.png)

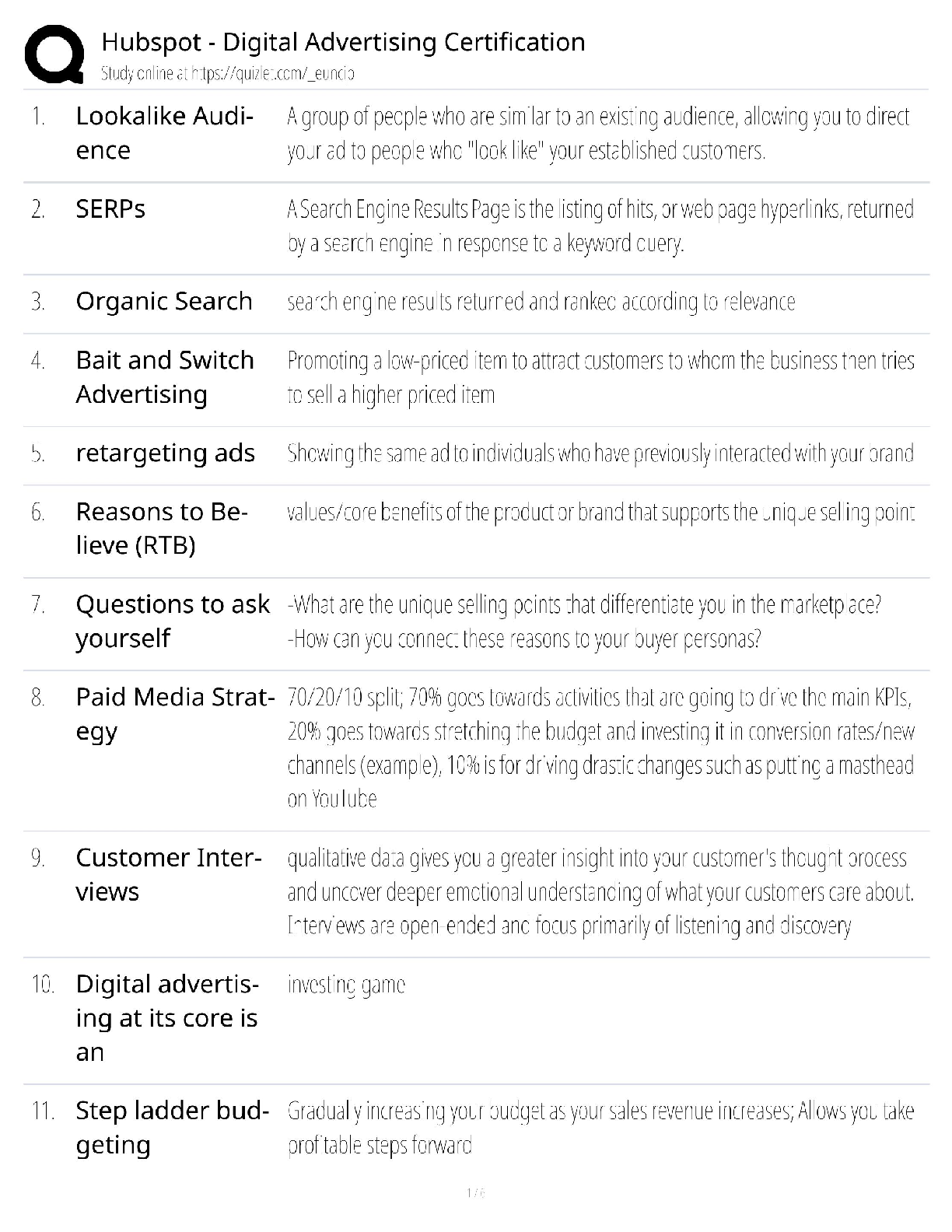

MATH399_Final_Exam_Review_Solutions 2021 Solution Guide.

