Air Methods Exam Questions with correct Answers || Complete Version 2024

$ 12.5

Nelson Physics 12 - Solutions Manual

$ 20

Exam2-1 - Pathophysiology (Essentials of Pathophysiology (Rasmussen University

$ 14.5

Summary Shadow Health COPD ;Debbie O’Connor- Subjective Data Collection: 32 of 32 (100.0%)

$ 13.5

Solution Manual For Web Development Full Stack 1st Edition by F. Max Coller Chapter 1-12

$ 19

ASTRONOMY 7n_Exam_2 - University of Phoenix. Contains 120 Q&A

$ 10.5

AQA GCSE MATHEMATICS PAPER 2 2020 QP/ TOP SCORE

$ 14

Solution and Answer Guide CompTIA CySA+ Guide to Cybersecurity Analyst (CS0-003) 3rd Edition 2025 by Mark Ciampa Chapter 1-12

$ 19

Ammo 63 U.S. ARMY EXPL SAFETY FAMILIARIZATION Defense Ammunition Center_Ammo-63-DL: U.S. Army Explosives Safety With 100% Correct Solution

$ 7

Actual 2024 AQA AS COMPUTER SCIENCE 7516/1 Paper 1 Merged Question Paper + Mark Scheme

$ 7

TEST BANK for An Introduction to Brain and Behavior 6th Edition by Bryan Kolb, Ian Whishaw and Campbell Teskey.

$ 25

Netsuite Developer II Certification Study Guide Questions with Correct Answers

$ 7.5

ECO 320 MACROECONOMIC THEORY - University of Texas. Problem Set 4: Aggregate Supply. Worked Solutions.

