Business > SOLUTIONS MANUAL > Pearson’s Federal Taxation 2023 Individuals, 36e Timothy Rupert, Kenneth Anderson, David Hulse (So (All)

Pearson’s Federal Taxation 2023 Individuals, 36e Timothy Rupert, Kenneth Anderson, David Hulse (Solutions Manual )

Document Content and Description Below

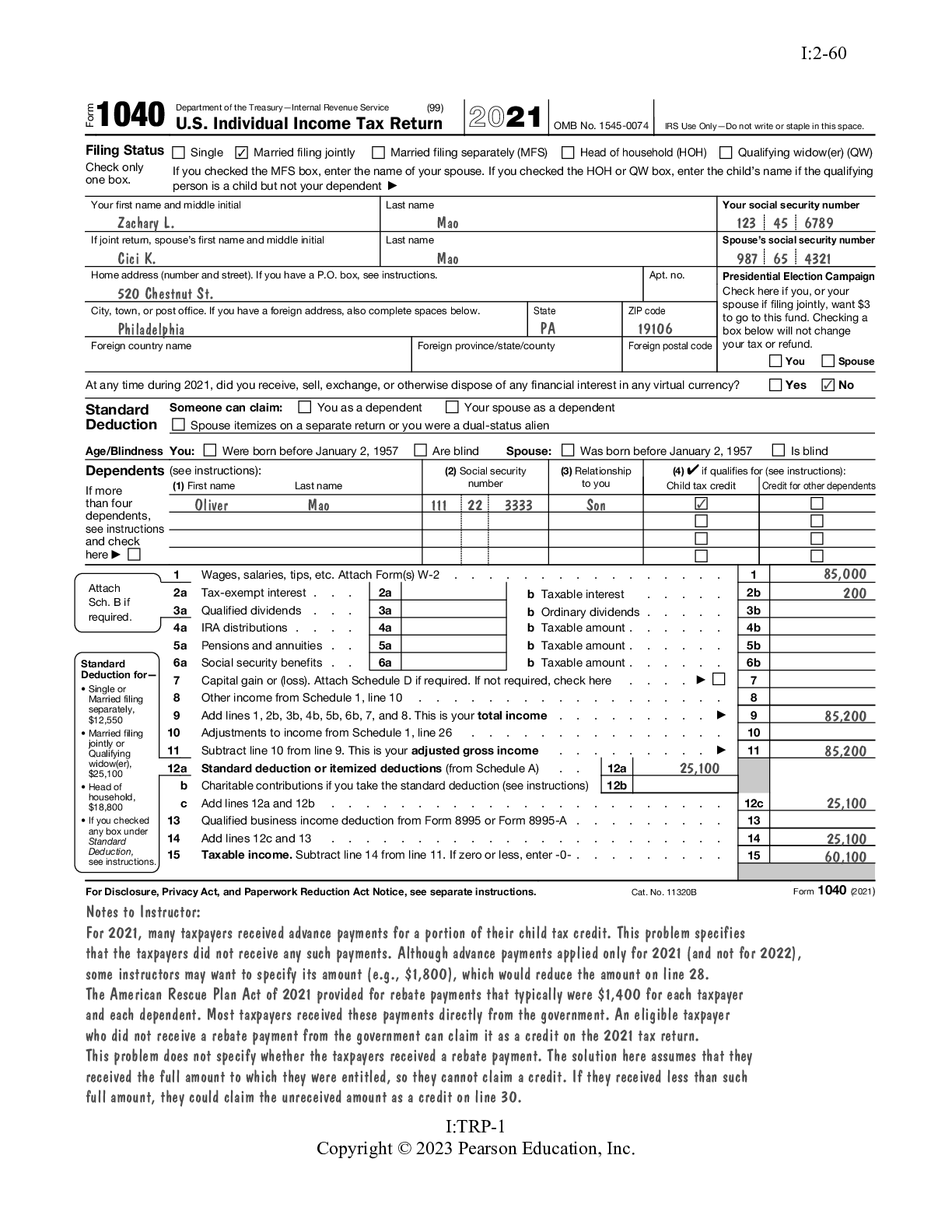

The Rupert/Anderson/Hulse series is unsurpassed in blending technical aspects of the most recent federal taxation mandates with maximum readability and relevance for students. Pearson's Federal Taxati... on 2023 Individuals contains strong pedagogical tools that enable readers to apply tax principles within the text to real-life situations. Incorporating tax information from 2021 and early 2022, the 36th Edition provides an up-to-date resource and a better teaching and learning experience for both you and your students. The Rupert/Anderson/Hulse series is unsurpassed in blending technical aspects of the most recent federal taxation mandates with maximum readability and relevance for students. Pearson's Federal Taxation 2023 Individuals contains strong pedagogical tools that enable readers to apply tax principles within the text to real-life situations. Incorporating tax information from 2021 and early 2022, the 36th Edition provides an up-to-date resource and a better teaching and learning experience for both you and your students. [Show More]

Last updated: 1 year ago

Preview 1 out of 566 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$20.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Feb 02, 2023

Number of pages

566

Written in

Additional information

This document has been written for:

Uploaded

Feb 02, 2023

Downloads

2

Views

215