Macroeconomics > TEST BANKS > Test bank Income Tax 2022/2023 answered | Graded A+ (All)

Test bank Income Tax 2022/2023 answered | Graded A+

Document Content and Description Below

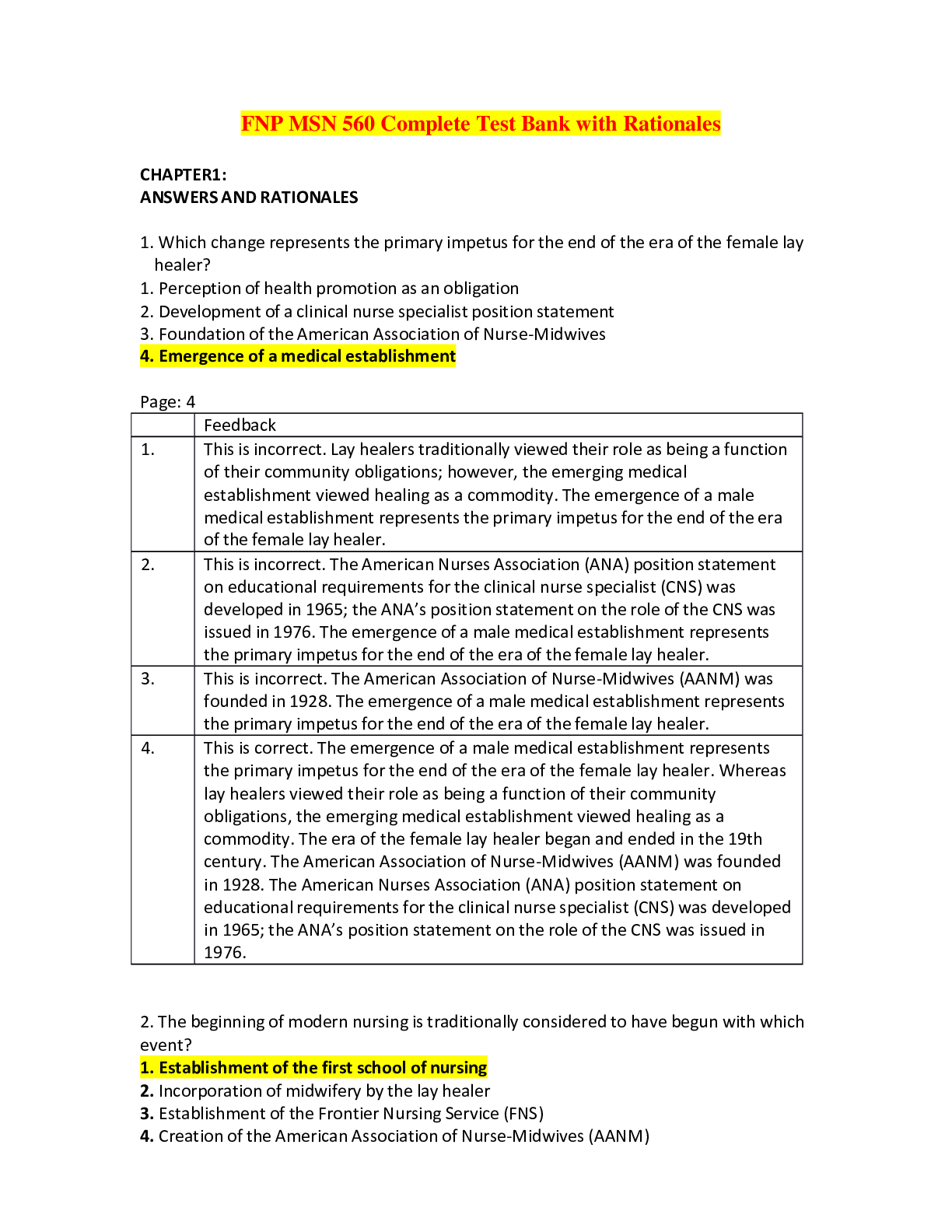

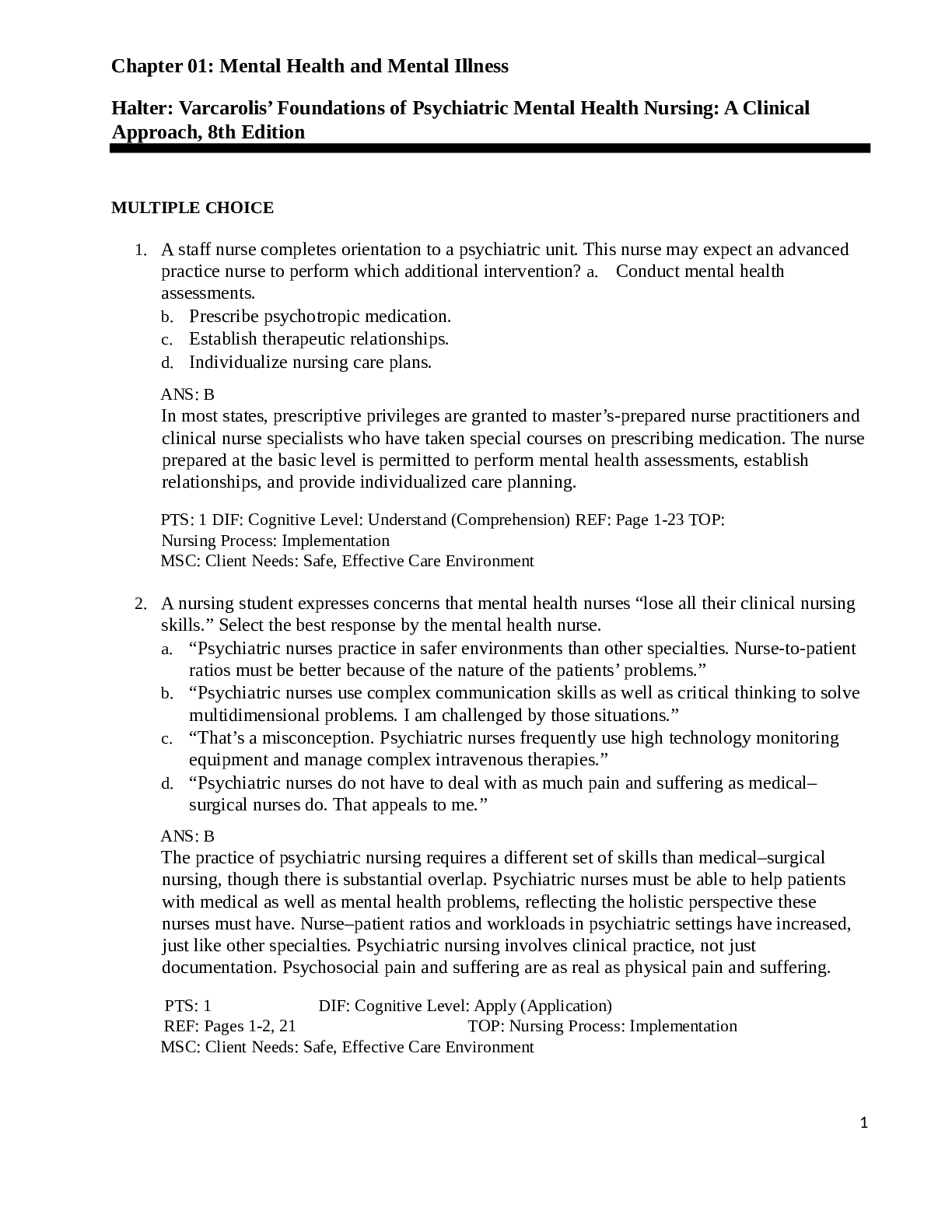

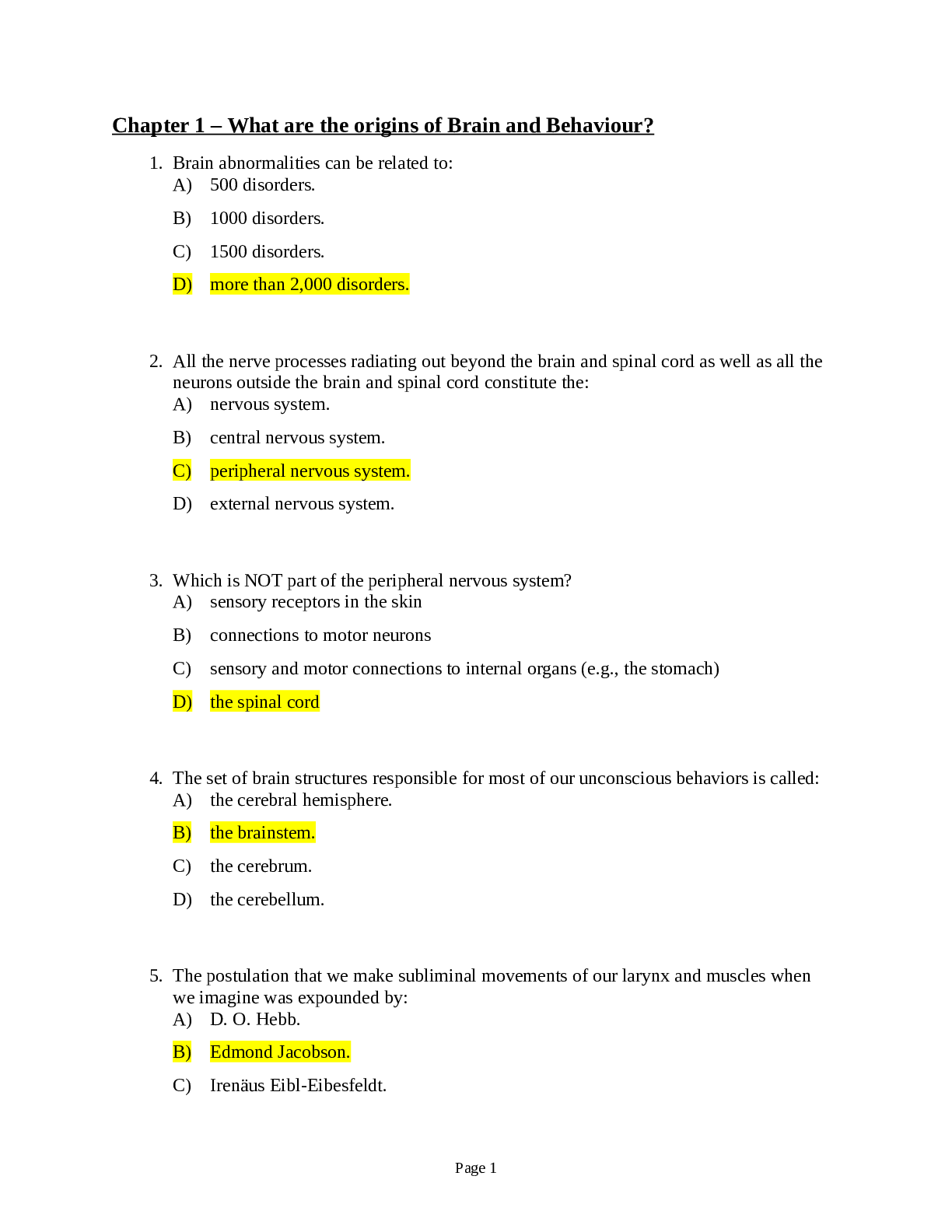

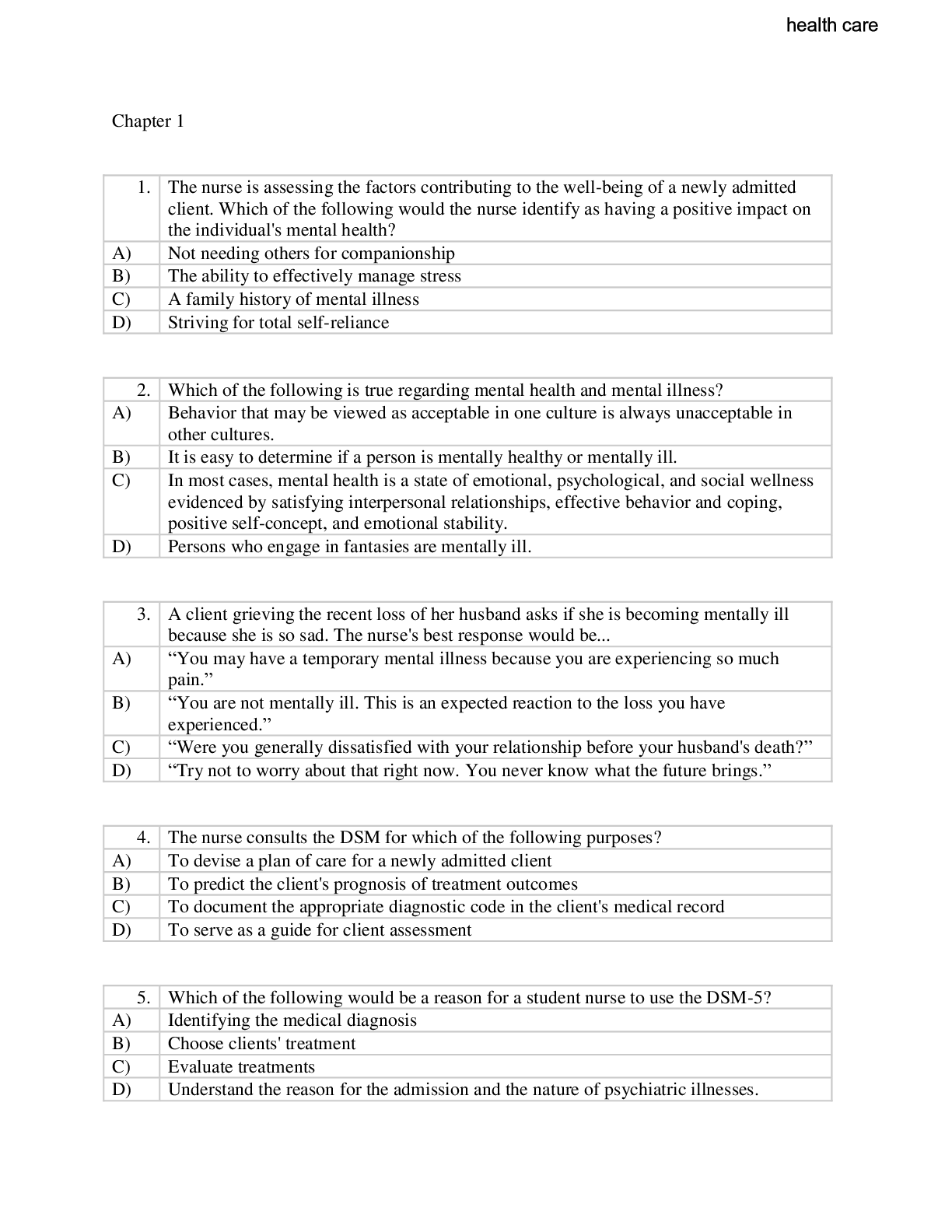

Test bank Income Tax CHAPTER 1: AN INTRODUCTION TO TAXATION AND UNDERSTANDING THE FEDERAL TAX LAW 1. The ratification of the Sixteenth Amendment to