TINA JONES SUBJECTIVE HEENT Completed Shadow Health

$ 7

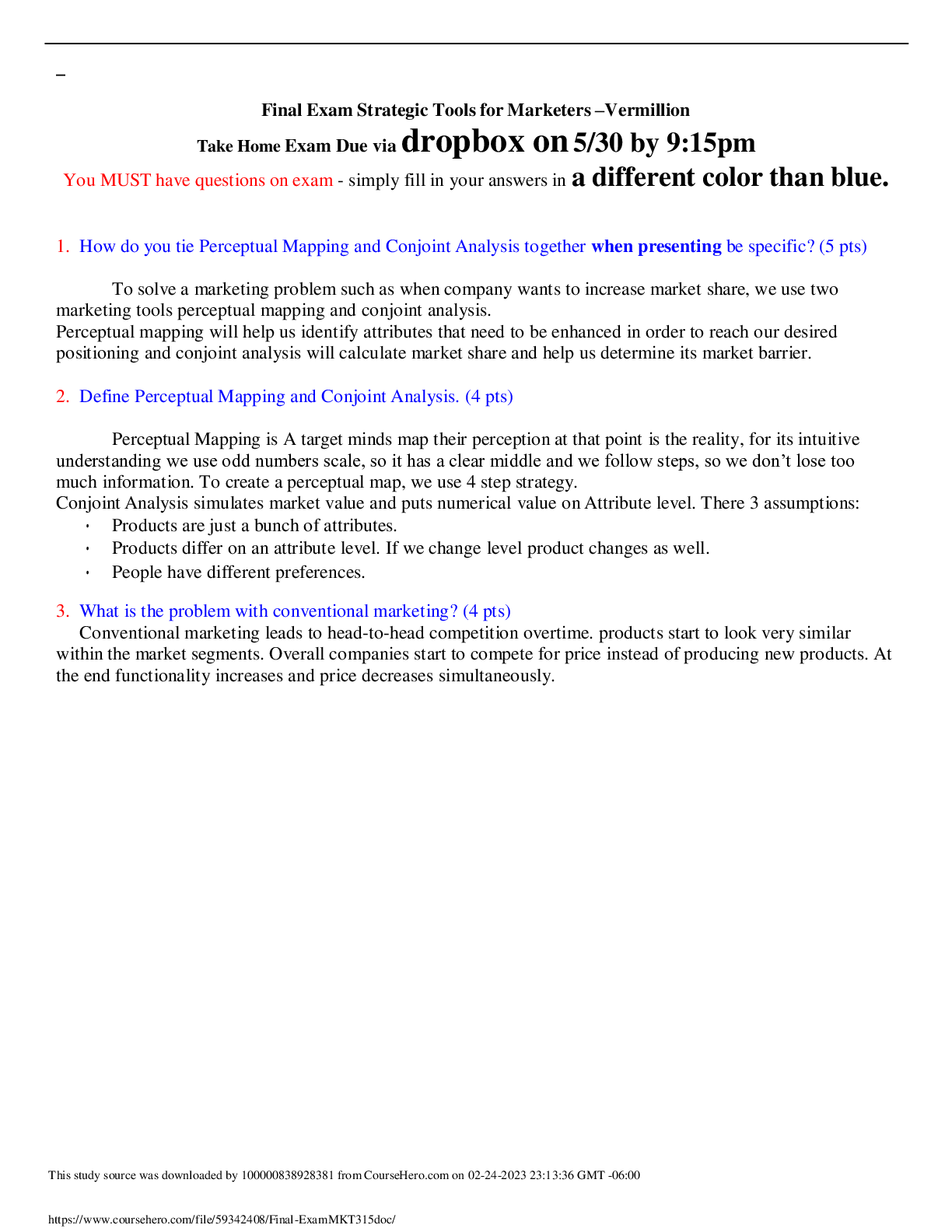

MKT 315|Final Exam Strategic Tools for Marketers –Vermillion|Latest Summer 2020 complete solutions,A+ Guide|Depaul University.

