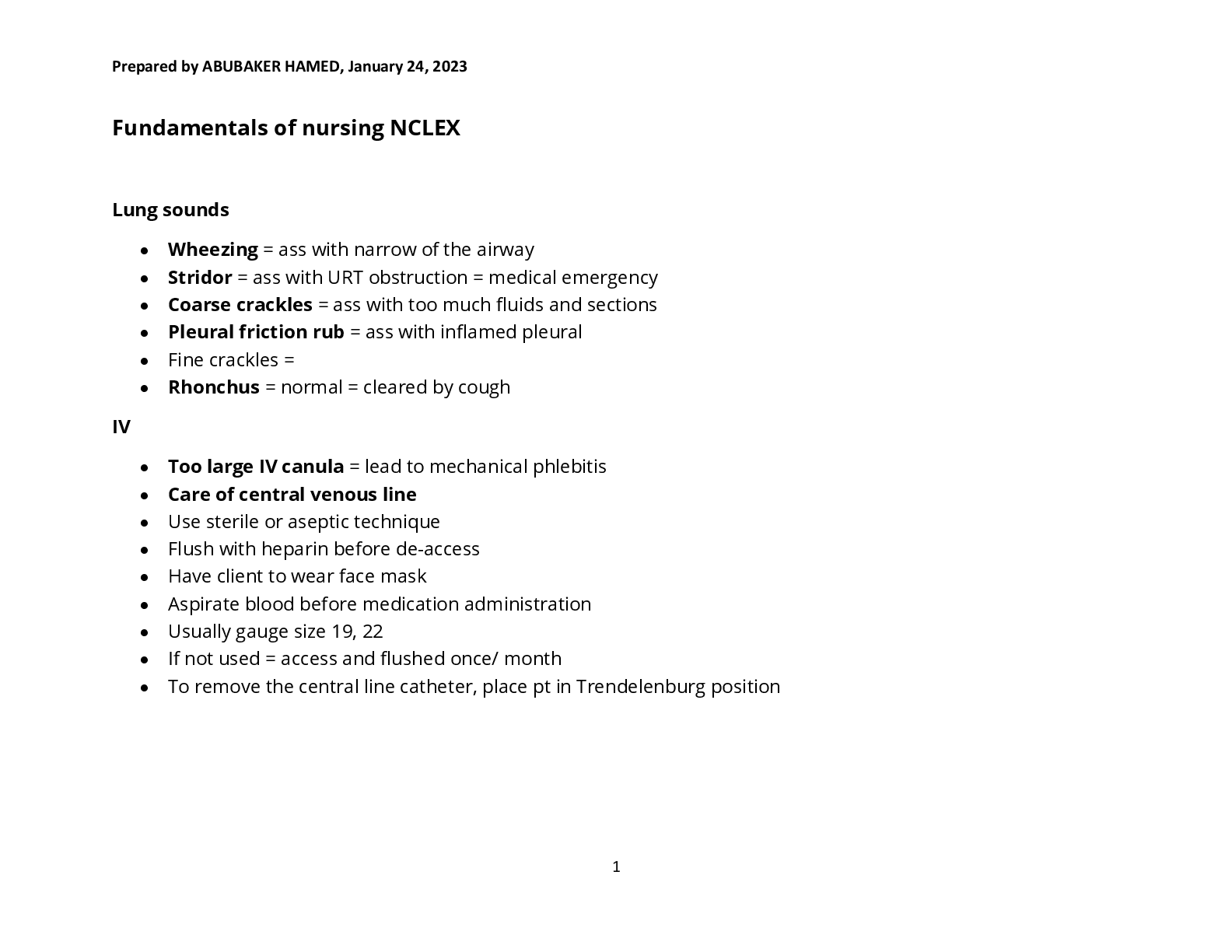

ALL-NCELX-SYSTEMS

$ 20

ADVANCED PRACTICE NURSING: ESSENTIAL KNOWLEDGE FOR THE PROFESSION 3RD EDITION DENISCO TEST BANK

$ 18

WGU C961 - Objective Assessment Personal Study Guide Questions And Answers

$ 10.5

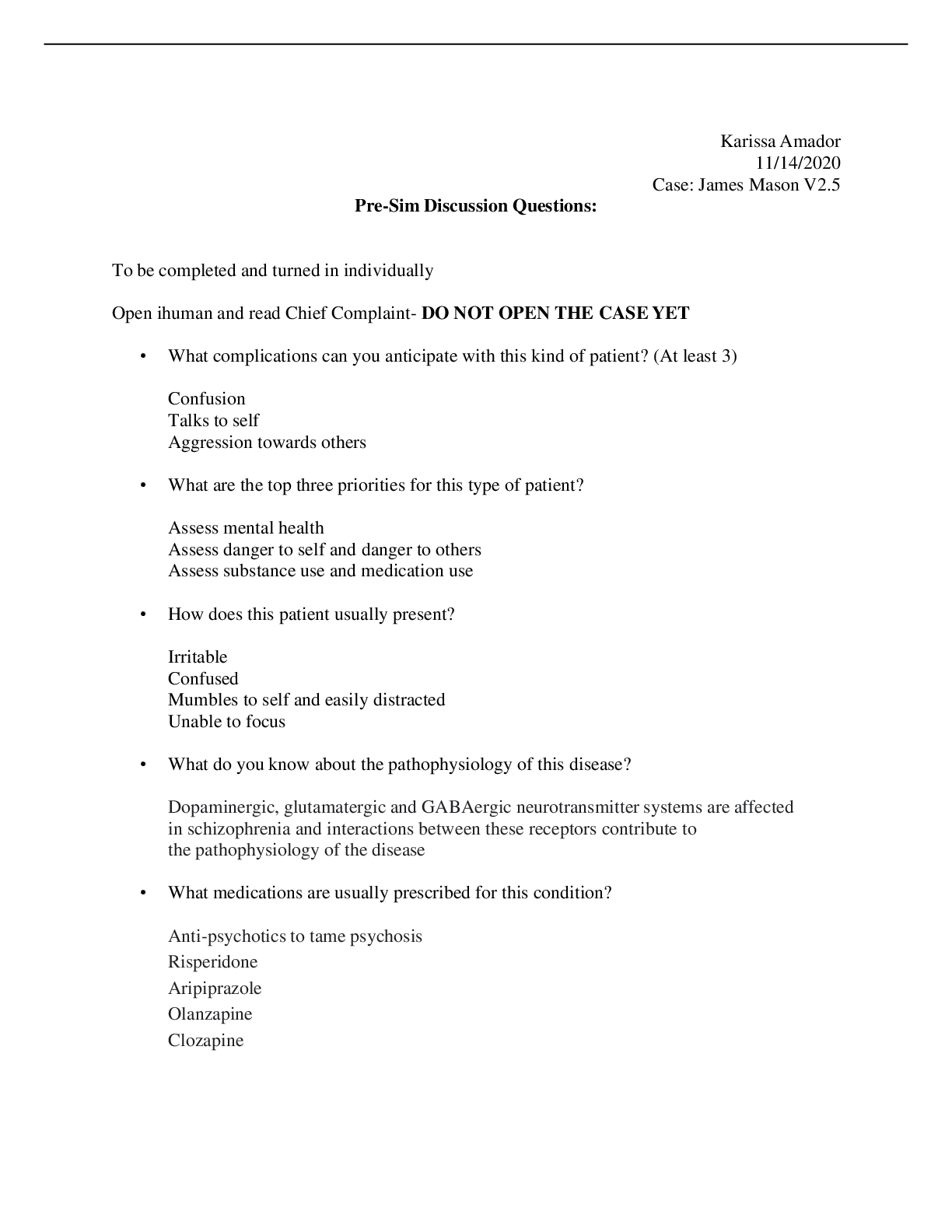

Case_for_James_Mason_IHUMAN_1

$ 8.5

Solutions Manual For Counseling the Culturally Diverse Theory and Practice, 8th Edition By Derald Wing Sue, David Sue, Helen Neville, Laura Smith

$ 30

NUR210 Pharmacology Notes/Unit 2 drugs (with all benzodiazepines from 2 and 3) worksheet-4

