Education > QUESTIONS & ANSWERS > Brookwood High School-Unit 5 Modeling and Practice Guide-Rational Decision Making, Using a rational (All)

Brookwood High School-Unit 5 Modeling and Practice Guide-Rational Decision Making, Using a rational decision making model, evaluate the costs and benefits of post-high school life choices… (i.e. college, workforce, technical schools). What did you decide is best for you after high school? Where will that happen? How will you pay for it?

Document Content and Description Below

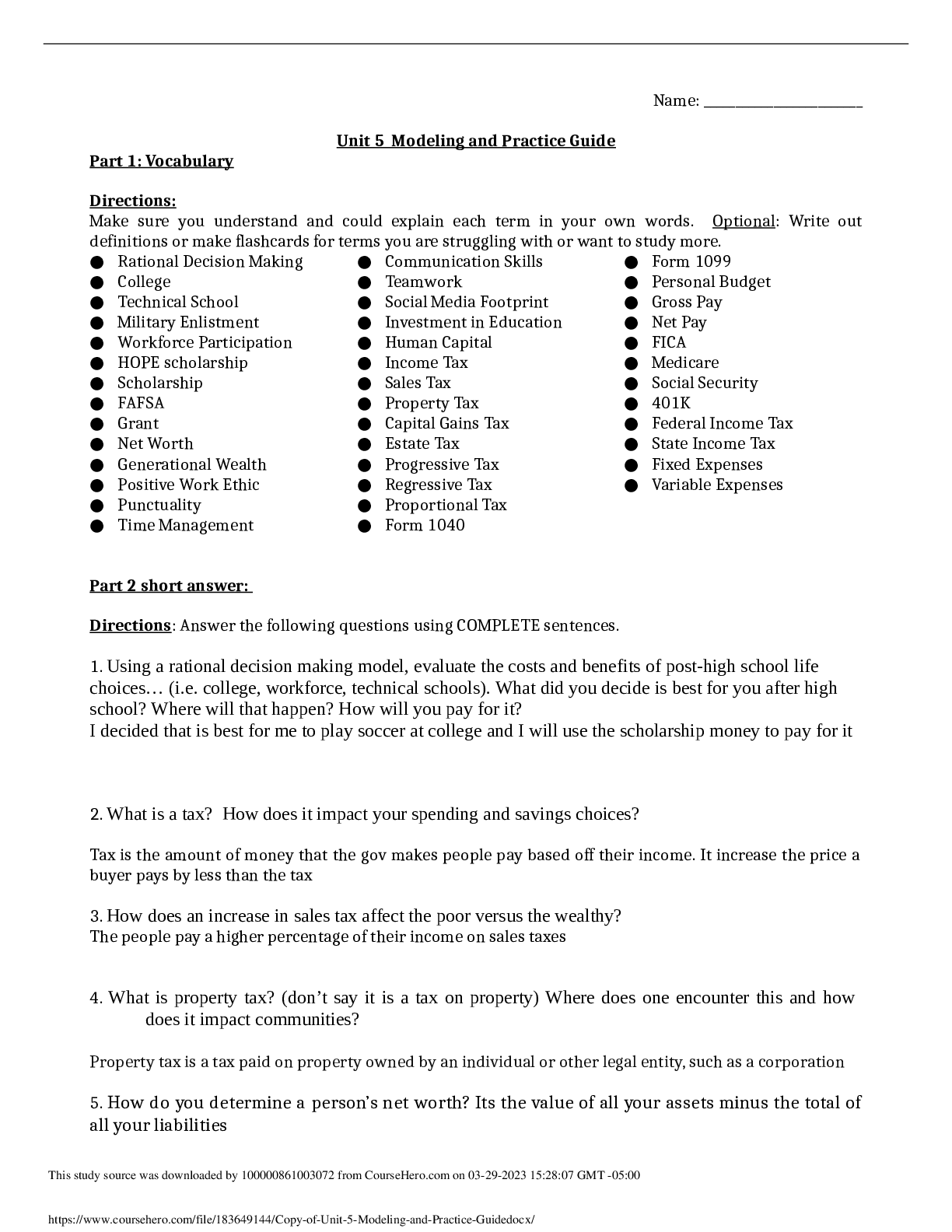

Unit 5 Modeling and Practice Guide Part 1: Vocabulary Directions: Make sure you understand and could explain each term in your own words. Optional: Write out definitions or make flashcards for ter ... ms you are struggling with or want to study more. ● Rational Decision Making ● College ● Technical School ● Military Enlistment ● Workforce Participation ● HOPE scholarship ● Scholarship ● FAFSA ● Grant ● Net Worth ● Generational Wealth ● Positive Work Ethic ● Punctuality ● Time Management ● Communication Skills ● Teamwork ● Social Media Footprint ● Investment in Education ● Human Capital ● Income Tax ● Sales Tax ● Property Tax ● Capital Gains Tax ● Estate Tax ● Progressive Tax ● Regressive Tax ● Proportional Tax ● Form 1040 ● Form 1099 ● Personal Budget ● Gross Pay ● Net Pay ● FICA ● Medicare ● Social Security ● 401K ● Federal Income Tax ● State Income Tax ● Fixed Expenses ● Variable Expenses Part 2 short answer: Directions: Answer the following questions using COMPLETE sentences. 1. Using a rational decision making model, evaluate the costs and benefits of post-high school life choices… (i.e. college, workforce, technical schools). What did you decide is best for you after high school? Where will that happen? How will you pay for it? I decided that is best for me to play soccer at college and I will use the scholarship money to pay for it 2. What is a tax? How does it impact your spending and savings choices? Tax is the amount of money that the gov makes people pay based off their income. It increase the price a buyer pays by less than the tax 3. How does an increase in sales tax affect the poor versus the wealthy? The people pay a higher percentage of their income on sales taxes 4. What is property tax? (don’t say it is a tax on property) Where does one encounter this and how does it impact communities? Property tax is a tax paid on property owned by an individual or other legal entity, such as a corporation 5. How do you determine a person’s net worth? Its the value of all your assets minus the total of all your liabilities 6. Describe the different types of taxes, give an example of each and tell how they impact the different groups of people in the chart. [Show More]

Last updated: 2 years ago

Preview 1 out of 5 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$5.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Mar 29, 2023

Number of pages

5

Written in

All

Additional information

This document has been written for:

Uploaded

Mar 29, 2023

Downloads

0

Views

85