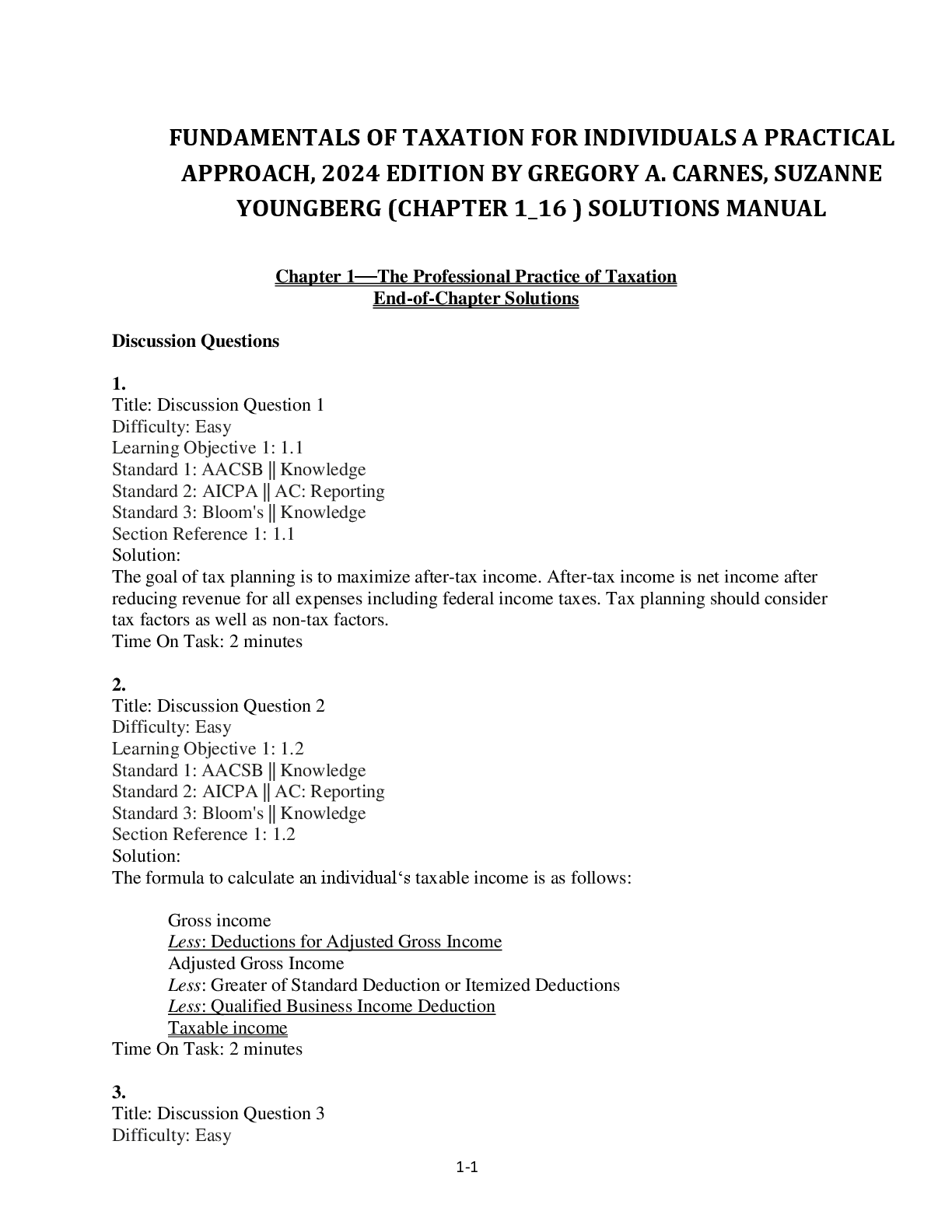

Fundamentals Of Taxation For Individuals A Practical Approach 2024 Edition By Gregory A. Carnes, Suzanne, Youngberg ( Chapter 1_16) SOLUTIONS MANUAL

Financial Accounting > TEST BANKS > CHAPTER 6 INVENTORIES:Test Bank for Accounting Principles, Eleventh Edition. This document/TEST BAN (All)