$ 13

[eBook] [PDF] Advanced Database Systems By Waqas Ahmed

$ 27

Teas 6 test-Reading,Math,Science & English, Latest (2020) Complete 100%

$ 13

Mock Exam - C810 - Foundations in Healthcare Data Management

$ 5

HESI PRACTICE OB

$ 10

HESI RN PEDIATRICS| 70 MCQ and Peds 3 74 Written Questions And Answers

$ 19

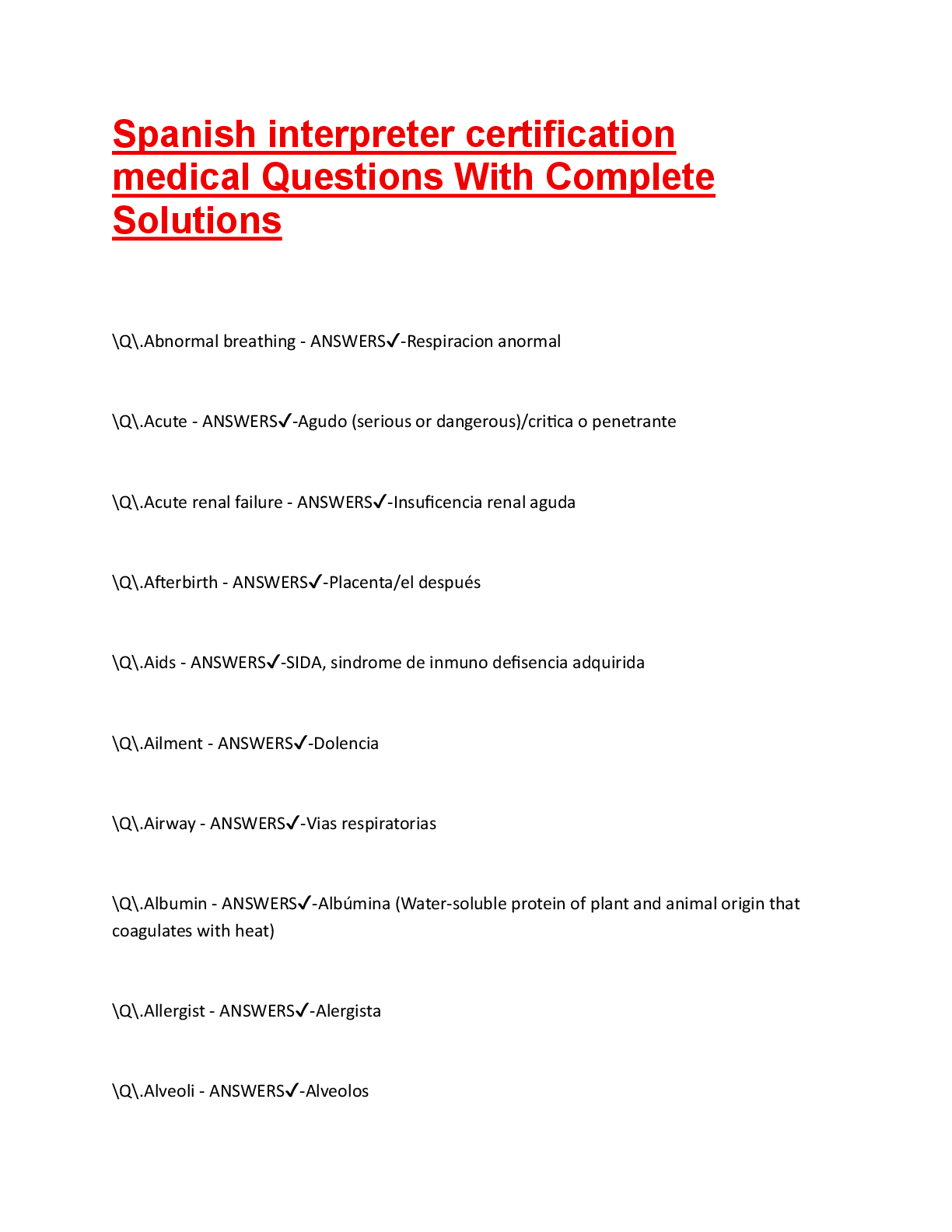

