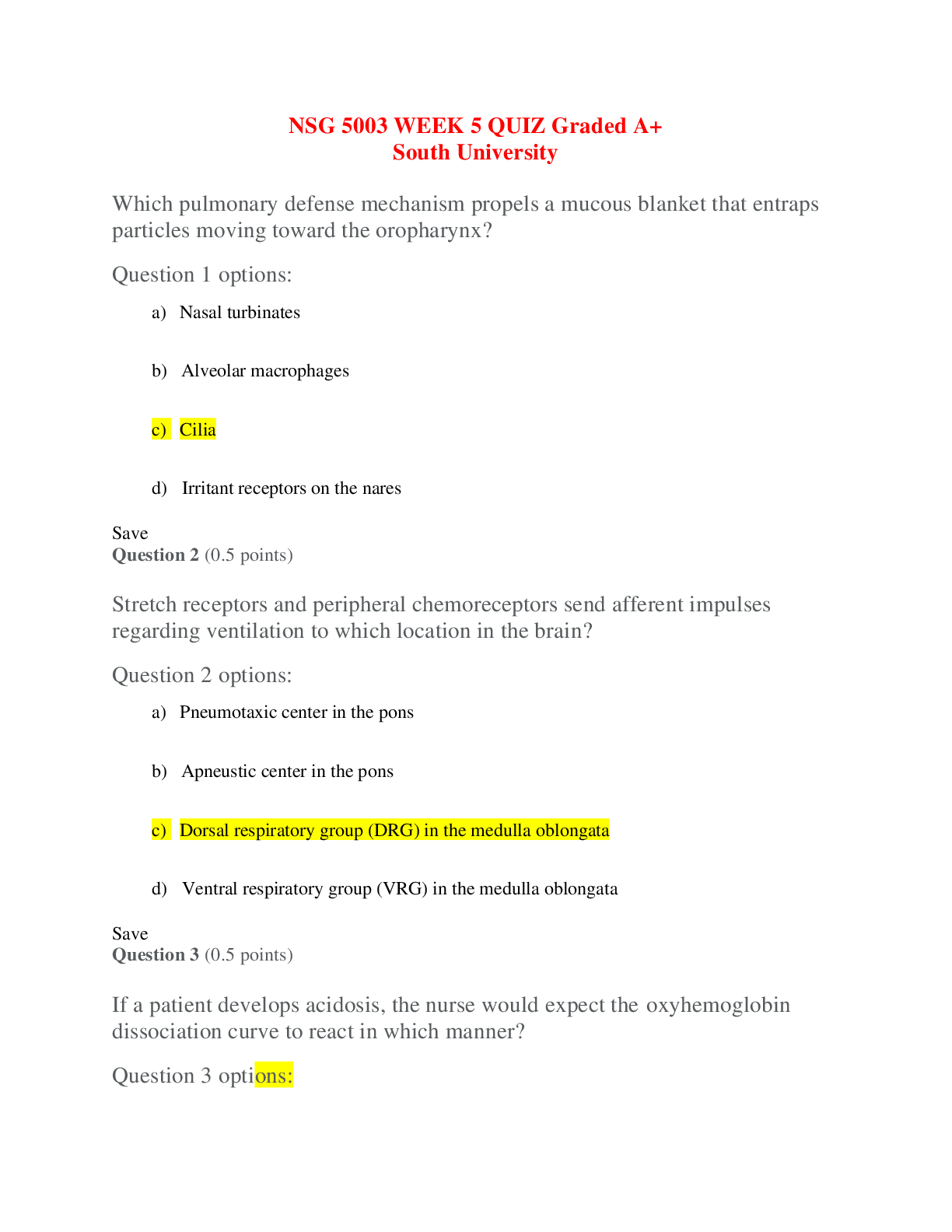

Business > QUESTIONS & ANSWERS > [Solved] Liberty University BUSI 530 Exam 3 (All)