$ 10

INSTRUCTOR’S SOLUTIONS MANUAL CALCULUS EARLY TRANSCENDENTALS William Briggs

$ 11

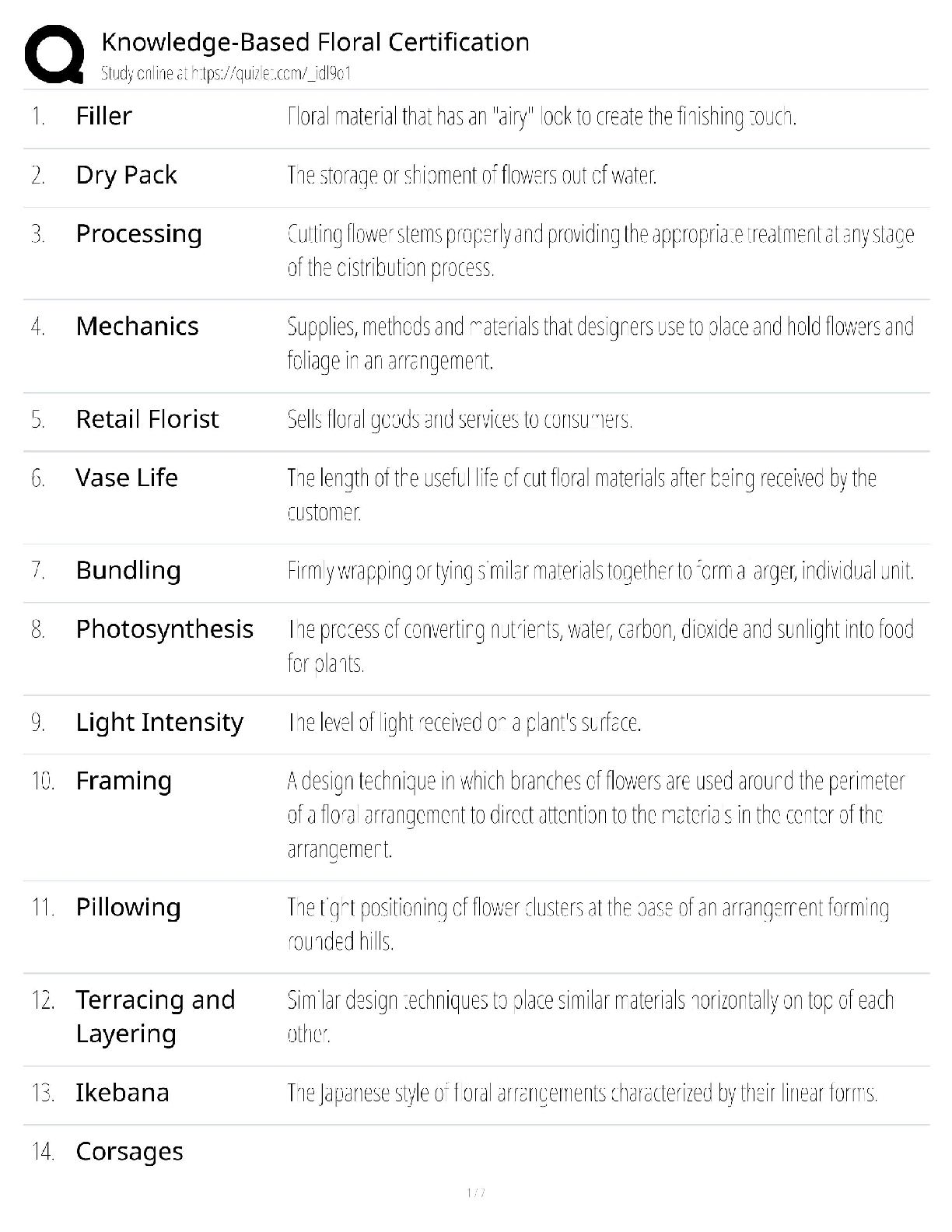

CTS CIS 4617 Evolve nivel III Questions and Answers

$ 15

eBook [PDF] Alfredian Prologues and Epilogues 1st Edition By Susan Irvine

Answered 2023.png)