Econ 121 Final Exam Review

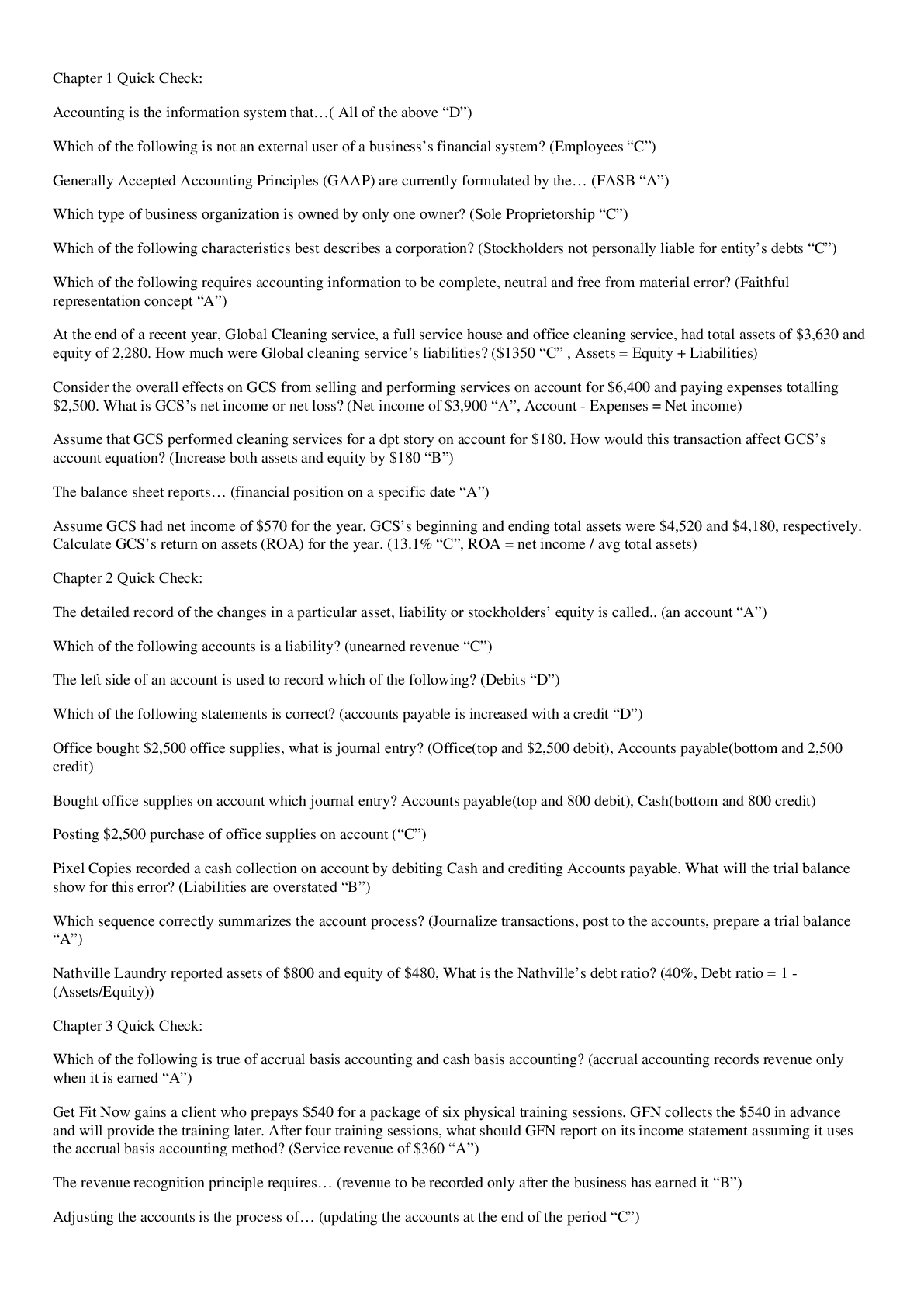

● Chapter 1 Quick Check:

1. Accounting is the information system that…

2. Which of the following is not an external user of a business’s financial system?

3. Generally Accepted Accounting

...