[Solved] Liberty University BUSI 530 Exam 3

Document Content and Description Below

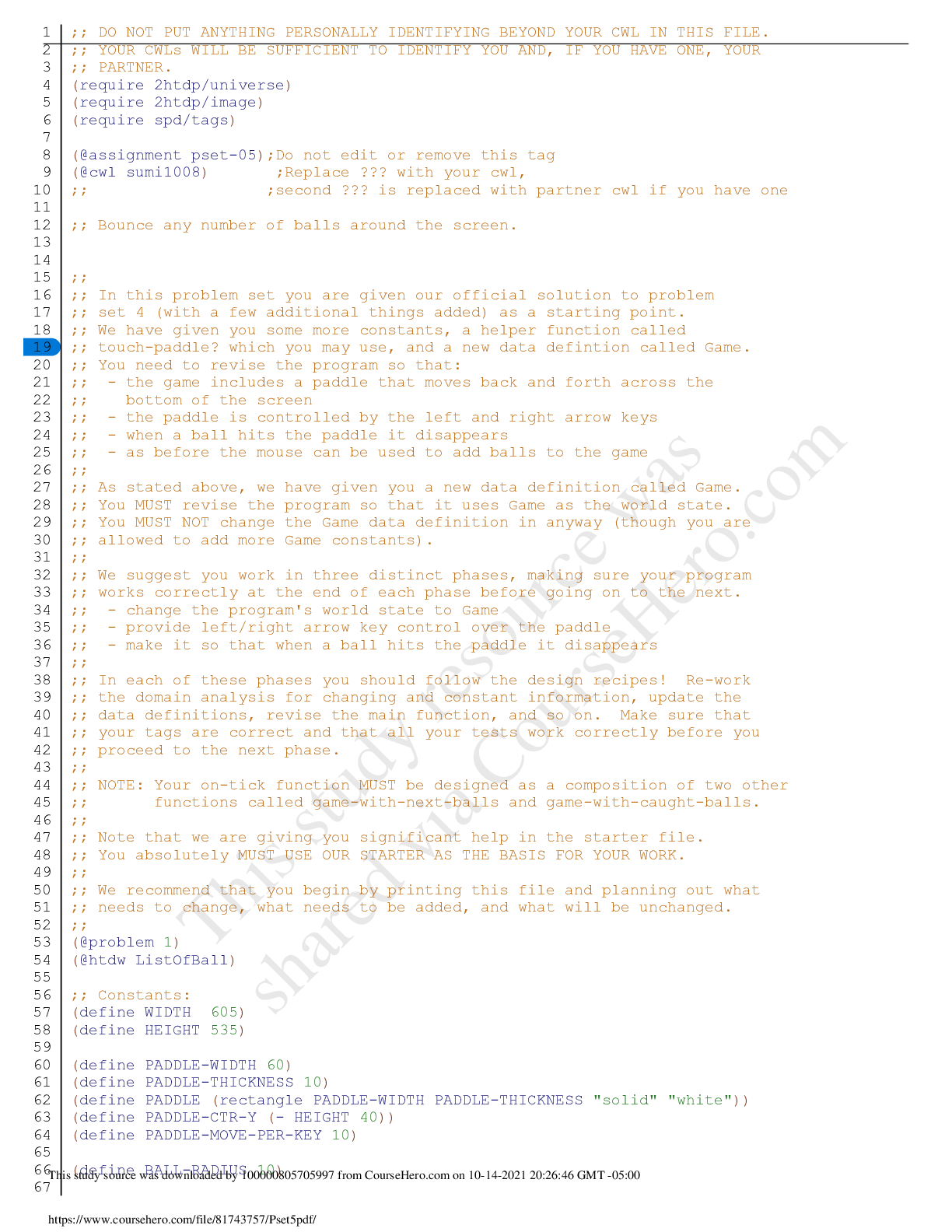

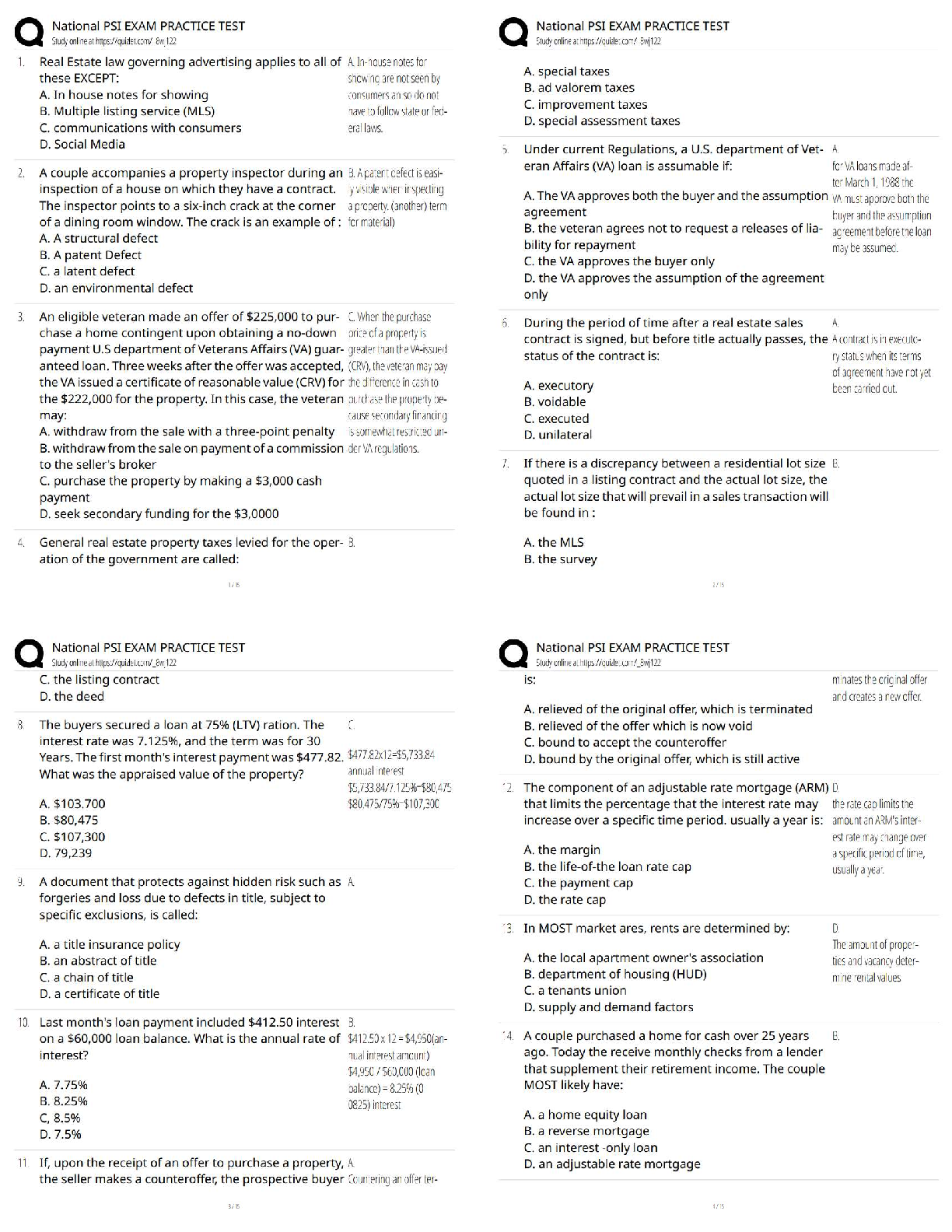

Liberty University BUSI 530 Exam 3 Liberty University BUSI 530 Exam 3 Item 1 3.5/3.5 points awarded Item Scored Item 1 Item 1 3.5 of 3.5 points awarded Item Scored Which one of th ... e following statements is incorrect concerning stock indexes? Multiple Choice • Indexes have been developed for foreign stocks. • Some indexes cover only a specific market sector. • Most indexes include all of the publicly-traded common stocks. Correct • Some indexes are equally weighted. Item 2 Item 2 3.5 of 3.5 points awarded Item Scored Macro risks are faced by all common stock investors. True or False 3 3.5/3.5 points awarded Item Scored Item 3 Item 3 3.5 of 3.5 points awarded Item Scored Although several stock indexes are available to inform investors of market changes, the Dow Jones Industrial Average: Multiple Choice • is the broadest-based of the market indexes. • is the only reliable market index. • accounts for approximately 90% of U.S. market value. • is one of the best-known of the U.S. market indexes. 3.5/3.5 points awarded Item Scored Item 4 Item 4 3.5 of 3.5 points awarded Item Scored Which one of the following firms is likely to exhibit the least macro risk exposure? Multiple Choice • Construction company • Airline company • Gold mining company Correct • Auto manufacturer Item 5 Item 5 3.5 of 3.5 points awarded Item Scored The average of the betas for all stocks is: Multiple Choice • greater than 1.0; most stocks are aggressive. • less than 1.0; most stocks are defensive. • unknown; betas are continually changing. • exactly 1.0; these stocks represent the market. Item 6 Item 6 3.5 of 3.5 points awarded Item Scored If the line measuring a stock's historic returns against the market's historic returns has a slope greater than 1.0, then the: Multiple Choice • stock is currently underpriced. • market risk premium is increasing. • stock has a significant amount of specific risk. • stock has a beta exceeding 1.0. Item 7 Item 7 3.5 of 3.5 points awarded Item Scored The security market line shows how the expected rate of return depends on beta. True or False 8 3.5/3.5 points awarded Item Scored Item 8 If the slope of the