Spanish interpreter certification medical Questions With Complete Solutions

$ 7

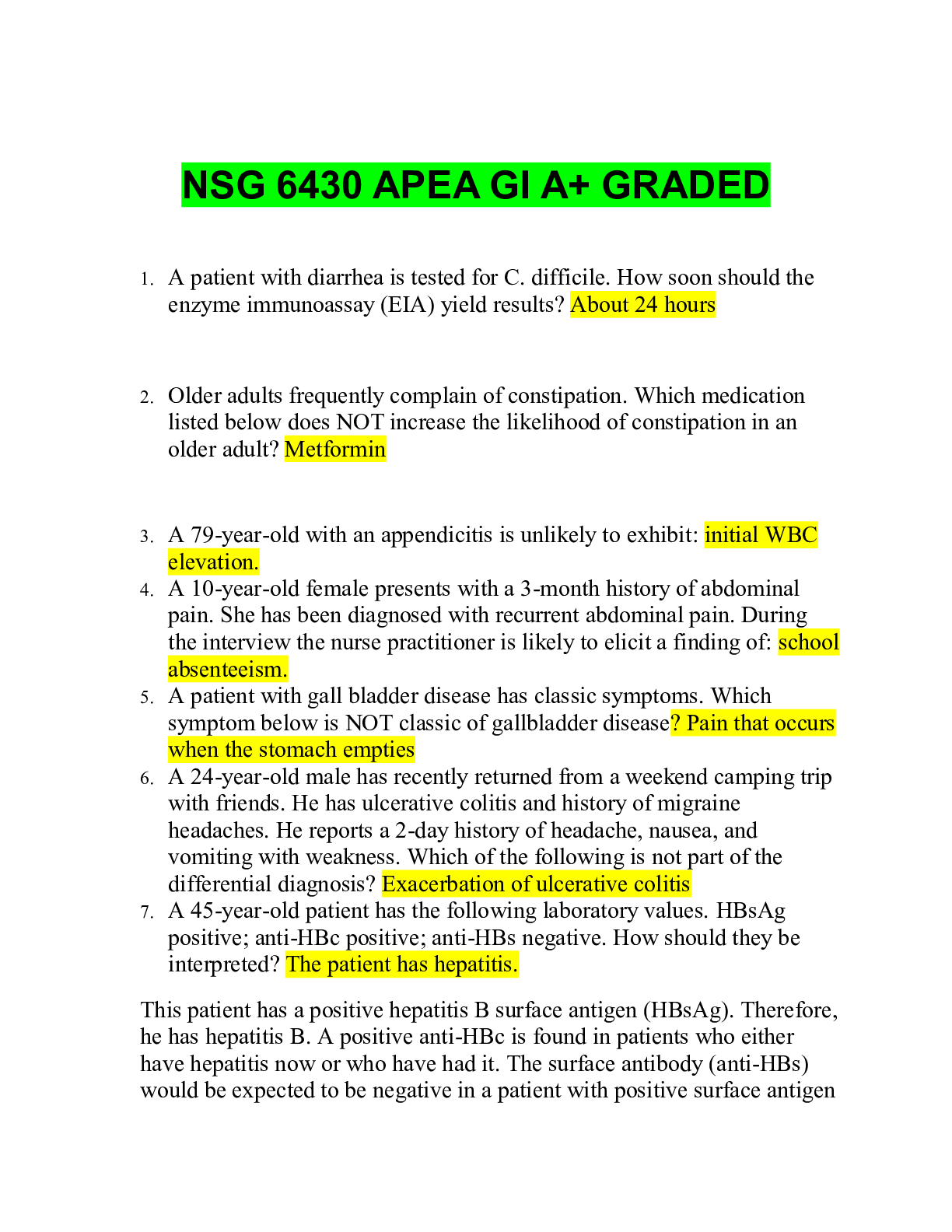

NSG 6430 APEA GI A+ GRADED

$ 25.5

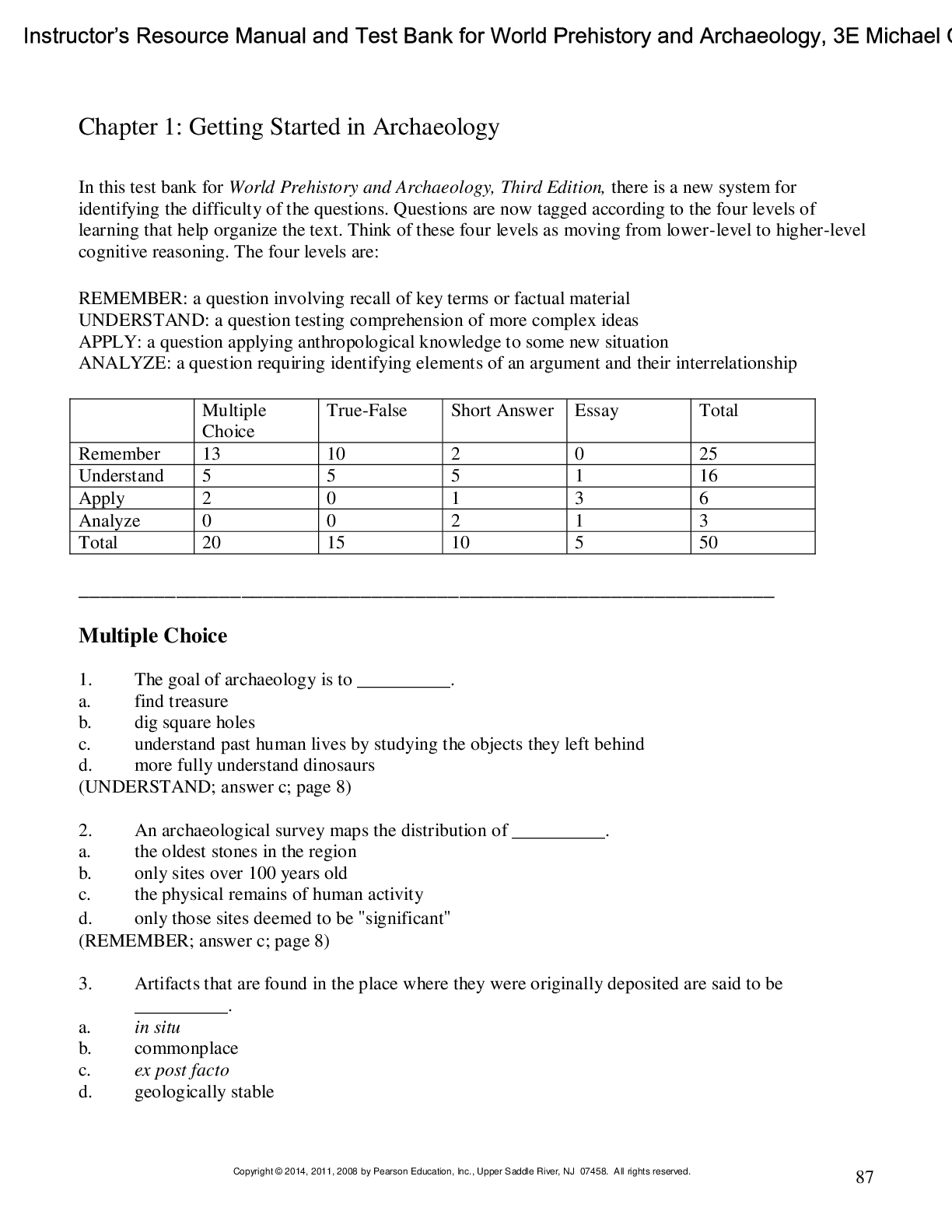

Instructor’s Resource Manual and Test Bank for World Prehistory and Archaeology, 3E By Michael

$ 25

Mona Hernandez. Diagnosis: Pneumonia. Includes Feedback Log. 94% Score.

