Financial Accounting > QUESTIONS & ANSWERS > CMA 412 p5-3. Hats and Shoes Corp. is projecting for the next five years. The volume of units to be (All)

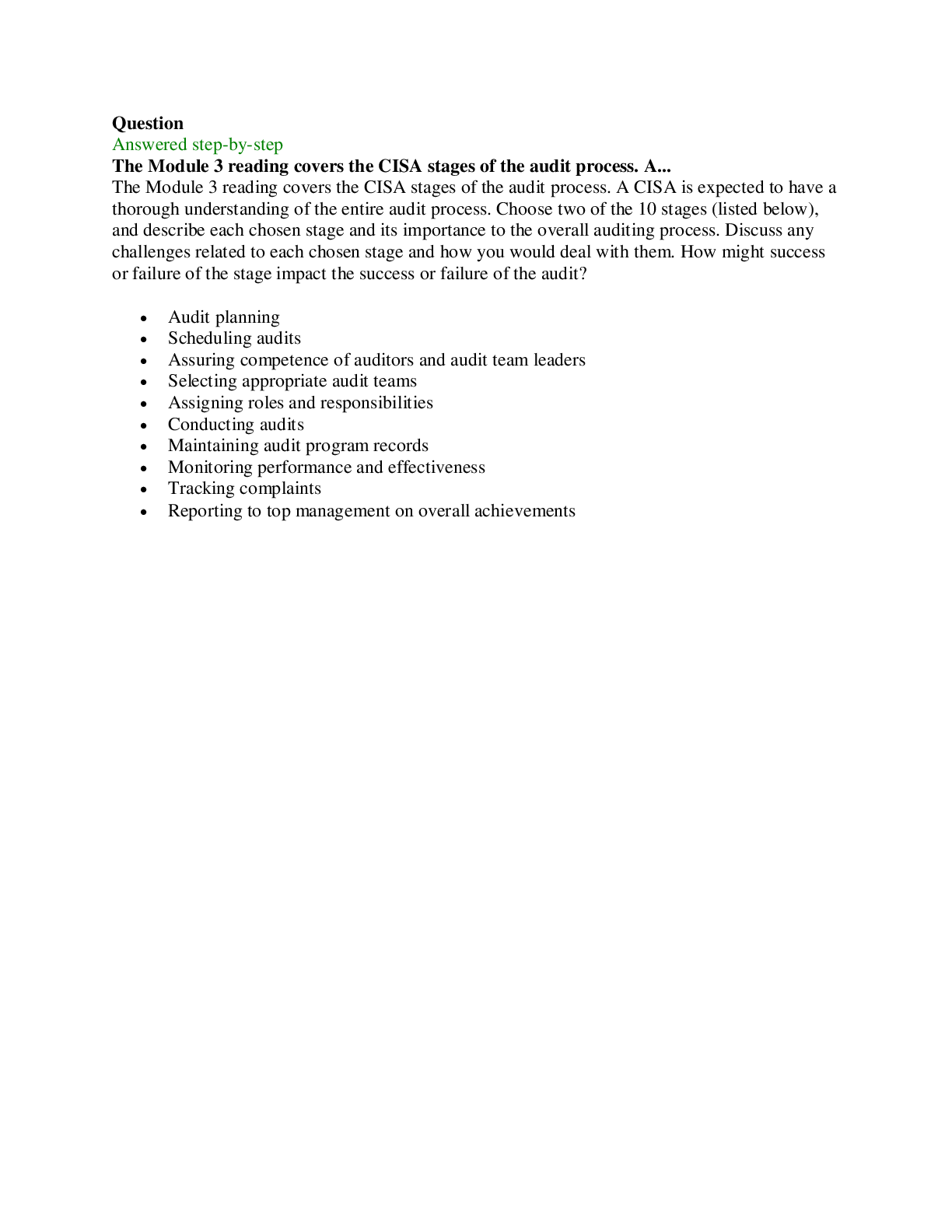

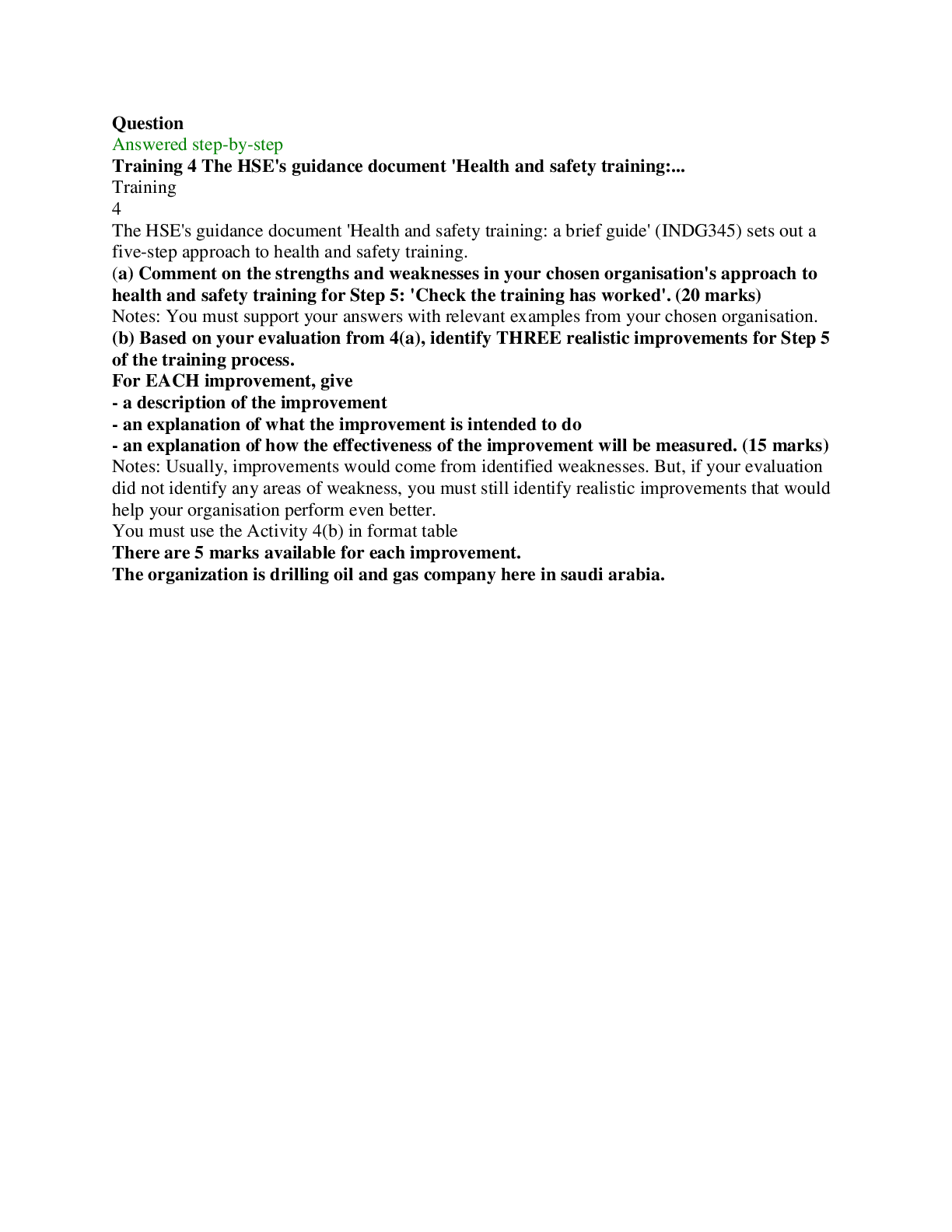

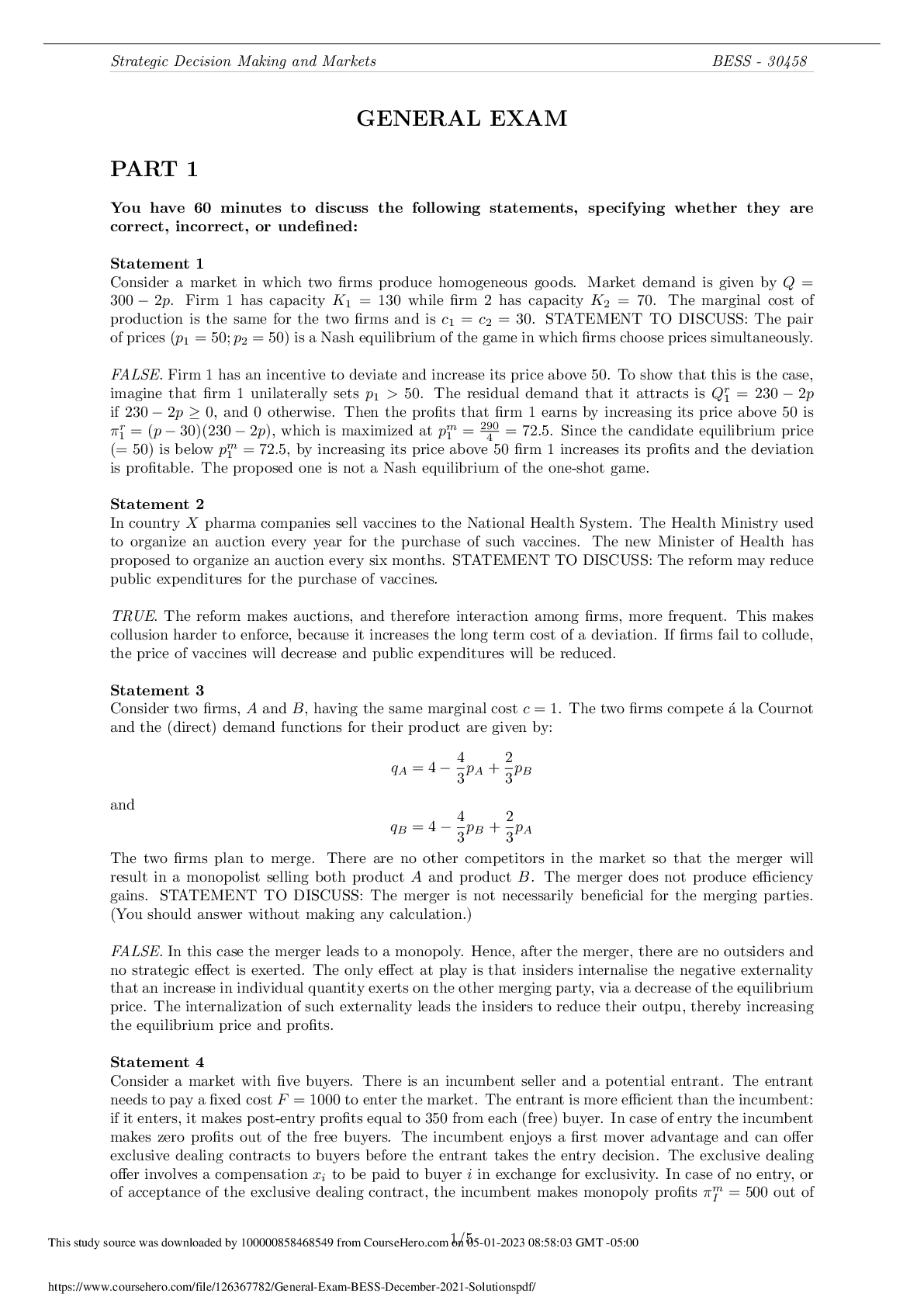

CMA 412 p5-3. Hats and Shoes Corp. is projecting for the next five years. The volume of units to be sold on the first year is 60 and is expected to grow by 15% every year. They are selling their merchandise at Php50 on the average. Operating income margin is 25%. 1. Compute for Hats and Shoes Corp's Revenue for Year 1, 2, 3, 4, and 5. 2. Compute for Hats and Shoes Corp's Operating Income for Year 1, 2, 3, 4, and 5. 3. Hats and Shoes Corp's Compounded Annualized Growth Rate for the 5 years is P5-4. Electricute Inc. has projected net cash flows from operations at Php45 Million on the first year. In order to realize the 10% growth for the next 4 years, Electricute purchased CAPEX amounting to Php250 Million within the first year. Half of the CAPEX was funded by liability and no other long term liability was existing before the purchase on the first year. 1. For its five-year projection, Electricute's discounted net cash flow to the firm assuming a discount rate of 7.5% is 2. For its five-year projection, Electricute's net cash flow to equity assuming a discount rate of 7.5% is