line measuring a stock's returns against the market's returns is positive, then the stock: Multiple Choice • has a beta greater than 1.0. • has no specific risk. • has a positive beta. Correct • plots above the security market line. Item 9 Item 9 4.75 of 4.75 points awarded Item Scored WACC can be used to determine the value of a firm by discounting the firm's: Multiple Choice • after-tax net profits. • pretax profits. • cash inflows. free cash flows. Item 10 Item 10 4.75 of 4.75 points awarded Item Scored The company cost of capital is the return that is expected on a portfolio of the company's: Multiple Choice • existing securities. Correct • equity securities. • debt securities. • proposed securities. Item 11 Item 11 3.5 of 3.5 points awarded Item Scored If 100 million shares of common stock are issued with a par value of $2 and additional paid in capital is $800 million, the total par value of the issued shares is: Multiple Choice • $200 million. Correct • $600 million. • $800 million. • $1 billion. Explanation Total par value = 100m × $2 = $200m Item 12 Item 12 3.5 of 3.5 points awarded Item Scored Companies sometimes sell the cash flows from a bundle of loans. Such bonds are known as asset-backed bonds. True or False Item 13 Item 13 3.5 of 3.5 points awarded Item Scored Funded debt refers to those liabilities that: Multiple Choice • have established a sinking fund for repayment. • are not callable at the option of the firm. • are secured by specific collateral. • have a maturity of more than one year remaining. Item 14 Item 14 3.5 of 3.5 points awarded Item Scored Dividends represent an important component of a firm's net book value. True or False 15 3.5/3.5 points awarded Item Scored Item 15 Item 15 3.5 of 3.5 points awarded Item Scored A stock's par value is the: Multiple Choice • maturity value of the stock. • price at which each share is recorded. Correct • price at which an investor could sell the stock. • price received by the firm when the stock was issued. Item 16 Item 16 3.5 of 3.5 points awarded Item Scored Equity capital in young businesses is known as venture capital and it is provided by venture capital firms, wealthy individuals, and investment institutions such as pension funds. True or False Item 17 Item 17 3.5 of 3.5 points awarded Item Scored The SEC