Econ 121 Final Exam Review

● Chapter 1 Quick Check:

1. Accounting is the information system that…

2. Which of the following is not an external user of a business’s financial system?

3. Generally Accepted Accounting Principles (GAAP) are currently formulated by the…

4. Which type of business organization is owned by only one owner?

5. Which of the following characteristics best describes a corporation?

6. Which of the following requires accounting information to be complete, neutral and free from material error?

7. At the end of a recent year, Global Cleaning service, a full service house and office cleaning service, had total assets of $3,630 and equityof 2,280. How much were Global cleaning service’s liabilities?

8. Consider the overall effects on GCS from selling and performing services on account for $6,400 and paying expenses totalling $2,500. What is GCS’s net income or net loss? ( )

9. Assume that GCS performed cleaning services for a dpt story on account for $180. How would this transaction affect GCS’s account equation?

10. The balance sheet reports…

11. Assume GCS had net income of $570 for the year. GCS’s beginning and ending total assets were $4,520 and $4,180, respectively. Calculate GCS’s return on assets (ROA) for the year.

Chapter 2 Quick Check:

1. The detailed record of the changes in a particular asset, liability or stockholders’ equity is called..

2. Which of the following accounts is a liability?

3. The left side of an account is used to record which of the following?

4. Which of the following statements is correct?

5. Office bought $2,500 office supplies, what is journal entry?

6. Bought office supplies on account which journal entry? )

7. Posting $2,500 purchase of office supplies on account

8. Pixel Copies recorded a cash collection on account by debiting Cash and crediting Accounts payable. What will the trial balance show for this error?

9. Which sequence correctly summarizes the account process?

10. Nathville Laundry reported assets of $800 and equity of $480, What is the Nathville’s debt ratio?

Chapter 3 Quick Check:

1. Which of the following is true of accrual basis accounting and cash basis accounting?

2. Get Fit Now gains a client who prepays $540 for a package of six physical training sessions. GFN collects the $540 in advance and will provide the training later. After four training sessions, what should GFN report on its income statement assuming it uses the accrual basis accounting method?

3. The revenue recognition principle requires…

4. Adjusting the accounts is the process of…

5. Which of the following is an example of a deferral (or prepaid) adjusting entry?

6. The adjusted trial balance shows…

7. A&D Window Cleaning performed $450 of services but has not yet billed customers for the month. If A&D fails to record the adjusting entry, what is the impact on the financial statements?

8. A worksheet….

Chapter 4 Quick Check:

1. Assets are listed on the balance sheet in the order of their…

2. Which of the following accounts would be included in the plant assets category of the classified balance sheet?

3. Which situation indicates a net loss within the Income Statement section of the worksheet?

4. Which of the following accounts is not closed?

5. What do closing entries accomplish?

6. Which of the following accounts may appear on a post-closing trial balance?

7. Which of the following steps of the accounting cycle is not completed is not completed at the end of the period?

8. Clean Water Softener Systems has Cash of $600, Accounts Receivable of $900, and Office Supplies of $400. Clean owes $500 on Accounts Payable and has Salaries Payable of $200. Clean’s current ratio is

9. Which of the following statements concerning reversing entries is true?

Chapter 5 Quick Check:

1. Which account does a merchandiser use that a service company does not use?

2. The two main inventory accounting systems are the…

3. JC manufacturing purchased inventory for $5,300 and also paid a $260 freight bill. JCM returned 45% of the goods to the seller and later took a 2% purchase discount. Assume JCM uses a perpetual inventory system. What is JCM’s final cost of the inventory it kept?

4. Suppose Austin Sound had sales of $300,000 and sales returns of $45,000. Cost of goods sold was $152,000. How much gross profit did Austin Sound report?

5. Which of the following accounts would be closed at the end of the year using the perpetual inventory system?

6. What is the order of the subtotals that appear on a multi-step income statement?

7. Assume Juniper natural dyes made net sales revenue of $90,000 and cost of goods sold totaled $58,000. What was JND’s gross profit percentage for this period

Chapter 6 Quick Check:

1. Which principle or concept states that businesses should use the same accounting methods and procedures from period to period?

2. Which inventory costing method assigns to ending merchandise inventory the newest - the most recent - costs incurred during the period?

3. Which inventory costing method results in lowest net income during a period of rising inventory costs?

4. Which of the following is most closely linked to accounting conservatism?

5. At December 31,2016, Stevenson Company overstated ending inventory by $36,000. How does this error affect cost of goods sold and net income for 2016?

6. Suppose Maestro’s had cost of goods sold during the year of $230,000. Beginning merchandise inventory was $35,000 and ending merchandise inventory was $45,000. Determine Maestro’s inventory turnover for the year. Round to the nearest hundredth.

