Financial Accounting > QUESTIONS & ANSWERS > Kaplan University, Davenport - ACCOUNTING AC116 Unit 6 assignment problem 12-1A. (All)

Kaplan University, Davenport - ACCOUNTING AC116 Unit 6 assignment problem 12-1A.

Document Content and Description Below

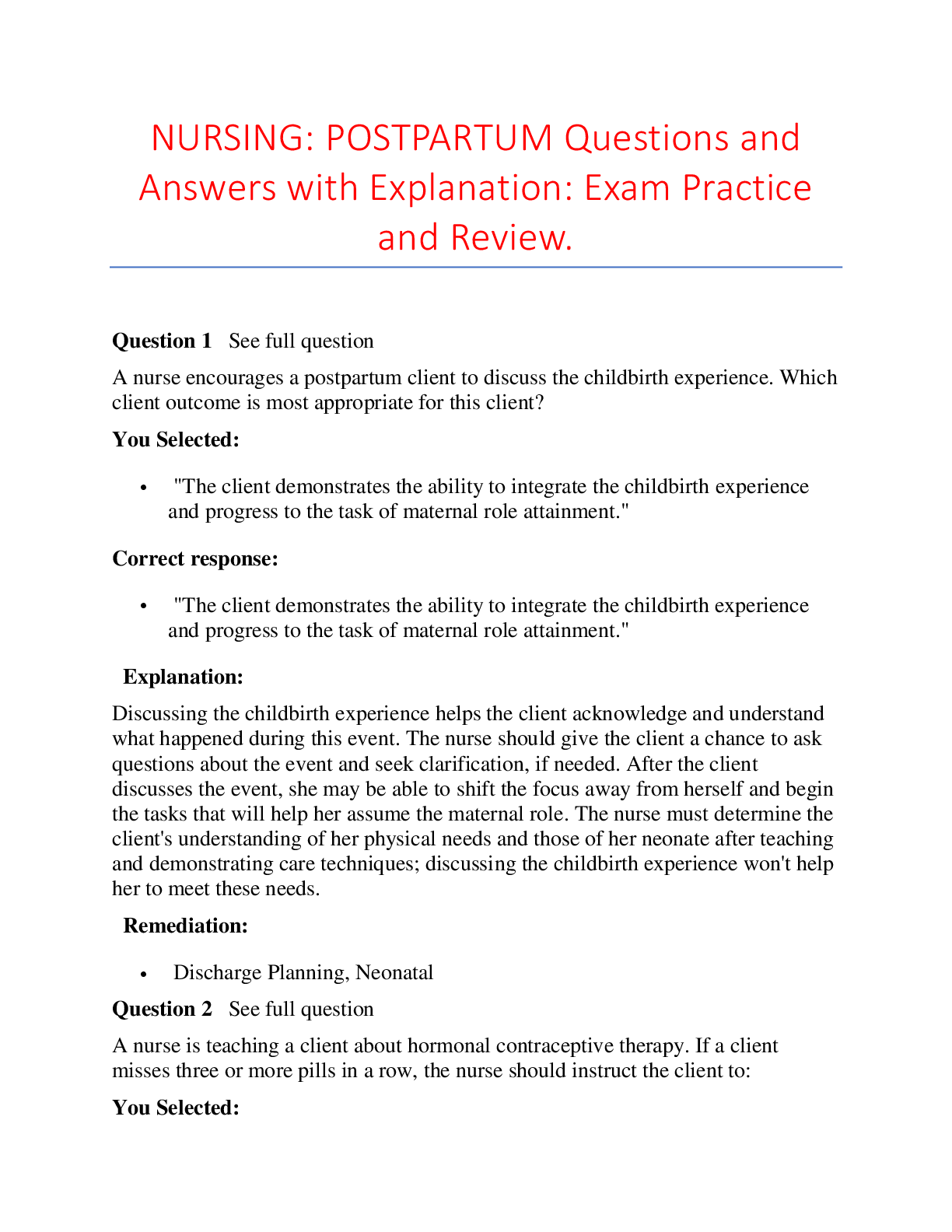

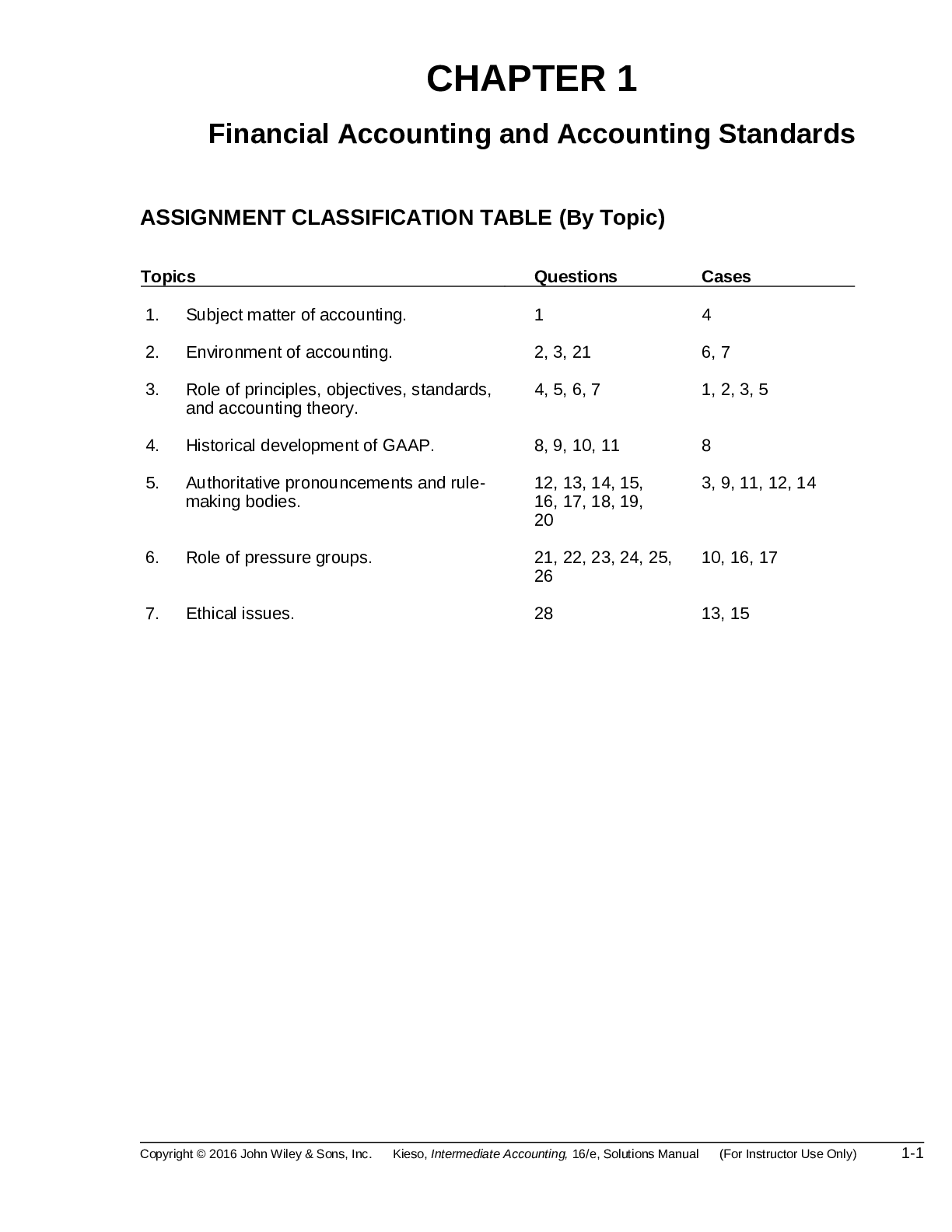

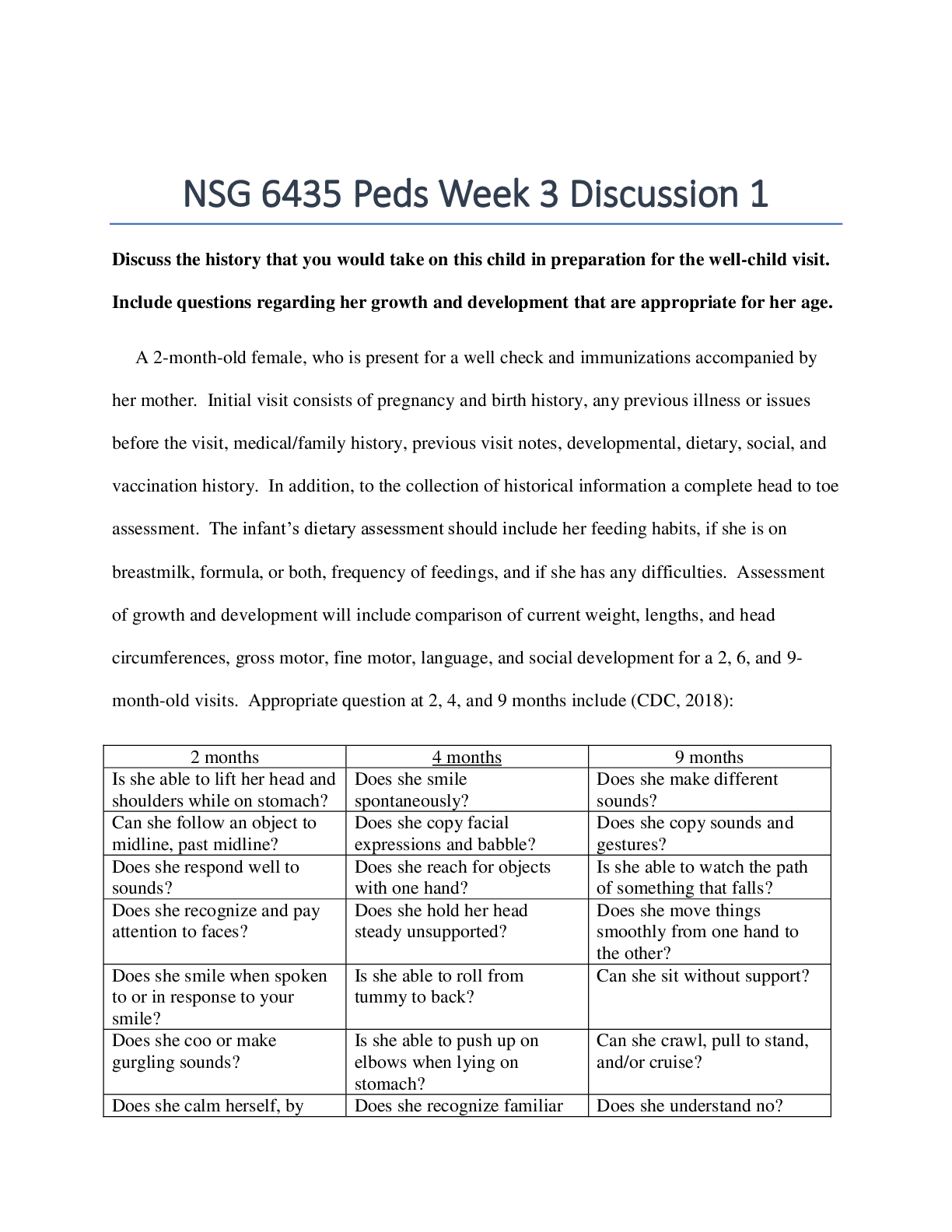

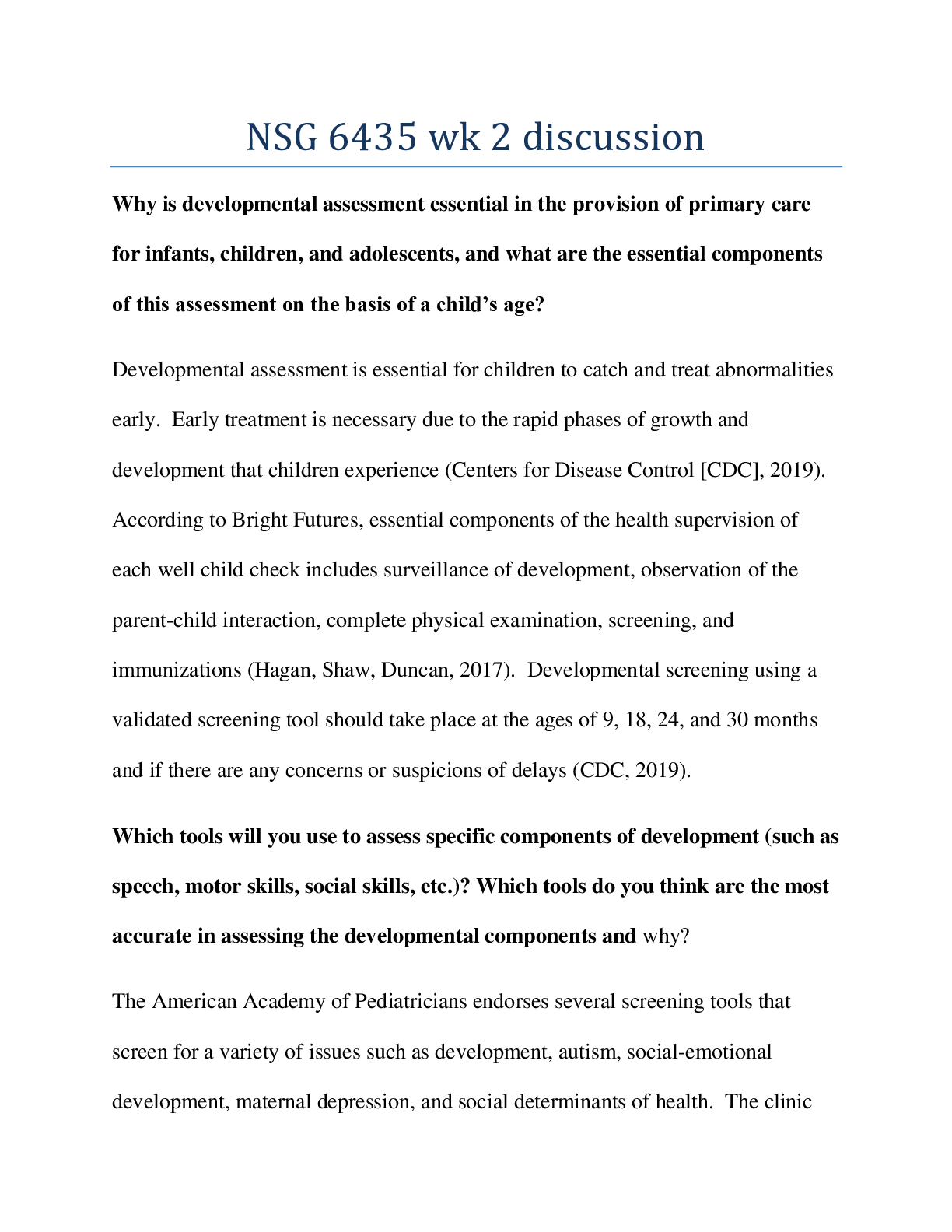

Kaplan University, Davenport - ACCOUNTING AC116 Unit 6 assignment problem 12-1A