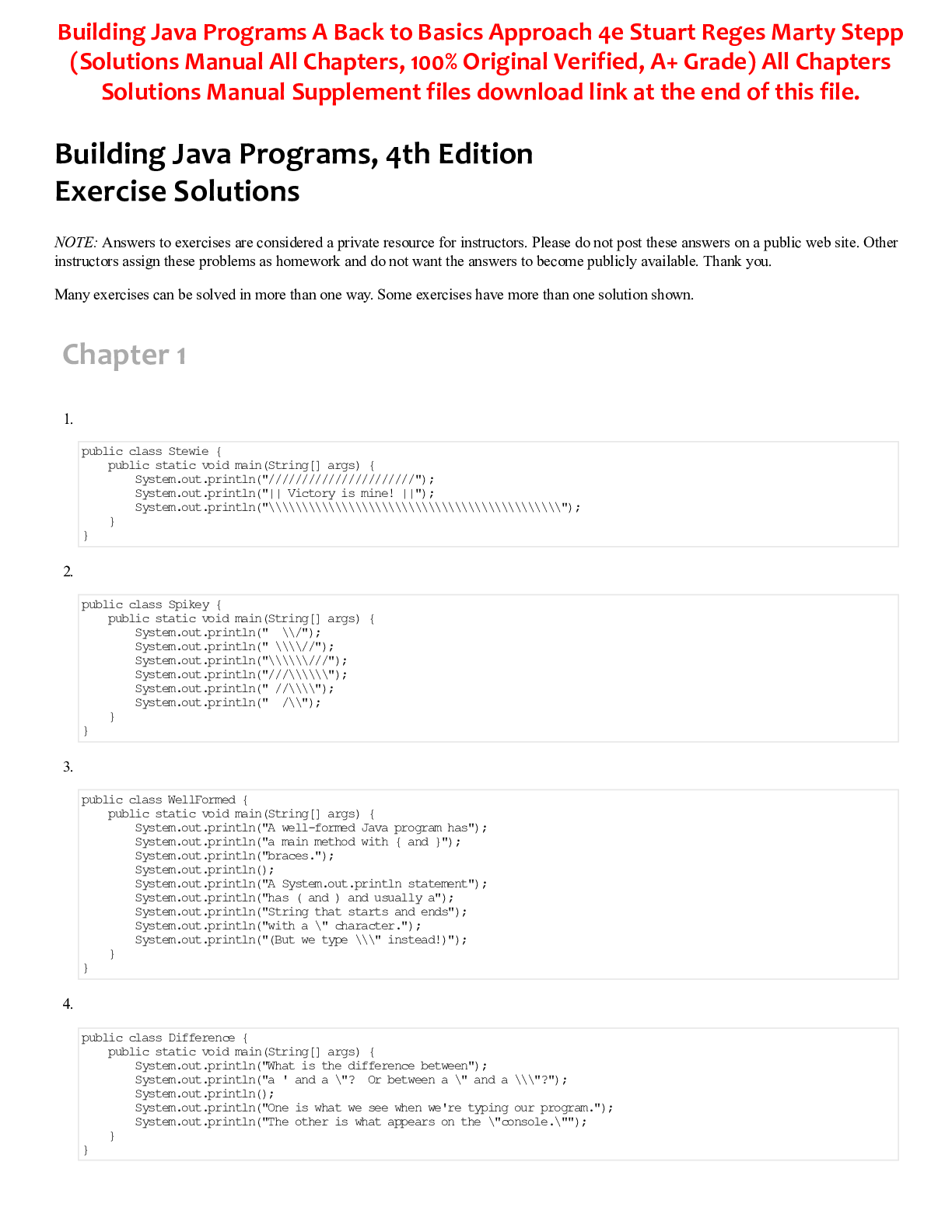

Solutions Manual For Building Java Programs A Back to Basics Approach 4th Edition By Stuart Reges Marty Stepp (All Chapters, 100% Original Verified, A+ Grade)

