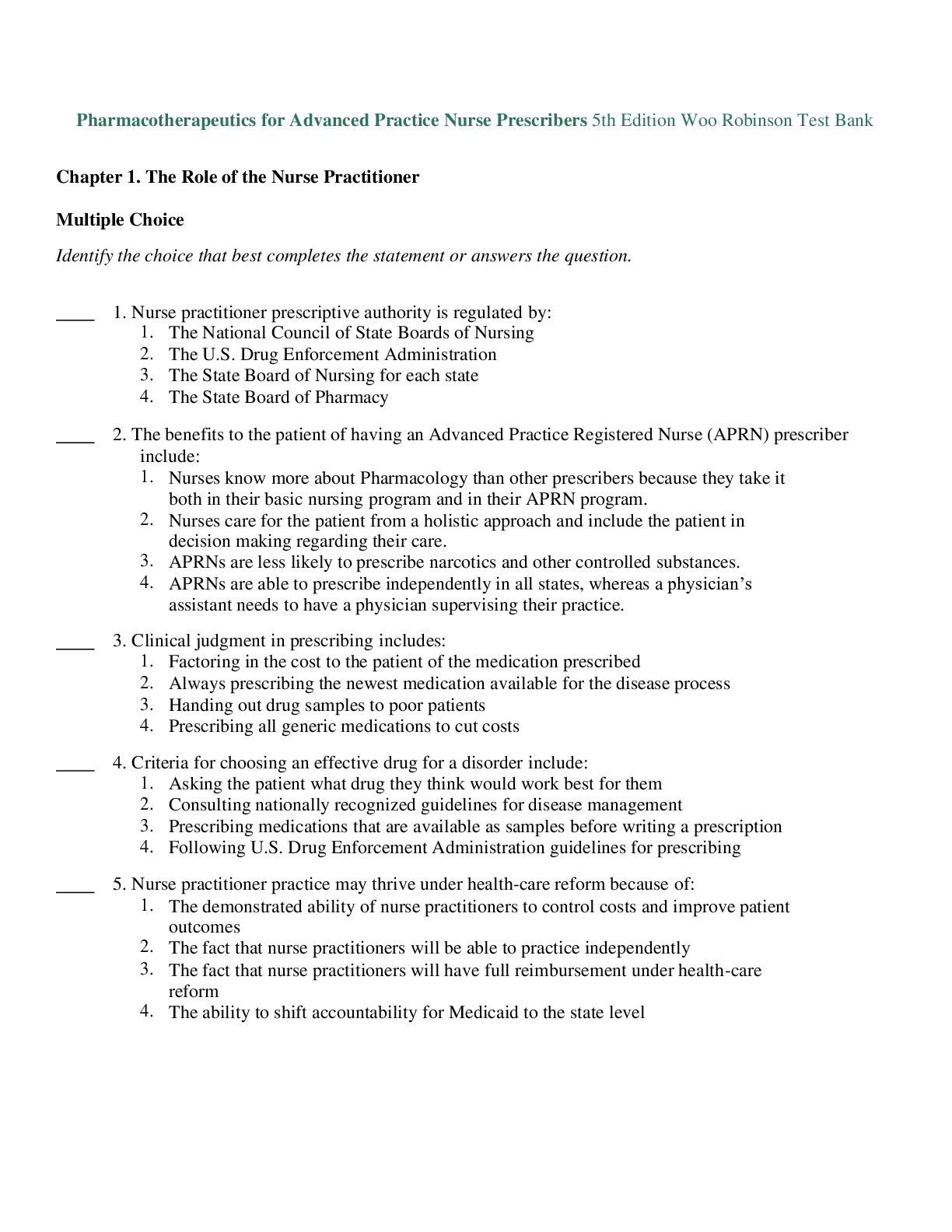

1. Many organizations must determine how to schedule employees to provide adequate service. If we assume that an

organization faces the same situation each week, this is referred to as

A meat market manager for a l

...

1. Many organizations must determine how to schedule employees to provide adequate service. If we assume that an

organization faces the same situation each week, this is referred to as

A meat market manager for a large grocery store is preparing a processing plan to stock the shelves with

sausage, ground meat, and jerky, which he can prepare from beef, pork and venison. Sausage and ground

meat can be made of any mix of the beef, pork and venison, as long at the fat contents are below 15% for

sausage and 10% for ground meat. Sausage sells for $5/pound and ground meat sells for $3/pound. Jerky,

which sells or $10/pound, is made in a drying process from beef or venison. In the drying process, there is a

50% loss in weight for jerky made from beef (e.g., one pound of beef yields 0.5 pounds of beef jerky) and a

30% loss in weight for jerky made from venison. The market can sell at most 500 pounds of sausage, 1000

pounds of ground meat, and 100 pounds of jerky before their expiration dates. There are currently 1,000

pounds of beef (10% fat content), 500 pounds of pork (8% fat content), and 200 pounds of venison (2% fat

content) available for processing.

2. What happens to the revenue when the optimal plan changes?

Nothing – it stays at $6,500 because the amount of the three products made stays that same.

3. Which of the following does not represent a broad class of applications of linear programming models?

a. Blending models

b. Financial portfolio models

c. Logistics models

d. Set covering models

e. Forecasting models

4. Many of the most successful applications of optimization in the real world have been in the areas of scheduling,

blending, logistics and aggregate planning.

a. True

b. False

Copyright Cengage Learning. Powered by Cognero. Page 1

Name: Class: Date:

Chapter 14

5. Many organizations must determine how to schedule employees to provide adequate service. If we assume that an

organization faces the same situation each week, this is referred to as

a. static scheduling problem

b. dynamic scheduling problem

c. transportation scheduling problem

d. All of these options

6. Workforce scheduling problems are often integer programming models, which means that they have:

a. an integer objective function

b. integer decision variables

c. integer constraints

d. all of these options

7. A common characteristic of integer programming models is that they:

a. are easy to solve graphically

b. produce the same answer and standard linear programming models

c. often produce multiple optimal solutions

d. all of these options

8. Which of the following is true regarding multiple optimal solutions?

a. All solutions have the same values for the decision variables

b. All solutions have the same value for the objective function

c. All solutions have the same shadow prices

d. All of these options

9. Rounding the solution of a linear programming to the nearest integer values provides a(n)

a. integer solution that is optimal

b. integer solution that may be neither feasible nor optimal

c. feasible solution that is not necessarily optimal

d. infeasible solution

Copyright Cengage Learning. Powered by Cognero. Page 2

Name: Class: Date:

Chapter 14

10. Which of the following statements are false?

a. Solver does not offer a sensitivity report for models with integer constraints

b. Solver’s sensitivity report is not suited for questions about multiple input changes

c. Solver’s sensitivity report is used primarily for questions about one-at-a time changes to input

d. None of these options

11. If refers to the number of hours employee works in week , then to indicate that the number of working hours of 4

employees in week 3 should not exceed 160 hours, we must have a constraint of the form

a.

b.

c.

d.

12. When we solve a linear programming problem with Solver, we cannot guarantee that the solution obtained is an optimal

solution.

a. True

b. False

alse

13. Multiple optimal solutions are quite common in linear programming models.

a. True

b. False

14. If an LP problem is not correctly formulated, Solver will automatically indicate that it is infeasible when trying to solve

it.

a. True

b. False

alse

15. Integer programming (IP) models are optimization models in which all of the variables must be integers.

a. True

b. False

alse

Copyright Cengage Learning. Powered by Cognero. Page 3

Name: Class: Date:

Chapter 14

16. Solver may be unable to solve some integer programming problems, even when they have an optimal solution.

a. True

b. False

17. If Solver fails to find an optimal solution to an integer programming problem, we might be able to find a near optimal

solution by increasing the tolerance setting.

a. True

b. False

18. The LP relaxation of an integer programming (IP) problem is the same model as the IP model except that some integer

constraints are omitted.

a. True

b. False

alse

19. The optimal solution to an LP problem was 3.69 and 1.21. If and were restricted to be integers, then

= 4 and 1 will be a feasible solution, but not necessarily an optimal solution to the IP problem.

a. True

b. False

alse

20. A good shipping plan uses as many cheap routes as possible, but ultimately is constrained by capacities and

demands.

a. True

b. False

alse

Copyright Cengage Learning. Powered by Cognero. Page 4

Name: Class: Date:

