Finance > QUESTIONS & ANSWERS > UNT Finance 3770 Cumulative Final Multiple Choice (All)

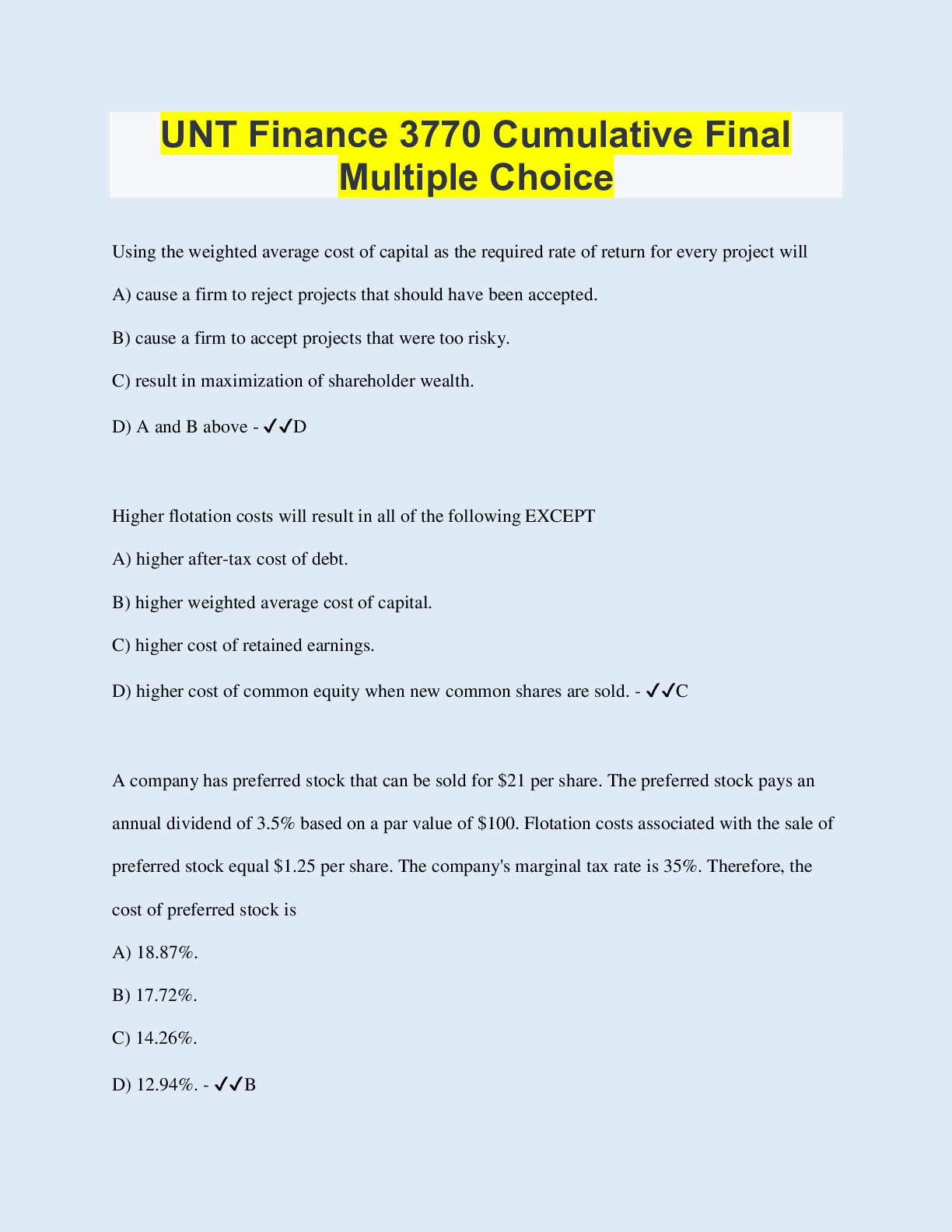

UNT Finance 3770 Cumulative Final Multiple Choice

Document Content and Description Below

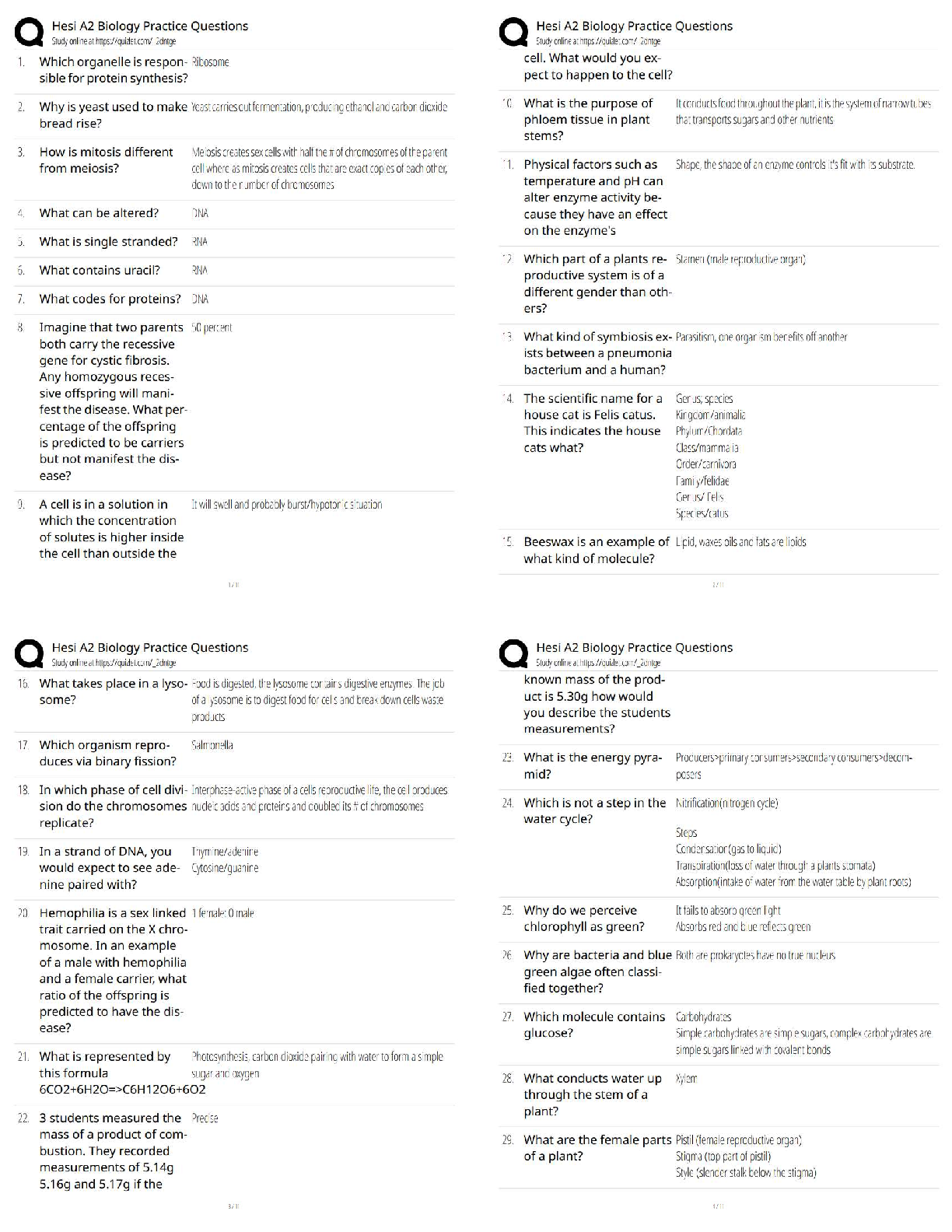

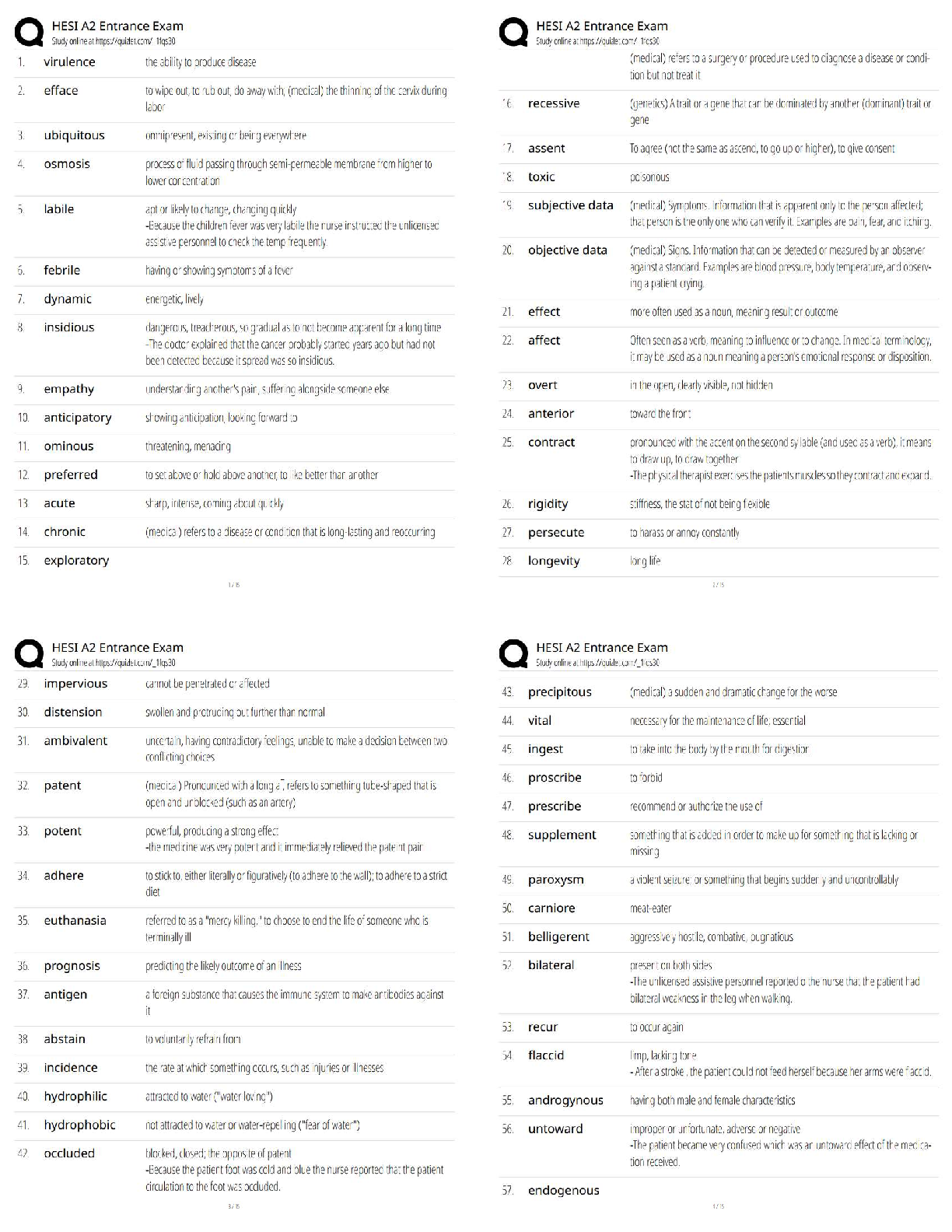

UNT Finance 3770 Cumulative Final Multiple Choice Using the weighted average cost of capital as the required rate of return for every project will A) cause a firm to reject projects that should hav ... e been accepted. B) cause a firm to accept projects that were too risky. C) result in maximization of shareholder wealth. D) A and B above - ✔✔D Higher flotation costs will result in all of the following EXCEPT A) higher after-tax cost of debt. B) higher weighted average cost of capital. C) higher cost of retained earnings. D) higher cost of common equity when new common shares are sold. - ✔✔C A company has preferred stock that can be sold