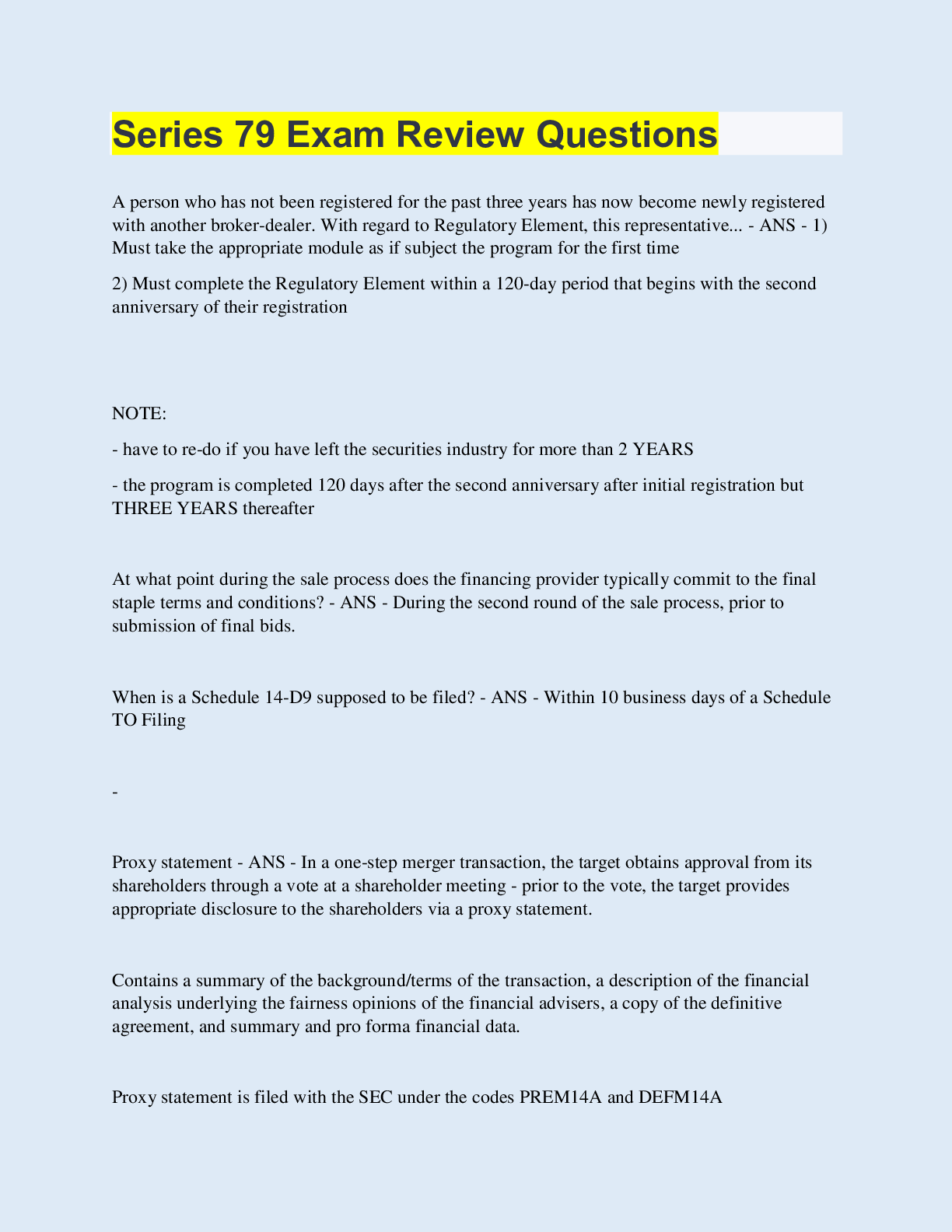

Series 79 Exam Review Questions

A person who has not been registered for the past three years has now become newly registered

with another broker-dealer. With regard to Regulatory Element, this representative... - ANS

...

Series 79 Exam Review Questions

A person who has not been registered for the past three years has now become newly registered

with another broker-dealer. With regard to Regulatory Element, this representative... - ANS - 1)

Must take the appropriate module as if subject the program for the first time

2) Must complete the Regulatory Element within a 120-day period that begins with the second

anniversary of their registration

NOTE:

- have to re-do if you have left the securities industry for more than 2 YEARS

- the program is completed 120 days after the second anniversary after initial registration but

THREE YEARS thereafter

At what point during the sale process does the financing provider typically commit to the final

staple terms and conditions? - ANS - During the second round of the sale process, prior to

submission of final bids.