$ 8

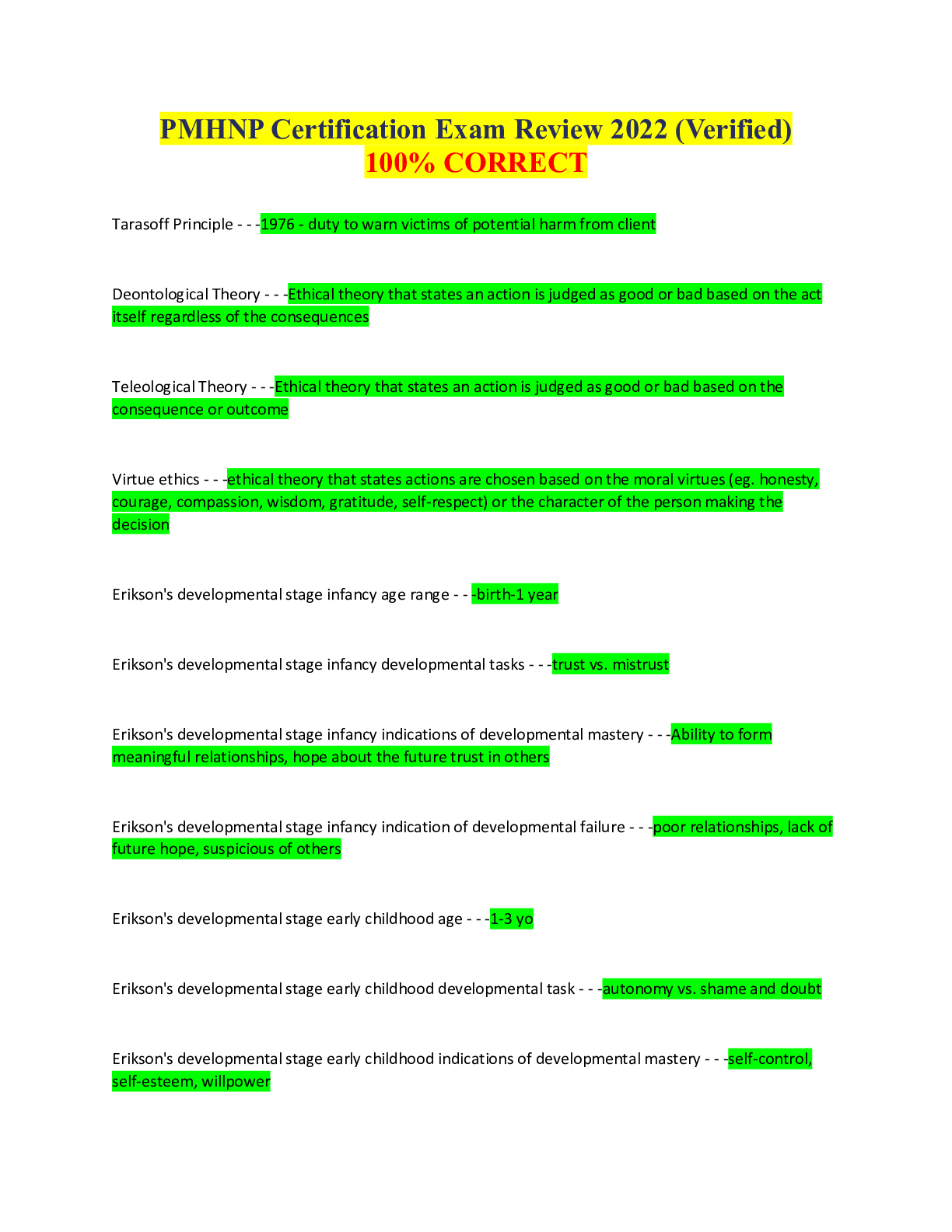

PMHNP Certification Exam Review 2022 (Verified) 100% CORRECT

$ 8

Exam (elaborations) NR 509 Advanced Physical Assessment-NR 509 Week 1-7 Quizes

$ 19

NEW HESI EXIT EXAM Version 4.0 TEST BANK 100% RATED A+

$ 18.5

NE 202 MIDTERM EXAM 1 STUDY GUIDE

