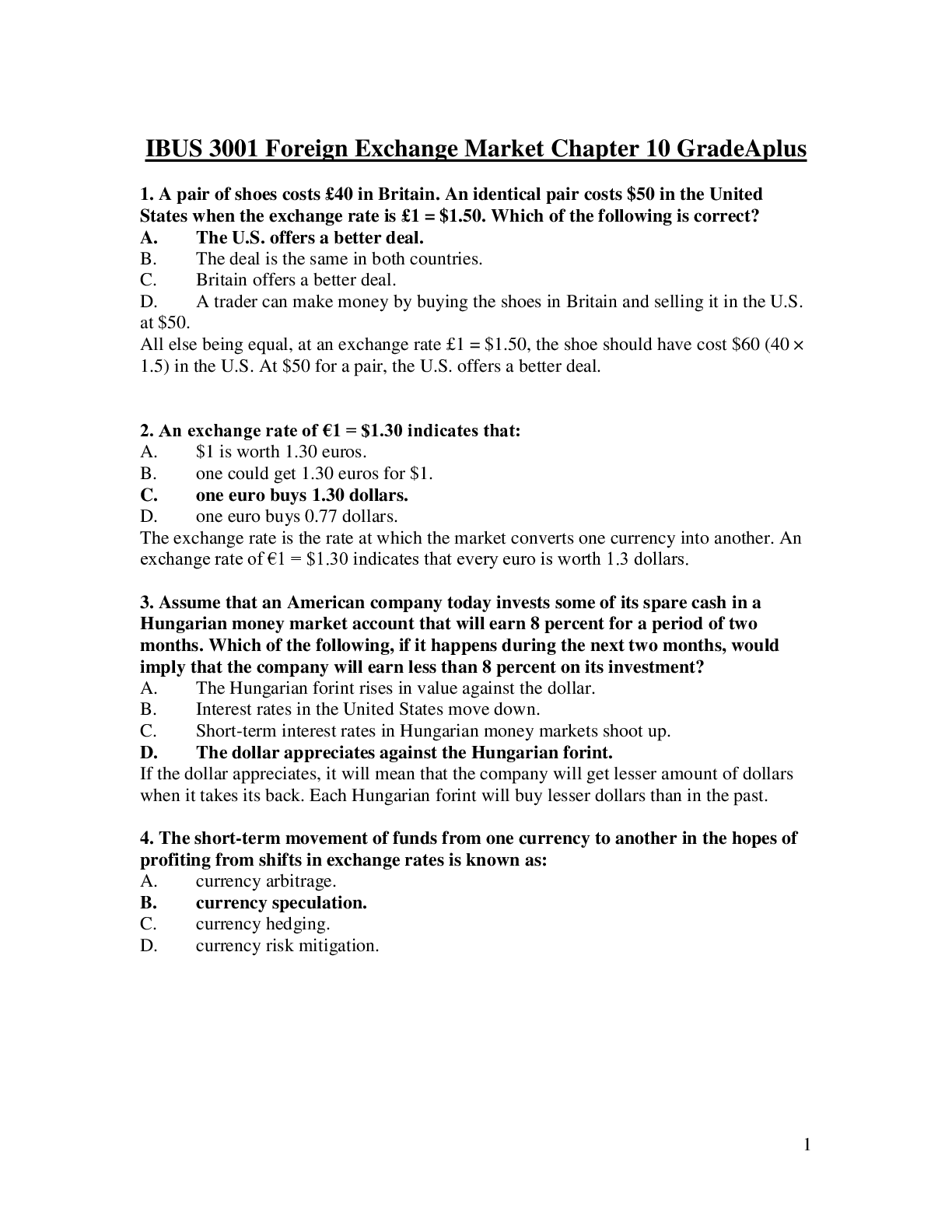

1. A pair of shoes costs £40 in Britain. An identical pair costs $50 in the United States when the exchange rate is £1 = $1.50. Which of the following is correct?

2. An exchange rate of €1 = $1.30 indicates that:

...

1. A pair of shoes costs £40 in Britain. An identical pair costs $50 in the United States when the exchange rate is £1 = $1.50. Which of the following is correct?