Chapter 14

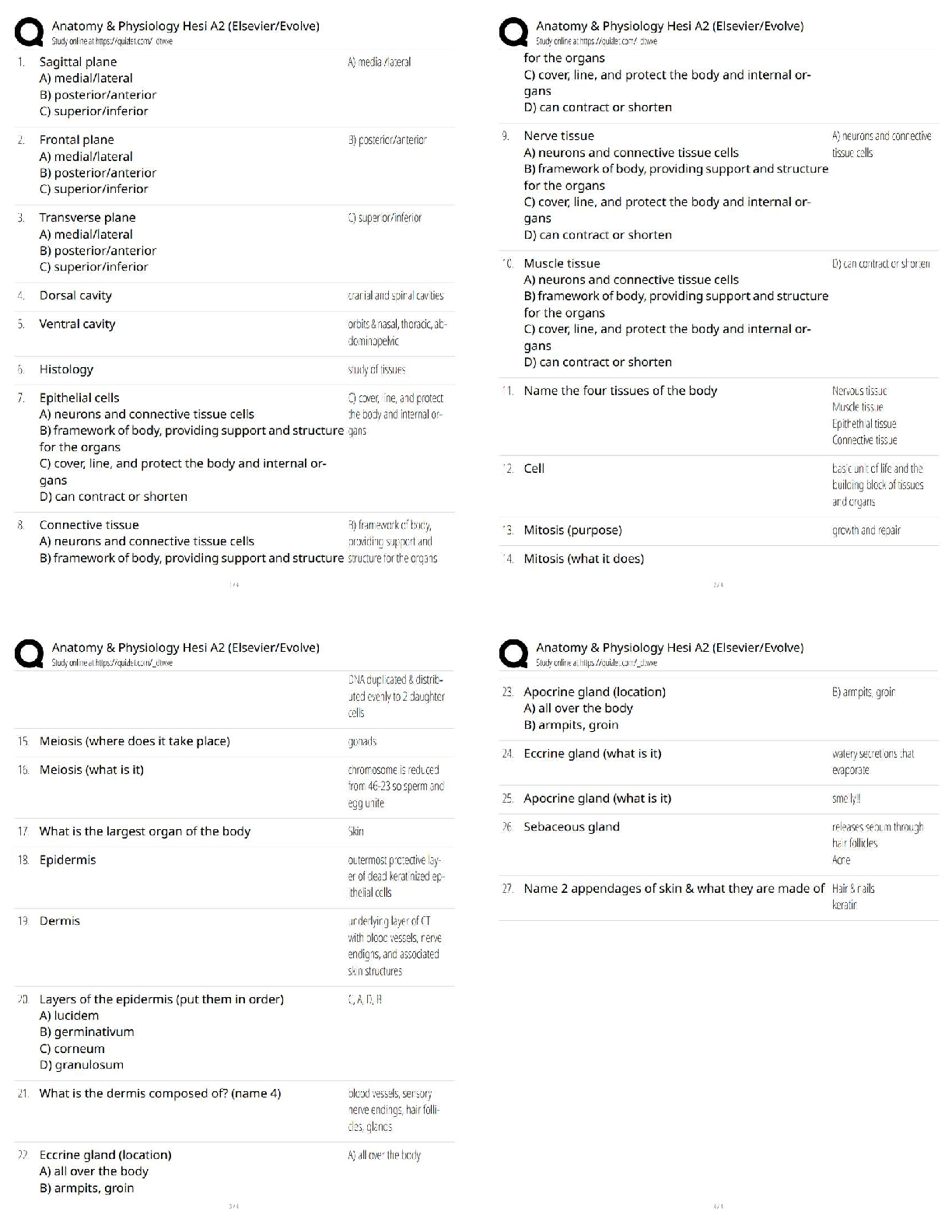

21. A Michigan company consists of three subsidiaries. Each has the respective average payroll, unemployment reserve

fund, and estimated payroll shown in the table below (all figures are in millions of dollars). Any employer in the state of

Michigan whose reserve to average payroll ratio is less than 1 must pay 25% of its estimated payroll in unemployment

insurance premiums. Otherwise, if the ratio is at least one, the employer pays 13%. The company can aggregate its

subsidiaries and label them as separate employers. For example, if subsidiaries 1 and 2 are aggregated, they must

pay 25% of their combined payroll in unemployment insurance premiums. Determine which subsidiaries should be

aggregated.

Subsidiary Ave. Payroll Reserve Est. Payroll

1 350 450 400

2 650 560 450

3 850 650 550

ata on subsidiaries

Subsidiary Ave. Payroll Reserve

Est.

Payroll

1 350 450 400

2 650 560 450

3 850 650 550

Any employer pays A% of its estimate payroll if its ratio of reserve to average payroll is

less than 1.0. Otherwise, it pays B%.

Given percentages

A 25%

B 13%

Companies that aggregate (1 if they

do, 0 otherwise)

None 1, 2 1,3 2,3 1,2,3 Sum Required

0 1 0 0 0 1 = 1

Total paid in each case 302 248 350 302 350

Total paid 248

22. A company has daily staffing requirements for two types of jobs, cleaning and customer service persons. The minimum

numbers of workers required each day for each type of job are shown in the table below. To meet these requirements,

the company can employ three types of workers: those who clean only, those who can perform customer service only,

and those who are able to do both. In each of these three categories, the company wants to meet its daily

requirements using only full-time workers. A full-time worker must work five consecutive days with two days off.

Workers who are able to perform only one type of work (cleaning or customer service) earn $50 per day. Those who are

able to perform both types of work earn $60 per day. As a matter of policy, the company wants to ensure that at least

20% of its total hours are staffed by “swing workers”; those who can do both types of jobs. The company wants to find

a staffing policy that covers the daily worker requirements at minimum total costs per week. Use solver to formulate

and solve the company’s problem.

Copyright Cengage Learning. Powered by Cognero. Page 5

Name: Class: Date:

Chapter 14

Daily requirements

Mon Tue Wed Thu Fri Sat Sun

Cleaning 8 7 7 10 9 15 11

Customer service 13 13 9 14 18 20 19

Copyright Cengage Learning. Powered by Cognero. Page 6

Name: Class: Date:

Chapter 14

A post office requires different numbers of full-time employees on different days of the week. The number of full-time

employees required each day is given in the table below.

Mon Tue Wed Thu Fri Sat Sun

20 16 18 22 17 19 14

Union rules state that each full-time employee must work five consecutive days and then receive two days off. The post

office wants to meet its daily requirements using only full-time employees. Its objective is to minimize the number of

full-time employees that must be hired.

23. (A) Use Solver to formulate and solve the post office’s problem.

(B) Suppose the post office has 30 full-time employees and is not allowed to hire or fire any employees.

Determine a schedule that maximizes the number of weekend days off received by the employees.

(A)

Number starting their five-day shift on various

days

Mon 6

Tue 7

Wed 0

Thu 9

Fri 0

Sat 5

Sun 0

Number working on various days (along top) who started their shift on various days (along side)

Mon Tue Wed Thu Fri Sat Sun

Mon 6 6 6 6 6

Tue 7 7 7 7 7

Wed 0 0 0 0 0

Thu 9 9 9 9 9

Fri 0 0 0 0 0

Sat 5 5 5 5 5

Sun 0 0 0 0 0

Totals Available 20 18 18 22 22 21 14

Min required 20 16 18 22 17 19 14

Total employees 27

(B)

Copyright Cengage Learning. Powered by Cognero. Page 7

Name: Class: Date:

Chapter 14

Starting day of

5-day shift

Mon. Tue. Wed. Thu. Fri. Sat. Sun.

Total Total

employed

Number starting 11 5 2 12 0 0 0 30 = 30

Number working on each day 23 16 18 30 30 19 14

Minimal number required each day 20 16 18 22 17 19 14

Weekend days-off 22 5 0 0 0 0 0

Total weekend days-off 27

24. During each 4-hour period, the police force in a small town in Ohio requires the following number of on-duty police

officers: 8 from midnight to 4 A.M.; 7 from 4 A.M. to 8 A.M.; 6 from 8 A.M. to noon; 6 from noon to 4 P.M.; 5 from 4

P.M. to 8 P.M.; and 4 from 8 P.M. to midnight. Each police officer works two consecutive 4-hour shifts. Determine how

to minimize the number of police officers needed to meet the town’s daily requirements.

Copyright Cengage Learning. Powered by Cognero. Page 8

Name: Class: Date:

Chapter 14

A construction company is preparing for a nine-month project, and will need to develop a staffing plan. The

company can assign up to 30 of its own full-time employees to the project, and will hire short-term contract

employees to make up any shortage in meeting the personnel requirements. Company employees earn

$6,000 per month, while short-term contract employees make $8,600/month. Contract employees can be

assigned to the project beginning in any month, and their contract period is two months. The number of

workers required for the project by month is shown below:

25. Determine the optimal staffing plan for the project.

Copyright Cengage Learning. Powered by Cognero. Page 9

Name: Class: Date:

Chapter 14

26. The project manager is evaluating options to complete the project early so that the company can earn a

bonus. He has determined that the project schedule can be compressed into a six-month schedule, with the

same total number of worker-months. In that case, the staffing requirements are as shown below.

Develop an optimal staffing plan for the project under the accelerated schedule.

27. Suppose the bonus for completing the project three months early is $250,000. What would be the net bonus

to the company, after adjusting for any difference in personnel costs under the accelerated schedule?

