Accounting > QUESTIONS & ANSWERS > AC210 Spring 2015 Final Exam Version A University of Alabama AC 210 (All)

AC210 Spring 2015 Final Exam Version A University of Alabama AC 210

Document Content and Description Below

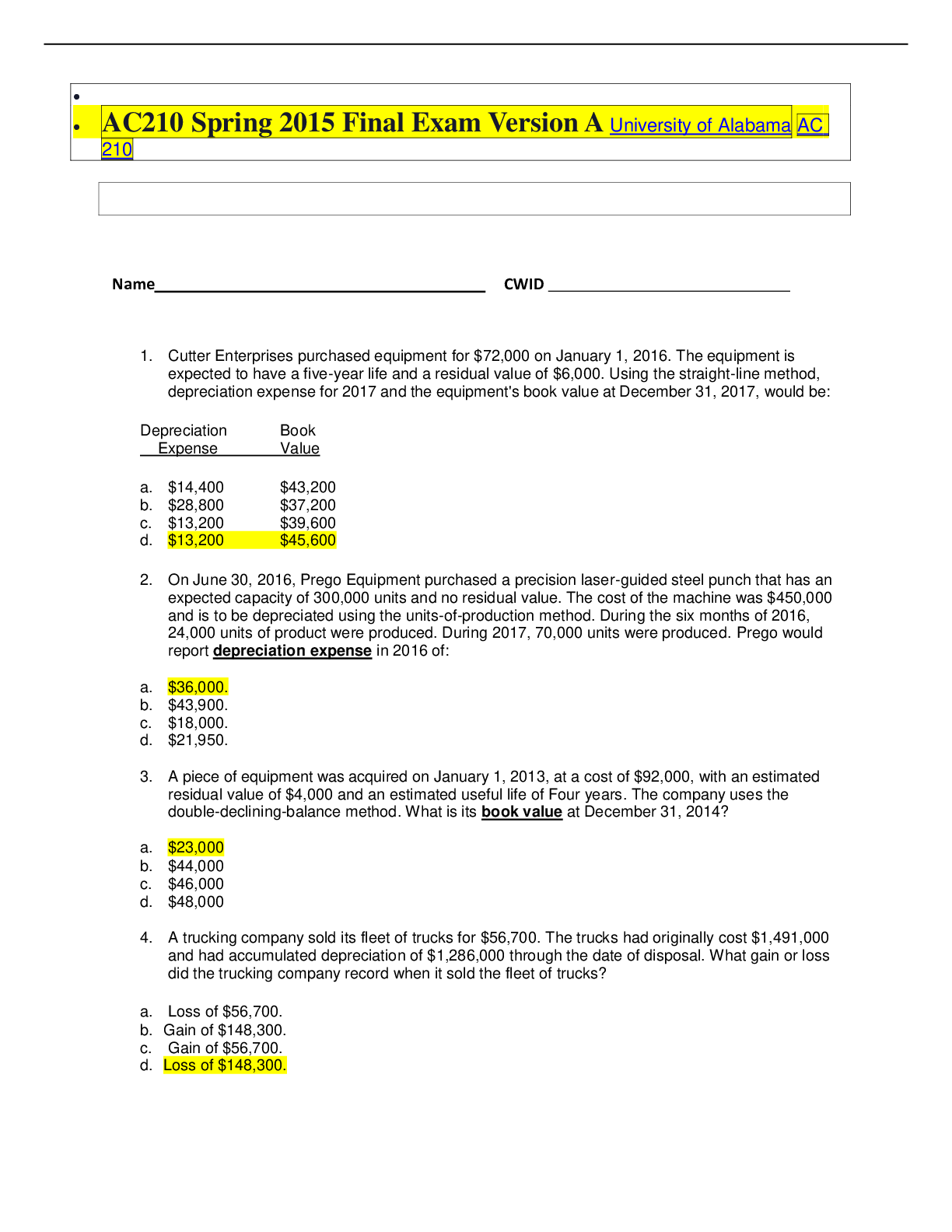

1. Cutter Enterprises purchased equipment for $72,000 on January 1, 2016. The equipment is expected to have a five-year life and a residual value of $6,000. Using the straight-line method, depreciat ... ion expense for 2017 and the equipment's book value at December 31, 2017, would be: Depreciation Book Expense Value a. $14,400 $43,200 b. $28,800 $37,200 c. $13,200 $39,600 d. $13,200 $45,600 2. On June 30, 2016, Prego Equipment purchased a precision laser-guided steel punch that has an expected capacity of 300,000 units and no residual value. The cost of the machine was $450,000 and is to be depreciated using the units-of-production method. During the six months of 2016, 24,000 units of product were produced. During 2017, 70,000 units were produced. Prego would report depreciation expense in 2016 of: a. $36,000. b. $43,900. c. $18,000. d. $21,950. 3. A piece of equipment was acquired on January 1, 2013, at a cost of $92,000, with an estimated residual value of $4,000 and an estimated useful life of Four years. The company uses the double-declining-balance method. What is its book value at December 31, 2014? a. $23,000 b. $44,000 c. $46,000 d. $48,000 4. A trucking company sold its fleet of trucks for $56,700. The trucks had originally cost $1,491,000 and had accumulated depreciation of $1,286,000 through the date of disposal. What gain or loss did the trucking company record when it sold the fleet of trucks? a. Loss of $56,700. b. Gain of $148,300. c. Gain of $56,700. d. Loss of $148,300. [Show More]

Last updated: 3 years ago

Preview 1 out of 7 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$6.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Dec 16, 2022

Number of pages

7

Written in

All

Additional information

This document has been written for:

Uploaded

Dec 16, 2022

Downloads

0

Views

150

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)