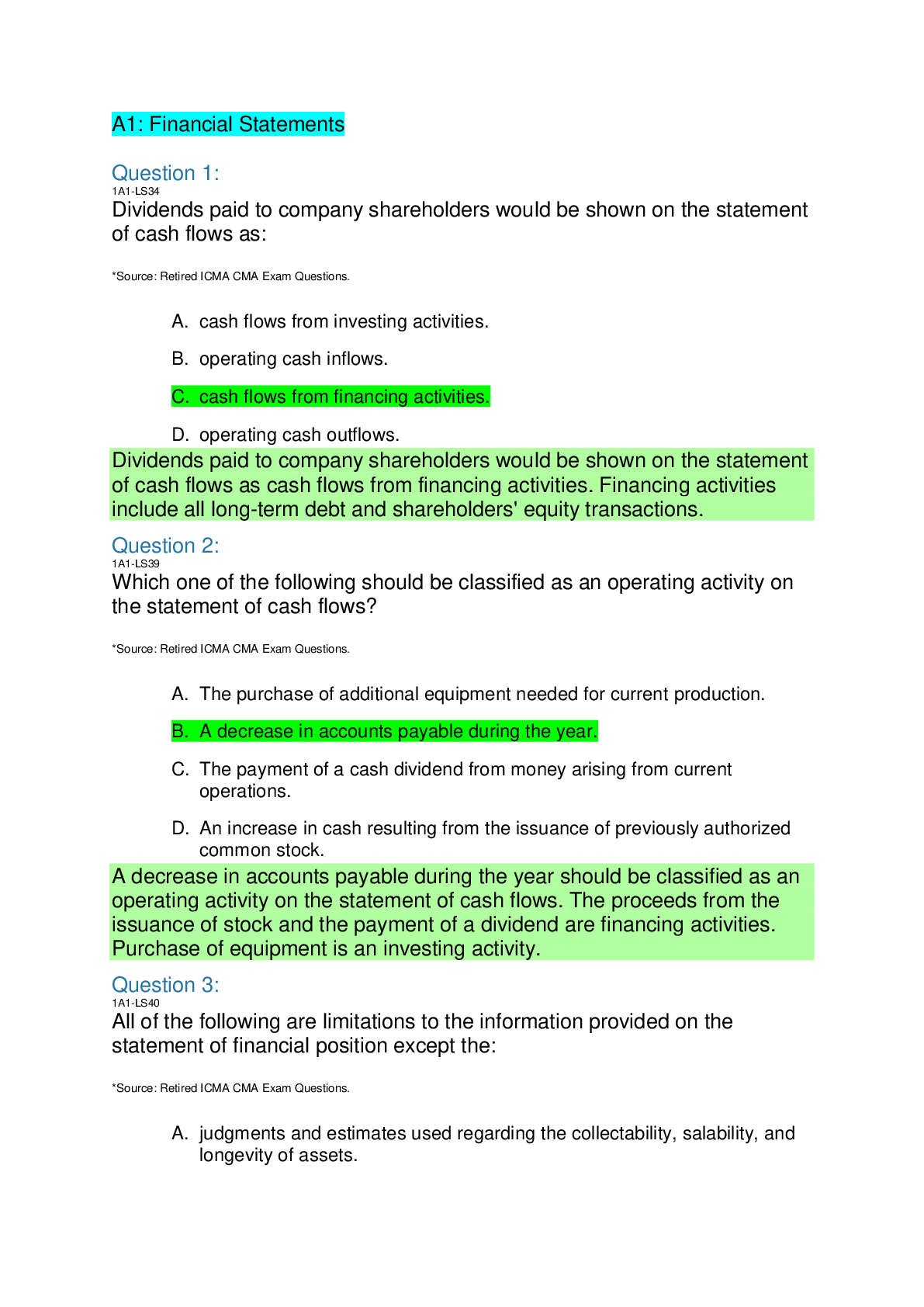

CMA Part I Question Bank WILEY A1: Financial Statements Question 1: 1A1-LS34 Dividends paid to company shareholders would be shown on the statement of cash flows as: *Source: Retired ICMA CMA Exam Questions. Question 2:

...