$250,000 – ($3,436,400-$3,387,200) = $200,800

Copyright Cengage Learning. Powered by Cognero. Page 10

Name: Class: Date:

Chapter 14

28. The production manager believes the cost of the contract employees, who are currently in high demand,

could be somewhat higher – perhaps as high as $10,000 per month. Perform a sensitivity analysis to

determine the effect on the number of full-time employees that will be needed for the project.

Once the salary reaches 9000, all 30 available full-time employees with be assigned to the

project (only 21 are needed under the existing plan).

29. Which of the following statements is a type of constraint that is often required in blending problems?

a. Integer constraint

b. Binary constraint

c. Quality constraint

d. None of these options

30. The constraints in a blending problem can be specified in a valid way and still lead to which of the following problems?

a. Unboundedness

b. Infeasibility

c. Nonlinearity

d. None of these options

Copyright Cengage Learning. Powered by Cognero. Page 11

Name: Class: Date:

Chapter 14

31. To specify that must be at most 75% of the blend of we must have a constraint of the form

a.

b.

c.

d.

e.

32. In blending problems, if a quality constraint involves a quotient, then the problem will be nonlinear.

a. True

b. False

33. You have decided to enter the candy business. You are considering producing two types of candies: A and

B, both of which consist solely of sugar, nuts, and chocolate. At present you have in stock 12,000 ounces of

sugar, 3000 ounces of nuts, and 3000 ounces of chocolate. The mixture used to make candy A must contain

at least 10% nuts and 10% chocolate. The mixture used to make candy B must contain at least 20% nuts.

Each ounce of candy A can be sold for $0.40 and each ounce of candy for $0.50. Determine how you can

maximize your revenues from candy sales.

Copyright Cengage Learning. Powered by Cognero. Page 12

Name: Class: Date:

Chapter 14

34. A company blends silicon and nitrogen to produce two types of fertilizers. Fertilizer 1 must be at least 40%

nitrogen and sells for $75 per pound. Fertilizer 2 must be at least 70% silicon and sells for $45 per pound.

The company can purchase up to 9000 pounds of nitrogen at $16 per pound and up to 12,000 pounds of

silicon at $12 per pound. Assuming that all fertilizer produced can be sold, determine how the company can

maximize its profit.

Copyright Cengage Learning. Powered by Cognero. Page 13

Name: Class: Date:

Chapter 14

A meat market manager for a large grocery store is preparing a processing plan to stock the shelves with

sausage, ground meat, and jerky, which he can prepare from beef, pork and venison. Sausage and ground

meat can be made of any mix of the beef, pork and venison, as long at the fat contents are below 15% for

sausage and 10% for ground meat. Sausage sells for $5/pound and ground meat sells for $3/pound. Jerky,

which sells or $10/pound, is made in a drying process from beef or venison. In the drying process, there is a

50% loss in weight for jerky made from beef (e.g., one pound of beef yields 0.5 pounds of beef jerky) and a

30% loss in weight for jerky made from venison. The market can sell at most 500 pounds of sausage, 1000

pounds of ground meat, and 100 pounds of jerky before their expiration dates. There are currently 1,000

pounds of beef (10% fat content), 500 pounds of pork (8% fat content), and 200 pounds of venison (2% fat

content) available for processing.

35. Determine the optimal processing plan for the meat market.

Copyright Cengage Learning. Powered by Cognero. Page 14

Name: Class: Date:

Chapter 14

36. Suppose that later in the year, venison will be out of season, but the market will be able to obtain an

additional 300 pounds of pork for the same costs. Develop a processing plan in that case. How does the

solution change?

The maximum amounts of each product can still be made. The jerky will be made from beef,

instead of venison, and the additional pork will be used in making ground meat, since less beef

will be available for that purpose.

Copyright Cengage Learning. Powered by Cognero. Page 15

Name: Class: Date:

Chapter 14

37. The market manager is concerned about variability in the fat content of beef, noting that it actually can be

as high as 20% and as low as 5%. Perform a sensitivity analysis to determine the effect, first on the amount

of beef used, and then on the revenue. What do the results indicate? Should the manager be concerned?

There’s nothing to worry about if the fat content is lower than 10%; however, if it increases above

10%, then less beef will be used in the processing plan, and if it increases above 15%, the

revenue will start to decrease, since the amounts of the products made will start to become

limited by their specifications.

Copyright Cengage Learning. Powered by Cognero. Page 16

Name: Class: Date:

Chapter 14

38. The problem which deals with the direct distribution of products from supply locations to demand locations is called

a(n)

a. transportation problem

b. assignment problem

c. network problem

d. transshipment problem

39. The objective in transportation problems is typically to:

a. maximize profits

b. maximize revenue

c. minimize costs

d. maximize feasibility

40. A typical transportation problem requires which of the following sets of input numbers:

a. Capacities, demands and flows

b. Capacities, demands and unit shipping costs

c. Supplies, demands and flows

d. Supplies, demands and arcs

41. Which of the following is not a required input for a typical transportation problem?

a. Capacities (or supplies)

b. Demands

c. Unit shipping (and possibly production) costs

d. Distance from origins to destinations

42. The decision variables in transportation problems are:

a. profits

b. costs

c. flows

d. capacities

Copyright Cengage Learning. Powered by Cognero. Page 17

Name: Class: Date:

Chapter 14

43. In a network representation of a transportation problem, the nodes generally represent:

a. warehouses

b. geographic locations

c. flows

d. capacities

44. In a network representation of a transportation problem, the arcs generally represent:

a. warehouses

b. geographic locations

c. flows

d. capacities

45. In formulating a transportation problem as linear programming model, which of the following statements are correct?

a. There is one constraint for each supply location

b. There is one constraint for each demand location

c. The sum of decision variables out of a supply location is constrained by the supply at that location

d. The sum of decision variables out of all supply locations to a specific demand location is constrained by the

demand at that location

e. All of these options

46. In a transshipment problem, shipments

a. can occur between any two nodes (suppliers, demanders, and transshipment locations)

b. cannot occur between two supply locations

c. cannot occur between two demand locations

d. cannot occur between a transshipment location and a demand location

e. cannot occur between a supply location and a demand location

47. Transportation and transshipment problems are both considered special cases of a class of linear programming

problems called

a. minimum cost problems

b. minimum cost network flow problems

c. supply locations network problems

d. demand locations network problems

Copyright Cengage Learning. Powered by Cognero. Page 18

Name: Class: Date:

Chapter 14

48. In a typical minimum cost network flow model, the nodes indicate

a. roads

b. rail lines

c. geographic locations

d. rivers

49. The flow balance constraint for each transshipment node, in a minimum cost network flow model, takes the form

a. Flow in Flow out + Net supply

b. Flow out Flow in + Net supply

c. Flow in = Flow out

d. Flow out Flow in + Net supply

e. Flow in Flow out + Net demand

50. In a minimum cost network flow model, the flow balance constraint for each supply node takes the form

a. Flow in Flow out + Net supply

b. Flow out Flow in + Net demand

c. Flow in = Flow out

d. Flow out Flow in + Net supply

e. Flow in Flow out + Net demand

51. In a minimum cost network flow model, the flow balance constraint for each demand node takes the form

a. Flow out Flow in + Net supply

b. Flow in Flow out + Net demand

c. Flow in = Flow out

d. Flow in Flow out + Net demand

e. Flow out Flow in + Net demand

52. Logistics problems are problems of finding the least expensive way to transport products from their origin to

their destination.

a. True

b. False

Copyright Cengage Learning. Powered by Cognero. Page 19

Name: Class: Date:

Chapter 14

53. If all the supplies and demands for a transportation model are integers, then the optimal Solver solution may or may

not have integer-valued shipments.

a. True

b. False

alse

54. In transportation problems, shipping costs are often nonlinear due to quantity discounts.

a. True

b. False

55. In a transportation problem, if it costs $4 per item to ship up to 200 items between cities, and $2 per item for each

additional item, the proportionality assumption of LP is satisfied.

a. True

b. False

alse

56. The transportation model is a special case of the minimum cost network flow model (MCNFM).

a. True

b. False

57. In transportation problems, shipments between supply points or between demand points are possible.

a. True

b. False

alse

58. In transportation problems, the three sets of input numbers that are required are capacities, demands and flows.

a. True

b. False

alse

59. In network models of transportation problems, arcs represent the routes for getting a product from one node to another.

a. True

b. False

Copyright Cengage Learning. Powered by Cognero. Page 20

Name: Class: Date:

Chapter 14

60. Transshipment points are locations where goods neither originate nor end up, but goods are allowed to enter such

points to be shipped out to their eventual destinations.

a. True

b. False

61. The flows in a general minimum cost network flow model (MCNFM) do all necessarily have to be from “left to right”;

that is, from supply points to demand points.

a. True

b. False

alse

62. In an optimized network flow model (MCNFM), all the available capacity will be used.

a. True

b. False

alse

Copyright Cengage Learning. Powered by Cognero. Page 21

Name: Class: Date:

Chapter 14

63. An auto company must meet (on time) the following demands for cars: 5000 in quarter 1; 3000 in quarter 2; 6000 in

quarter 3; 2000 in quarter 4. At the beginning of quarter 1, there are 500 autos in stock. The company has the capacity

to produce at most 3600 cars per quarter. At the beginning of each quarter, the company can change production

capacity. It costs $125 to increase quarterly production capacity by one unit. It also costs $60 per quarter to maintain

each unit of production capacity (even if it is unused during the current quarter). The variable cost of producing a car is

$2400. A holding cost of $200 per car is assessed against each quarter’s ending inventory. It is required that at the

end of quarter 4, plant capacity must be at least 5000 cars. Determine how to minimize the total cost incurred during

the next four quarters.