$ 9.5

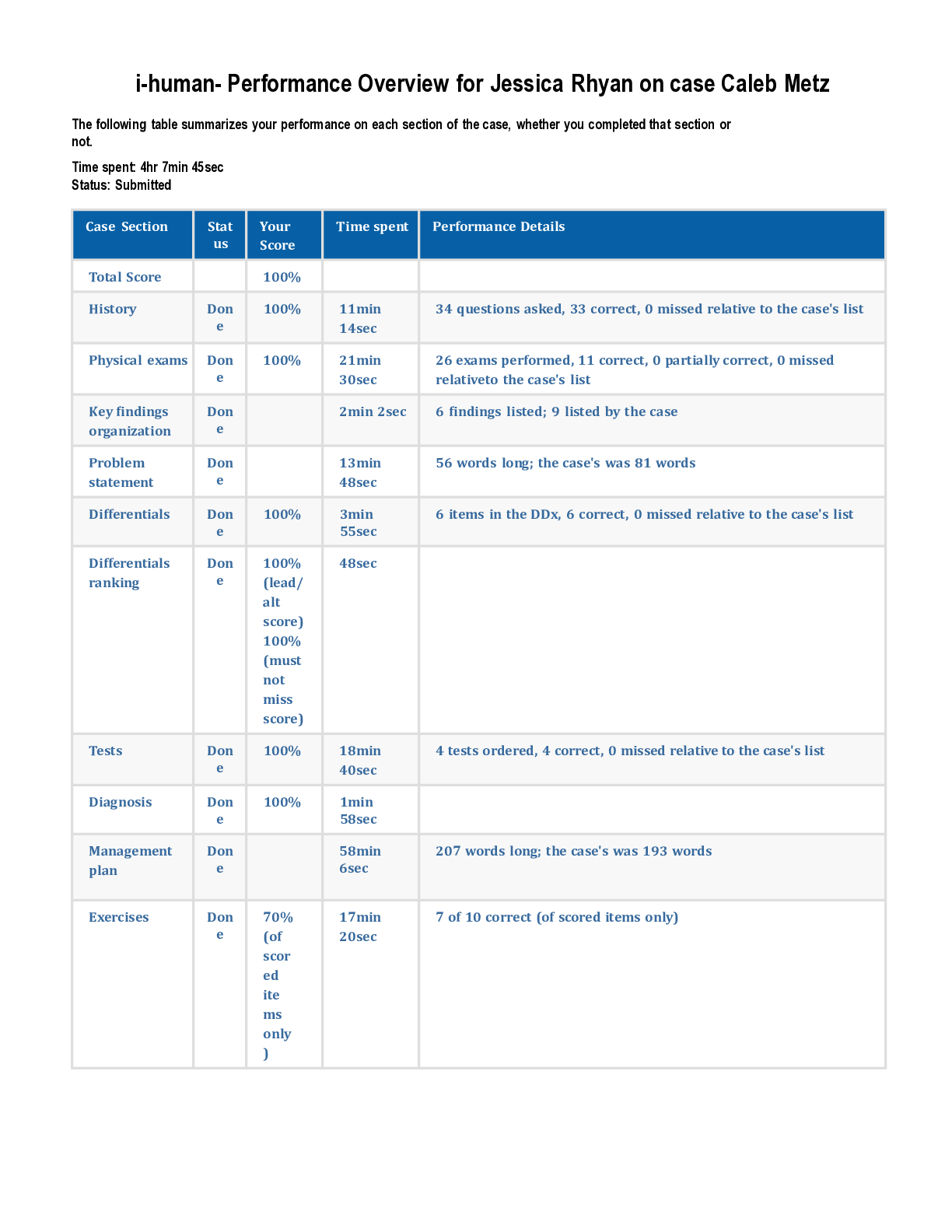

i-human- Performance Overview for Jessica Rhyan on case Caleb Metz

$ 14.5

NBCOT Exam Practice Questions and Answers with Rationale

$ 9

eBook Forest Pest and Disease Management in Latin America 1st Edition By Sergio A. Estay

$ 30

Contemporary Linguistic Analysis An Introduction, 9th Edition, By John Archibald, William O'Grady [PDF] [eBook]

$ 29

APICS - CPIM-SMR CPIM Strategic Management of Resources TEST PREP with answers

$ 12

SP 180 Module 3 Quiz | Score 90/100 | Ashworth College

$ 12

A level GCE Further Mathematics A Y533/01: Mechanics Advanced Subsidiary GCE Mark Scheme for Autumn 2021

$ 5

Pearson Edexcel Mark Scheme (Provisional) Summer 2021 Pearson Edexcel International GCSE In Science (Single Award) (4SS0) Paper 1B

$ 6

VATI Comprehensive Predictor NCLEX Questions and Correct Answers Graded A+

$ 8

Intro to Mass Media Final Exam 2022 with complete solution

$ 8.5

COMP-230 Week 6 Course Project: Automating Administrative Tasks [RATED A]

$ 13

.png)

AHIP Module 2 Questions with Answers

$ 4

NBCOT Test Prep A_ Questions & Answers.

$ 10

AICP EXAM PREP Questions with 100% Correct Answers Latest Updates 2024 GRADE A+

$ 9.5

Program Evaluation and Performance Measurement An Introduction to Practice 2nd Edition By James McDavid Irene Huse Laura Ingleson (Test Bank )

$ 17

MN 553 Unit 7 Quiz - Question and Answers | GRADED A

$ 13

LETRS Module 2 Test | All Solved

$ 6

Summary DCSA SPeD: Physical Security Certification (PSC) Solution Guide

$ 8.5

AQA A-level BUSINESS Paper 3 Business 3 2021 QP

$ 6

(WGU D173) - EDUC 5060 Educational Technology for Teaching & Learning - FA Review 20242025

$ 11

Official June 2024 AQA AS ENGLISH LANGUAGE 7701/2 Paper 2 Language varieties Merged Question Paper + Mark Scheme

$ 7

AEM 6.0 Business Practitioner Exam Study Guide with complete and correct solution

$ 5

ADVANCED PATHOPHYSIOLOGY MIDTERM- exam practice questions with verified answers solution 2020/2021

$ 9.5

Oxford AQA AS AND A LEVEL GEOGRAPHY 9636 and 9637 2021 ASSESSMENT RESOURCES Answers and commentaries. 2021 ANSWERS AND COMMENTARIES