Mock Final Exam:

1) On January 1, 2018, Jordan, Inc. acquired a machine for $1,000,000. The estimated useful life of the asset is five years. Residual value at the end of five years is estimated to be $50,000. Calculate the depreciation expense per year using the straight−line method.

On a multi−step income statement, which of the following is added to operating income to arrive at net income?

A.

sales revenue

B.

interest expense

C.

sales discounts forfeited

This is the correct answer.

D.

operating expenses

All State Services, Inc. acquired 100,000 shares of Omega Metals, Inc. on January 1, 2018. Omega pays a cash dividend of $0.25 per share on March 2, 2019 . With the current investment, All State Services, Inc. holds 8% of Omega. In the journal entry on March 2, 2019, ________.

A.

Dividend Revenue is credited

This is the correct answer.

B.

Equity Investments is debited

C.

Cash Dividends is credited

D.

Equity Investments is credited

The type of intangible asset related to the exclusive right to reproduce and sell a book or intellectual property is a ________.

A.

copyright

This is the correct answer.

B.

patent

C.

franchise

D.

trademark

Which of the following accounts would appear in the income statement credit column of the worksheet?

A.

Unearned Revenue

B.

Prepaid Insurance

C.

Depreciation Expense

D.

Service Revenue

Which of the following accounting methods is generally used to compute amortization expense?

A.

declining-balance

B.

units-of-production

C.

straight-line

This is the correct answer.

D.

first-in, first-out

Short-term investments ________.

A.

are debt and equity securities that the investor expects to hold for more than a year

B.

are investments in debt securities that the investor intends to hold until maturity

C.

are investments in debt securities or equity securities in which the investor holds less than 50 percent of the voting stock and that the investor plans to sell two years after the balance sheet date

D.

are investments in debt and equity securities that are readily marketable and that the investor intends to convert to cash within one year

Which of the following depreciation methods always allocates a higher amount of depreciation in earlier years than in later years?

A.

the straight-line method

B.

the double-declining-balance method

This is the correct answer.

C.

the first-in, first-out method

D.

the units-of-production method

The matching principle requires businesses to report Warranty Expense ________.

A.

in the long-term assets section of the balance sheet

B.

in the period prior to which the company records the revenue related to that warranty

C.

in the same period that the company records the revenue related to that warranty

This is the correct answer.

D.

in the period after the related revenue is recorded

Regarding the accounting equation, which of the following is a correct statement?

A.

The accounting equation is the basic tool of accounting.

B.

Assets

minus−

Liabilities = Equity.

C.

The accounting equation is made up of three parts.

D.

All of the statements are correct.

At the beginning of 2019, Patriots, Inc. has the following account balances:

Accounts Receivable $45,000 (Debit)

Allowance for Bad Debts $8,000 (Credit)

Bad Debts Expense $0

During the year, credit sales amounted to $810,000. Cash collected on credit sales amounted to $770,000, and $18,000 has been written off. At the end of the year, the company adjusted for bad debts expense using the percent-of-sales method and applied a rate, based on past history, of 3.5%. The amount of bad debts expense for 2019 is ________.

A.

$56,875

B.

$18,000

C.

$18,350

D.

$28,350

Which of the following statements is not correct?

A.

Even in a perpetual inventory system, a business must count inventory at least one a year.

B.

Restaurants and small retail stores often use the periodic inventory system.

C.

In a periodic inventory system, merchandise inventory and purchasing systems are integrated with the records for Accounts Receivable and Sales Revenue.

This is the correct answer.

D.

In a perpetual inventory system, the "cash register" at the store is a computer terminal that records sales and updates inventory records.

Which of the following is subtracted from net sales revenue to arrive at gross profit on a

Multiminus−step income statement?

A.

selling expense

B.

sales discounts

C.

cost of goods sold

This is the correct answer.

D.

all of the above

Kentucky Company uses the indirect method to prepare the statement of cash flows. Refer to the following income statement:

Kentucky Company

Income Statement

Year Ended December 31, 2019

Sales Revenue $249,000

Interest Revenue 2,300

Gain on Sale of Plant Assets 5,300

Total Revenues and Gains $256,600

Cost of Goods Sold 124,000

Salary Expense 43,000

Depreciation Expense 14,000

Other Operating Expenses 20,000

Interest Expense 1,600

Income Tax Expense 5,100

Total Expenses 207,700

Net Income (Loss)

$48,900

Additional information provided by the company includes the following:

1. Current assets, other than cash, increased by $21,000.

2. Current liabilities decreased by $1,200.

Compute the net cash provided by (used for) operating activities.