$ 9

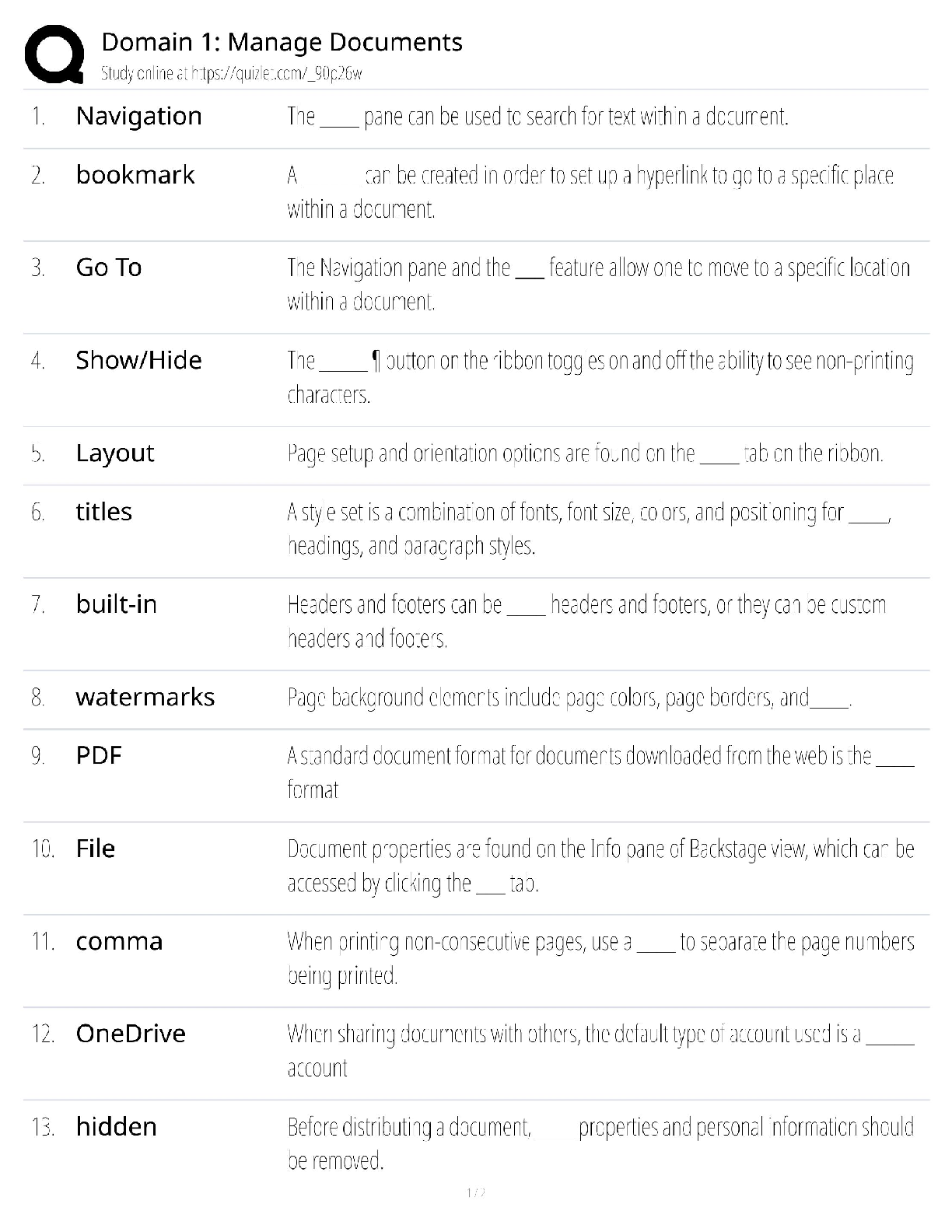

Domain 1 Manage Documents Test Bank / Document Management Certification / 2025 Update / Score 100%

.png)