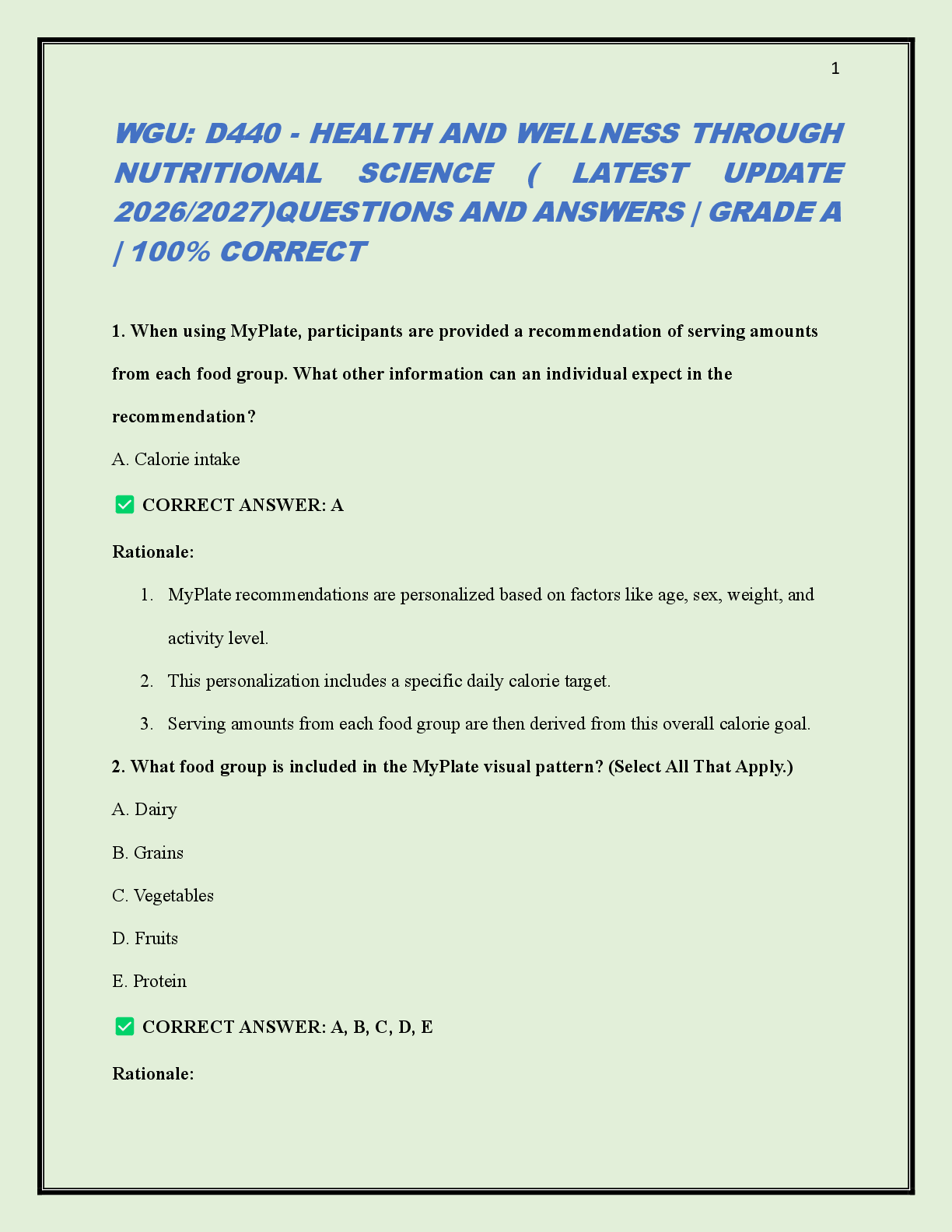

Retirement Plans Exam Review quiz

Document Content and Description Below

Last updated: 3 years ago

Preview 1 out of 2 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$12.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Nov 25, 2022

Number of pages

2

Written in

All

Additional information

This document has been written for:

Uploaded

Nov 25, 2022

Downloads

0

Views

63