D196 Study Guide Questions and

Answers Rated A

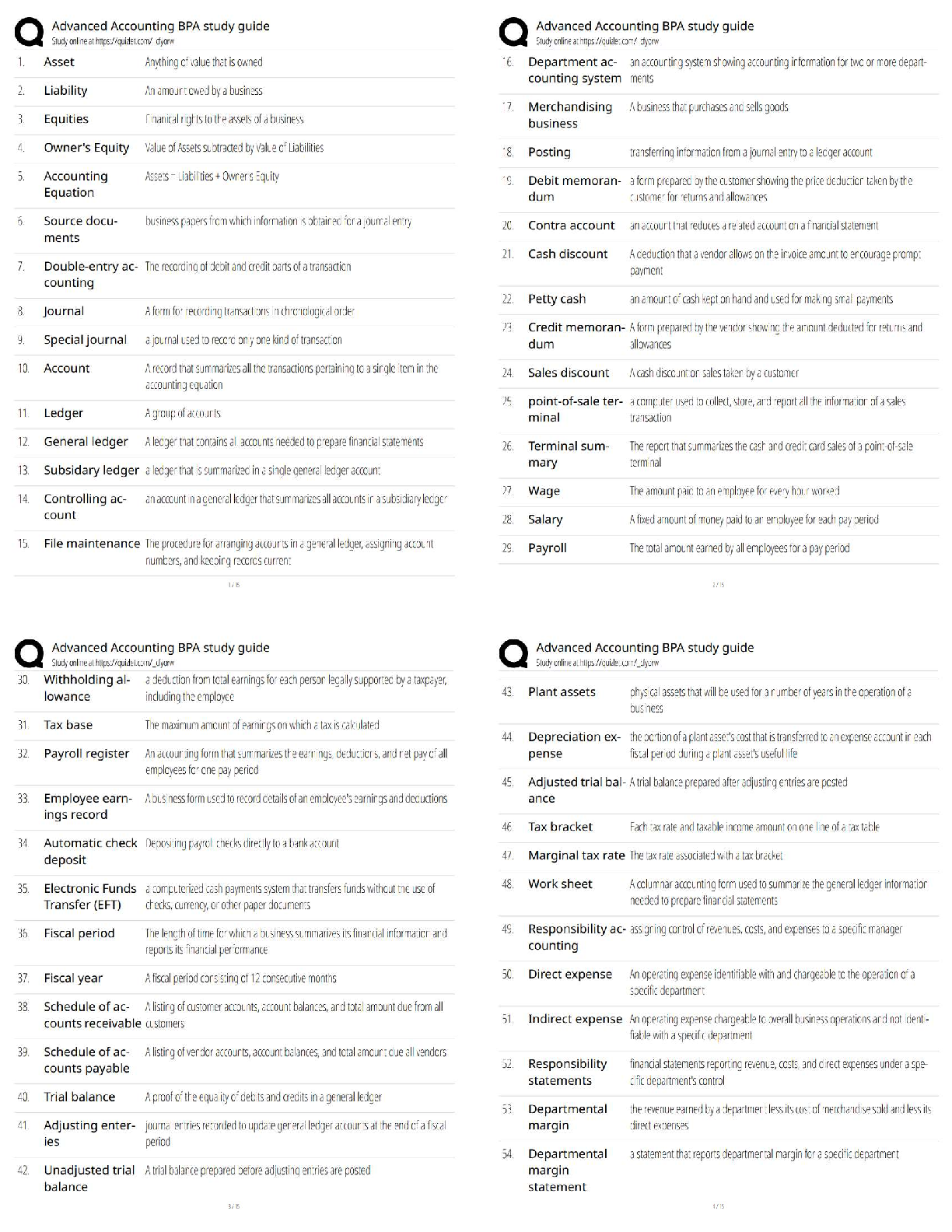

What is the role and purpose of accounting? ✔✔Accounting is used to accumulate, measure, and

communicate financial information about organizations. This information is us

...

D196 Study Guide Questions and

Answers Rated A

What is the role and purpose of accounting? ✔✔Accounting is used to accumulate, measure, and

communicate financial information about organizations. This information is used to make

informed decisions regarding resource usage and allocation.

Who uses accounting information and why? ✔✔Managerial Accounting: Internal decision

making (managers, CEO's, supervisors, etc.)

Financial Accounting: External user benefit (stakeholders, investors, tax authorities, etc.)

What are important influences on Accounting? ✔✔Development of GAAP by FASB in the U.S.

and by the IASB worldwide. International business considerations, ethical considerations.