2. An exchange rate of €1 = $1.30 indicates that:

3. Assume that an American company today invests some of its spare cash in a Hungarian money market account that will earn 8 percent for a period of two months. Which of the following, if it happens during the next two months, would imply that the company will earn less than 8 percent on its investment?

4. The short-term movement of funds from one currency to another in the hopes of profiting from shifts in exchange rates is known as:

5. Which of the following involves borrowing in one currency where interest rates are low, and then using the proceeds to invest in another currency where interest rates are high?

6. Assume that the interest rate on borrowings in Japan is 1 percent, while the interest rate on deposits in Australian banks is 5 percent. A trader borrows in yen and then converts the money into Australian dollars and deposits it in an Australian bank to make a 4 percent margin. Which type of trade is this an example of?

7. When two parties agree to exchange currency and execute the deal immediately, the transaction is a:

8. Assume that the current exchange rate is €1 = $1.50. If you exchange 1,000 euros for dollars, you will receive ____.

7. _____ are exchange rates governing some specific future date foreign exchange transactions.

8. Assuming the 30-day forward exchange rate were $1 = ¥130 and the spot exchange rate were $1 = ¥120, the dollar is selling at a _____ on the 30-day forward market.

9. Which of the following refers to the simultaneous purchase and sale of a given amount of foreign exchange for two different value dates?

10. Which of the following is the most important foreign exchange trading center?

11. Assume that the yen/dollar exchange rate quoted in Tokyo at 3:00 p.m. is ¥120 = $1, and the yen/dollar exchange rate quoted in New York at the same time is ¥123 = $1. A dealer in New York uses dollars to purchase yen and then immediately sells the yen to buy dollars in Tokyo, thereby making a profit. The dealer has engaged in a(n):

12. If the demand for dollars outstrips its supply and if the supply of Japanese yen is greater than the demand for it, what will happen?

13. The _____ states that in competitive markets free of transportation costs and barriers to trade, identical products sold in different countries must sell for the same price when their price is expressed in terms of the same currency.

14. According to the law of one price, if the exchange rate between the British pound and the dollar is £1 = $1.50, a shirt that retails for $120 in New York should sell for _____ in London.

15. The _____ suggests that given relatively efficient markets, the price of a "basket of goods" should be roughly equivalent in each country.

16. Suppose the price of a Big Mac in New York is $3.00 and the price of a Big Mac in Paris is equivalent to $3.75 at the prevailing euro/dollar exchange rate. Using the concept of purchasing power parity, the euro is:

17. Identify the incorrect statement about the PPP theory.

18. Which of the following is referred to as the purchasing power parity puzzle?

19. The _____ states that a country's "nominal" interest rate is the sum of the required "real" rate of interest and the expected rate of inflation over the period for which the funds are to be lent.

20. It follows from the Fisher Effect that if the real interest rate is the same worldwide; any difference in interest rates between countries reflects differing expectations about _____.

21. The _____ states that for any two countries, the spot exchange rate should change in an equal amount but in the opposite direction to the difference in nominal interest rates between the two countries.

22. Which of the following occurs when traders start moving as a herd in the same direction at the same time?

23. The _____ school of thought argues that forward exchange rates do the best possible job of forecasting future spot rates and therefore investing in forecasting services would be a waste of money.

24. _____ uses price and volume data to determine past trends, which are expected to continue into the future.

25. A currency is said to be freely convertible when:

26. Why do governments limit currency convertibility?

27. What is the difference between a spot exchange rate and a forward exchange rate?

28. What is meant by the phrases ‘the dollar is selling at a discount' on the 30-day forward market and ‘the dollar is selling at a premium' on the 30-day forward market?

29. Discuss the failure of PPP theory to predict exchange rates accurately. What is the purchasing power puzzle?

30. Compare and contrast the Fisher Effect and the International Fisher Effect.

31. Consider the role of investor psychology and bandwagon effects on how well PPP and the International Fisher Effect explain short-term movements in exchange rates.

32. Discuss the two schools of thought on exchange rate forecasting.

33. What is countertrade? Why would a firm engage in countertrade?

[Show More]