Business > AQA QUESTION and MARK SCHEMES > MID-TERM EXAMINATION Business Taxation 2 nd Semester (All)

MID-TERM EXAMINATION Business Taxation 2 nd Semester

Document Content and Description Below

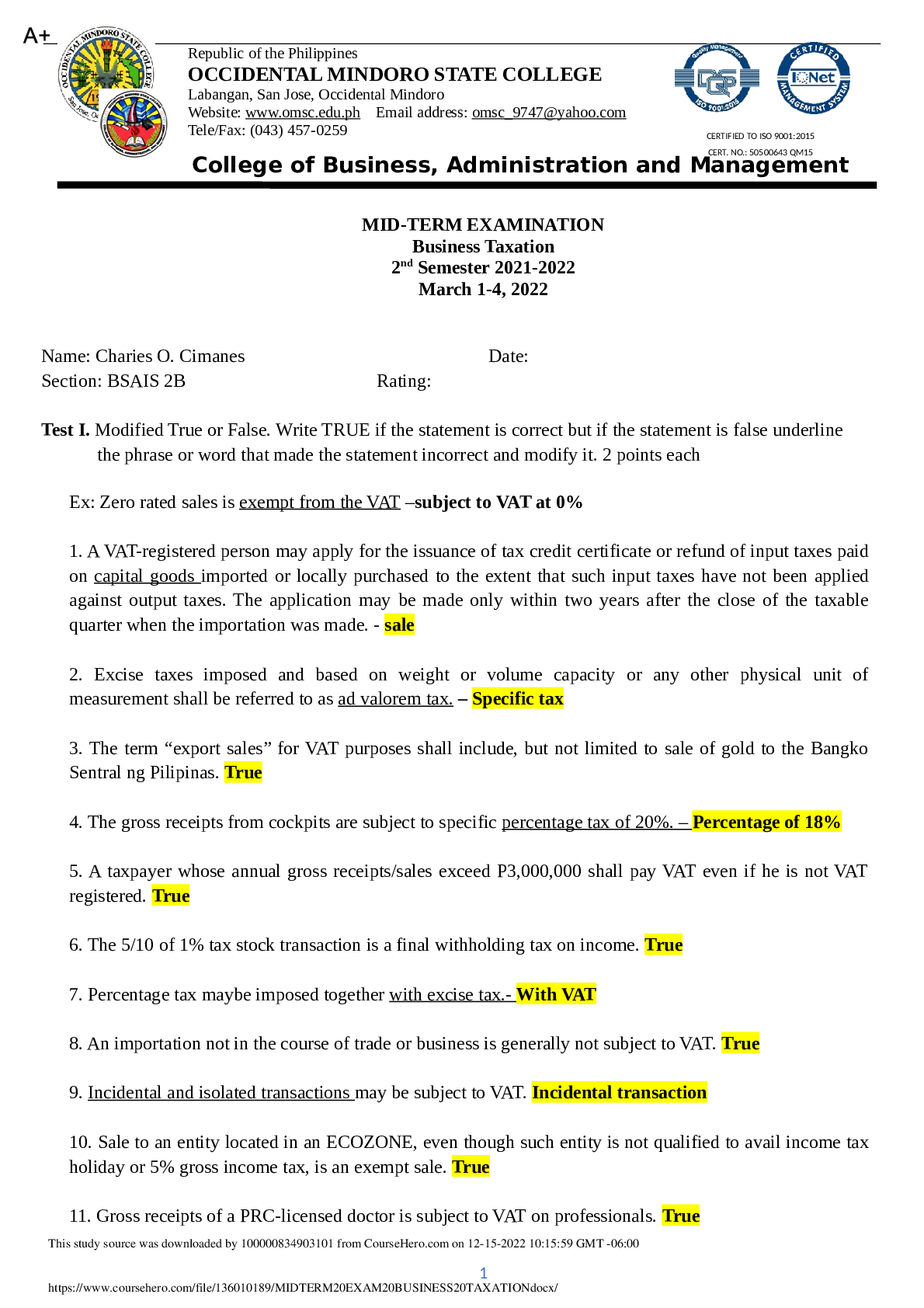

Test I. Modified True or False. Write TRUE if the statement is correct but if the statement is false underline the phrase or word that made the statement incorrect and modify it. 2 points each Ex: Z ... ero rated sales is exempt from the VAT –subject to VAT at 0% 1. A VAT-registered person may apply for the issuance of tax credit certificate or refund of input taxes paid on capital goods imported or locally purchased to the extent that such input taxes have not been applied against output taxes. The application may be made only within two years after the close of the taxable quarter when the importation was made. - sale 2. Excise taxes imposed and based on weight or volume capacity or any other physical unit of measurement shall be referred to as ad valorem tax. – Specific tax 3. The term “export sales” for VAT purposes shall include, but not limited to sale of gold to the Bangko Sentral ng Pilipinas. True 4. The gross receipts from cockpits are subject to specific percentage tax of 20%. – Percentage of 18% 5. A taxpayer whose annual gross receipts/sales exceed P3,000,000 shall pay VAT even if he is not VAT registered. True 6. The 5/10 of 1% tax stock transaction is a final withholding tax on income. True 7. Percentage tax maybe imposed together with excise tax.- With VAT 8. An importation not in the course of trade or business is generally not subject to VAT. True 9. Incidental and isolated transactions may be subject to VAT. Incidental transaction 10. Sale to an entity located in an ECOZONE, even though such entity is not qualified to avail income tax holiday or 5% gross income tax, is an exempt sale. True 11. Gross receipts of a PRC-licensed doctor is subject to VAT on professionals. True 1 CERT. NO.: 50500643 QM15 CERTIFIED TO ISO 9001:2015 This study source was downloaded by 100000834903101 from CourseHero.com on 12-15-2022 10:15:59 GMT -06:00 https://www.coursehero.com/file/136010189/MIDTERM20EXAM20BUSINESS20TAXATIONdocx/ A+ 12. ECOZONEs are not separate customs territory by fiction of law. ECOZONEs are separate 13. Sale of bagasse is subject to 12% Output VAT. 14. Sale of power or fuel generated thru renewable sources of energy is subject to Percentage Tax. True 15. Insurance commissions in a life and non-life insurance policy are subject to VAT. True Test II. Situational Problem Solving. Choose the correct answers for each question. For items 1 to 3, refer to the following information: Namjoon is engaged in the manufacture and sale of butter pancakes. Namjoon purchased P2,500,000 worth of raw materials, VAT-exclusive, from VAT-registered local suppliers. During the taxable year 2021, it was able to generate export sales of P2,000,000, and domestic sales of P2,500,000 for its pancakes. 