$ 25

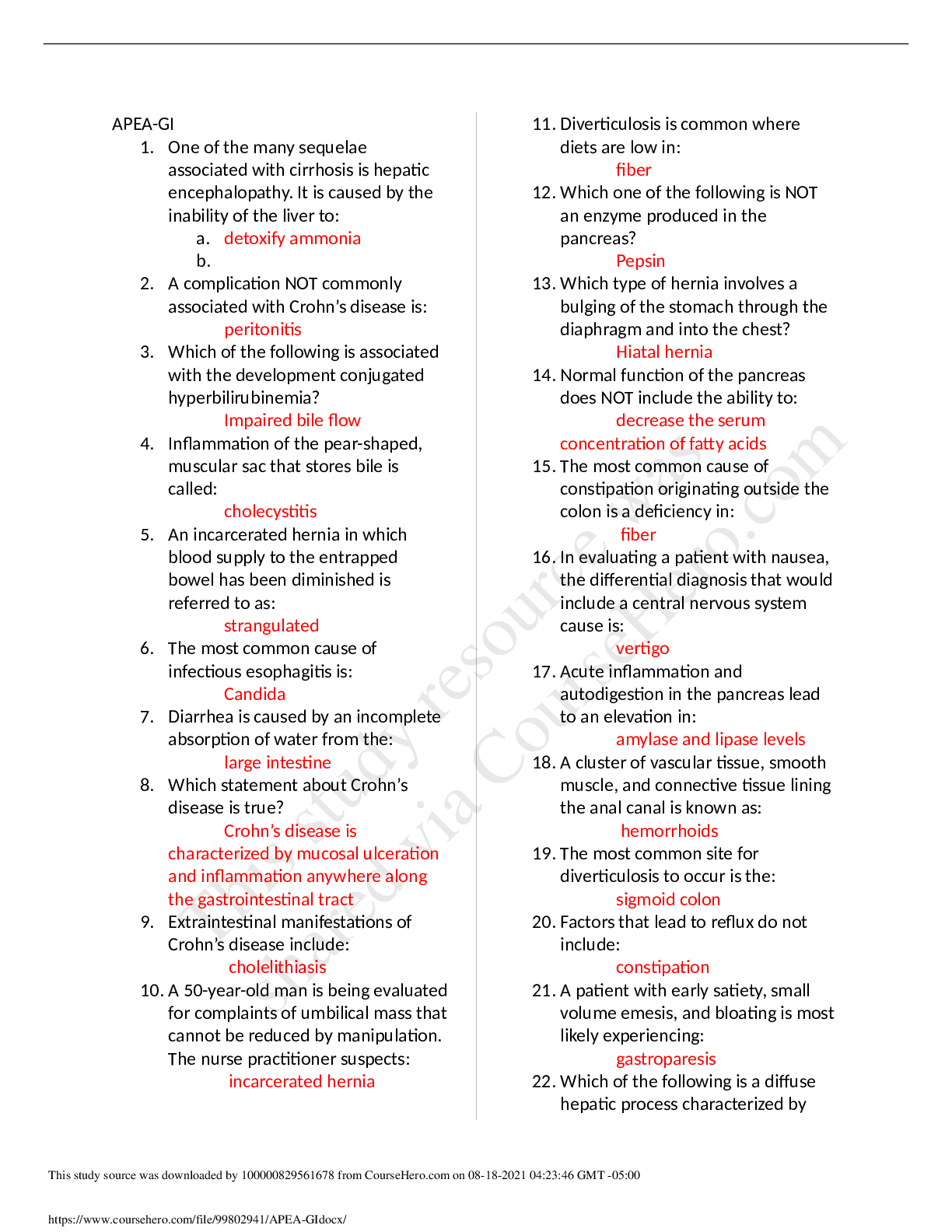

APEA-GI

$ 7

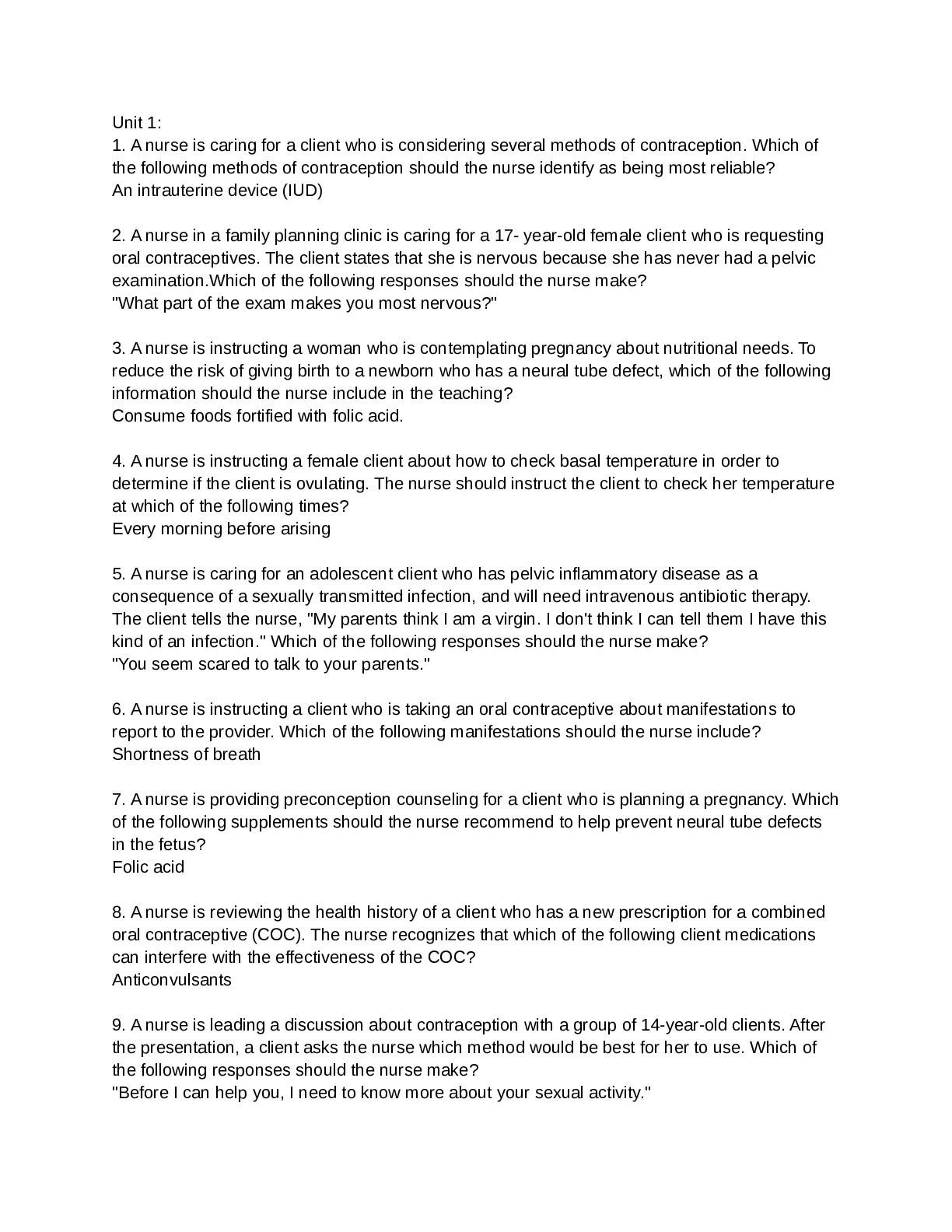

ATI PEDS FINAL EXAM STUDY GUIDE

$ 8

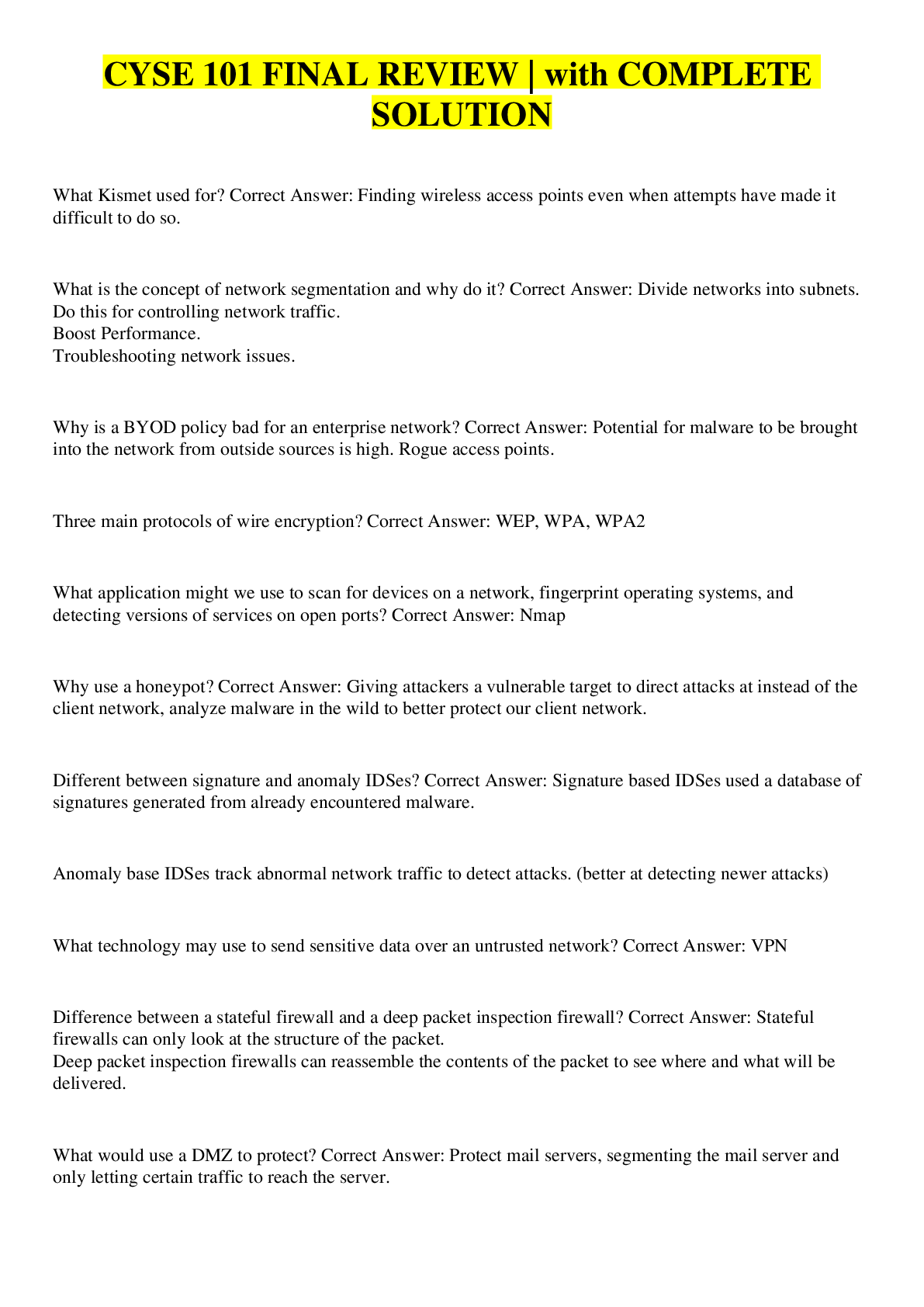

CYSE 101 FINAL REVIEW | with COMPLETE SOLUTION

$ 10

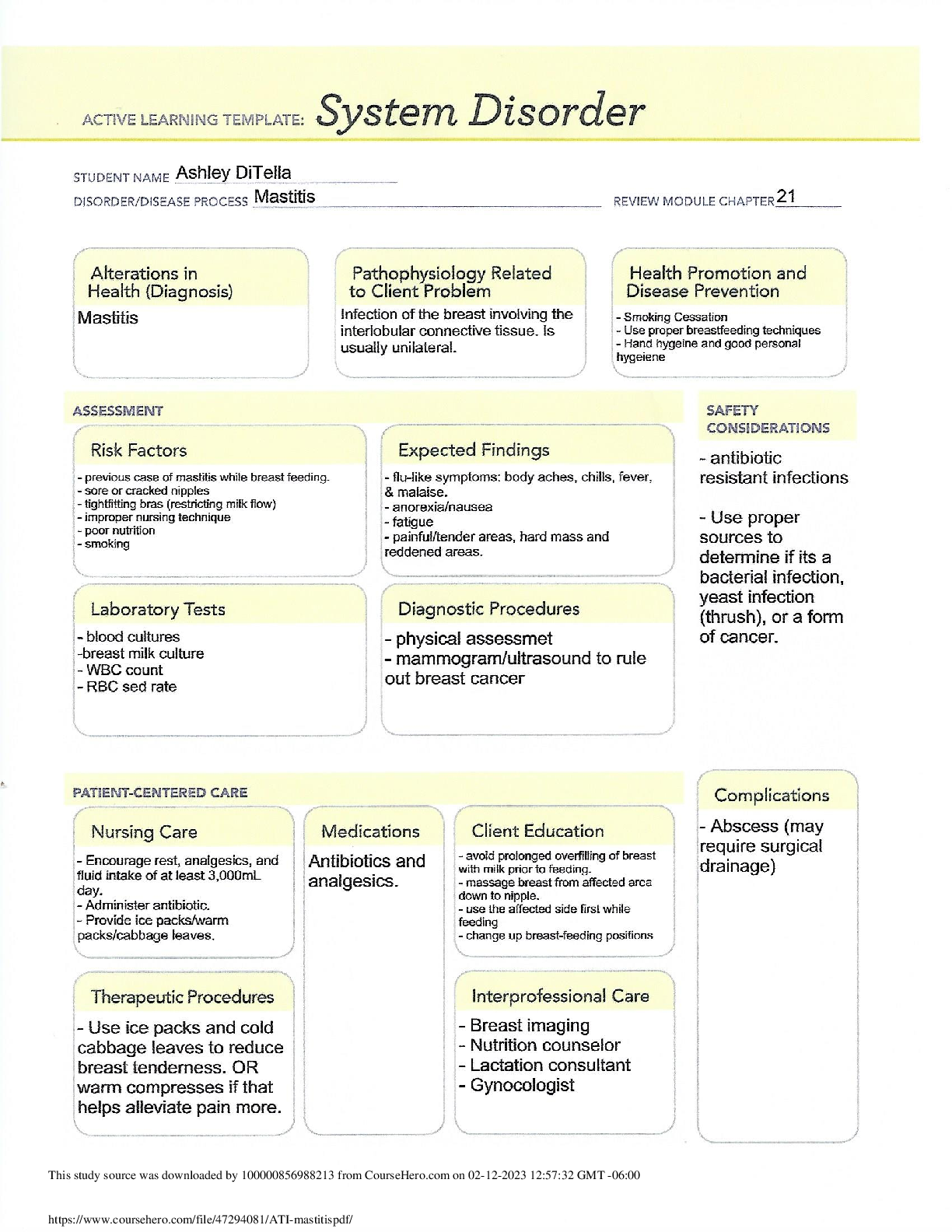

ATI_mastitis

$ 8.5

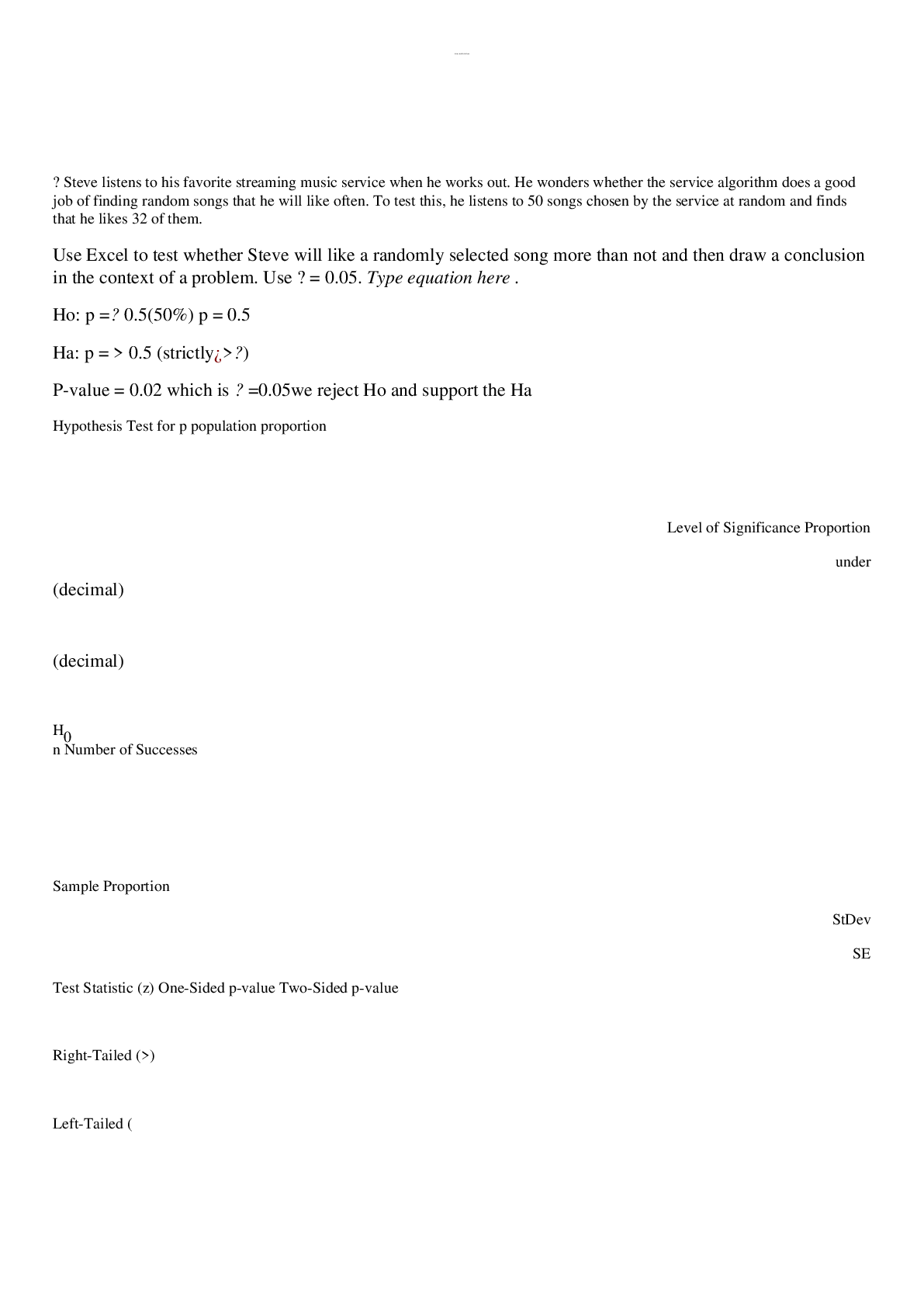

MATH 225N Week 7 Hypothesis Testing..RATED ASSIGNMENT!GOOD LUCK

$ 8

PDF(eBook) The Numerical Method of Lines and Duality Principles Applied to Models in Physics and Engineering,Fabio Silva Botelho,1e