A.

$35,400

This is the correct answer.

B.

$11,800

C.

$26,700

D.

$40,700

The ending Merchandise Inventory for the current accounting period is understated by $2,700. What effect will this error have on Cost of Goods Sold and Net Income for the current accounting period?

A.

Cost of Goods Sold Net Income

Overstated Overstated

B.

Cost of Goods Sold Net Income

Understated Overstated

C.

Cost of Goods Sold Net Income

Overstated Understated

This is the correct answer.

D.

Cost of Goods Sold Net Income

Understated Understated

If a company is using accrual basis accounting, when should it record revenue?

A.

when cash is received, even though services may be performed at a later date

B.

before services are performed

C.

when cash is received, 30 days after the completion of the services

D.

when services are performed, even though cash may be received at a later date

Nichols, Inc. had the following balances and transactions during 2018:

Beginning Merchandise Inventory as of January 1, 2018

300300

units at $ 82$82

March 10 Sold

8080

units

June 10 Purchased

600600

units at $ 84$84

October 30 Sold

380380

units

What would be reported for Ending Merchandise Inventory on the balance sheet at December 31, 2018 if the perpetual inventory system and the firstminus−in,firstminus−out inventory costing method are used?

A.

$ 24 comma 600$24,600

B.

$ 50 comma 400$50,400

C.

$ 36 comma 960$36,960

This is the correct answer.

D.

$ 6 comma 560

Cougar, Inc. had the following balances and transactions during 2019:

Beginning Merchandise Inventory 150 units at $80

March 10 Sold 50 units

June 10 Purchased 300 units at $82

October 30 Sold 140 units

What would be reported as Cost of Goods Sold on the income statement for the year ending December 31, 2019 if the perpetual inventory system and the

weightedminus−average

inventory costing method are used? (Round the unit costs to two decimal places and total costs to the nearest dollar.)

A.

$11,410

B.

$15,410

This is the correct answer.

C.

$32,600

D.

$21,190

A company originally issued 17 comma 000 17,000 shares of $ 10.00$10.00 par value common stock at $ 9.00$9.00 per share. The board of directors declares a 1111% stock dividend when the market price of the stock is $ 14.00$14.00 a share. Which of the following is included in the entry to record the declaration of a stock dividend?

A.

Stock Dividends is credited for

$ 26 comma 180$26,180.

B.

Stock Dividends is debited for

$ 16 comma 830$16,830.

C.

Stock Dividends is debited for

$ 26 comma 180$26,180.

This is the correct answer.

D.

Paidminus−In

Capital in Excess of

Parlong dash—Common

is credited for

$ 16 comma 830$16,830.

On a multiminus−step income statement, the operating expenses are subtracted from ________ to arrive at operating income.

A.

net sales

B.

cost of goods sold

C.

gross profit

This is the correct answer.

D.

net profit

Which of the following is the correct accounting treatment for a patent?

A.

A patent must be shown as a current asset on the balance sheet.

B.

A patent must be depreciated or impaired, but not amortized.

C.

A patent must be capitalized and amortized over 20 years or less.

This is the correct answer.

D.

A patent must be expensed, not capitalized, in the period in which it is purchased.

The ending merchandise inventory for the current year is overstated by $26,000. What effect will this error have on the following year's net income?

A.

The net income will be overstated by

$ 26 comma 000$26,000.

B.

The net income will be understated by

$ 26 comma 000$26,000.

This is the correct answer.

C.

The net income will be overstated by

$ 52 comma 000$52,000.

D.

The net income will be understated by

$ 52 comma 000$52,000

An account that is not closed at the end of the period is called a(n) ________.

A.

temporary account

B.

revenue account

C.

expense account

D.

permanent account

Barron, Inc. sold goods for $883,500 on account. The company operates in a state that imposes a 9% sales tax. What is the amount of the sales tax payable to thestate?

A.

$19,879

B.

$79,515

This is the correct answer.

C.

$159,030

D.

$39,758

On January 1, 2018, Jordan, Inc. acquired a machine for $1,010,000. The estimated useful life of the asset is five years. Residual value at the end of five years is estimated to be $61,000. Calculate the depreciation expense per year using the straightminus−line method.

