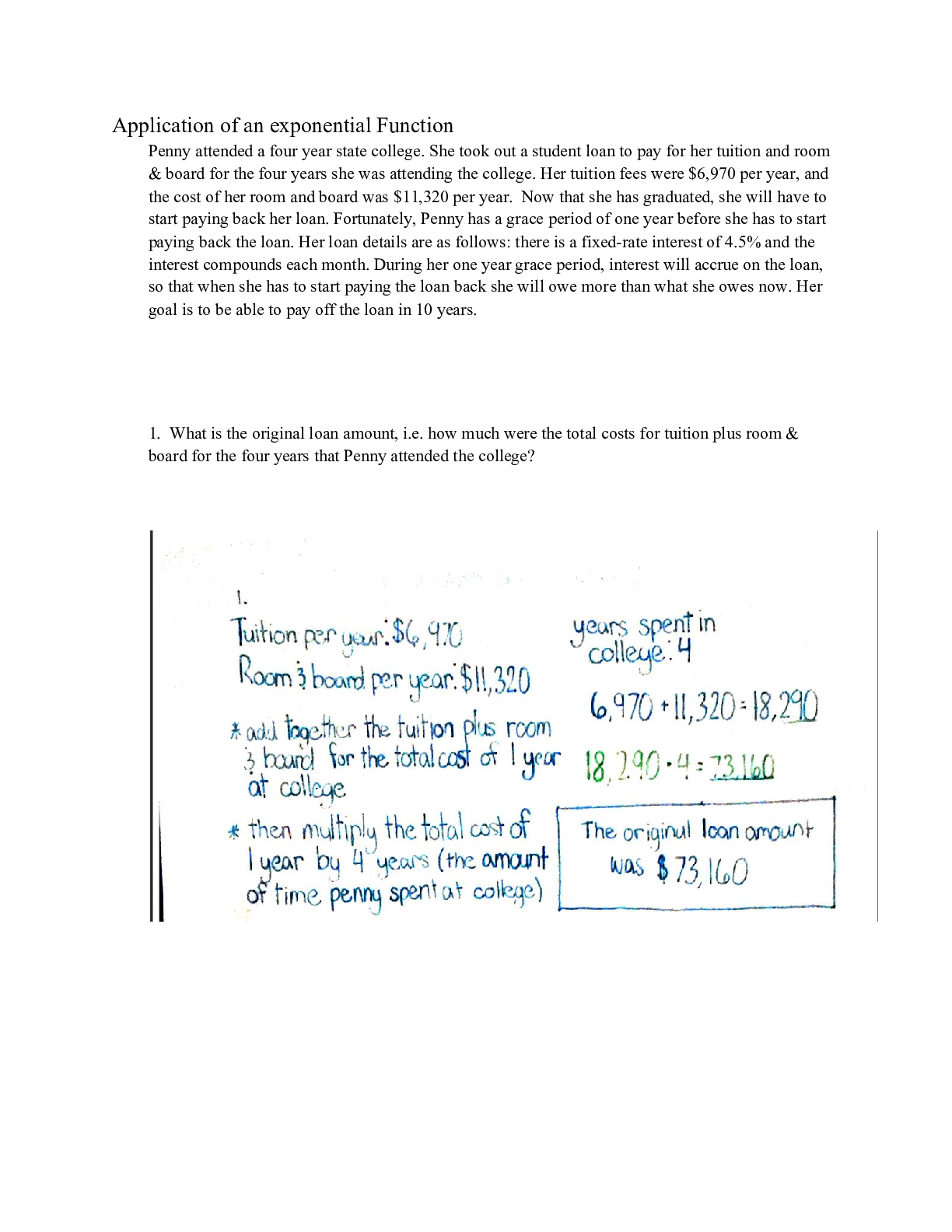

1. Condensed financial data are presented below for the Phoenix Corporation:

2. 3. 2019 4. 5. 2018

6. Accounts receivable 7. 8. 267,500 9. 10. 11. $ 12. 230,000 13.

14. Inventory 15. 16. 312,500 17. 18. 19.

...

1. Condensed financial data are presented below for the Phoenix Corporation:

2. 3. 2019 4. 5. 2018

6. Accounts receivable 7. 8. 267,500 9. 10. 11. $ 12. 230,000 13.

14. Inventory 15. 16. 312,500 17. 18. 19. 20. 257,500 21.

22. Total current assets 23. 24. 670,000 25. 26. 27. 28. 565,000 29.

30. Intangible assets 31. 32. 50,000 33. 34. 35. 36. 60,000 37.

38. Total assets 39. 40. 825,000 41. 42. 43. 44. 695,000 45.

46. Current liabilities 47. 48. 252,500 49. 50. 51. 52. 200,000 53.

54. Long-term liabilities 55. 56. 77,500 57. 58. 59. 60. 75,000 61.

62. Sales 63. 64. 1,640,000 65. 66. 67. 68. 69.

70. Cost of goods sold 71. 72. 982,500 73. 74. 75. 76. 77.

78. Interest expense 79. 80. 10,000 81. 82. 83. 84. 85.

86. Income tax expense 87. 88. 77,500 89. 90. 91. 92. 93.

94. Net income 95. 96. 127,500 97. 98. 99. 100. 101.

102. Cash flow from operations 103. 104. 71,000 105. 106. 107. 108. 109.

110. Cash flow from investing activities 111. 112. (6,000 113. ) 114. 115. 116. 117.

118. Cash flow from financing activities 119. 120. (62,500 121. ) 122. 123. 124. 125.

126. Tax rate 127. 128. 30 129. % 130. 131. 132. 133.

134. The total asset turnover ratio for 2019 is (rounded):

135. Floating-rate debt is the most common method for lenders to protect themselves from losses that may arise as a result of:

136. Cheery Company follows IFRS for its financial reporting. On January 1, 2018 Cheery issued €250 million of 10-year convertible notes that pay interest at 5% annually. Investors pay €250 million for the notes even though the company’s credit risk at the time implies a 10% interest rate for traditional debt of similar duration. When the cash flows associated with the debt are discounted at 10%, the resulting value is €175 million.

137. How much cash will Cheery pay for interest during 2018?

138. The components of pension expense are:

139. Defined contribution plans are preferred by companies for all except which of the following reasons?

140. Cash dividends paid by a corporation:

141. Companies with surplus cash will consider the needs of cash for:

142. When a dividend is not declared on preferred stock, and the common share¬holders cannot receive a dividend until all past and current dividends are paid to the preferred shareholders, the preferred stock is:

143. Mandatorily redeemable preferred stock is reported on the balance sheet as:

[Show More]