$ 25

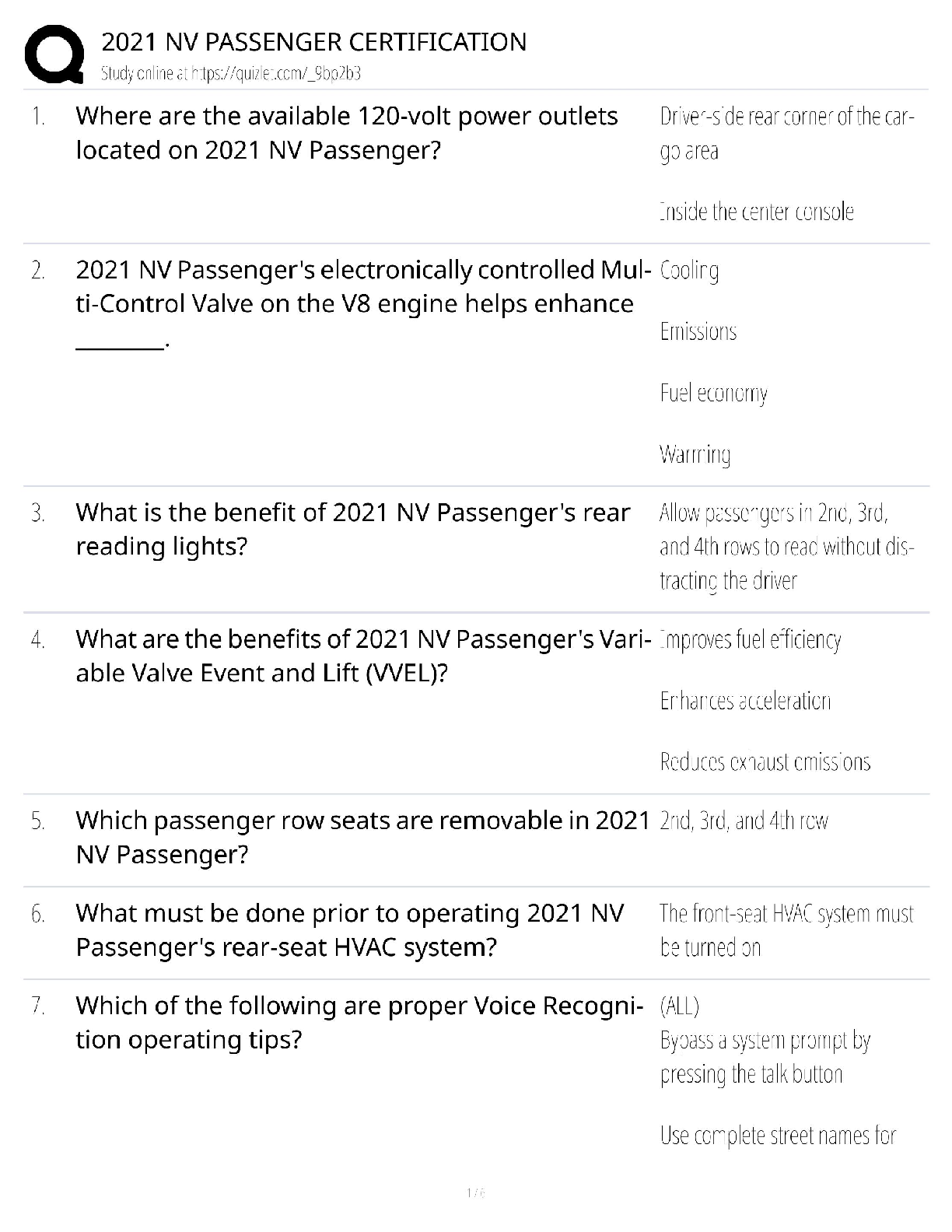

2021 NV Passenger Certification / Latest Study Guide / DMV Test Prep / Pass Guaranteed

$ 14.5

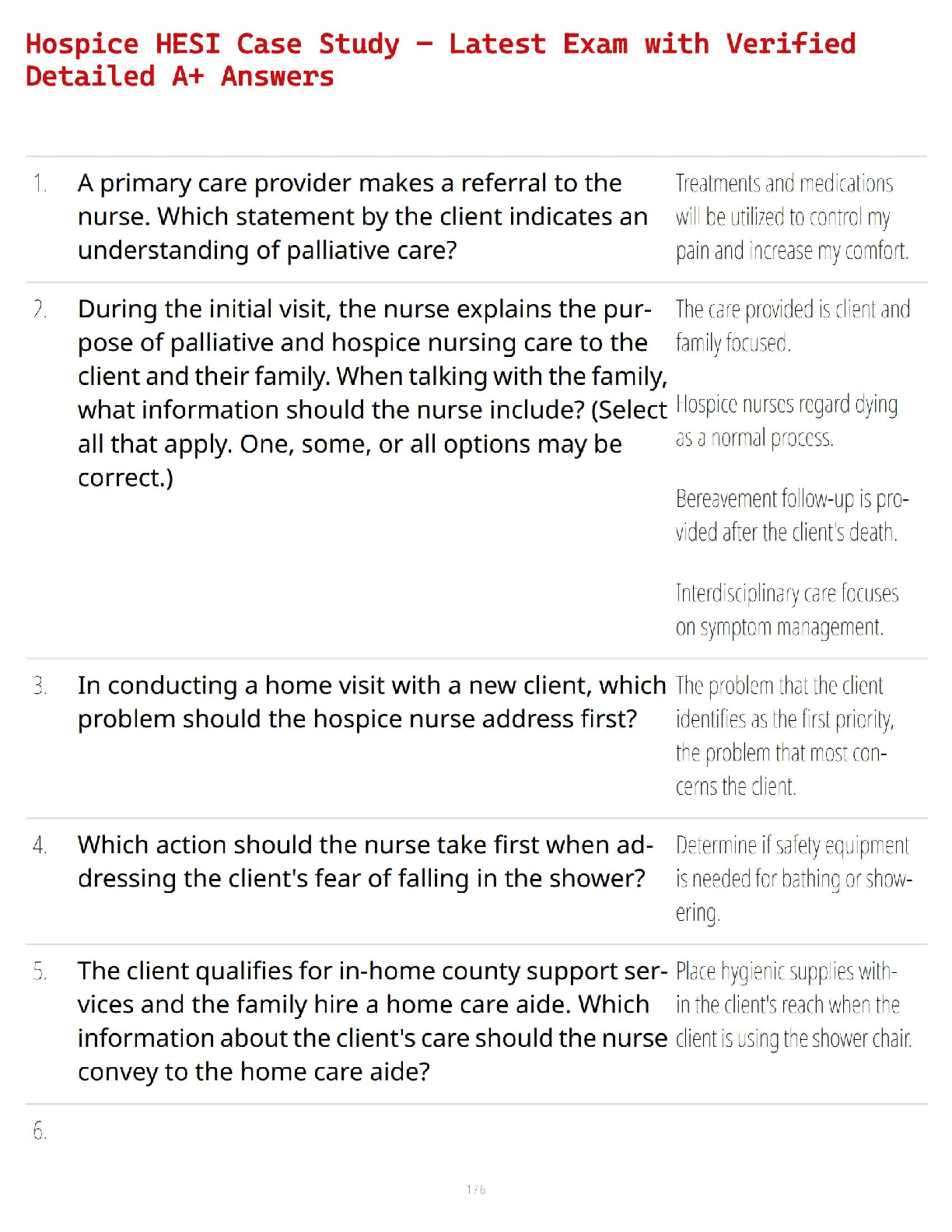

Hospice HESI Case Study – Latest Exam with Verified Detailed A+ Answers

$ 8

NURS 231Patho Portage Learning -[Graded A+ ] Questions And Answers-Portage Learning

$ 20

[eTextBook] [PDF] Source Separation in Physical-Chemical Sensing By Christian Jutten, Leonardo Tomazeli Duarte, Saïd Moussaoui

$ 25

NR 222 Week 5 Edapt

$ 30

NUR 3946L Finals Readiness Exam Q & S (UF) - (Individual Clinical Practice)

$ 12

TIME SERIES ANALYSIS

$ 8

.png)

PMK-EE for E-5 (Career Information)

$ 7

PSY 140 life span module 3- Portage Learning

$ 14.5

eBook Oncogenic Viruses (Volume 2) 1st Edition By Moulay Mustapha Ennaji

$ 30

eBook Climate Change Alleviation for Sustainable Progression 1st Edition By Moonisa Aslam Dervash , Akhlaq Amin Wani

$ 30

[eBook] [PDF] Managing Machine Learning Projects By Simon Thompson

$ 25

NURS 661 Test 4 Review 2022 with complete solution

$ 7

CBL 1 - Noisy Breathing

$ 14

Danny Rivera.Focused Exam_ Cough _ Subjective Data_ Shadow Health. Complete Solution