A.

$ 250 comma 800$250,800

B.

$189,800

This is the correct answer.

C.

$ 202 comma 000$202,000

D.

$ 252 comma 500

Sunset, Inc. has a policy of accruing $2,300 for every employee as a vacation benefit. Sarah, an employee, took a vacation. Which of the following is the correct journal entry for the vacation benefit paid?

A.

Vacation Benefits Payable 1,917

Vacation Benefits Expense 1,917

B.

Vacation Benefits Expense 2,300

Cash 2,300

C.

Vacation Benefits Payable 2,300

Cash 2,300

This is the correct answer.

D.

Vacation Benefits Expense 1,917

Vacation Benefits Payable 1,917

Which one of the following account groups will decrease with a debit?

A.

assets and expenses

B.

liabilities and revenues

This is the correct answer.

C.

assets and liabilities

D.

revenues and expenses

The Interest Expense in the worksheet's unadjusted trial balance column is $3,000. Interest Expense in the income statement column is $7,000. Which of the following entries would have caused this difference?

A.

a

$ 7 comma 000$7,000

credit to Interest Expense in the worksheet's adjustments column

B.

a

$4,000 debit to Interest Expense in the worksheet's adjustments column

This is the correct answer.

C.

a

$ 7 comma 000$7,000

credit to Interest Payable in the worksheet's adjustments column

D.

a

$ 4 comma 000$4,000

credit to Interest Expense in the worksheet's adjustments column

Element Corporation reported the following equity section on its current balance sheet. The common stock is currently selling for $ 17.00$17.00 per share.

Common Stock,

$ 5.00$5.00

par, 330,000

shares authorized, 143,000

shares issued and outstanding $715,000

Paidminus−In

Capital in Excess of

Parlong dash—Common 135,000

Retained Earnings 296,000

Total Stockholders' Equity

$1,146,000

After a

2minus−forminus−1

stock split, what is the number of issued shares?

A.

286,000

This is the correct answer.

B.

135 comma 000135,000

C.

278 comma 000278,000

D.

270 comma 000

Which of the following is a liability account?

A.

Cash

B.

Building

C.

Prepaid Advertising

D.

Unearned Rent

A company that uses the perpetual inventory system purchases inventory for $61,000 on account, with terms of 22/10, n/30. Which of the following is the journal entry to record the payment made within 10 days?

A.

a debit to Accounts Payable for

$ 59 comma 780$59,780,

a debit to Merchandise Inventory for

$ 1 comma 220$1,220,

and a credit to Cash for $ 61 comma 000$61,000

B.

a debit to Merchandise Inventory for

$ 1 comma 220$1,220,

a debit to Accounts Payable for

$ 61 comma 000$61,000,

and a credit to Cash for $ 62 comma 220$62,220

C.

a debit to Accounts Payable for $61,000, a credit to Merchandise Inventory for $1,220, and a credit to Cash for $59,780

This is the correct answer.

D.

a debit to Accounts Payable for

$ 61 comma 000$61,000,

a credit to Cash for

$ 1 comma 220$1,220,

and a credit to Merchandise Inventory for $ 59 comma 780

Unearned Revenue is classified as a(n) ________ account.

A.

liability

This is the correct answer.

B.

equity

C.

revenue

D.

asset

Bentley Corporation received cash from issuing 10,000 shares of common stock at par on January 1, 2018. The stock has a par value of $0.01 per share. Which is the correct journal entry to record this transaction?

A.

Paidminus−In

Capital in Excess of

Parlong dash—Common

is debited for

$ 9 comma 900$9,900,

and Common

Stocklong dash—$ 0.01$0.01

Par Value is credited for

$ 9 comma 900$9,900.

B.

Cash is debited for $100, and Common Stocklong dash—$0.01

Par Value is credited for $100.

This is the correct answer.

C.

Cash is credited for

$ 10 comma 000$10,000

and Common

Stocklong dash—$ 0.01$0.01

Par Value is debited for

$ 10 comma 000$10,000.

D.

Cash is debited for

$ 10 comma 000$10,000,

Common

Stocklong dash—$ 0.01$0.01

Par Value is credited for

$ 100$100,

and

Paidminus−In

Capital in Excess of

Parminus−Common

credited for

$ 9 comma 900$9,900.