for $21 per share. The preferred stock pays an annual dividend of 3.5% based on a par value of $100. Flotation costs associated with the sale of preferred stock equal $1.25 per share. The company's marginal tax rate is 35%. Therefore, the cost of preferred stock is A) 18.87%. B) 17.72%. C) 14.26%. D) 12.94%. - ✔✔B Sentry Manufacturing paid a dividend yesterday of $5 per share. The dividend is expected to grow at a constant rate of 8% per year. The price of Sentry Manufacturing's stock today is $29 per share. If Sentry Manufacturing decides to issue new common stock, flotation costs will equal $2.50 per share. Sentry Manufacturing's marginal tax rate is 35%. Based on the above information, the cost of retained earnings is A) 28.38%. B) 24.12%. C) 26.62%. D) 31.40%. - ✔✔C Sentry Manufacturing paid a dividend yesterday of $5 per share. The dividend is expected to grow at a constant rate of 8% per year. The price of Sentry Manufacturing's stock today is $29 per share. If Sentry Manufacturing decides to issue new common stock, flotation costs will equal $2.50 per share. Sentry Manufacturing's marginal tax rate is 35%. Based on the above information, the cost of new common stock is A) 28.38%. B) 24.12%. C) 26.62%. D) 31.40%. - ✔✔A The risk free rate of return is 2.5% and the market risk premium is 8%. Rogue Transport has a beta of 2.2 and a standard deviation of returns of 28%. Rogue Transport's marginal tax rate is 35%. Analysts expect Rogue Transport's dividends to grow by 6% per year for the foreseeable future. Using the capital asset pricing model, what is Rogue Transport's cost of retained [Show More]

Last updated: 2 years ago

Preview 1 out of 17 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jan 29, 2023

Number of pages

17

Written in

All

Additional information

This document has been written for:

Uploaded

Jan 29, 2023

Downloads

0

Views

104

.png)