$ 16

NATE core Exam | 71 Exam Questions with 100% Correct Answers

$ 5

Test Bank for Management Information Systems 5th Edition by Baltzan

$ 20

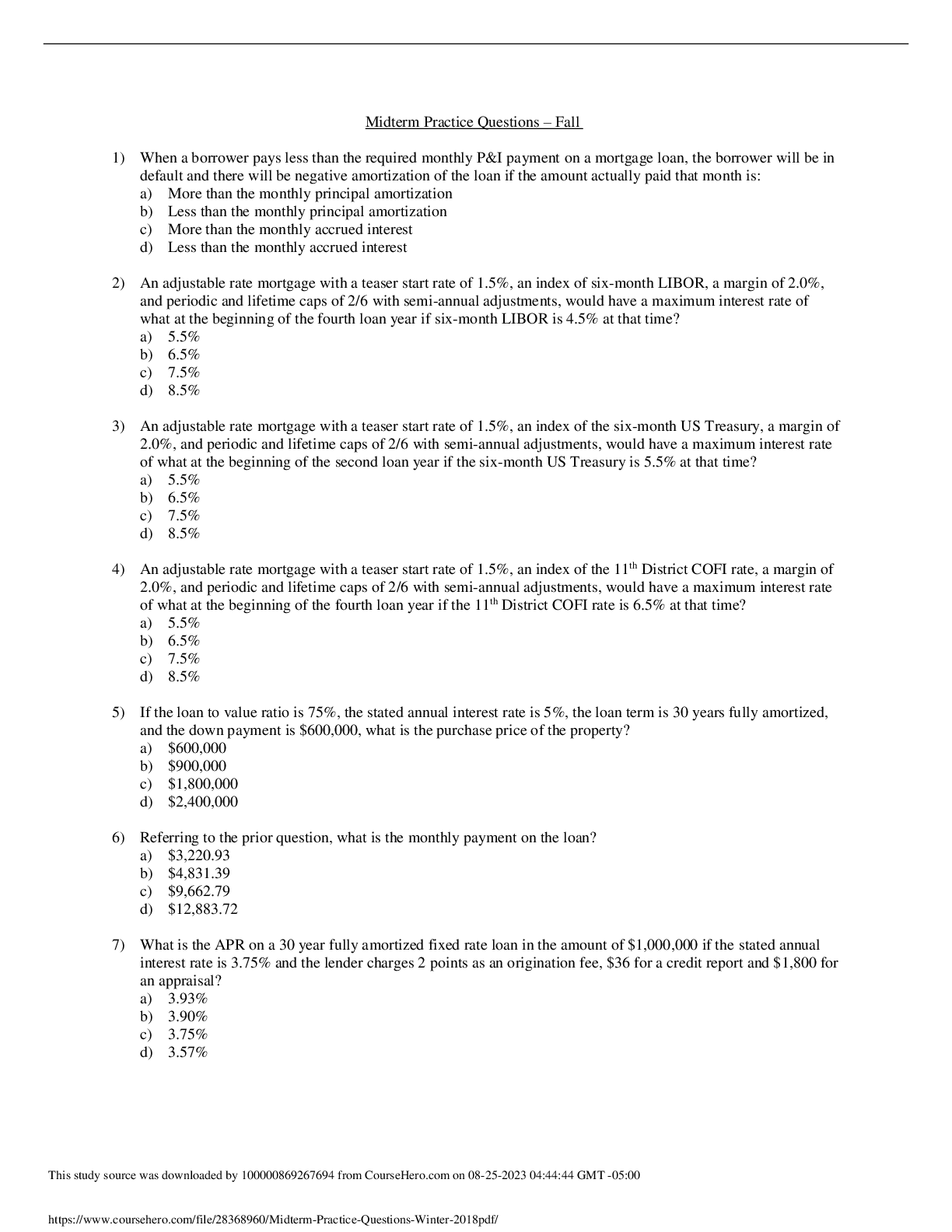

MGMT 180 Midterm Practice Questions Fall 2023

$ 13

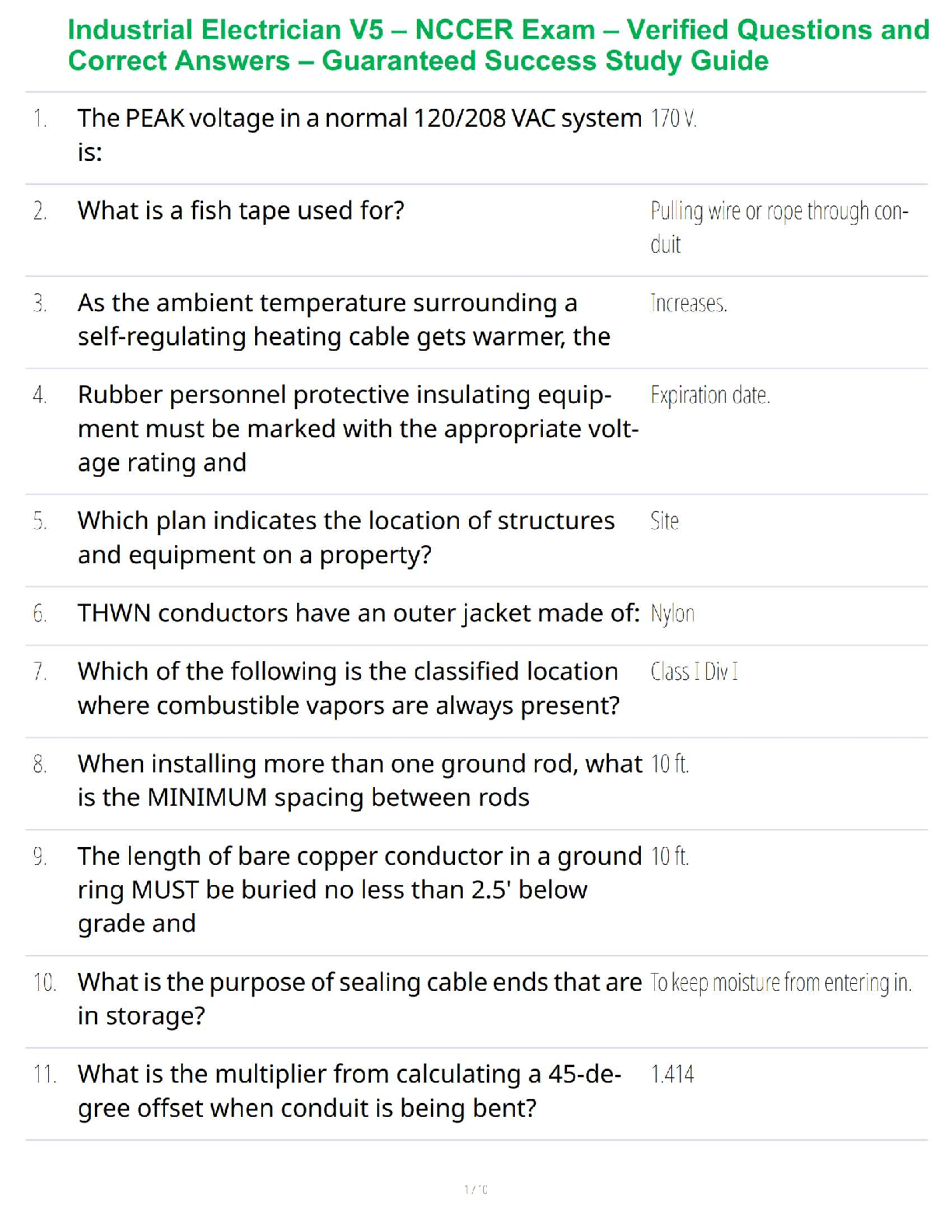

Industrial Electrician V5 – NCCER Exam – Verified Questions and Correct Answers – Guaranteed Success Study Guide

$ 8

Test Bank For Operations Management Processes and Supply Chains, 12th Edition By Krajewski, Malhotra, Ritzman

$ 20.5

NUR 635 Week 1 Discussion Question # 1/COMPLETE SOLUTION

$ 11

Capella UniversityPM FPX 5334_Assesment_2_1 Risk Management Plan Taylor Kitchen Remodel

$ 13

Gen 499 Critical Thinking Quiz

$ 5

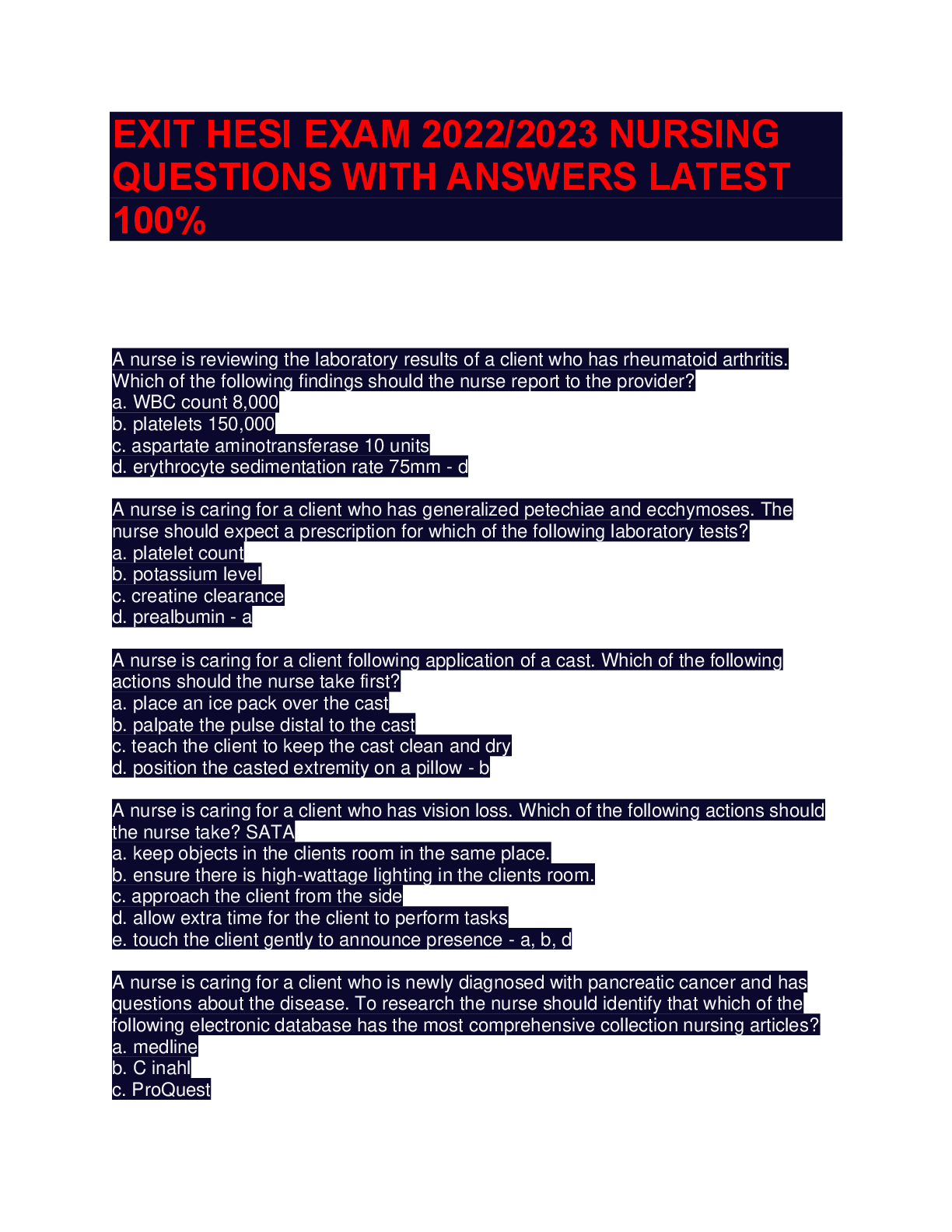

EXIT_HESI_EXAM_2022

$ 18

(EPUB) eBook Evolutionary Large-Scale Multi-Objective Optimization and Applications 1st Edition By Xingyi Zhang, Ran Cheng, Ye Tian, Yaochu Jin

$ 29

hesi_exit_v2_2022

$ 11

[eBook] [PDF] How Machine Learning is Innovating Today's World By Arindam Dey, Sukanta Nayak, Ranjan Kumar, Sachi Nandan Mohanty

$ 25

.png)

NUR 2063 Essentials of Pathophysiology Final Winter 2021

$ 14

EMT FINAL exam solution 2022 100% latest solution

$ 8.5

eBook [PDF] Electric and Hybrid Electric Vehicles By James Haslderman, Curt Ward

$ 30

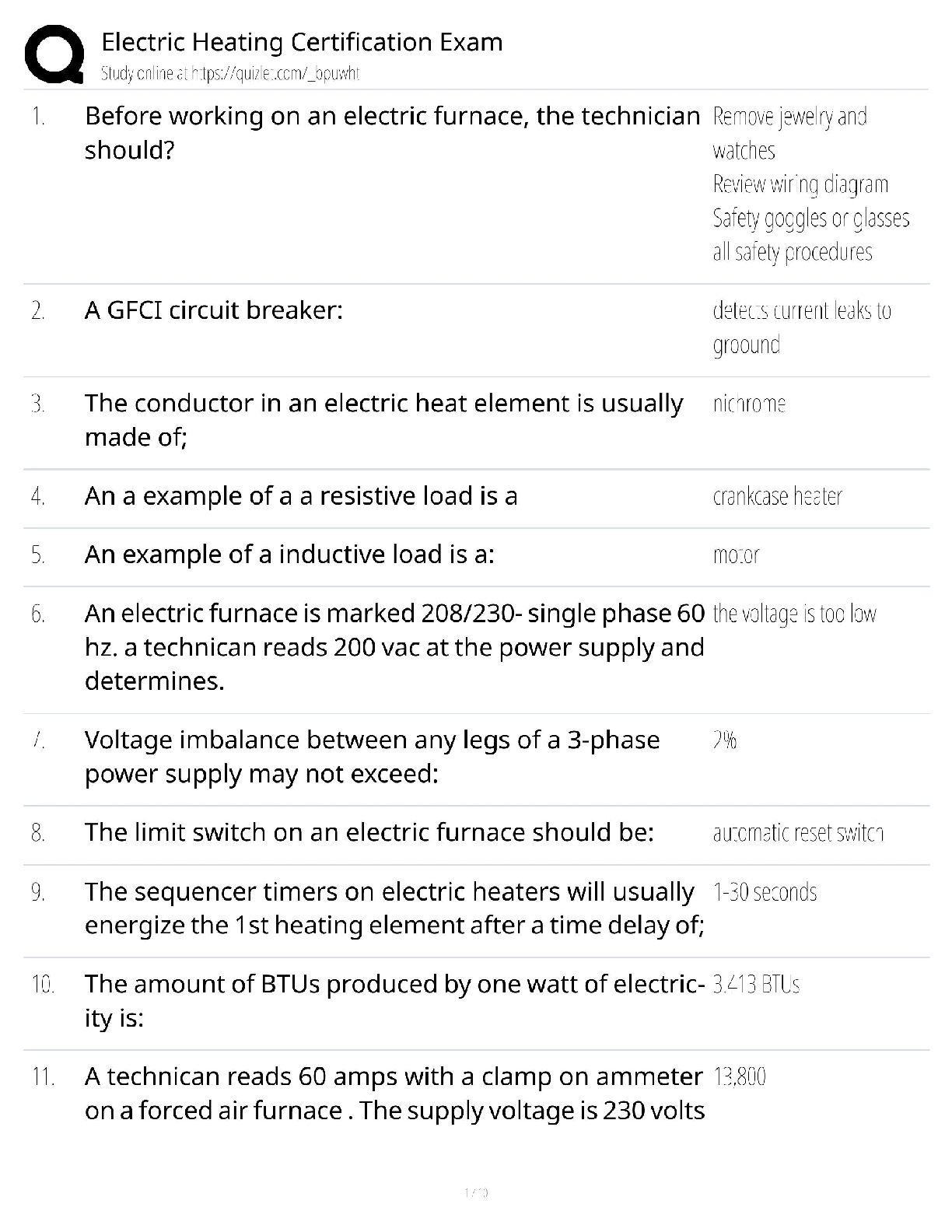

Electric Heating Certification Exam / Electrical Heating Systems / 2026 Update / Practice Test & Study Guide