Initial inventory 500

Initial capacity per quarter 3600

Cost to increase capacity by 1 unit $125

Cost to maintain 1 unit of capacity $60

Variable cost of producing a car $2,400

Holding cost per car in inventory $200

Quarter 1 2 3 4

Increase in capacity 900 0 500 0

Production 4500 4000 5000 2000

Capacity 4500 4500 5000 5000

Required final capacity 5000

On hand after production 5000 4000 6000 2000

Demand 5000 3000 6000 2000

End inventory 0 1000 0 0

Production cost $37,200,000

Holding cost $200,000

Cost of increasing capacity $175,000

Cost of maintaining capacity $1,140,000

Total cost $38,715,000

64. An electronic company is considering opening warehouses in New York, Los Angeles, Madison, and Tampa. Each

warehouse can ship 125 units per week. The weekly fixed cost for keeping each warehouse open is $500 for New

York, $600 for Los Angeles, $400 for Madison, and $200 for Tampa. Region 1 of the country requires 90 units per

week, region 2 requires 80 units per week, and region 3 requires 50 units per week. The costs (including production

and shipping costs) of sending one unit from a plant to a region are shown in the table below.

To

From Region 1 Region 2 Region 3

NY $25 $45 $55

Copyright Cengage Learning. Powered by Cognero. Page 22

Name: Class: Date:

Chapter 14

LA $52 $19 $30

Madison $29 $38 $21

Tampa $28 $54 $39

Show how the company can meet weekly demands at a minimum cost, subject to the above information and the

following restrictions:

If the New York warehouse is opened, then Los Angeles must be opened.

At most two warehouses can be opened.

Either the Tampa or the Los Angeles warehouses must be opened.

Unit production and

shipping costs

To

Region 1 Region 2

Region

3

Fixed

cost Capacity

NY $25 $45 $55 $500 125

From LA $52 $19 $30 $600 125

Madison $29 $38 $21 $400 125

Tampa $28 $54 $39 $200 125

Warehouses to open (1 if

open, 0 if not)

NY 0

LA 1

Madison 1

Tampa 0

Amount produced and

shipped To

Region 1 Region 2

Region

3 Total Capacity

NY 0 0 0 0 0

From LA 0 80 15 95 125

Madison 90 0 35 125 125

Tampa 0 0 0 0 0

Total 90 80 50

Required 90 80 50

If NY, then LA constraint

NY LA

0 1

At most two open

warehouses constraint

# open Max

2 2

Either Tampa or LA

Copyright Cengage Learning. Powered by Cognero. Page 23

Name: Class: Date:

Chapter 14

constraint

# open Min

1 1

Cost of opening

warehouses $1,000

Cost of production and

shipping $5,315

Total cost $6,315

Copyright Cengage Learning. Powered by Cognero. Page 24

Name: Class: Date:

Chapter 14

A company supplies goods to three customers, each of whom requires 50 units. The company has two warehouses. In

warehouse 1, 75 units are available, and in warehouse 2, 55 units are available. The costs of shipping one unit from

each warehouse to each customer are shown in the table below.

To

From Customer 1 Customer 2 Customer 3

Warehouse 1 $20 $40 $30

Warehouse 2 $15 $35 $45

Not shipped (shortage) $100 $90 $115

There is a penalty for each unsatisfied customer unit of demand – with customer 1, a penalty cost of $100 is incurred;

with customer 2, $90; and with customer 3, $115.

65. Suppose that the company can purchase and ship extra units to either warehouse for a total cost of $125 per unit and

that all customer demand must be met. Determine how to minimize the sum of purchasing and shipping costs.

Unit shipping costs To

From Customer 1

Customer

2

Customer

3

Unit

purchase

cost

Warehouse 1 $20 $40 $30 $125

Warehouse 2 $15 $35 $45 $125

Units purchased for: Originally available

Warehouse 1 0 75

Warehouse 2 20 55

Shipments To

From Customer 1

Customer

2

Customer

3 Total Available

Warehouse 1 0 25 50 75 75

Warehouse 2 50 25 0 75 75

Total 50 50 50

Required 50 50 50

Costs

Total purchase cost $2,500

Total shipping cost $4,125

Total cost $6,625

An auto company produces cars at Los Angeles and Detroit, and has a warehouse in Atlanta. The company supplies

cars to dealers in Dallas and Orlando. The costs of shipping a car between various points are shown in the table below,

where “NA” means that a shipment is not allowed. Los Angeles can produce up to 1400 cars, and Detroit can produce

up to 3200 cars. Dallas must receive 2800 cars, and Orlando must receive 1800 cars.

To

From LA Detroit Atlanta Dallas Orlando

Copyright Cengage Learning. Powered by Cognero. Page 25

Name: Class: Date:

Chapter 14

LA $12,000 $190 $150 $140 $275

Detroit $195 $12,000 $160 $160 $160

Atlanta $155 $165 $12,000 $160 $130

Dallas $140 $160 $170 $12,000 $12,000

Orlando $260 $170 $130 $12,000 $12,000

66. (A) Determine how to minimize the cost of meeting demands at Dallas and Orlando.

(B) Modify the answer to (A) if shipments between Los Angeles and Detroit are not allowed.

(A)

Unit shipping costs

To

LA Detroit Atlanta Dallas Orlando

LA $12,000 $190 $150 $140 $275

Detroit $195 $12,000 $160 $160 $160

From Atlanta $155 $165 $12,000 $160 $130

Dallas $140 $160 $170 $12,000 $12,000

Orlando $260 $170 $130 $12,000 $12,000

Shipments

To

LA Detroit Atlanta Dallas Orlando

Total

outflow

LA 0 0 0 1400 0 1400

Detroit 0 0 0 1400 1800 3200

From Atlanta 0 0 0 0 0 0

Dallas 0 0 0 0 0 0

Orlando 0 0 0 0 0 0

Total inflow 0 0 0 2800 1800

Total outflow 1400 3200 0 0 0

Net flow out or in 1400 3200 0 2800 1800

= = =

Required 1400 3200 0 2800 1800

Total cost $708,000

(B)

To disallow shipments between LA and Detroit, enter large unit costs in LA / Detroit routes.

However, since no cars were shipped between LA and Detroit anyway, the optimal shipments

are still the same.

Each year, a computer company produces up to 600 computers in New York and up to 500 computers in Memphis.

Los Angeles customers must receive 600 computers, and 500 computers must be supplies to Oklahoma City

customers. Producing a computer costs $850 in New York and $950 in Memphis. Computers are transported by plane

Copyright Cengage Learning. Powered by Cognero. Page 26

Name: Class: Date:

Chapter 14

and can be sent through Chicago. The costs of shipping a computer between cities are shown below.

To

From Chicago Oklahoma City L.A.

New York $95 $245 $295

Memphis $115 $155 $195

Chicago NA $60 $65

Copyright Cengage Learning. Powered by Cognero. Page 27

Name: Class: Date:

Chapter 14

67. (A) Determine how to minimize the total (production plus distribution) costs of meeting the company’s annual demand.

(B) How would you modify the model in (A) if at most 300 units can be shipped through Chicago?

(A)

Unit ship costs To

Chicago

Oklahoma

City L.A.