1. Is Namjoon required to be a VAT-registered taxpayer? a. Yes, because his sales breached the P3,000,000 threshold. b. Yes, because his VAT-subject sales breached the P3,000,000 threshold. c. No, because his sales have not breached the P3,000,000 threshold. d. No, because an exporter need not be a VAT-registered taxpayer. 2. Assuming Namjoon is not required to be a VAT-registered taxpayer and remains to be a non-vat registered taxpayer, which of the following statements is true? I. Namjoon is liable of percentage tax under Section 116 (3%, temporarily 1% under CREATE Act) II. Namjoon is liable to pay value-added taxes. III. Namjoon cannot claim input tax credit from his purchases. a. I and III only b. II and III only c. I and II only d. I, II, and III 3. Assuming Namjoon is required to be a VAT-registered taxpayer and remains to be a non-vat registered taxpayer, which of the following statements is true? I. Namjoon is liable of percentage tax under Section 116 (3%, temporarily 1% under CREATE Act) II. Namjoon is liable to pay value-added taxes III. Namjoon cannot claim input tax credit from his purchases. a. I and III only b. II and III only c. I and II only d. I, II, and III Rafael is the sole proprietor of a VAT-registered t-shirt printing business. During the taxable month of September 2018, he made the following transactions: 2 This study source was downloaded by 100000834903101 from CourseHero.com on 12-15-2022 10:15:59 GMT -06:00 https://www.coursehero.com/file/136010189/MIDTERM20EXAM20BUSINESS20TAXATIONdocx/ A+ Transactions Value Importation of clothing for personal use P 189,000 Importation of clothing to be resold in business 1,240,000 Importation of printers 975,000 Domestic purchase of t-shirt ink 880,000 Payment for maintenance services rendered for business 358,000 Total P 3,642,000 4. How much is the input VAT? a. 265,800 c. 414,360 b. 371,400 d. 437,040 5. Which of the follow [Show More]

Last updated: 3 years ago

Preview 1 out of 6 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$6.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Dec 16, 2022

Number of pages

6

Written in

All

Additional information

This document has been written for:

Uploaded

Dec 16, 2022

Downloads

0

Views

122