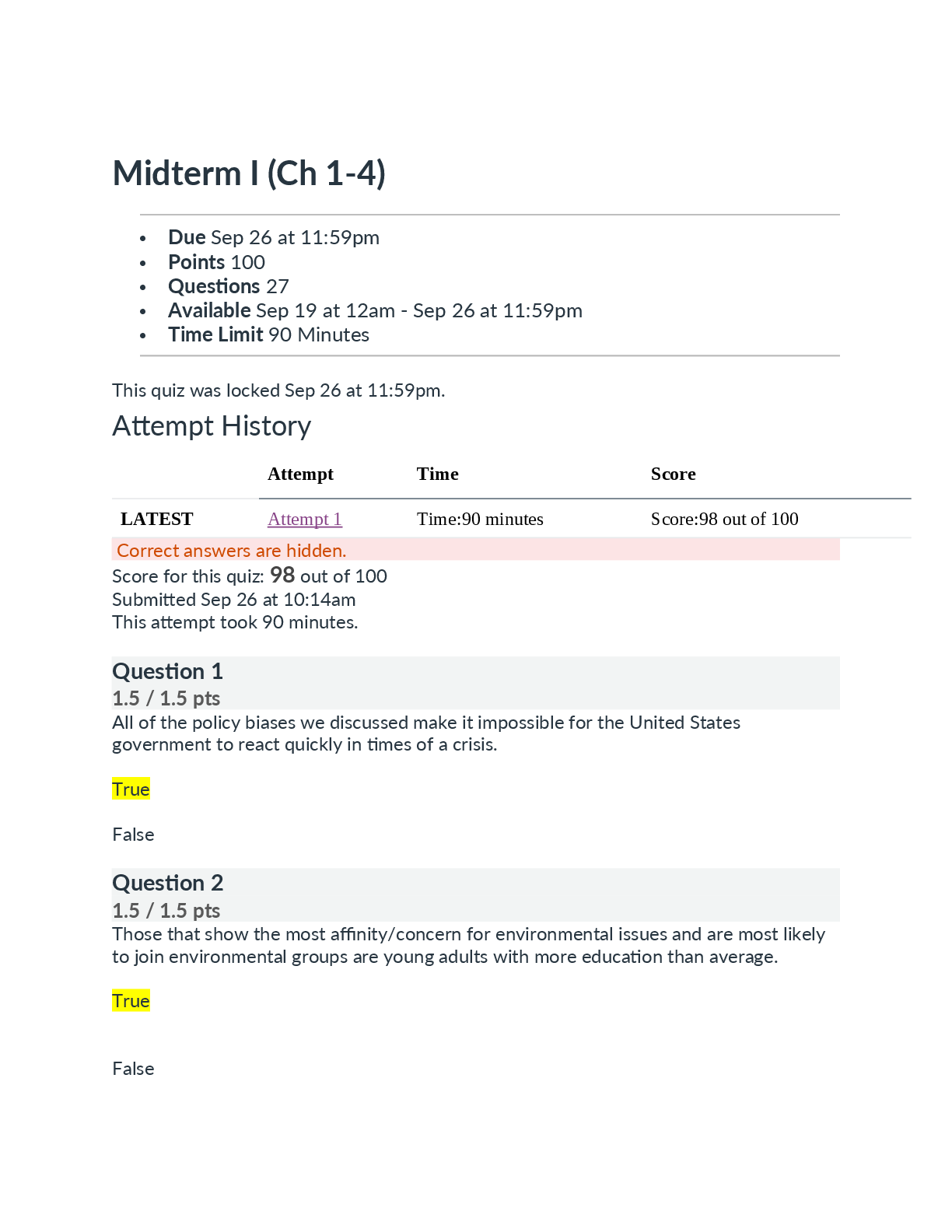

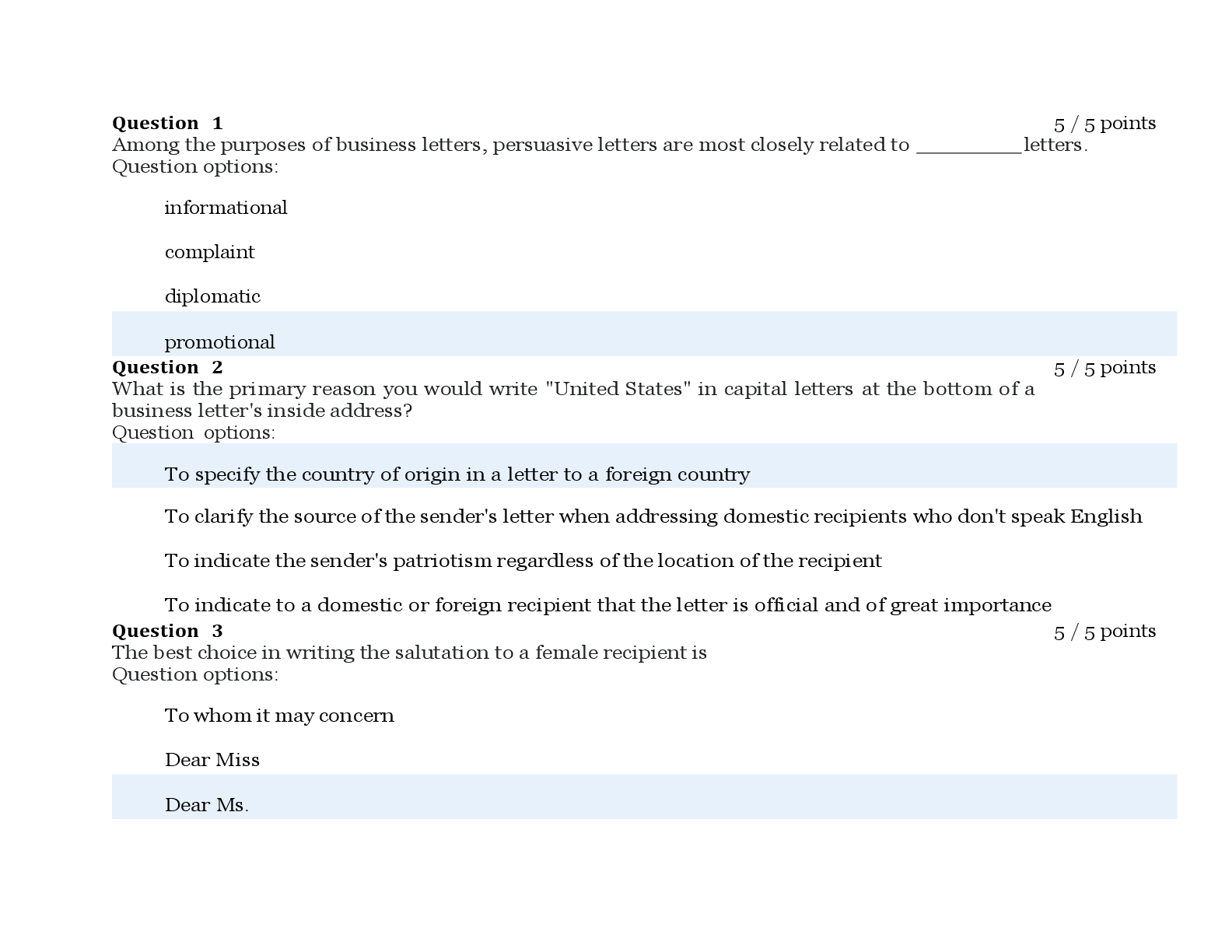

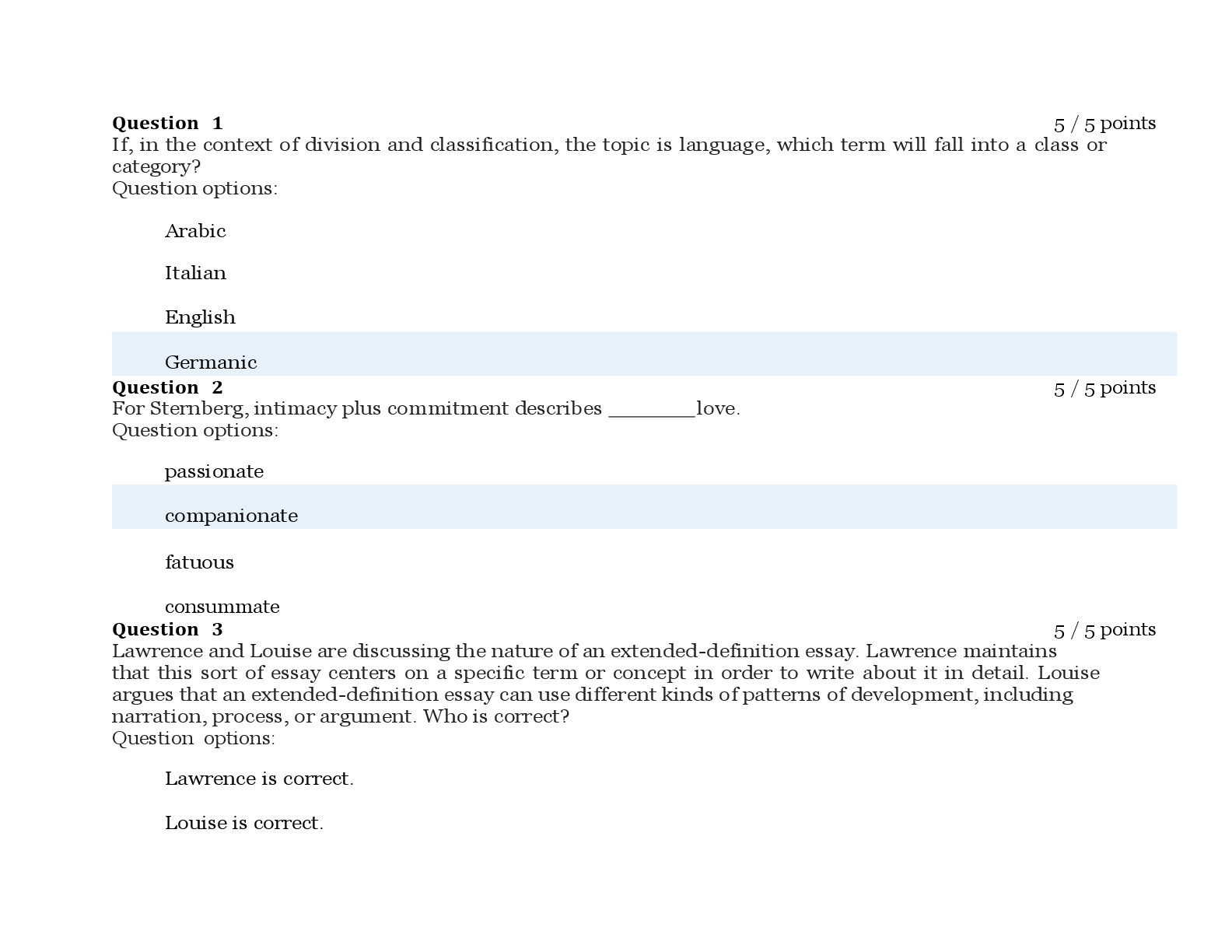

CMA Part I Question Bank WILEY A1: Financial Statements Question 1: 1A1-LS34 Dividends paid to company shareholders would be shown on the statement of cash flows as: *Source: Retired ICMA CMA Exam Questions. Question 2: 1A1-LS39 Which one of the following should be classified as an operating activity on the statement of cash flows? *Source: Retired ICMA CMA Exam Questions. Question 3: 1A1-LS40 All of the following are limitations to the information provided on the statement of financial position except the: *Source: Retired ICMA CMA Exam Questions. . Question 4: 1A1-CQ09 Pierre Company had the following transactions during the fiscal year ending December 31, year 3: • Sold a delivery van with a net book value of $5,000 for $6,000 cash, reporting