New York $95 $245 $295

From Memphis $115 $155 $195

Chicago NA $60 $65

Unit production

costs

New York $850

Memphis $950

To

From New York Memphis Chicago

Oklahoma

City LA

New York $55,000 $55,000 $945 $1,095 $1,145

Memphis $55,000 $55,000 $1,065 $1,105 $1,145

Chicago $55,000 $55,000 $55,000 $40 $50

Oklahoma

City $55,000 $55,000 $55,000 $55,000 $55,000

LA $55,000 $55,000 $55,000 $55,000 $55,000

(B)

Shipments

To

From

New

York Memphis Chicago

Oklahoma

City LA

Total

outflow Capacity

New York 0 0 300 300 0 600

Memphis 0 0 0 200 300 500

Chicago 0 0 0 0 300 300 300

Oklahoma City 0 0 0 0 0 0

LA 0 0 0 0 0 0

Total inflow 0 0 300 500 600

Total outflow 600 500 300 0 0

Net flow in or out600 500 0 500 600

= = =

Required 600 500 0 500 600

Total cost =

$1,191,500

An oil company produces oil at two wells. Well 1 can produce up to 150,000 barrels per day, and well 2 can produce

up to 200,000 barrels per day. It is possible to ship oil directly from the wells to customers in Los Angeles and New

York. Alternatively, the company could transport oil to the ports of Mobile and Galveston and then ship it by tanker to

New York or Los Angeles. Los Angeles requires 160,000 barrels per day, and New York requires 140,000 barrels per

day. The costs (in dollars) of shipping 1000 barrels between various locations are shown below:

Copyright Cengage Learning. Powered by Cognero. Page 28

Name: Class: Date:

Chapter 14

To

From Well 1 Well 2 Mobile Galveston New York Los Angeles

Well 1 $10,000 $10,000 $10 $13 $25 $28

Well 2 $10,000 $10,000 $15 $12 $26 $25

Mobile $10,000 $10,000 $10,000 $6 $16 $17

Galveston $10,000 $10,000 $6 $10,000 $14 $16

New York $10,000 $10,000 $10,000 $10,000 $10,000 $15

Los Angeles $10,000 $10,000 $10,000 $10,000 $15 $10,000

68. (A) Assume that before being shipped to Los Angeles or New York, all oil produced at the wells must be refined at

either Mobile or Galveston. To refine 10000 barrels of oil costs $12 at Mobile and $10 at Galveston. Assuming that both

Mobile and Galveston have infinite refinery capacity, determine how to minimize the daily cost of transporting and

refining the oil requirements of Los Angeles and New York.

(B) Rework (A) under the assumption that Galveston has a refinery capacity of 150,000 barrels per day, and Mobile

has a refinery capacity of 180,000 barrels per day.

(A)

Unit shipping

costs (per 1000

barrels)

To

From Well 1 Well 2 Mobile Galveston NY LA

Well 1 $10,000 $10,000 $10 $13 $10,000 $10,000

Well 2 $10,000 $10,000 $15 $12 $10,000 $10,000

Mobile $10,000 $10,000 $10,000 $6 $16 $17

Galveston $10,000 $10,000 $6 $10,000 $14 $16

NY $10,000 $10,000 $10,000 $10,000 $10,000 $15

LA $10,000 $10,000 $10,000 $10,000 $15 $10,000

Refinery cost (per

1000 barrels)

Mobile $12

Effectively requires all oil

from the wells to go to

Mobile or Galveston first,

where it can be refined.

Galveston $10

Shipments (in

1000s of barrels)

To

From Well 1 Well 2 Mobile Galveston NY LA

Total

outflow

Well 1 0 0 100 0 0 0 100

Well 2 0 0 0 200 0 0 200

Mobile 0 0 0 0 0 100 100

Galveston 0 0 0 0 140 60 200

NY 0 0 0 0 0 0 0

LA 0 0 0 0 0 0 0

Copyright Cengage Learning. Powered by Cognero. Page 29

Name: Class: Date:

Chapter 14

Total inflow 0 0 100 200 140 160

Total outflow 100 200 100 200 0 0

Net flow in or out 100 200 0 0 140 160

<= <= = = = =

Required 150 200 0 0 140 160

Total Cost =

$11,220,000

(B)

Unit shipping

costs (per

1000 barrels)

To

From Well 1 Well 2 Mobile Galveston NY LA

Well 1 $10,000 $10,000 $10 $13 $10,000 $10,000

Well 2 $10,000 $10,000 $15 $12 $10,000 $10,000

Mobile $10,000 $10,000 $10,000 $6 $16 $17

Galveston $10,000 $10,000 $6 $10,000 $14 $16

NY $10,000 $10,000 $10,000 $10,000 $10,000 $15

LA $10,000 $10,000 $10,000 $10,000 $15 $10,000

Refinery cost

(per 1000

barrels)

Mobile $12

Galveston $10

Shipments (in

1000s of

barrels)

To Total

From Well 1 Well 2 Mobile Galveston NY LA outflow Capacity

Well 1 0 0 150 0 0 0 150

Well 2 0 0 0 150 0 0 150

Mobile 0 0 0 0 0 150 150 <= 180

Galveston 0 0 0 0 140 10 150 <= 150

NY 0 0 0 0 0 0 0

LA 0 0 0 0 0 0 0

Total inflow 0 0 150 150 140 160

Total outflow 150 150 150 150 0 0

Net flow in or

out 150 150 0 0 140 160

<= <= = = = =

Required 150 200 0 0 140 160

Total Cost =

$11,270,000

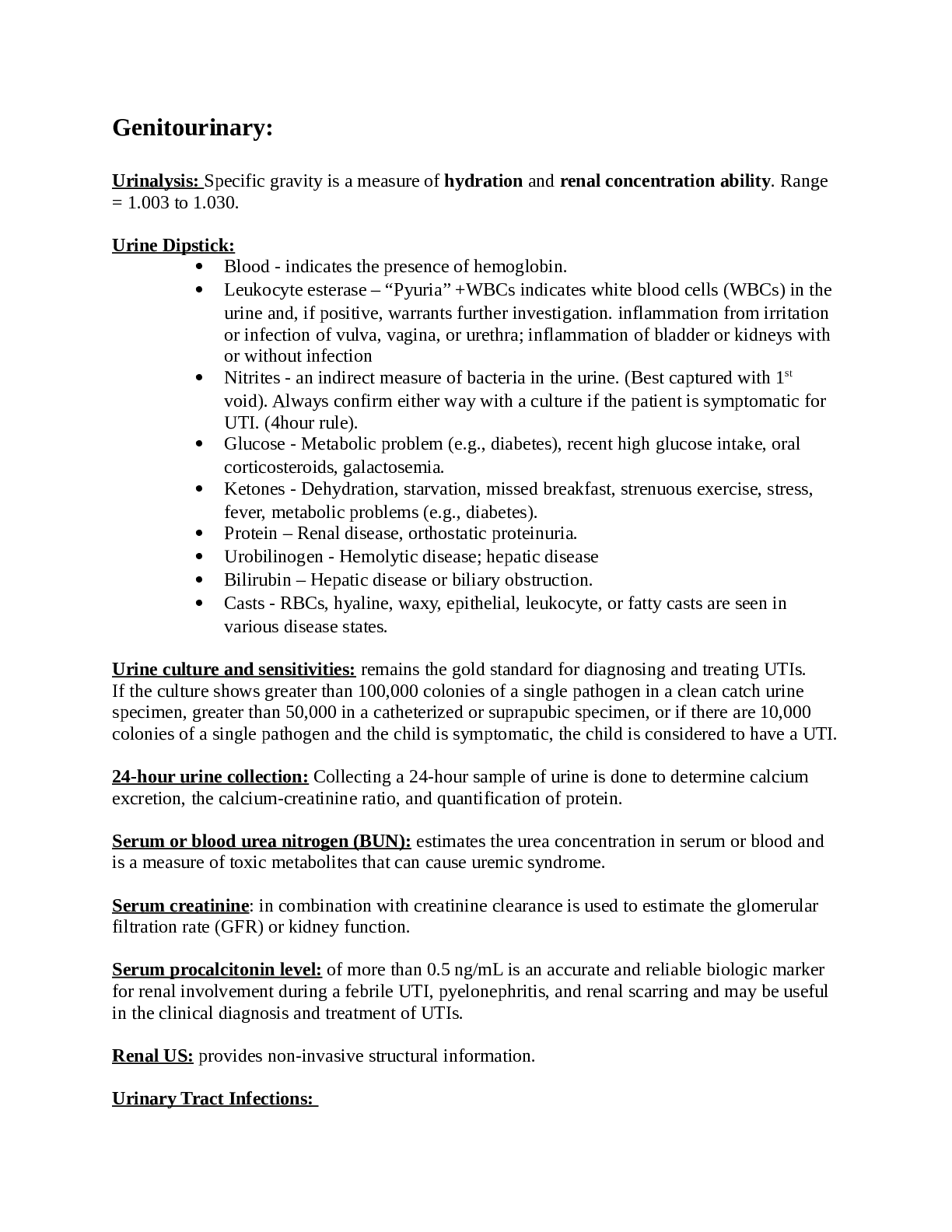

An oil company has oil fields in San Diego and Los Angeles. The San Diego field can produce up to 500,000 barrels

per day, and the Los Angeles field can produce up to 400,000 barrels per day. Oil is sent from the fields to a refinery,

either in Dallas or in Houston. Assume that each refinery has unlimited capacity. To refine 100,000 barrels costs $725

Copyright Cengage Learning. Powered by Cognero. Page 30

Name: Class: Date:

Chapter 14

at Dallas and $950 at Houston. Refined oil is shipped to customers in Chicago and New York. Chicago customers

require 400,000 barrels per day, and New York customers require 300,000 barrels per day. The costs of shipping

100,000 barrels of oil (refined or unrefined) between cities are shown in the table below:

69. (A) Determine how to minimize the total cost of meeting all demands.