$ 9

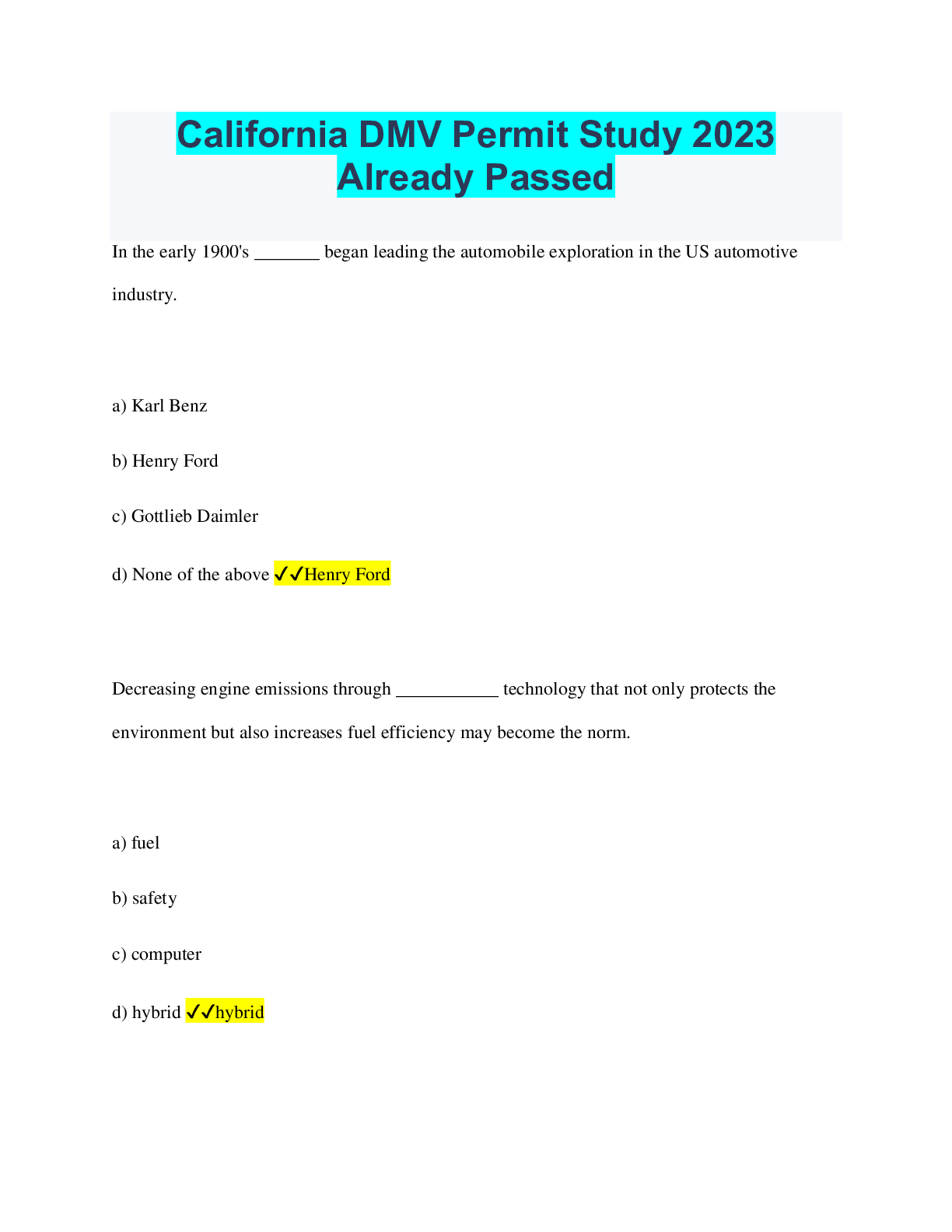

California DMV Permit Study 2023 Already Passed

$ 10.5

NR 599 FINAL EXAM

$ 15

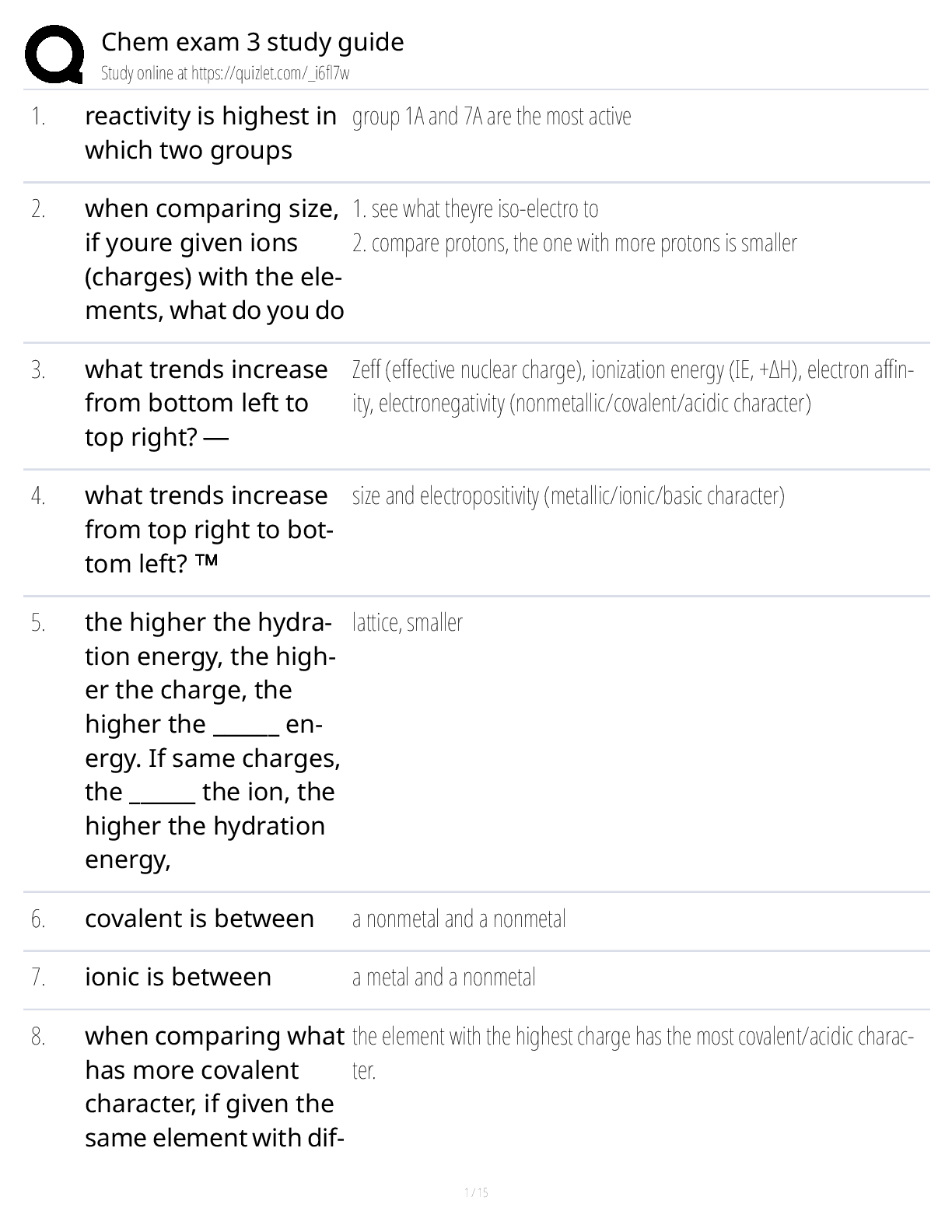

Chem Exam 3 Study Guide — Class Notes, Study Guide & Test Bank (General & Organic Chemistry Prep)