When is a Schedule 14-D9 supposed to be filed? - ANS - Within 10 business days of a Schedule

TO Filing

-

Proxy statement - ANS - In a one-step merger transaction, the target obtains approval from its

shareholders through a vote at a shareholder meeting - prior to the vote, the target provides

appropriate disclosure to the shareholders via a proxy statement.

Contains a summary of the background/terms of the transaction, a description of the financial

analysis underlying the fairness opinions of the financial advisers, a copy of the definitive

agreement, and summary and pro forma financial data.

Proxy statement is filed with the SEC under the codes PREM14A and DEFM14A

Schedule TO - ANS - Filing made after the acquirer mails an offer to purchase to the target's

shareholder's for a tender offer.

In response to the tender offer, the target files a Schedule 14D-9 within 10 business days of

commencement which contains a recommendation from the target's board of directors on how to

respond to the tender offer, typically includes a fairness opinion

NOTE: Schedule TO filed by ACQUIRER

vs. Schedule 14-D9 filed by TARGET

Schedule 13D - ANS - Required for anyone who acquires more than 5% of a voting class of a

public company's common stock. In addition to acquirers, it may be required of traders and

arbitrageurs who participate in tenders for profit

Schedule 14(d) - ANS - Required under the '33 Act, provides public information about entities

involved in tenders, other than the acquirer

Regulation A - ANS - A public offering is EXEMPT from SEC registration if the amount of

securities offered does not exceed $5 million in any 12 month period

- permits shareholders to sell up to 1.5 million of securities - this sale counts against the 5 million

total

- if you claim this exception you must file an offering statement with the SEC for review

(consists of notification, offering circular, and exhibits)

Advantages: financial statements are simpler & do not need to be audited, there are no Exchange

Act reporting obligations unless the company has more than $10mm in total assets, Filing with

the SEC is less expensive than with the normal process

Regulation A+ - ANS - Two tiers of registration exempt offerings:

Tier 1: eligible issues may offer and sell up to $20mm of securities in a 12 month period of

which no more than $6mm may constitute secondary sales by security holders

Tier 2: Issuers may offer and sell up to $50mm of securities in a 12 month period of which no

more than $15mm may constitute secondary sales by affiliates

Both must be accompanied by financial statements for the previous 2 fiscal years. Tier 2 must be

audited and requires annual reports to be filed.

Rule 147 - ANS - = Intrastate offering exemption

- Applies to companies that are incorporated in the state where the securities are to be offered,

carry out a significant amount of their business in that state (has principal office located in state,

derives 80% of gross revenues in past 6 months from state, has 80% of assets located in that

state, uses 80% of proceeds from offering to operate within state), and offer and sell their

securities only to residents of that state

Regulation D - ANS - D FOR DEBT

Establishes three exemptions from registration for private placements of equity and debt

securities. Requires the issuing company to file a notice (Form D) with SEC within 15 days of

the first sales of securities

- allows sales to an unlimited number of accredited investors and up to 35 non-accredited

investors

Accredited investor - ANS - Includes:

- officers and directors of the issuer

- institutions with assets of $5mm and with have legitimate business purposes

- individuals with $200K of net income ($300K if married) and in each of the last 2 years $1mm

net worth

Note:

- while banks, insurance companies, and others are accredited investors, there are certain

institutions (i.e. trusts) that need $5mm in assets to be accredited

- employees of the issuer are NOT accredited --> would NOT be solicited in a private placement

BAD ACTOR PROVISION - issuers cannot rely on private placement exemption if the issuer or

an individual associated with the issuer (i.e. predecessor, officer/director, beneficial owner of >

20% of equity securities, investment manager) has been convicted of a felony or securities

related misdemeanor in the past 10 years, has been subject to a securities related court injunction

in the previous 5 years, or subject to an order from a state securities commissioner barring

securities related activities

Regulation FD - ANS - FD = FAIR DISCLOSURE

Prevents the selective disclosure of material information about a publicly traded company to

outsiders prior to the time that the same information is generally available to all investors

Intentional disclosure --> broadly disclosed SIMULTANEOUSLY

Unintentional disclosure --> broadly disclosed PROMPTLY (24 later or the open of trading on

the next business day)

Disclose this via an 8K

Regulation M - ANS - M for MANIPULATION

- regulation M was enacted to prevent manipulative cond

[Show More]