(B) If each refinery had a capacity of 380,000 barrels per day, how would you modify the model in (A)?

(A)

(B)

Copyright Cengage Learning. Powered by Cognero. Page 31

Name: Class: Date:

Chapter 14

Copyright Cengage Learning. Powered by Cognero. Page 32

Name: Class: Date:

Chapter 14

70. During the next 4 quarters, an automobile company must meet (on time) the following demands for cars: 4000 in

quarter 1; 2000 in quarter 2; 5000 in quarter 3; 1000 in quarter 4. At the beginning of quarter 1, there are 300 autos in

stock. The company has the capacity to produce at most 3000 cars per quarter. At the beginning of each quarter, the

company can change production capacity. It costs $100 to increase quarterly production capacity by 1 unit. For

example, it would cost $20,000 to increase capacity from 3000 to 3200. It also costs $60 per quarter to maintain each

unit of production capacity (even if it is unused during the current quarter). The variable cost of producing a car is

$2200. A holding cost of $160 per car is assessed against each quarter’s ending inventory. It is required that at the

end of quarter 4, plant capacity must be at least 4000 cars. Determine how to minimize the total cost incurred during

the next 4 quarters.

Copyright Cengage Learning. Powered by Cognero. Page 33

Name: Class: Date:

Chapter 14

71. A large accounting firm has three auditors. Each can work up to 180 hours during the next month, during

which time three projects must be completed. Project 1 takes 140 hours, project 2 takes 150 hours, and

project 3 takes 170 hours. The amount per hour that can be billed for assigning each auditor to each project

is given in the table below:

Determine how to maximize total billings during the next month by formulating the company’s problem as

a transportation model.

72. In aggregate planning models, which of the following statements are correct?

a. The number of workers available influences the possible production levels

b. We allow the workforce level to be modified each month through the hiring and firing of workers

c. We eventually allow demand to be backlogged; that is, demand need not be met on time

d. All of these options

73. In aggregate planning models, the number of workers available influences the possible production levels.

a. True

b. False

Copyright Cengage Learning. Powered by Cognero. Page 34

Name: Class: Date:

Chapter 14

74. Aggregate planning models are usually implemented through a rolling planning horizon.

a. True

b. False

75. In aggregate planning models, we can model backlogging of demand by allowing a month’s inventory to be negative.

a. True

b. False

76. An oil delivery truck contains five compartments, holding up to 2800, 2900, 1200, 1800, and 3200 gallons of fuel,

respectively. The company must deliver three types of fuel (super, regular, and unleaded) to a customer. The demands,

penalty per gallon short, and the maximum allowed shortage are shown in the table below. Each compartment of the

truck can carry only one type of gasoline. Determine how to load the truck in a way that minimizes shortage costs.

Demand Cost (Gallon short) Maximum shortage allowed

Super 3000 $9 400

Regular 4000 $7 400

Unleaded 5000 $5 400

ata on customer demands

Cost/gallon

short

Max

shortage

(in 100s)

Super $9 4

Regular $7 4

Unleaded $5 4

Compartments used for various types of

gasoline (1 if used, 0 if not)

Compt 1 Compt 2 Compt 3 Compt 4 Compt 5

Super 0 1 0 0 0

Regular 1 0 1 0 0

Unleaded 0 0 0 1 1

Sum 1 1 1 1 1

Max 1 1 1 1 1

Amounts stored in various

compartments (in 100s of

gallons)

Compt 1 Compt 2 Compt 3 Compt 4 Compt 5Total Demand

Super 0 29 0 0 0 29 30

Regular 28 0 12 0 0 40 40

Unleaded 0 0 0 18 32 50 50

Total 28 29 12 18 32

Copyright Cengage Learning. Powered by Cognero. Page 35

Name: Class: Date:

Chapter 14

Capacity 28 29 12 18 32

Max shortage constraints (in

100s of gallons)

Shortage Max

Super 1 4

Regular 0 4

Unleaded 0 4

Logical constraints (can't ship gas type in container unless 0-1 variable is 1; then upper limit

is container capacity)

Sent 0 29 0 0 0

28 0 12 0 0

0 0 0 18 32

Logical bounds 0 29 0 0 0

28 0 12 0 0

0 0 0 18 32

Shortage cost $900

Copyright Cengage Learning. Powered by Cognero. Page 36

Name: Class: Date:

Chapter 14

A company supplies goods to three customers, each of whom requires 50 units. The company has two warehouses. In

warehouse 1, 75 units are available, and in warehouse 2, 55 units are available. The costs of shipping one unit from

each warehouse to each customer are shown in the table below.

To

From Customer 1 Customer 2 Customer 3

Warehouse 1 $20 $40 $30

Warehouse 2 $15 $35 $45

Not shipped (shortage) $100 $90 $115

There is a penalty for each unsatisfied customer unit of demand – with customer 1, a penalty cost of $100 is incurred;

with customer 2, $90; and with customer 3, $115.

77. Determine how to minimize the sum of shortage and shipping costs.

Unit

shipping

costs To

From Customer 1 Customer 2 Customer 3

Warehouse 1 $20 $40 $30

Warehouse 2 $15 $35 $45

Not shipped

(shortage) $100 $90 $115

Shipments To

From Customer 1 Customer 2 Customer 3 Total Available

Warehouse 1 0 25 50 75 = 75

Warehouse 2 50 5 0 55 = 55

Not shipped

(shortage) 0 20 0 20 = 20

Total 50 50 50

= = =

Required 50 50 50

Costs

Total

shipping

cost $3,425

Total

shortage

cost $1,800

Total cost $5,225

Copyright Cengage Learning. Powered by Cognero. Page 37

Name: Class: Date:

Chapter 14

78. The cost per day running a hotel is 200,000 + 0.002 dollars, where x is the number of customers served per day.

What number of customers served per day minimizes the cost per customer of running the hotel?

ost per day of serving x customers is a + bx2, where

a 200000

b 0.002

Number of customers served 10000.02

Cost per customer per day $40

79. An oil company controls two oil fields. Field 1 can produce up to 45 million barrels of oil per day, and field 2 can

produce up to 55 million barrels of oil per day. At field1, it costs $3 to extract and refine a barrel of oil; at field 2, the

cost is $2. The company sells oil to two countries: France and Japan. The shipping costs per barrel are shown below.

Each day, France is willing to buy up to 45 million barrels (at $6 per barrel), and Japan is willing to buy up to 35 million

barrels (at $6.50 per barrel). Determine how to maximize the company’s profit.

Copyright Cengage Learning. Powered by Cognero. Page 38

Name: Class: Date:

Chapter 14

80. The cost per day of running a hospital is 250,000 + dollars, where x is the number of patients served

per day. What number of patients served per day minimizes the cost per patient of running the hospital?

81. A company manufactures two products. If it charges price for product I, it can sell units of product I, where

. It costs $25 to produce a unit of product 1 and $72 to produce a unit of

product 2. How many units of each product should the company produce, and what prices should it charge, to

maximize its profit?

Copyright Cengage Learning. Powered by Cognero. Page 39

Name: Class: Date:

Chapter 14

A motorcycle company is determining its production schedule for the next four quarters. Demands for

motorcycles are forecasted to be 40 in quarter 1; 70 in quarter 2; 50 in quarter 3; 20 in quarter 4. The

company incurs four types of costs:

∙ It costs the company $400 to manufacture each motorcycle

∙ A holding cost of $100 per motorcycle left in inventory is incurred at the end of each quarter.

∙ Increasing production from one quarter to the next incurs costs for training employees. It is estimated that

a cost of $700 per motorcycle is incurred if production is increased from one quarter to the next.

∙ Decreasing production from one quarter to the next incurs costs for severance pay, decreasing morale, and

so forth. It is estimated that a cost of $600 per motorcycle is incurred if production is decreased from one

quarter to the next.

All demands must be met on time, and a quarter’s production can be used to meet demand for the current

quarter (as well as future quarters). During the quarter immediately preceding quarter1, 50 motorcycles

were produced. Assume that at the beginning of quarter 1, no motorcycles are in inventory.

82. Determine how to minimize the company’s total cost during the next four quarters.

Copyright Cengage Learning. Powered by Cognero. Page 40

Name: Class: Date:

Chapter 14

83. Discuss how the company’s optimal production schedule would be affected by a change in the cost of

increasing production from one quarter to the next.

One way to answer this question is to use SolverTable to see how the previous month’s

production quantities (namely; 50, 55, 55, and 50) and total cost vary as costs of decreasing

production change.