Problem 12-1A The post-closing trial balances of two proprietorships on January 1, 2017, are presented below. Sor... ensen Company Lucas Company Dr. Cr. Dr. Cr. Cash $11,000 $9,100 Accounts receivable 13,500 20,000 Allowance for doubtful accounts $2,300 $3,300 Inventory 20,000 14,000 Equipment 34,000 22,000 Accumulated depreciation—equipment 18,200 8,400 Notes payable 13,700 11,400 Accounts payable 16,700 23,600 Sorensen, capital 27,600 Lucas, capital 18,400 $78,500 $78,500 $65,100 $65,100 Sorensen and Lucas decide to form a partnership, Solu Company, with the following agreed upon valuations for noncash assets. Sorensen Company Lucas Company Accounts receivable $13,500 $20,000 Allowance for doubtful accounts 3,400 3,000 Inventory 21,300 15,200 Equipment 19,000 11,400 All cash will be transferred to the partnership, and the partnership will assume all the liabilities of the two proprietorships. Further, it is agreed that Sorensen will invest an additional $3,800 in cash, and Lucas will invest an additional $14,400 in cash. Your answer is correct. Prepare separate journal entries to record the transfer of each proprietorship’s assets and liabilities to the partnership. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit [Show More]

Last updated: 2 years ago

Preview 1 out of 2 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jan 19, 2021

Number of pages

2

Written in

Additional information

This document has been written for:

Uploaded

Jan 19, 2021

Downloads

0

Views

65