Financial Accounting > QUESTIONS and ANSWERS > ACC 222 Exam 2 Practice- Northern Virginia Community College (All)

ACC 222 Exam 2 Practice- Northern Virginia Community College

Document Content and Description Below

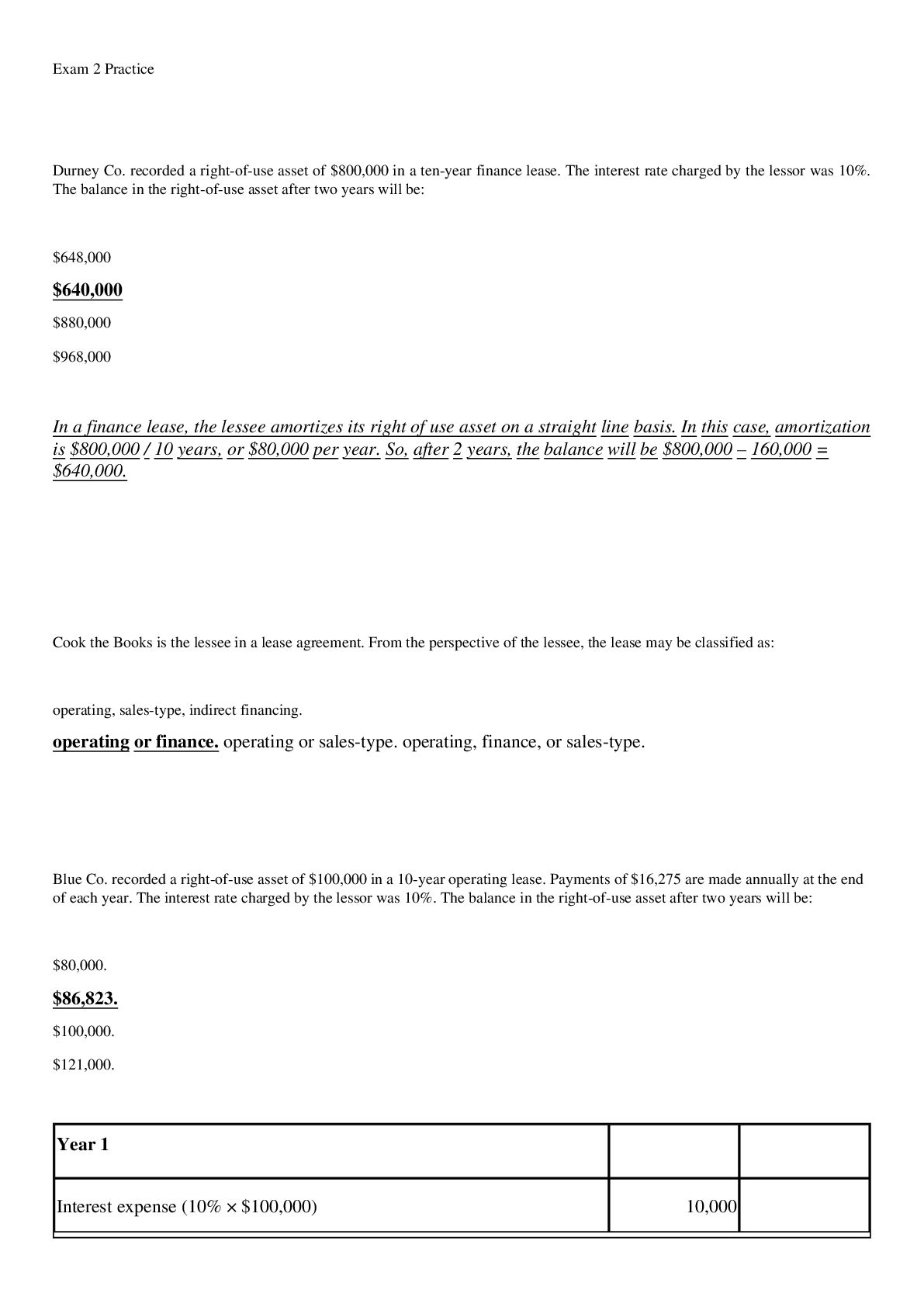

Durney Co. recorded a right-of-use asset of $800,000 in a ten-year finance lease. The interest rate charged by the lessor was 10%. The balance in the right-of-use asset after two years will be: $648,0... 00! $640,000 $880,000 $968,000 In a finance lease, the lessee amortizes its right of use asset on a straight line basis. In this case, amortization is $800,000 / 10 years, or $80,000 per year. So, after 2 years, the balance will be $800,000 – 160,000 = $640,000. Cook the Books is the lessee in a lease agreement. From the perspective of the lessee, the lease may be classified as: operating, sales-type, indirect financing. operating or finance. operating or sales-type. operating, finance, or sales-type. Blue Co. recorded a right-of-use asset of $100,000 in a 10-year operating lease. Payments of $16,275 are made annually at the end of each year. The interest rate charged by the lessor was 10%. The balance in the right-of-use asset after two years will be: [Show More]

Last updated: 2 years ago

Preview 1 out of 53 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$8.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Feb 02, 2023

Number of pages

53

Written in

Additional information

This document has been written for:

Uploaded

Feb 02, 2023

Downloads

0

Views

70

.png)

.png)