A Plus Appliances sells dishwashers with a four minus−year warranty. In 2019, sales revenue for dishwashers is $87,000. The company estimates warranty expense at4.5%

of revenues. What is the total estimated warranty payable of A Plus Appliances as of December 31, 2019? A Plus Applicances began operating in 2019. (Round your final answer to the nearest dollar.)

A.

$3,915

This is the correct answer.

B.

$1,433

C.

$ 979$979

D.

$ 3 comma 071

Adjusting entries are needed to correctly measure the ________.

A.

net income (loss) on the balance sheet

B.

net income (loss) on the income statement

This is the correct answer.

C.

beginning balance in the Cash account

D.

ending balance in the Cash account

Which of the following is true of internal control?

A.

Internal control procedures tend to diminish the importance of operational efficiency.

B.

Internal controls are only necessary for public companies.

C.

One of the major purposes of internal control is to ensure that the assets are safeguarded.

This is the correct answer.

D.

A company's outside auditor is responsible for the company's internal control system.

Murphy, Inc. prepaid $9,600 on October 1, 2018 for a one−year insurance premium. Coverage begins October 1. On January 1, 2019 (after December 31adjustments), the Prepaid Insurance account will have a debit balance of ________. (Round any intermediate calculations to two decimal places, and your final answer to the nearest whole number.)

A.

$7,200

This is the correct answer.

B.

$8,000

C.

$10,400

D.

$9,600

A company purchased 100 units for $40 each on January 31. It purchased 120 units for $50

each on February 28. It sold 175 units for $65 each from March 1 through December 31. If the company uses the lastminus−in, firstminus−out inventory costing method, what is the amount of Cost of Goods Sold on the income statement for the year ending December 31? (Assume that the company uses a perpetual inventory system.)

A.

$ 4 comma 000$4,000

B.

$ 6 comma 000$6,000

C.

$8,200

This is the correct answer.

D.

$ 10 comma 000

If bonds with a face value of $205,000 are issued at 94, the amount of cash proceeds is ________.

A.

$ 204 comma 906$204,906

B.

$ 180 comma 400$180,400

C.

$192,700

This is the correct answer.

D.

$ 205 comma 000

Trading debt investments include ________.

A.

debt securities that the investor expects to hold longer than one year or debt securities that are not readily marketable

B.

debt securities that the investor plans to sell in the very near future

This is the correct answer.

C.

investments in debt securities that the investor intends to hold until they mature

D.

investments in debt securities that are not readily marketable and that the investor intends to hold until they mature

Which of the following will be shown under the investing activities section of the statement of cash flows?

A.

loaned money to a third party

This is the correct answer.

B.

purchased treasury stock for cash

C.

issued notes payable to purchase equipment

D.

paid cash dividends to stockholders

A company receives payment from one of its customers on August 5 for services performed on July 21. Which of the following entries would be recorded if the company uses accrual basis accounting?

A.

Service Revenue 1,000

Cash 1,000

B.

Cash 1,000

Accounts Receivable 1,000

This is the correct answer.

C.

Accounts Payable 1,000

Cash 1,000

D.

Cash 1,000

Service Revenue 1,000

Which of the following is the correct order of subtotals that appear on a multiminus−step income statement?

A.

Gross profit, Net sales revenue, Net income

B.

Net income, Operating income, Net income

C.

Gross profit, Operating income, Net income

This is the correct answer.

D.

Operating income, Gross profit, Net income

The matching principle requires businesses to report Warranty Expense ________.

A.

in the period prior to which the company records the revenue related to that warranty

B.

in the long-term assets section of the balance sheet

C.

in the period after the related revenue is recorded

D.

in the same period that the company records the revenue related to that warranty

Short-term investments ________.

A.

are investments in debt securities or equity securities in which the investor holds less than 50 percent of the voting stock and that the investor plans to sell two years after the balance sheet date

B.

are debt and equity securities that the investor expects to hold for more than a year

C.

are investments in debt and equity securities that are readily marketable and that the investor intends to convert to cash within one year

This is the correct answer.

D.

are investments in debt securities that the investor intends to hold until maturity

Which of the following accounts would appear in the income statement credit column of the worksheet?

A.

Depreciation Expense

B.

Unearned Revenue

C.

Service Revenue

This is the correct answer.

D.

Prepaid Insurance

The type of intangible asset related to the exclusive right to reproduce and sell a book or intellectual property is a ________.