reviews the registration statement and determines whether or not an investment in the firm is advisable. True or False Item 18 Item 18 3.5 of 3.5 points awarded Item Scored The evidence indicates that industrial stock prices in the U.S. decrease by approximately 3%, on average, when new equity issues are announced. True or False Item 19 Item 19 3.5 of 3.5 points awarded Item Scored The SEC requires the sale of a private placement to be limited to a small number of knowledgeable investors. True or False Item 20 Item 20 3.5 of 3.5 points awarded Item Scored Prospective investors are advised of a stock's potential risks by the: Multiple Choice • underwriter. • underpricing laws. • prospectus. Correct • initial public offering. Item 21 Item 21 3.5 of 3.5 points awarded Item Scored Debt usage will have an effect on: Multiple Choice • business risk. • financial risk. Correct • operating risk. • asset risk. Item 22 Item 22 3.5 of 3.5 points awarded Item Scored In the absence of taxes, which one of the following would not be expected to change with changes in the firm's capital structure? Multiple Choice • Weighted-average cost of capital • Expected return on equity • Expected return on assets Correct • Expected earnings per share Item 23 Item 23 3.5 of 3.5 points awarded Item Scored When asked about key factors of debt policy, financial managers commonly mention the tax advantage of debt and the importance of maintaining their credit rating. True or False Item 24 Item 24 3.5 of 3.5 points awarded Item Scored According to MM, debt restructuring will not change the firm’s overall value. True or False Item 25 Item 25 3.5 of 3.5 points awarded Item Scored A firm's capital structure is represented by its mix of: Multiple Choice • assets. • liabilities and equity. Correct • assets and liabilities. • assets, liabilities, and equity. [Show More]

Last updated: 3 years ago

Preview 1 out of 8 pages

![Preview image of [Solved] Liberty University BUSI 530 Exam 3 document](https://scholarfriends.com/storage/BUSI-530-Exam-3.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$14.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jan 17, 2021

Number of pages

8

Written in

All

Additional information

This document has been written for:

Uploaded

Jan 17, 2021

Downloads

0

Views

51

.png)