$ 11.5

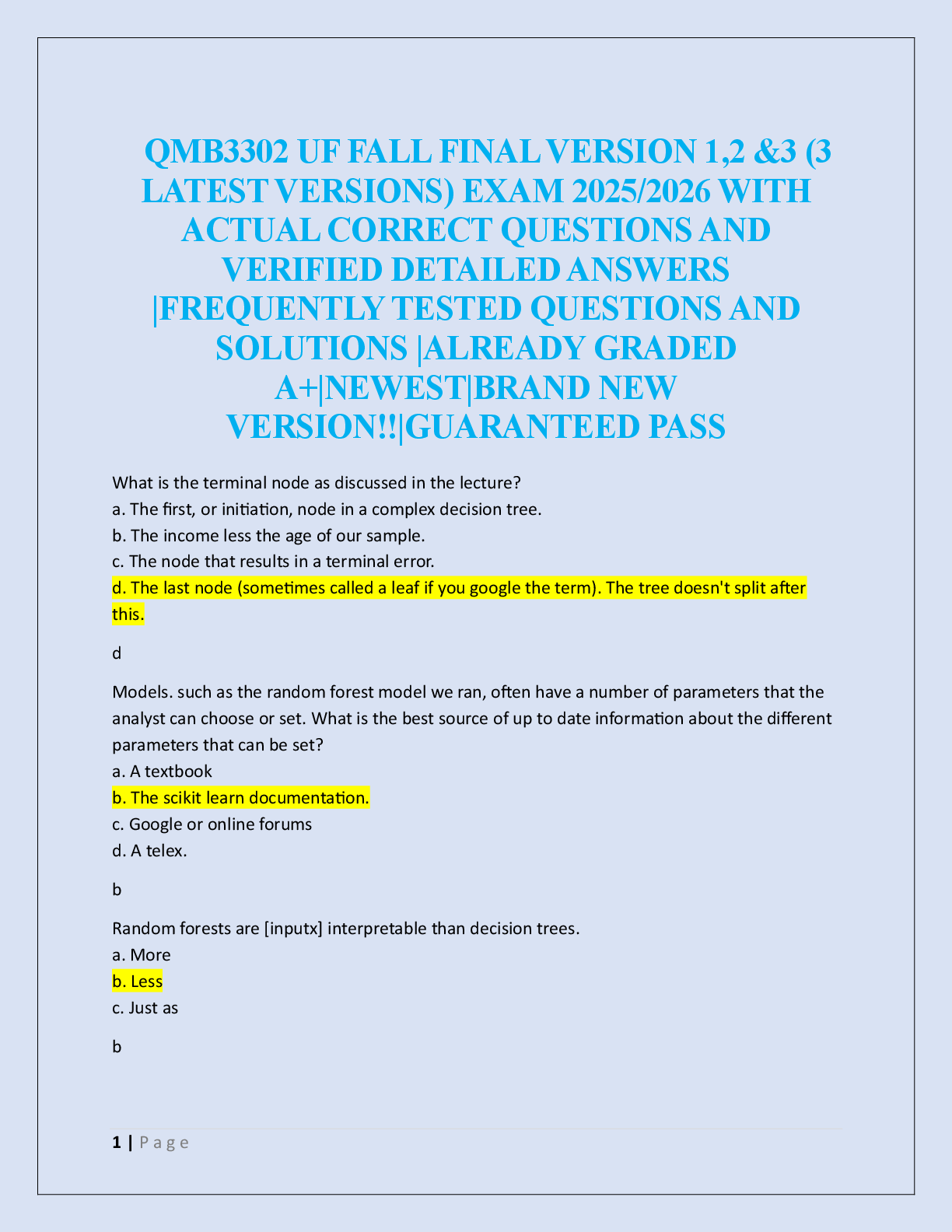

QMB3302 UF FALL FINAL VERSION 1,2 &3 (3 LATEST VERSIONS) EXAM

$ 23

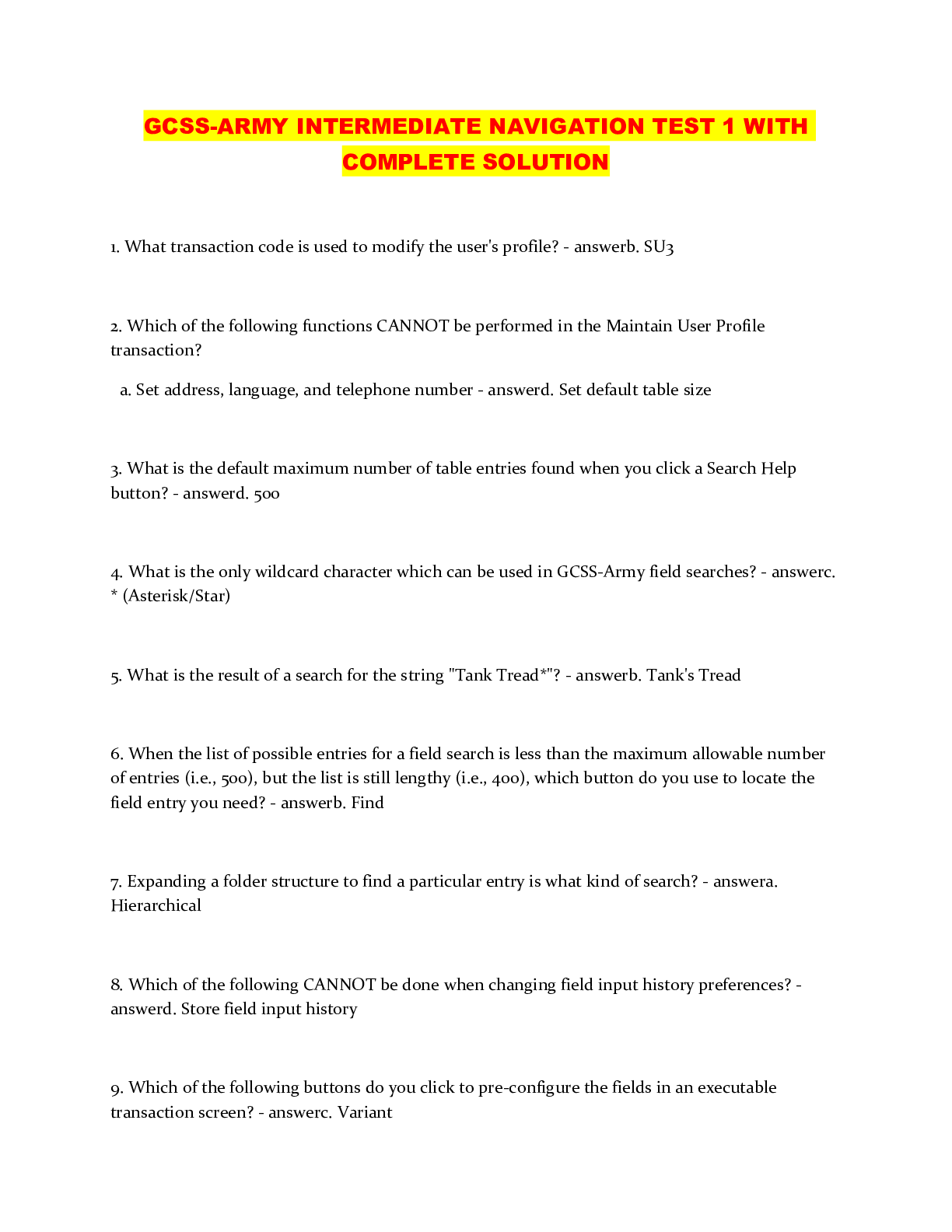

GCSS-ARMY INTERMEDIATE NAVIGATION TEST 1 WITH COMPLETE SOLUTION

$ 8

.png)

Complete solution manual for Database Systems Design Implementation and Management 12th Edition/Top Score

$ 11

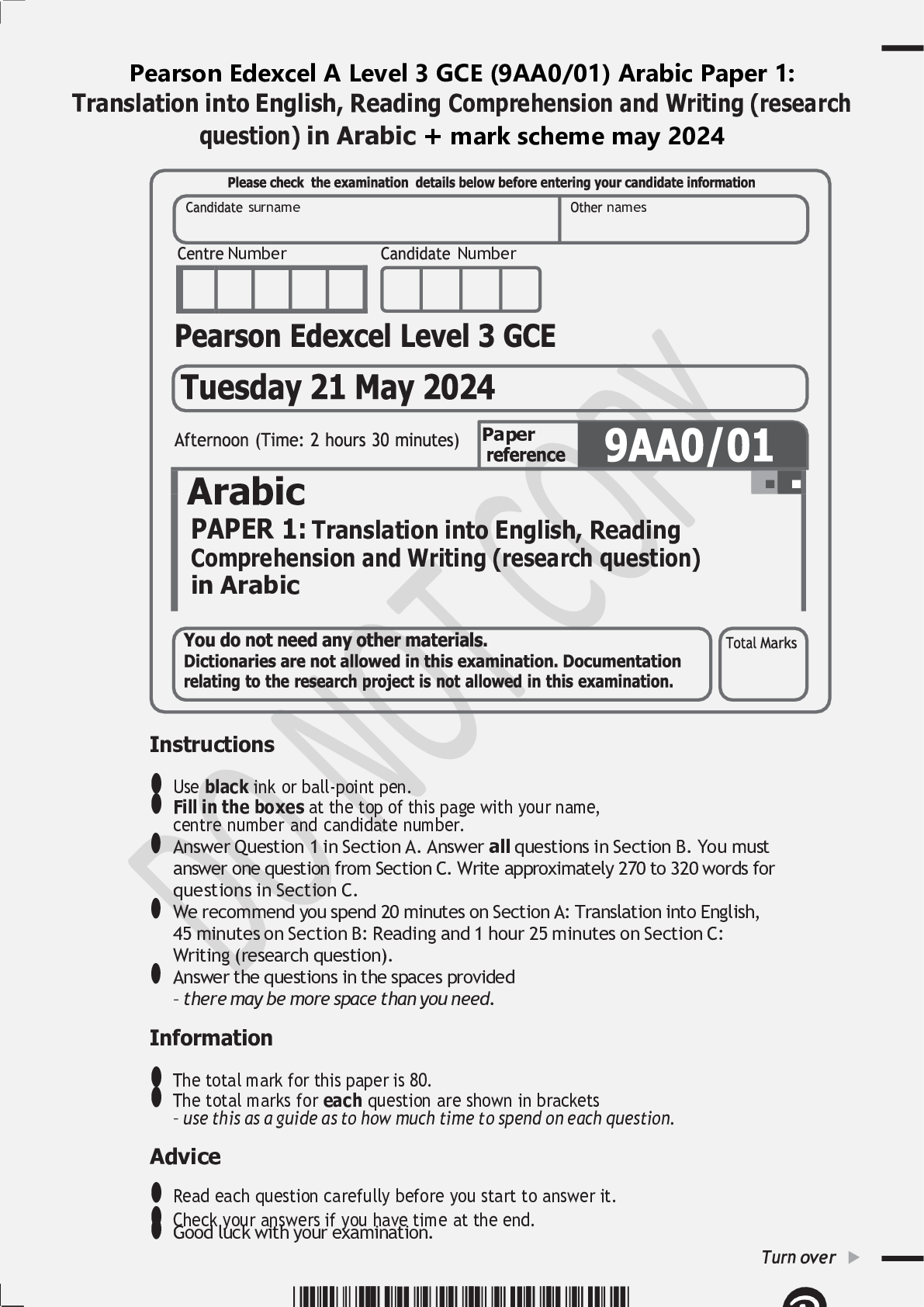

Pearson Edexcel A Level 3 GCE (9AA0/01) Arabic Paper 1 question paper + mark scheme 2024

$ 10

NETSUITE ERP CONSULTANT CERTIFICATION STDY GUIDE 2023 QUESTIONS WITH ANSWERS

$ 12

Stationary Engineer Exam - Questions and Answers (Complete Solutions)

$ 24

Instructor’s Solution Manual for INTRODUCTION TO REAL ANALYSIS

$ 17

.png)

ONCC Practice Tests (OCN - Treatment Modalities)

$ 7.5

.png)

CHAPTER 11 DECISION MAKING AND RELEVANT INFORMATION: answers

$ 6

Research Paper > Methodological recommendations for Summative Assessment “Physics” (advanced level) Grade 11