$ 15

CH 06 - Distribution and Network Models..Questions and Answers

$ 5

NR 601 Midterm Exam Information> Questions and Answers A+

$ 19

HESI RN EXTRA CREDIT MODULE 3 (MENTAL HEALTH CONCEPTS) EXAM QUESTIONS AND ANSWERS WITH EXPLANATIONS

$ 14

Pearson Edexcel Level 3 GCE_Physics_9PH0/03 Question Paper 2020 | General and Practical Principles in Physics

$ 6.5

Aviation 8 Questions and Answers Graded A+

$ 5

Summary Week 4.doc British Petroleum Oil Spill University of Phoenix ENV/420 British Petroleum Oil Spill œOn April 20, 2010, the oil drilling rig Deepwater Horizon, operating in the Macondo Prospect in the Gulf of Mexico, exploded and sank resulting in th

$ 13

GCE Turkish F889/01: Listening, Reading and Writing 1 Advanced Subsidiary GCE Mark Scheme for November 2020

$ 7.5

Diabetic Exam Questions with Answers 100% Correctly Tested and Verified Updates

$ 18.5

ATI COMPREHENSIVE 2019 C

$ 11

RN Comprehensive Predictor Form A (Solutions by a Verified Tutor)

$ 10

Chapter 1 exam questions and answer solution docs 2020

$ 9.5

Cambridge IGCSE: PHYSICS Paper 6 Alternative to Practical QUESTION PAPER - March 2022

$ 5.5

.png)

NR 509 Week 2 Midweek Comprehension Quiz | Graded with all answers correct

$ 5

Test Bank for Discrete Mathematics and Its Applications 8th Edition by Kenneth H. Rosen

$ 19

OCR A Level Biology B (Advancing Biology) H422/01 Fundamentals of biology Thursday 9 June 2022 – Afternoon

$ 9

Test Bank For Psychology 13th Edition By Carole Wade, Carol Tavris, Samuel Sommers, Lisa Shin

$ 18

CMAA 2022- Practice Exam 293 Questions with 100% Correct Answers – COMPLETE SOLUTION

$ 10

NR 706 Week 7 Assignment; Web-Based Intervention Proposal Paper

$ 10

eBook Applications of Fourier Transforms to Generalized Functions 1st Edition by M. Rahman

$ 29

PreClinical Lab OCCT 2004: Americans with Disabilities Act ppt (Exam 3/ Final)

$ 8.5

Pearson Edexcel International_GCSE (9-1) English Literature_4ET1/01 Mark Scheme Jan 2022 | Paper 1: Poetry and Modern Prose

$ 7.5

Pearson Edexcel Level 3 GCE 9ET0/03 English Literature Advanced PAPER 3: Poetry question p aper 3 june 2023 + mark scheme

$ 10

Columbia University - CS 4111database_2014

$ 3

CRST 290 Quiz 2 - Maker of Heaven and Earth | Score 50/50 | Liberty University

$ 11

Questions and Answers > Chapter 8 Case Study & Questions Discussion Case 1

$ 7

eBook PDF for Plasma Science and Technology Lectures in Physics, Chemistry, Biology, and Engineering 1st Edition By Fridman A.

$ 30

ATI RN Capstone Weekly Tips

$ 20

NR-535 Week 4 Assignment: Preparing to Teach – Developing a Teaching Plan

$ 10

SEJPME 1 Post Test 100%.pdf

$ 10

Solutions Manual for Product Design For Engineers 1st Edition By Devdas Shetty

$ 23

.png)

HSM 340 MIDTERM EXAM QUESTIONS AND ANSWERS(TOP SOLUTION)A+

$ 10.5

eBook [PDF] Livestock and Literature Reimagining Postanimal Companion Species 1st Edition By Liza Bauer