Document Content and Description Below

Araullo University CMA CMA 412 p5-3. Hats and Shoes Corp. is projecting for the next five years. The volume of units to be sold on the first year is 60 and is expected to grow by 15% every ye... ar. They are selling their merchandise at Php50 on the average. Operating income margin is 25%. 1. Compute for Hats and Shoes Corp's Revenue for Year 1, 2, 3, 4, and 5. 2. Compute for Hats and Shoes Corp's Operating Income for Year 1, 2, 3, 4, and 5. 3. Hats and Shoes Corp's Compounded Annualized Growth Rate for the 5 years is P5-4. Electricute Inc. has projected net cash flows from operations at Php45 Million on the first year. In order to realize the 10% growth for the next 4 years, Electricute purchased CAPEX amounting to Php250 Million within the first year. Half of the CAPEX was funded by liability and no other long term liability was existing before the purchase on the first year. 1. For its five-year projection, Electricute's discounted net cash flow to the firm assuming a discount rate of 7.5% is 2. For its five-year projection, Electricute's net cash flow to equity assuming a discount rate of 7.5% is P5-5. An analyst is evaluating Wicked Inc. and shared the following projected net cash flows for the next 10 years. Y1 1,000,000 Y2 1,000,000 Y3 1, 150,000 Y4 1,200,000 Y5 1,200,000 Y6 1,300,000 Y7 1,500,000 Y8 1,700,000 Y9 2,000,000 Y10 2,200,000 Wicked expects to continue to grow infinitely using the CAGR of the 10-year forecast period Required return relevant to Wicked Inc is at 12 1% Requirements: 1 What is the compounded annual growth rate of 10-yr net cash flow projection of Wicked Inc.? 2. What is the terminal value to be incorporated in the net cash flow to the firm computation? 3. What is the net cash flow to the firm of Wicked Inc.? 4. What is the net cash flow to equity of Wicked Inc.? Accounting Business Financial Accounting CMA 412 [Show More]

Last updated: 2 years ago

Preview 1 out of 3 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$5.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jan 25, 2023

Number of pages

3

Written in

Additional information

This document has been written for:

Uploaded

Jan 25, 2023

Downloads

0

Views

219

and is exposed.png)