$ 6

BTEC Applied Science Unit One Biology 128 Questions with Answers,100% CORRECT

$ 11.5

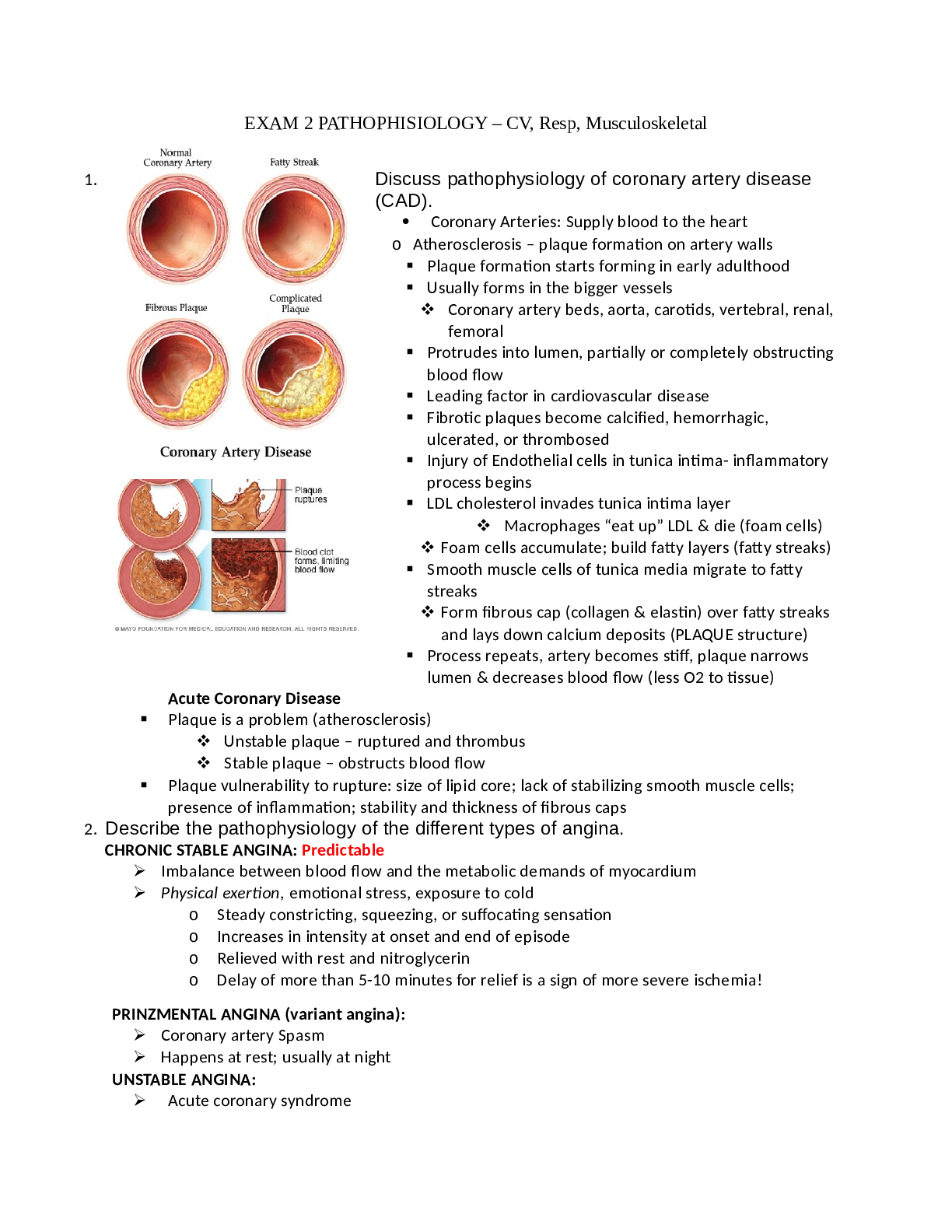

EXAM 2 PATHOPHISIOLOGY – CV, Resp, Musculoskeletal

$ 9

WGU C720 All Competencies Latest 2022 Already Passed

$ 15

Astronomy Assignment #8: CRATERING

$ 12.5

EXIT EXAM ATI 2023 Questions and Answers 100% Verified

$ 10

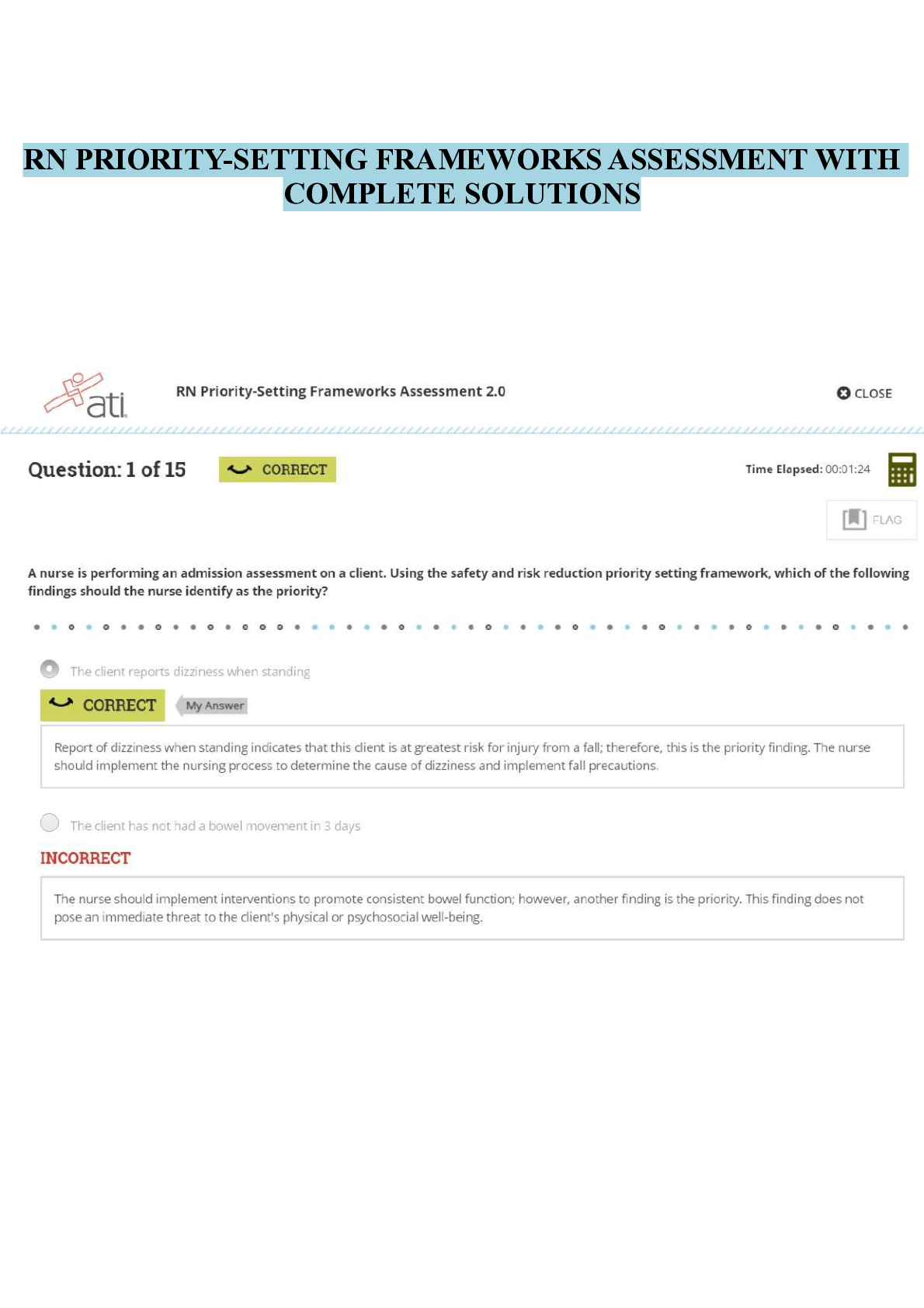

ATI RN Priority-Setting Frameworks Assessment With Complete Solutions