$ 29

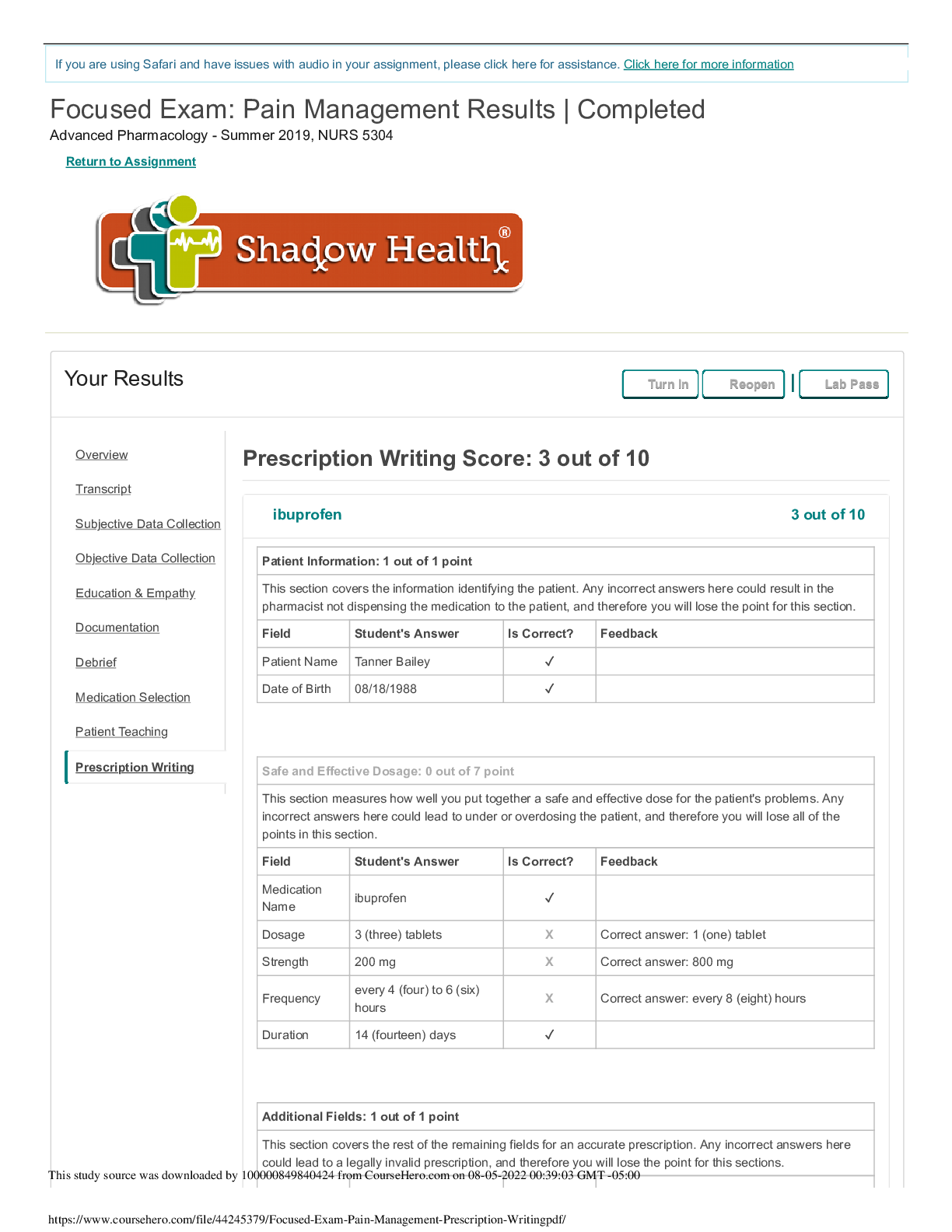

Tanner Bailey Pain Management Shadow Health Focused Exam-Prescription Writing

![Preview image of Income Tax School Comprehensive Module 2: Final Exam [ALL CORRECT SOLUTIONS] document](https://browseimages.nyc3.digitaloceanspaces.com/paper-images/2023/Apr/21/SEnZrEiC2023-04-20-11-1064419c3576599.png)