When cost of decreasing production changes, total cost increases, but the production schedule stays the

same except for production in quarter 4. It is less when this cost is low.

84. Discuss how the company’s optimal production schedule would be affected by a change in the cost of

decreasing production from one quarter to the next.

One way to answer this question is to use SolverTable to see how the previous month’s

production quantities (namely; 50, 55, 55, and 50) and total cost vary as costs of decreasing

production change.

When cost of decreasing production changes, total cost increases, but the production schedule stays the

same except for production in quarter 4. It is less when this cost is low.

Copyright Cengage Learning. Powered by Cognero. Page 41

Name: Class: Date:

Chapter 14

85. A total of 160 hours of labor are available each week at $15 per hour. Additional labor can be purchased at

$25 per hour. Capital can be purchased in unlimited quantities at a cost of $45 per unit. If K units of capital

and L units of labor are available during a week, then machines can be produced. Each machine

sells for $270. How can the firm maximize its weekly profit?

86. A statistician is currently trying to maximize his profit in the bond market. Four bonds are available for purchase and

sale at the bid and ask prices shown in the table below. The statistician can buy up to 1300 units of each bond at the

ask price or sell up to 1300 units of each bond at the bid price. During each of the next three years the person who

sells a bond will pay the owner of the bond the cash payments that are also shown in the table below. The

statistician’s goal is to maximize his revenue from selling bonds less his payments for buying bonds, subject to the

constraint that after each year’s payments are received, his current cash position (due only to cash payments from

bonds and not purchases or sales of bonds) is nonnegative. His current cash position can depend on past coupons

and that cash accumulated at the end of each year earns 12% annual interest. Determine how to maximize net profit

from buying and selling bonds, subject to the constraints previously described.

Bid (for selling) and ask (for buying) prices of bonds

Bond 1 Bond 2 Bond 3 Bond 4

Bid $1,000 $99 $980 $960

Ask $1,020 $1,015 $1,002 $184

Cash payments from seller to buyer

Copyright Cengage Learning. Powered by Cognero. Page 42

Name: Class: Date:

Chapter 14

Bond 1 Bond 2 Bond 3 Bond 4

Year 1 $120 $100 $90 $70

Year 2 $140 $130 $110 $90

Year 3 $1,300 $1,320 $1,290 $1,310

ond 1 Bond 2 Bond 3 Bond 4

Bid $1,000 $99 $980 $960

Ask $1,020 $1,015 $1,002 $184

Bond 1 Bond 2 Bond 3 Bond 4

Year 1 $120 $100 $90 $70

Year 2 $140 $130 $110 $90

Year 3 $1,300 $1,320 $1,290 $1,310

Interest rate for cash 12.000%

Bond 1 Bond 2 Bond 3 Bond 4

Buys 1300 943 0 1300

Maximum 1300 1300 1300 1300

Sells 0 0 1300 1300

Maximum 1300 1300 1300 1300

Cash in Cash out Net cash

Accumulated cash

with interest

Year 0 (right after buy,

sells) $2,522,000 $2,522,000 $0 $0

Year 1 $341,266 $208,000 $133,266 $133,266

Year 2 $421,546 $260,000 $161,546 $310,804

Year 3 $4,637,311 $3,380,000 $1,257,311 $1,605,412

Cash at end of year 3 $1,605,412

Copyright Cengage Learning. Powered by Cognero. Page 43

Name: Class: Date:

Chapter 14

87. Assume that you are given the following means, standard deviations, and correlations for the annual return on three

stocks.

Stock 1 Stock 2 Stock 3

Mean return 0.15 0.18 0.23

Stdev. of return 0.18 0.28 0.38

Correlation matrix

Stock 1 Stock 2 Stock 3

Stock 1 1.00 0.62 0.72

Stock 2 0.62 1.00 0.39

Stock 3 0.72 0.39 1.00

The correlation between stocks 1 and 2 is 0.62, between stocks 1 and 3 is 0.72, and between stocks 2 and 3 is 0.39.

You have $12,000 to invest and can invest no more than 55% of your money in any single stock. Determine the

minimum variance portfolio that yields an expected annual return of at least 0.15.

Stock 1 Stock 2 Stock 3

Mean return 0.15 0.18 0.23

Stdev of return 0.18 0.28 0.38

Correlation matrix

Stock 1 Stock 2 Stock 3

Stock 1 1 0.62 0.72

Stock 2 0.62 1 0.39

Stock 3 0.72 0.39 1

Stocks Stock 1 Stock 2 Stock 3 Total Available

Dollars $6,600 $4,824 $576 $12,000 = $12,000

Fraction 0.55 0.402028 0.047972

Maximum 0.55 0.55 0.55

Actual Required

0.165899 0.15

Standard deviations times fractions invested

Stock 1 Stock 2 Stock 3

0.099 0.112568 0.018229

Portfolio variance 0.040823

Portfolio Stdev. 0.202047

Copyright Cengage Learning. Powered by Cognero. Page 44

Name: Class: Date:

Chapter 14

88. At time 0, you have $10,000. Investments A and B are available; their cash flows are shown in the table below:

Assume that any money not invested in A or B earns interest at an annual rate of 8%. Determine how to maximize

your cash on hand at time 3.

Investment Time 0 Time 1 Time 2 Time 3

A -$1.00 $0.20 $1.50 $0.00

B $0.00 -$1.00 $0.00 $1.90

ash flows per dollar invested

Time 0 Time 1 Time 2 Time 3

Chapter 14

89. You are given the following means, standard deviations, and correlations for the annual return on three

stocks. The means are 0.12, 0.15, and 0.20. The standard deviations are 0.20, 0.30, and 0.40. The correlation

between stocks 1 and 2 is 0.65, between stocks 1 and 3 is 0.75, and between stocks 2 and 3 is 0.41. You have

$13,000 to invest and can invest no more than half of your money in any single stock. Determine the

minimum variance portfolio that yields an expected annual return of at least 0.14.

Copyright Cengage Learning. Powered by Cognero. Page 46

Name: Class: Date:

Chapter 14

90. Laila, an Egyptian Broker, is currently trying to maximize her profit in the bond market. Four bonds are available for

purchase and sale at the bid and ask prices shown in the table be below:

Laila can buy up to 1000 units of each bond at the ask price or sell up to 1000 units of each bond at the bid price.

During each of the next 3 years, the person who sells a bond will pay the owner of the bond the cash payments shown

in the table below:

Laila’s goal is to maximize her revenue from selling bonds less her payment for buying bonds, subject to the constraint

that after each year’s payments are received, her current cash position (due only to cash payments from bonds and

not purchases or sales of bonds) is nonnegative. Note that her current cash position can depend on past coupons and

that cash accumulated at the end of each year earns 13% annual interest. Determine how to maximize net profit from

buying and selling bonds, subject to the constraints previously described. Why do you think we limit the number of

units of each bond that can be bought or sold?

Copyright Cengage Learning. Powered by Cognero. Page 47

Name: Class: Date:

Chapter 14

91. Any integer program involving 0 – 1 variables with constraint(s) is called a knapsack problem.

a. three

b. two

c. one

d. zero

92. The binary variables in the fixed cost models correspond to:

a. the number of units or products produced

b. the total profit

c. the amount of labor hours

d. a process for which a fixed cost occurs

93. A 0-1 variable, also called a binary variable, is a variable that must equal 0 or 1.

a. True

b. False

alse

94. Any integer programming problem involving 0-1 variables with only one constraint is called a knapsack problem.

a. True

b. False

95. In a set-covering model, each member of a given set (set 1) must be “covered” by an acceptable member of another

set (set 2). The objective of such problems is to minimize the number of elements in set 2 that are needed to cover all

the elements in set 1.

a. True

b. False

Copyright Cengage Learning. Powered by Cognero. Page 48

Name: Class: Date:

Chapter 14

96. Suppose that on Monday morning you have $5000 in cash on hand. For the following seven days, the following cash

requirements must be met: Monday, $6,000; Tuesday, $7,000; Wednesday, $10,000; Thursday, $3,000; Friday,

$8,000; Saturday, $3,000; Sunday, $4,000. At the beginning of each day, you must decide how much money (if any) to

withdraw from the bank. It costs $8 to make a withdrawal of any size. You believe that the opportunity cost of having

$1 of cash on hand for a year is $0.25. Assume that opportunity costs are incurred on each day’s ending balance.

Determine how much money you should withdraw from the bank during each of the next 7 days.