$ 18

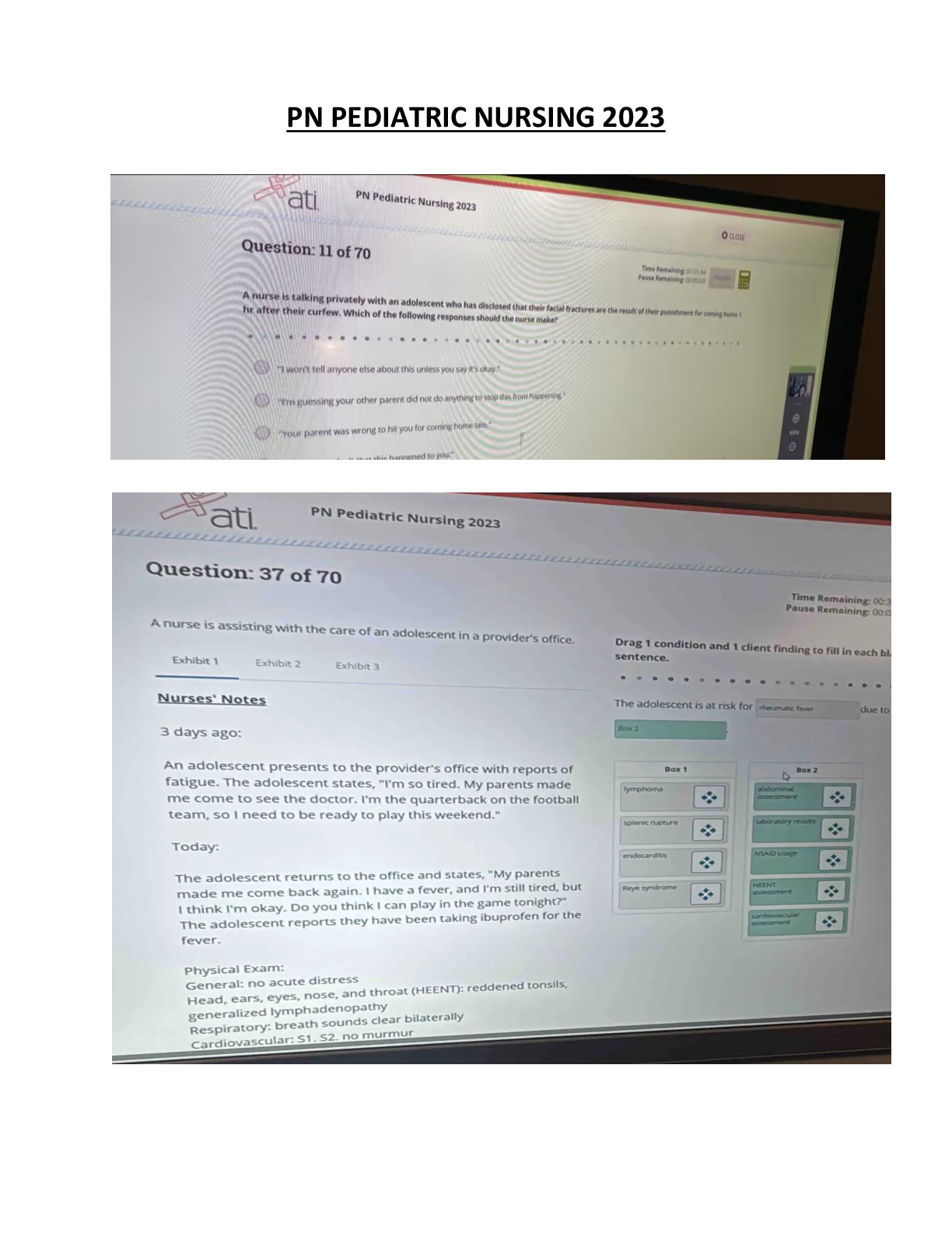

PN PEDIATRIC NURSING

$ 30

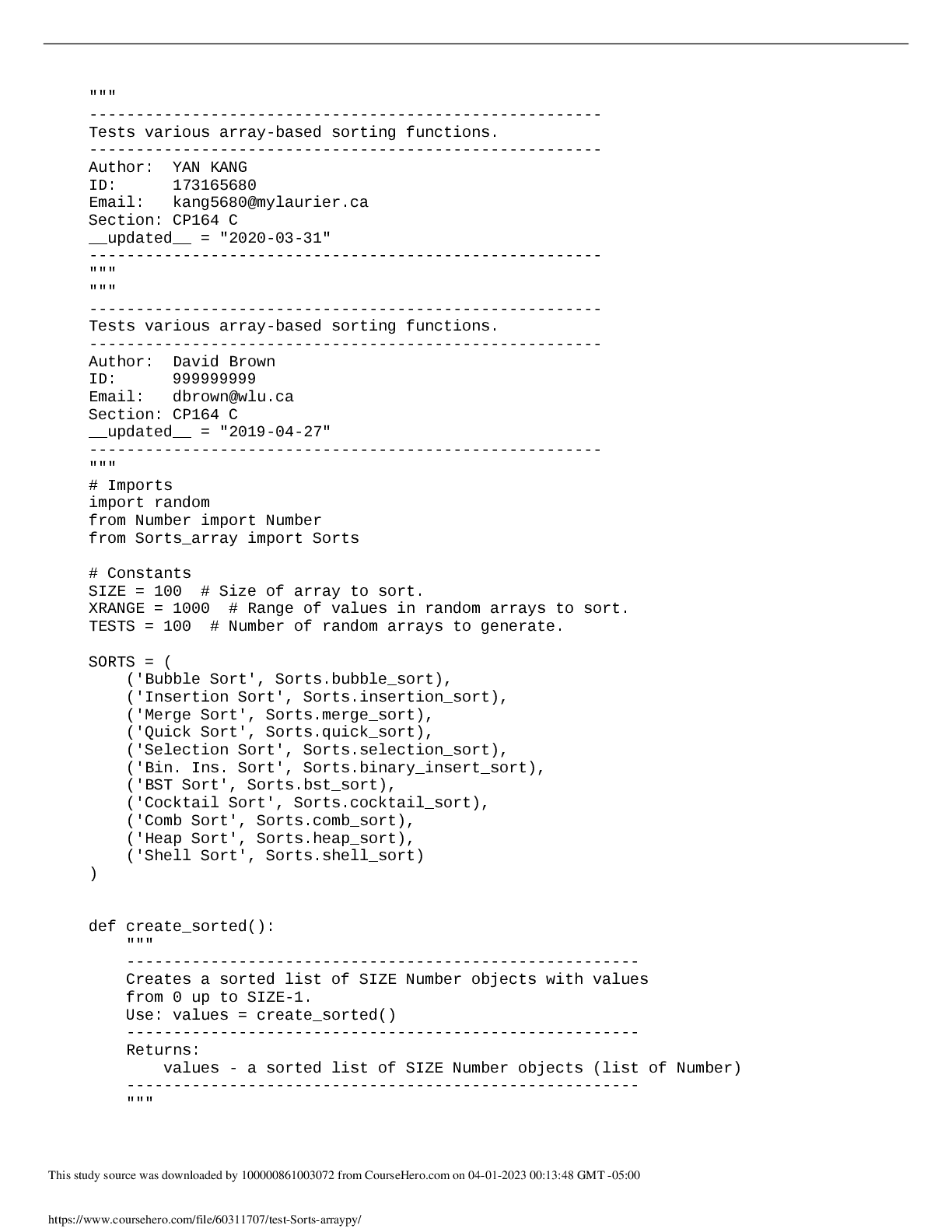

CP 164 Data Structures _ test_Sorts_array.py

$ 7.5

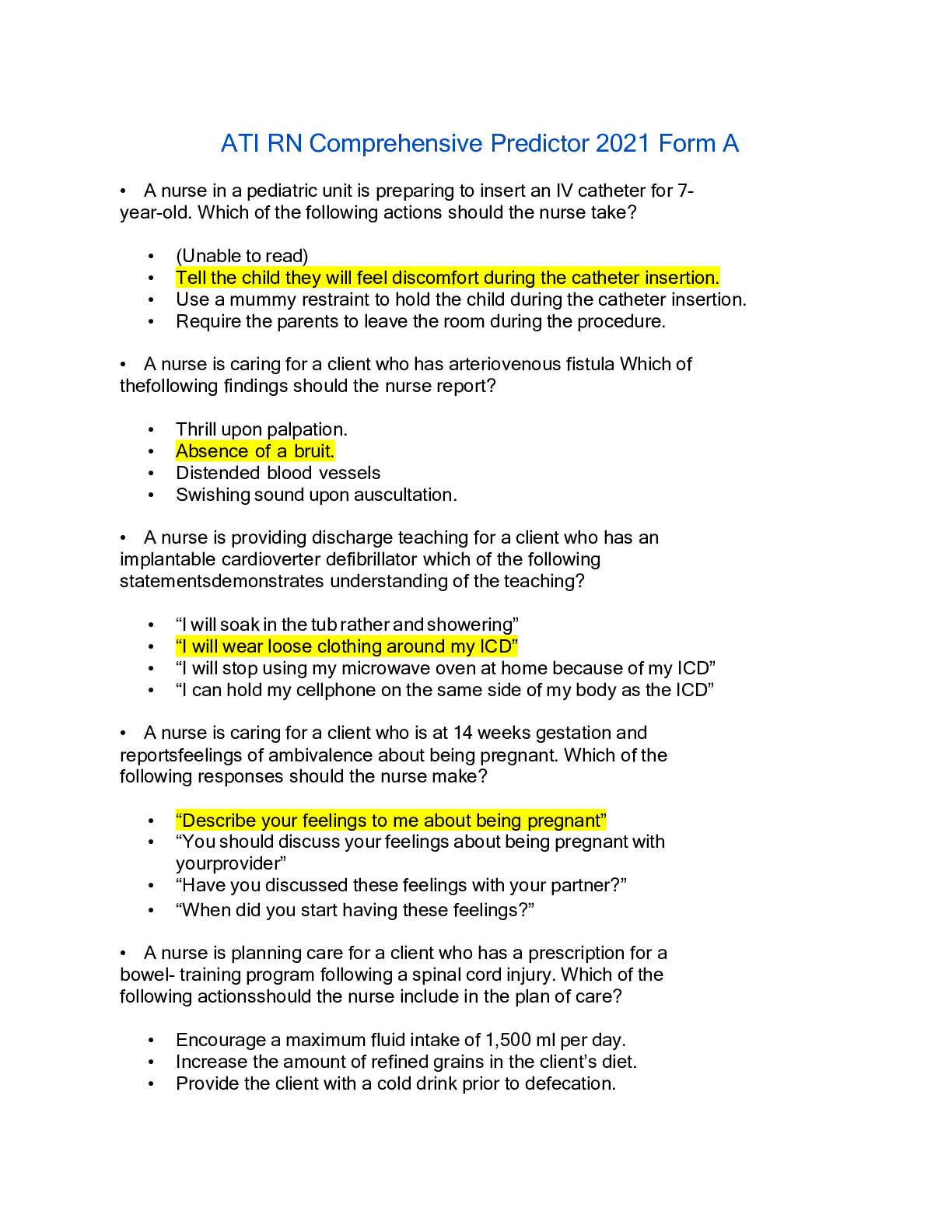

ATI RN Comprehensive Predictor 2021 Form A

$ 17

ATI Community Health Version 1

$ 13.5

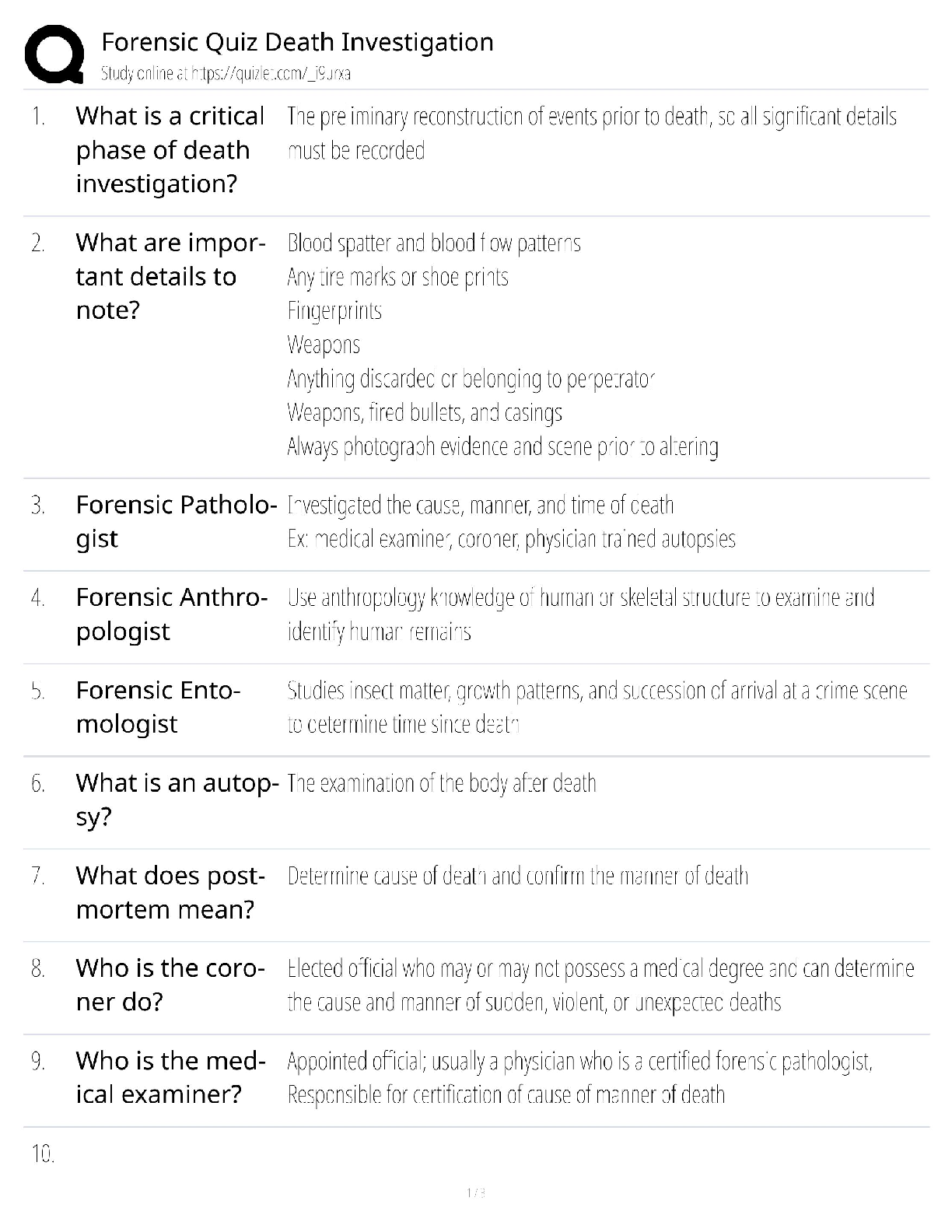

Forensic Quiz Death Investigation / CSI & Medicolegal Exam / 2025 Study Guide / Score 100% / Test Bank