$ 17

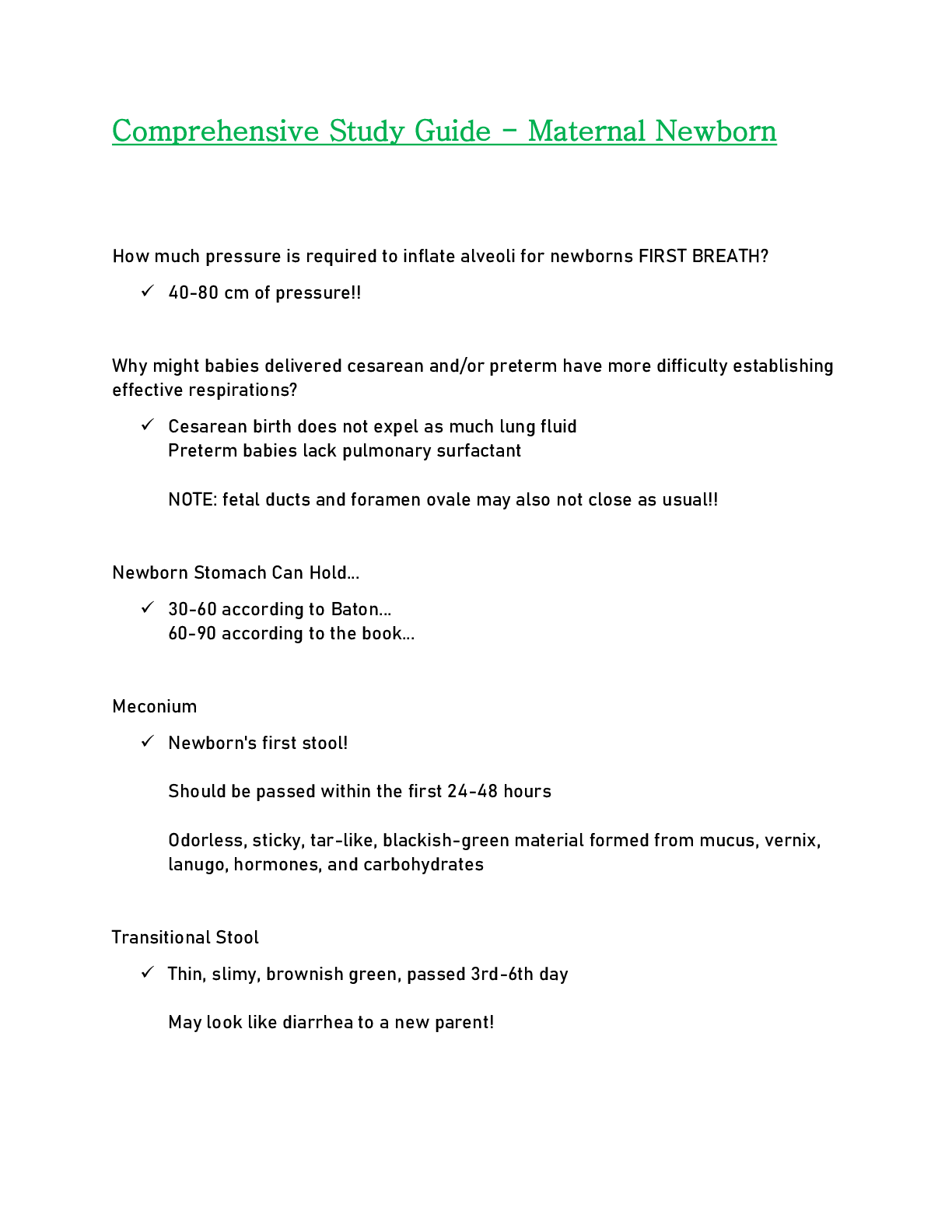

Comprehensive Study Guide - Maternal Newborn

$ 20

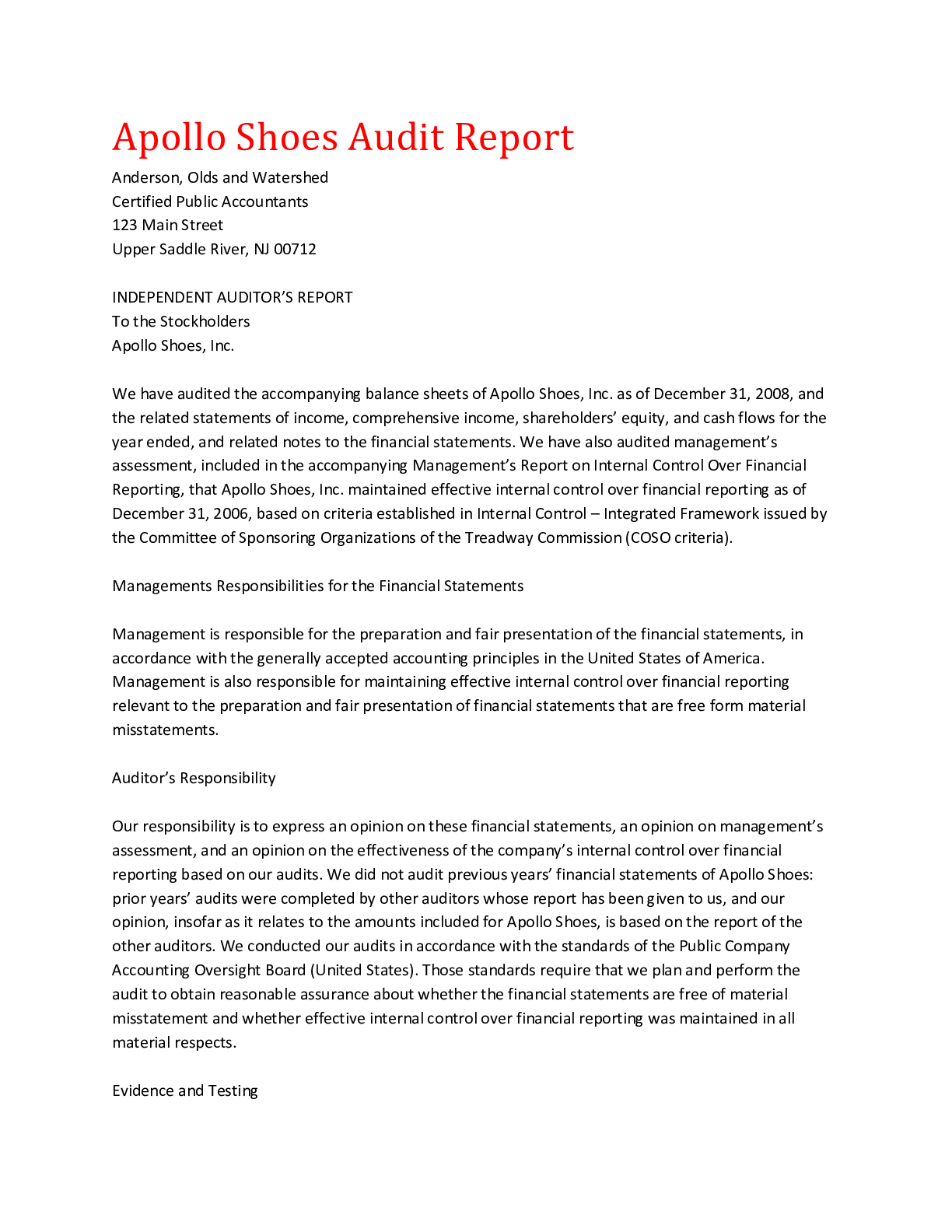

Apollo Shoes Audit Report

$ 9

Nursing 216 NCLEX Practice Question and Answers.

$ 12.5

NR 507 Week 8 Final Exam Questions with Answers (May 2018).docx

$ 6

Maternal Newborn Practice A

$ 9

eBook PDF The Exorcist Effect 1st Edition By Joseph Laycock, Eric Harrelson

$ 20

Test Bank For Macroeconomics 11th Edition By Gregory Mankiw

$ 25

.png)

NR-442 Assignment: Clinical Reflection Journal # 5: Chamberlain College of Nursing

$ 6.5

ATI RN Maternal Newborn Proctored Exam 2022,

$ 14

.png)

Final Quiz Review NUR2474 Module_10 (latest 2021,2022)

$ 9.5

HOSA NUTRITION REVIEW TEST 500 ACTUAL QUESTIONS AND ANSWERS GRADED A+ 2025

$ 17

[eTextBook] [PDF] Health Services Research Methods 3rd Edition By Leiyu Shi

$ 29

BIO 2301 Digestive quiz from book

$ 8.5

eBook [PDF] Managing Classroom Behavior Using Positive Behavior Supports 1st Edition By Terrance Scott, Cynthia Anderson, Peter Alter

$ 30

ENV 101 Study Guide for Exam 5,100% CORRECT

$ 20

ATI TEAS 7 - English & LanguageUsage(2022)

$ 20

2021 BIOLOGY 206 OpenStax Microbiology Test Bank- Chapter 8: Microbial Metabolism

.png)