the U.S. Constitution was necessary to validate th... e Federal income tax on corporations. a. True b. False ANSWER: False RATIONALE: The Sixteenth Amendment validated only the tax on individuals. The income tax on corporations had been previously sanctioned by the courts. 2. Before the Sixteenth Amendment to the Constitution was ratified, there was no valid Federal income tax on individuals. a. True b. False ANSWER: False RATIONALE: There existed a Federal income tax during the Civil War that was sanctioned by the U.S. Supreme Court. 3. The first income tax on individuals (after the ratification of the Sixteenth Amendment to the Constitution) levied tax rates from a low of 2% to a high of 6%. a. True b. False ANSWER: True 4. The Federal income tax on individuals generates more revenue than the Federal income tax on corporations. 1 a. True b. False ANSWER: True 5. The payasyougo feature of the Federal income tax on individuals conforms to Adam Smith’s canon of certainty. a. True b. False ANSWER: False RATIONALE: Pay-as-you-go refers to the withholding provisions applicable to wages and other types of income and adds convenience to the tax system. [Show More]

Last updated: 2 years ago

Preview 1 out of 344 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$19.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Feb 20, 2023

Number of pages

344

Written in

Additional information

This document has been written for:

Uploaded

Feb 20, 2023

Downloads

0

Views

115