$ 20

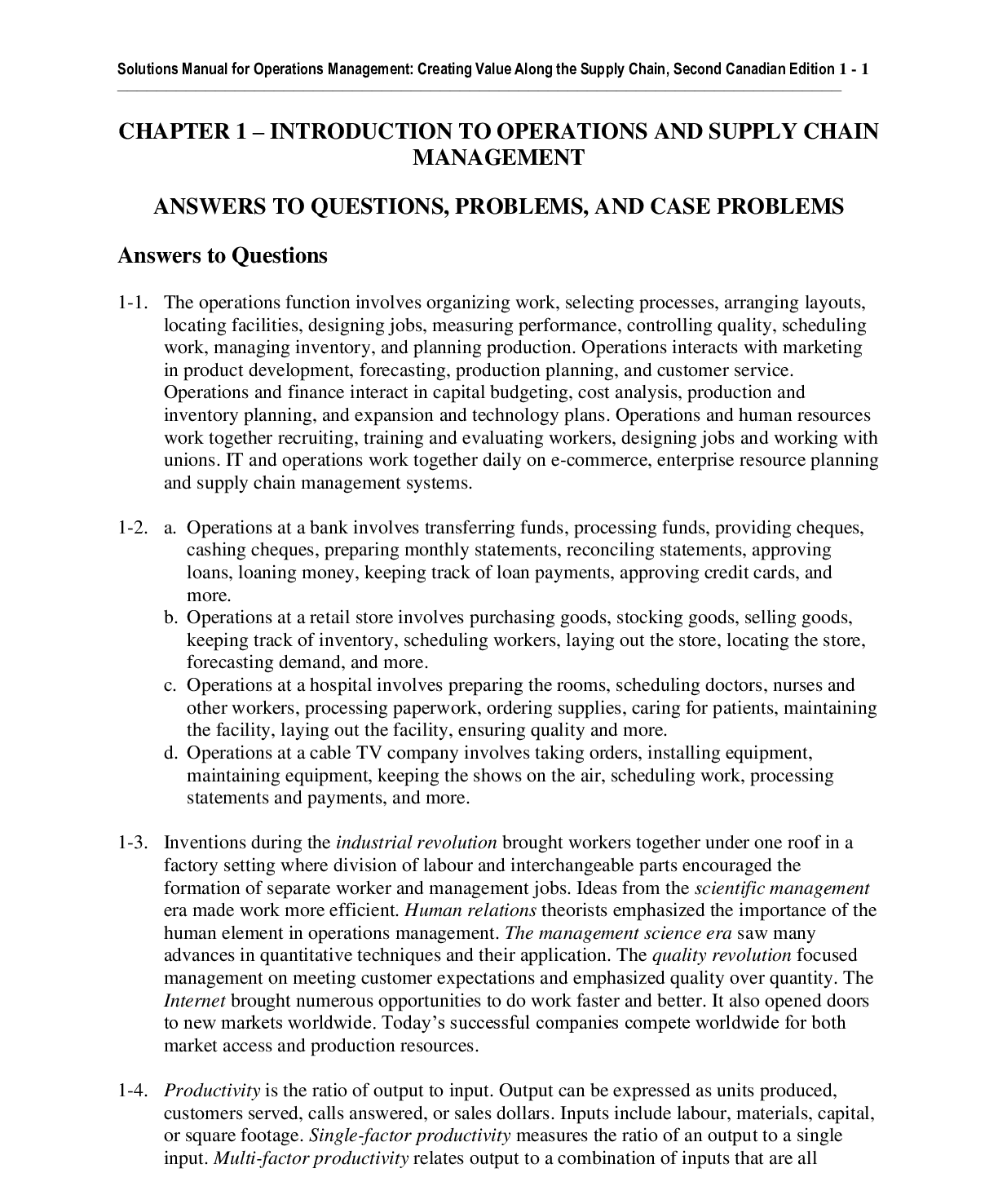

Operations Management Creating Value Along the Supply Chain, 2nd Canadian Edition, 2e Roberta Russell, Bernard Taylor, Tiffany Bayley, Ignacio Castillo (Solutions Manual)

$ 25

.png)

RHIA Domain 2 Questions and Answers 100% Verified

$ 10

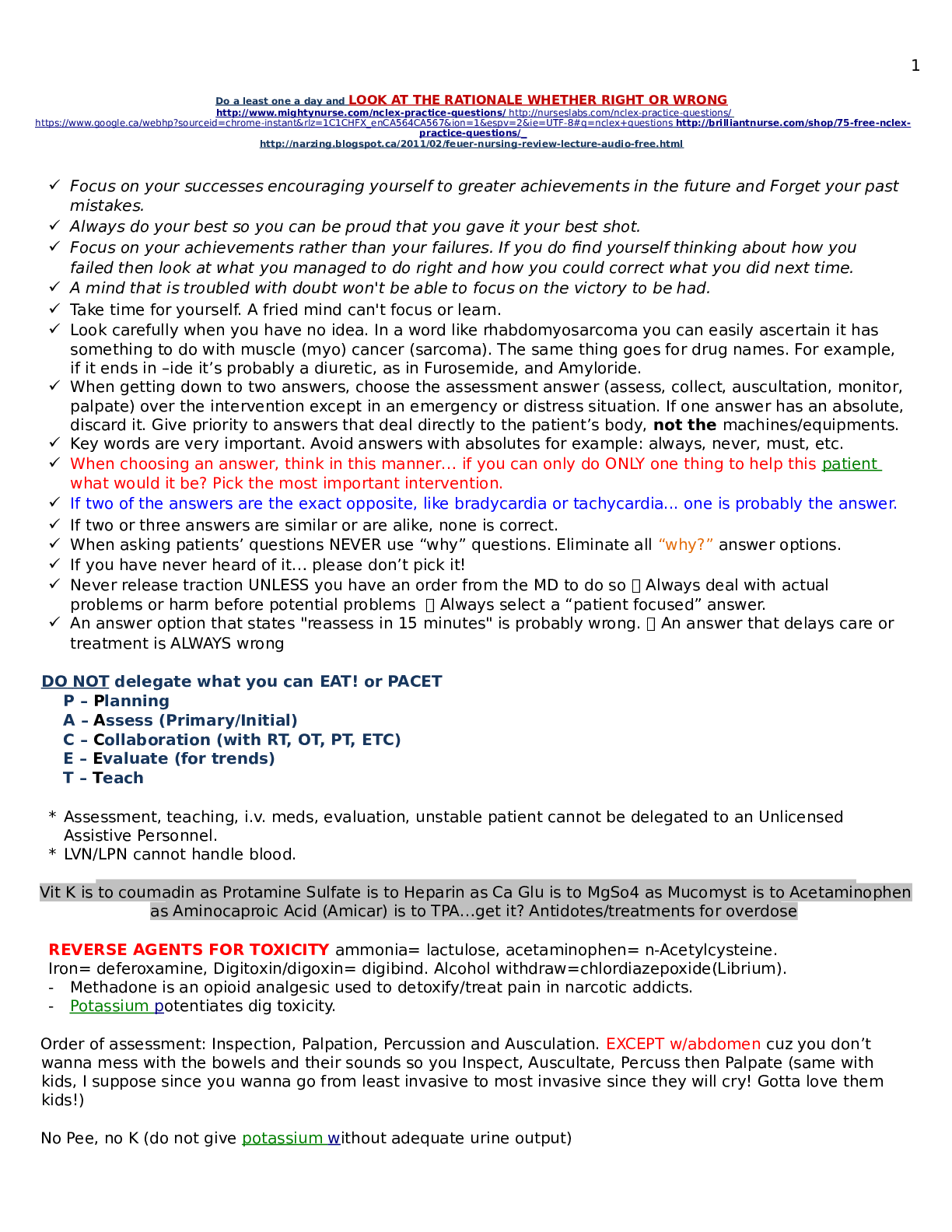

Nursing 121 Updated Nclex Study Guide 2023

$ 14

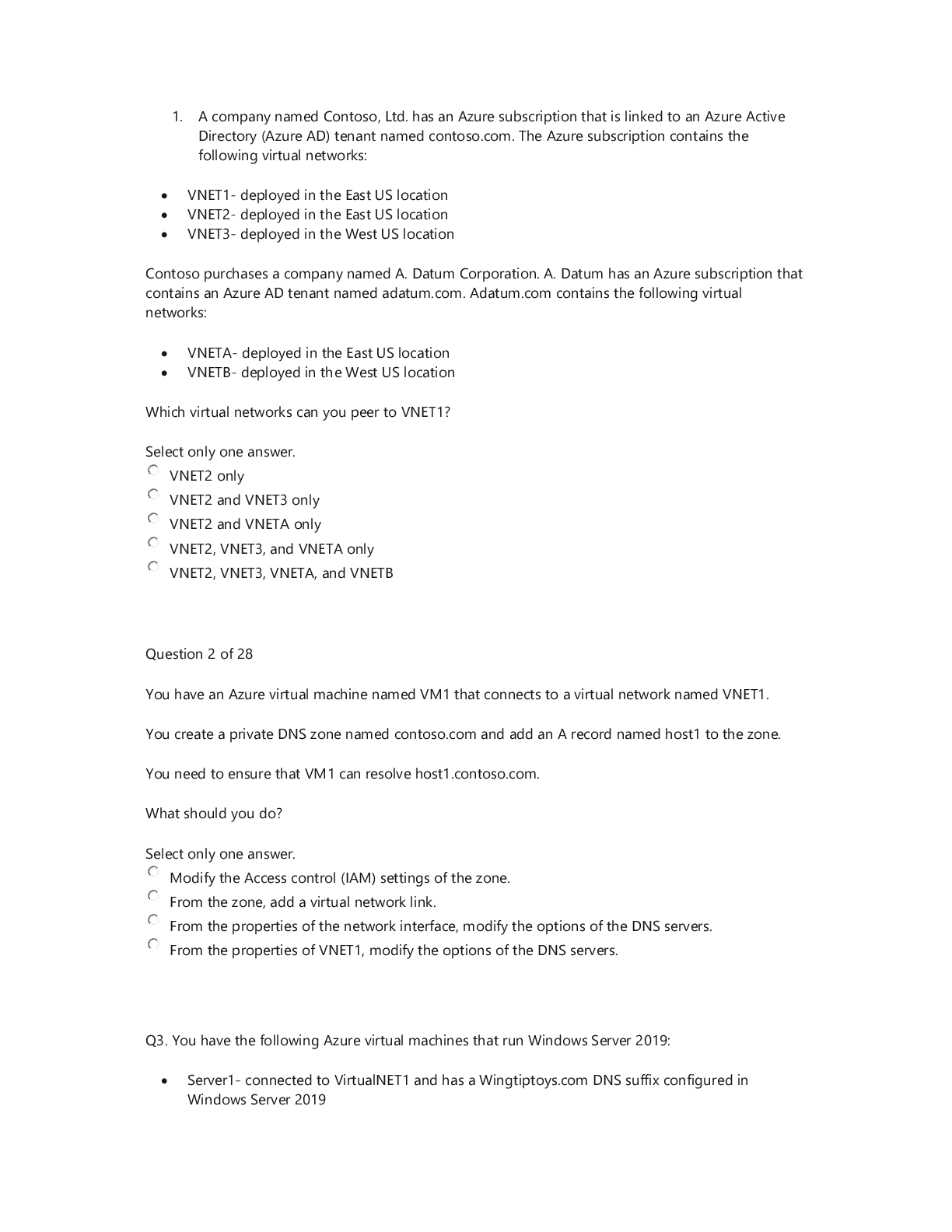

Azure Exam Latest 104

$ 8

UIPath RPA Certification 2022

$ 12

ATI RN COMPREHENSIVE PREDICTOR RETAKE

$ 8

ENG 105 Quiz 1 Study Test!

$ 4

Ncp on meningitis Handwritten Notes

$ 10

MAJOR ZONE STRATEGY

$ 8

HESI A2 Reading Passages Versions 1 & 2 2022/2023 Real! (with 100% CORRECT ANSWERS)

$ 20

NUR550 Focused Note -Chest Pain – Brian Foster

$ 10

[eBook-PDF] How It Works Book of Amazing Vehicles (11th Edition) – Bookazine by How It Works Team

$ 7.5

USPS Exam 421 Window Clerk Practice

$ 11

PMH-C Final Exam – Complete Questions & Verified Answers (2 Versions)

$ 26

ATI Comprehensive - Predictor review 2019-STUDY GUIDE

$ 12

ATI_comprehensive_predictor_JM

$ 10.5

eBook PDF What's that Sound An Introduction to Rock and Its History 6th Edition By John Covach, Andrew Flory

$ 30

USPAP 15-hour course Questions and Answers 100% Pass

$ 14

Operations And Supply Chain Management The Core 6th Edition By F. Robert Jacobs, Richard B. Chase TEST BANK

$ 25

.png)

PMP Certification Exam Study Guide A+ Work Latest 2022

$ 10

Comprehensive Preventive Dentistry

$ 20

Pearson Edexcel_A Level Physical Education_9PE0/01 Mark Scheme 2021 | Paper 1: Scientific Principles of Physical Education