A.

franchise

B.

patent

C.

copyright

This is the correct answer.

D.

Trademark

Which of the following accounts increases with a credit?

A.

Accounts Receivable

B.

Prepaid Expense

C.

Common Stock

This is the correct answer.

D.

Dividends

Which of the following depreciation methods allocate a varying amount of depreciation to expense each year based on an asset's usage?

A.

the double-declining-balance method

B.

the straight-line method

C.

the units-of-production method

This is the correct answer.

D.

the annuity method

Businesses record goodwill ________.

A.

when they continue the business of an acquired corporation

B.

if their market value has increased significantly in the recent years

C.

when they enjoy an outstanding reputation and loyalty with customers

D.

if they acquire another company at an amount higher than the market value of its net assets

All State Services, Inc. acquired 100,000 shares of Omega Metals, Inc. on January 1, 2018. Omega pays a cash dividend of $0.25 per share on March 2, 2019 . With the current investment, All State Services, Inc. holds 8% of Omega. In the journal entry on March 2, 2019, ________.

A.

Dividend Revenue is credited

This is the correct answer.

B.

Cash Dividends is credited

C.

Equity Investments is debited

D.

Equity Investments is credited

When preparing a worksheet, net income is recorded in the _______.

A.

adjusted trial balance debit column

B.

income statement debit column

This is the correct answer.

C.

balance sheet debit column

D.

income statement credit column

A check payment for $658 was incorrectly entered in the Cash account as $856. Which of the following adjustments needs to be made?

A.

increase the book balance

This is the correct answer.

B.

decrease the bank statement balance

C.

increase the bank statement balance

D.

decrease the book balance

Which of the following is a benefit provided by internal control?

A.

ensuring timely collection of accounts receivables

B.

ensuring that a business is profitable

C.

promoting operational efficiency

This is the correct answer.

D.

ensuring that collusion will never happen

On a multiminus−step income statement, which of the following is added to operating income to arrive at net income?

A.

sales revenue

B.

interest expense

C.

sales discounts forfeited

This is the correct answer.

D.

operating expenses

Which of the following is an expense that results from the usage of a natural resource?

A.

depletion

This is the correct answer.

B.

obsolescence

C.

amortization

D.

Depreciation

Regarding the accounting equation, which of the following is a correct statement?

A.

Assets − Liabilities = Equity.

B.

The accounting equation is made up of three parts.

C.

The accounting equation is the basic tool of accounting.

D.

All of the statements are correct.

Which of the following sections of the statement of cash flows include activities that affect net income on the income statement?

A.

the investing activities section

B.

the operating activities section

This is the correct answer.

C.

the financing activities section

D.

the non-cash investing and financing section

Which of the following accounting methods is generally used to compute amortization expense?

A.

straight-line

This is the correct answer.

B.

units-of-production

C.

first-in, first-out

D.

declining-balance

Which one of the following items requires an adjustment on the bank side of the bank reconciliation?

A.

deposits in transit

This is the correct answer.

B.

interest earned

C.

a note collected by the bank

D.

a bank service charge

The account title used for recording a written promise that a customer will pay the business a fixed amount of money and interest by a certain date in the future is________.

A.

Notes Receivable

This is the correct answer.

B.

Prepaid Note

C.

Notes Payable

D.

Accounts Receivable

The assets of Star Company are $100,000 and the total liabilities are $20,000. The equity is ________.

A.

$ 100 comma 000$100,000

B.

$80,000

This is the correct answer.

C.

$ 20 comma 000$20,000

D.

$ 120 comma 000

The entries that transfer the revenue, expense, and dividends balances to the Retained Earnings account to prepare the company's books for the next period are called________ entries.

A.

adjusting

B.

closing

This is the correct answer.

C.

opening

D.

end of period

Which of the following depreciation methods always allocates a higher amount of depreciation in earlier years than in later years?

A.

the double-declining-balance method

This is the correct answer.

B.

the straight-line method

C.

the units-of-production method

D.

the first-in, first-out method

The entry to record depreciation includes a debit to the ________ account.

A.

Cash

B.

Depreciation Expense

This is the correct answer.

C.

Equipment

D.

Accumulated Depreciation

Merchandise inventory accounting systems can be broadly categorized into two types. They are ________.

A.

manufacturer and producer

B.

FIFO and LIFO

C.

wholesale and retail

D.

perpetual and periodic

[Show More]

.png)