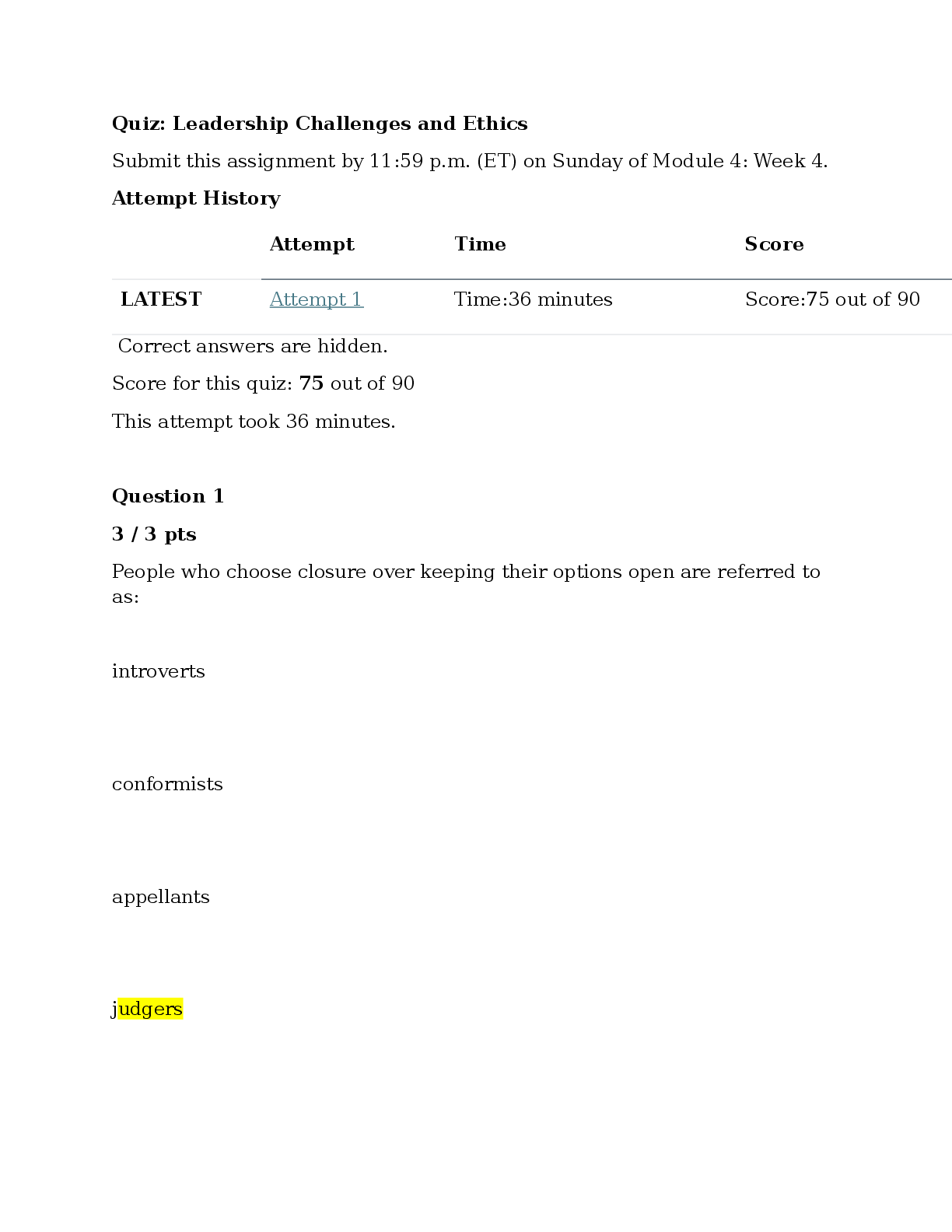

Financial Accounting > EXAM > ACCT 304 Quiz 5 - Complete A+ rated solutions (All)

ACCT 304 Quiz 5 - Complete A+ rated solutions

Document Content and Description Below

Last updated: 3 years ago

Preview 1 out of 3 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

ACCT 304 Exams and Quizzes|Latest versions, Rated 100% by other students

ACCT 304 WEEK 2 QUIZ 1|ACCT 304 Week 8 Exam|ACCT 304 Midterm Exam|ACCT 304 Quiz 5|ACCT 304 Quiz 1|ACCT 304 WEEK 8 FINAL EXAM|ACCT 304 Final Exam

By Ajay25 5 years ago

$30

7

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jan 29, 2021

Number of pages

3

Written in

All

Additional information

This document has been written for:

Uploaded

Jan 29, 2021

Downloads

0

Views

146