Initial cash (in $1000s) $5

Fixed cost of withdrawal $8

Opportunity cost/$1/day $0.25

Days to withdraw (1 if a withdrawal, 0 if

not)

Mon Tue Wed Thur Fri Sat Sun

1 0 0 0 0 0 0

Amount withdrawn (in $1000s) $36 $0 $0 $0 $0 $0 $0

Logical upper bound $36 $0 $0 $0 $0 $0 $0

Cash requirement (in $1000s) $6 $7 $10 $3 $8 $3 $4

Cash on hand at end of day $35 $28 $18 $15 $7 $4 $0

Meet requirements on time 0 0 0 0 0 0 0

Summary of costs (in dollars)

Withdrawal cost $8.0

Opportunity cost $24.7

Total cost $32.7

Copyright Cengage Learning. Powered by Cognero. Page 49

Name: Class: Date:

Chapter 14

97. A manufacturer can sell product 1 at a profit of $2 per unit and product 2 at a profit of $6 per unit. Three units of raw

material are needed to manufacture one unit of product 1, and 6 units of raw material are needed to manufacture unit of

product 2. A total of 120 units of raw material are available. If any of product 1 is produced, a setup cost of $10 is

incurred, and if any of product 2 is produced, a setup cost of $20 is incurred. Determine how to maximize the

manufacturer’s profit.

Copyright Cengage Learning. Powered by Cognero. Page 50

Name: Class: Date:

Chapter 14

98. The financial CEO is given a group of possible investments projects for his company’s capital. For each

project, he is given the NPV that each project would add to the firm, as well as the cash outflow required by

each project during each year as shown in the table below:

Determine the investments that maximize the firm’s NPV. The firm has 30 million dollars available during

each of the next 5 years. All numbers are in millions of dollars.

99. A company produces three types of glue on two different production lines. Each line can be utilized by up to

six workers at a time. Workers are paid $550 per week on production line 1 and $950 per week on

production line 2. For a week of production it costs $1,050 to set up production line 1 and $2,050 to set up

production line 2. During a week on a production line each worker produces the number of units of glue

shown in the table below:

Each week at least 120 units of glue 1, at least 150 units of glue 2, and at least 200 units of glue 3 must be

Copyright Cengage Learning. Powered by Cognero. Page 51

Name: Class: Date:

Chapter 14

produced. Determine how to minimize the total cost of meeting weekly demands.

Copyright Cengage Learning. Powered by Cognero. Page 52

Name: Class: Date:

Chapter 14

100. A product can be produced on four different machines. Each machine has a fixed setup cost, variable

production cost per unit processed, and a production capacity, as shown below:

A total of 2000 units of the product must be produced. Determine how to minimize the total cost.

Copyright Cengage Learning. Powered by Cognero. Page 53

Name: Class: Date:

Chapter 14

101. My friend Lee Meadow moved from Ferris State University in Michigan to Indiana University East in Indiana and has

rented a truck that can haul up to 1100 cubic feet of furniture. The volume and value of each item he considered moving

on the truck are giving below.

Which items did he take with him to Indiana? What is the value of these items?

102. In nonlinear models, which of the following statements are correct?

a. Only the objective function is not a linear function of the decision variables

b. Only the constraints are not linear functions of the decision variables

c. The objective function and/or the constraints are not linear functions of the decision variables

d. All of these options

103. A nonlinear programming problem (NLP) is an optimization problem in which the objective function and/or the

constraints are not linear functions of the decision variables.

a. True

b. False

104. When we solve a nonlinear programming problem (NLP), it is very possible that Solver will obtain the wrong answer.

a. True

b. False

Copyright Cengage Learning. Powered by Cognero. Page 54

Name: Class: Date:

Chapter 14

105. For some types of integer programming problems, their LP relaxation solutions are optimal.

a. True

b. False

106. A local optimal solution is better than all nearby solutions, but a solution far away might be better than it.

a. True

b. False

107. A global optimal solution is not necessarily the best solution overall.

a. True

b. False

alse

108. Chemical Bank is attempting to determine where its assets should be invested during the current year. At present,

$800,000 is available for investment in bonds, home loans, auto loans, and personal loans. The annual rate of return on

each type of investment is known to be the following: bonds, 12%, home loans, 18%, auto loans, 15%, personal loans,

22%. To ensure that the bank's portfolio is not too risky, the bank’s investment manager has placed the following

restrictions on the bank portfolio:

∙ No more than 30% of the total amount invested may be in personal loans

∙ The amount invested in home loans cannot exceed the amount invested in auto loans

∙ The amount invested in personal loans cannot exceed the amount invested in bonds.

Determine how the bank can maximize the annual return on its investment portfolio.

nnual rates

Bonds Home loans Auto loans Personal loans

12% 18% 15% 24%

Maximum percent in personal loans 30%

Amounts invested

Bonds Home loans Auto loans Personal loans

$240,000 $160,000 $160,000 $240,000

$240,000 $160,000 $240,000

Annual return $139,200

109. A company is considering investing a total amount of $2.50 million in four bonds. The expected annual return, the

worst-case annual return on each bond, and the “duration” of each bond are given in the table below.

Copyright Cengage Learning. Powered by Cognero. Page 55

Name: Class: Date:

Chapter 14

Bond 1 Bond 2 Bond 3 Bond 4

Expected 16% 11% 14% 19%

Worst case 7% 9% 11% 10%

Duration 4 5 8 10

The duration of a bond is a measure of the bond’s sensitively to interest rates. The company wants to maximize the

expected return from its bond investments, subject to the following constraints:

∙ The worst-case return of the bond portfolio must be at least 90%.

∙ The average duration of the portfolio must be at most 7

∙ Because of diversification requirements, at most 35% of the total amount invested in a single bond.

Determine how the company can maximize the expected return on its investment.

Chapter 14

110. The risk index of an investment can be obtained by taking the absolute values of percentage changes in the

value of the investment for each year and averaging them. Suppose you are trying to determine what

percentage of your money you should invest in T-bills, gold, and stocks. The table below lists the annual

returns (percentage changes in value) for these investments for the years 1968–1988.

Copyright Cengage Learning. Powered by Cognero. Page 57

Name: Class: Date:

Chapter 14

Let the risk index of a portfolio be the weighted average of the risk indexes of these investments, where the

weights are the fractions of your money assigned to the investments. Suppose that the amount of each

investment must be between 20% and 50% of the total invested. You would like the risk index of your

portfolio to equal 0.15, and your goal is to maximize the expected return on your portfolio. Determine the

maximum expected return on your portfolio, subject to the stated constraints. Use the average return

earned by each investment during the years 1968-1988 as your estimate of expected return.

Copyright Cengage Learning. Powered by Cognero. Page 58

Name: Class: Date:

Chapter 14

Determine the cheapest way of producing today’s batch of this drug.

112. A minimum cost network flow model (MCNFM) has the following advantage relative to the special case of a simple

transportation model:

a. a MCNFM does not require capacity restrictions on the arcs of the network

b. the flows in a general MCNFM don’t all necessarily have to be from supply locations to demand locations

c. a MCNFM is generally easier to formulate and solve

d. All of these options

Chapter 14

An oil company produces oil at two wells. Well 1 can produce up to 150,000 barrels per day, and well 2 can produce

up to 200,000 barrels per day. It is possible to ship oil directly from the wells to customers in Los Angeles and New

York. Alternatively, the company could transport oil to the ports of Mobile and Galveston and then ship it by tanker to

New York or Los Angeles. Los Angeles requires 160,000 barrels per day, and New York requires 140,000 barrels per

day. The costs (in dollars) of shipping 1000 barrels between various locations are shown below:

To

From Well 1 Well 2 Mobile Galveston New York Los Angeles

Well 1 $10,000 $10,000 $10 $13 $25 $28

Well 2 $10,000 $10,000 $15 $12 $26 $25

Mobile $10,000 $10,000 $10,000 $6 $16 $17

Galveston $10,000 $10,000 $6 $10,000 $14 $16

New York $10,000 $10,000 $10,000 $10,000 $10,000 $15

Los Angeles $10,000 $10,000 $10,000 $10,000 $15 $10,000

113. Determine how to minimize the transportation cost in meeting the oil demands of Los Angeles and New York.

114. A company manufactures two products. If it charges price for product , it can sell units of product , where

It costs the company $20 to produce a unit of product 1 and $65 to

produce a unit of product 2. How many units of each product should the company produce, and what prices should it

charge, to maximize its profit?115. Linear programming models are used by many financial firms to select a desirable bond portfolio. The following is a

simplified version of such a model. Abby is considering investing in four bonds; $1.5 million is available for investment.

The expected annual return, the worst-case annual return on each bond, and the “duration” of each bond are given

below (The duration of a bond is a measure of the bond’s sensitivity to interest rates.)

Abby wants to maximize the expected return from its bond investments, subject to the following three constraints:

∙ The worst-case return of the bond portfolio must be at least 8%.

∙ The average duration of the portfolio must be at most 6. For example, a portfolio that invests $600,000 in bond 1 and

$400,000 in bond 4 has an average duration of [600,000(3) + 400,000 (9)]/1,000,000 = 5.4

∙ Because of diversification requirements, at most 40% of the total amount invested can be invested in a single bond.

Determine how Abby can maximize the expected return on her investment.

[Show More]

.png)