a gain of $1,000. • Paid interest to bondholders for the amount of $275,000 • Declared dividends on December 31, year 3, of $.08 per share on the 1.3 million shares outstanding, payable to shareholders of record on January 31, year 4. No dividends were declared or paid in prior years. • Accounts receivable decreased from $70,000 on December 31, year 2 to $60,000 on December 31, year 3. • Accounts payable increased from $40,000 on December 31, year 2 to $45,000 on December 31, year 3. • The cash balance was $150,000 on December 31, year 2, and $177,500 on December 31, year 3. Which of the answers below describes the correct entry for Pierre Company's statement of cash flows on December 31, year 3 using the indirect method? Question 5: 1A1-CQ10 Pierre Company had the following transactions during the fiscal year ending December 31, year 3: • Sold a delivery van with a net book value of $5,000 for $6,000 cash, reporting a gain of $1,000. • Paid interest to bondholders for the amount of $275,000 • Declared dividends on December 31, year 3, of $.08 per share on the 1.3 million shares outstanding, payable to shareholders of record on January 31, year 4. No dividends were declared or paid in prior years. • Accounts receivable decreased from $70,000 on December 31, year 2 to $60,000 on December 31, year 3. • Accounts payable increased from $40,000 on December 31, year 2 to $45,000 on December 31, year 3.The cash balance was $150,000 on December 31, year 2, and $177,500 on December 31, year 3 What is the net effect of taking the total cash provided (used) by operating activities, adding it to the cash provided (used) by investing activities, and adding that to the cash provided (used) by financing activities?

[Show More]