What is the role of ethics in Accounting? ✔✔Accountants are seen by the public as ensuring that

misrepresentation of financial information does not occur.

What is the PCAOB and what does it do? ✔✔PCAOB is the Public Company Accounting

Oversight Board, and they oversee audits of public companies. Created by the SEC after passage

of the Sarbanes Oxley Act of 2002 to restore public confidence.

Explain the accounting cycle. ✔✔1. Analyze transactions

2. Record effects of transactions

3. Summarize effects of transactions

3a. Post journal entries

3b. Prepare trial balance

4. Prepare financial reports

4a. Adjust journal entries

4b. Prepare financial statements

4c. Close books

What is the basic accounting equation? ✔✔Assets (resources, cash, equipment)

=

Liabilities (method of financing req. repayment)

+

Owner's Equity (method of financing NOT req. repayment)

What is the expanded accounting equation? ✔✔Assets = Liabilities + Capital Stock + Revenues

- Expenses - Dividends

What are the four financial statements covered? ✔✔1. The Balance Sheet

2. The Income Statement

3. The Statement of Retained Earnings

4. The Statement of Cash Flows

What is the purpose of the balance sheet? ✔✔To report the financial position of an entity at any

point in time.

What components make up the balance sheet? ✔✔Assets (resources), Liabilities (obligations),

and Owners Equity

What is the purpose of the income statement? ✔✔To show the Revenue, Expenses and Net Profit

for the period for an entity. **Also provides info re: long term profitability.

What components make up the income statement? ✔✔Revenues, Expenses, and Net Income

(loss)

What is the purpose of the Statement of Retained Earnings? ✔✔Displays the changes in retained

earnings from one accounting period to another. **Also links the balance sheet and the income

statement together.

What components make up the Statement of Retained Earnings

? ✔✔Previous retained earnings, plus net income for the year, minus dividends paid = retained

earnings now.

What is the purpose of the Statement of Cash Flows? ✔✔Shows the cash inflows (receipts) and

cash outflows (payments) of an entity during a period of time.

How are cash flow items classified (statement of cash flows)? ✔✔Cash flow items are placed

into one of three categories

1. Operating

Selling goods/services

Paying wages/utilities/taxes

2. Investing

Selling Buildings/Land

Purchasing Buildings/Land

3. Financing

Borrowing Money

Repaying Loans/Distributions to owners

What are the four categories of notes included in financial statements? ✔✔1. Summary of

significant accounting policies

2. Additional info re: summary totals found in statements

3. Disclosure of info not recognized in statements

4. Supplemental info required by FASB or SEC

What are common-size financial statements? ✔✔Common-size statements display items as a

percentage of a common base figure.

How are common-size financial statements used? ✔✔These statements are commonly used for

easy analysis between different companies or of the same company period to period.

What is horizontal analysis and what information does it provide? ✔✔H. A. compares a firms

results from year to year. It is used to note general trends or one-time events that may require

further investigation.

What is vertical analysis and what information does it provide? ✔✔V. A. compares companies in

the same industry at the same point in time.

What is the cash budgeting process? ✔✔To use past patterns of cash collection and cash

disbursement to create a forecast for expected future cash inflows and outflows.

Why is cash budgeting important to an entity? ✔✔Org is able to determine if it will have excess

cash for new initiatives or need to borrow additional cash to meet expense demands for the

upcoming periods.

ENTER CASH BUDGETING WORD PROBLEM HERE ✔✔

What is a master budget and why do we prepare one? ✔✔Master budget = blueprint for the

upcoming periods' operations.

Serves as a framework for changes in plans if the periods' events don't go as planned.

What is the master budgeting process for a manufacturing firm? ✔✔1. All budgets begins with

the sales budget or sales forecast.

2. Based on sales budget, a production budget is created (after deciding the level of finished

goods inventory and factoring in how much beginning inventory is on hand)

3. Direct Materials, Direct Labor, and Manufacturing Overhead budget are created from the

production budget.

4. Those budgets are combined with the selling & admin expense budget (which represents a

period rather than manufacturing costs) to determine the prelim. cash budget.

5. Once inflows and outflows are known, a budgeted income statement and balance sheet (called

pro-forma financial statements) are created.

What is the sales budget based on? ✔✔It is the expected # of items sold x price per item

Ex. 8400 Sweaters x $30.00 / sweater = $252,000 (Q1)

[Show More]

.png)

.png)

.png)