Risk Management and Insurance > QUESTIONS & ANSWERS > Texas Life Insurance Exam Question and Answers with Certified Solutions (All)

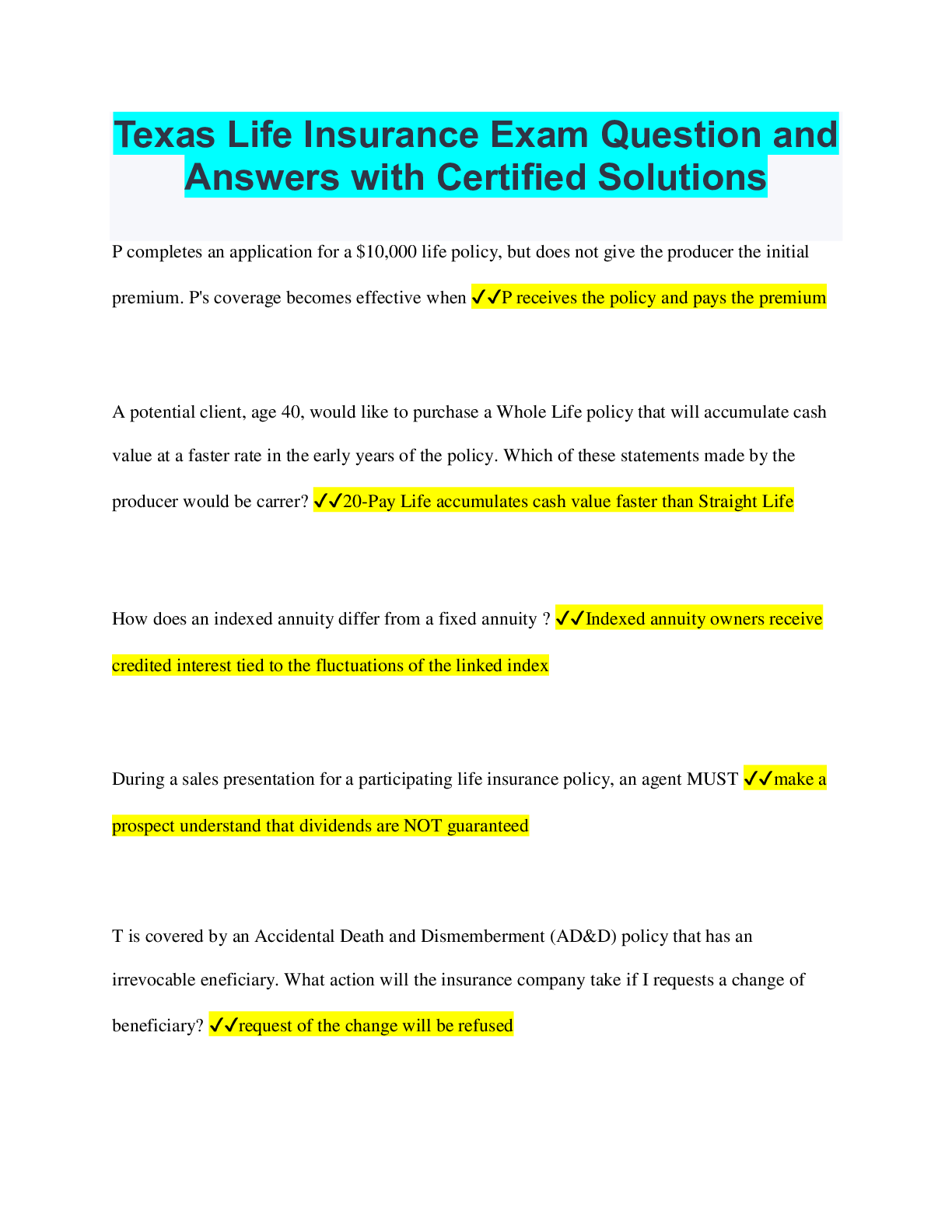

Texas Life Insurance Exam Question and Answers with Certified Solutions

Document Content and Description Below

Texas Life Insurance Exam Question and Answers with Certified Solutions P completes an application for a $10,000 life policy, but does not give the producer the initial premium. P's coverage become ... s effective when ✔✔P receives the policy and pays the premium A potential client, age 40, would like to purchase a Whole Life policy that will accumulate cash value at a faster rate in the early years of the policy. Which of these statements made by the producer would be carrer? ✔✔20-Pay Life accumulates cash value faster than Straight Life How does an indexed annuity differ from a fixed annuity ? ✔✔Indexed annuity owners receive credited interest tied to the fluctuations of the linked index During a sales presentation for a participating life insurance policy, an agent MUST ✔✔make a prospect understand that dividends are NOT guaranteed T is covered by an Accidental Death and Dismemberment (AD&D) policy that has an irrevocable eneficiary. What action will the insurance company take if I requests a change of beneficiary? ✔✔request of the change will be refused Which provision allows the policyowner to change a term life policy to a permanent one without providing proof of good health? ✔✔conversion T has a term policy that allows him to continue the coverage after expiration of the initial policy period What type of term coverage is this? ✔✔renewable Which of the following is NOT a required provision in group life policies? ✔✔Right to loan The Insurance Commissioner must give how many days notice prior to holding a hearing regarding an agent's unfair or deceptive practice? ✔✔30 The Accelerated Death Benefit provision in a life insurance policy is also known as a(n) ) ✔✔Living Benefit In Texas, an individual life insurance policy is required to have a grace period of ✔✔31 days Which statement is correct regarding the premium payment schedule for whole life policies? ✔✔Premiums are payable throughout the insured's lifetime/ coverage lasts until death of the insured Company Z has a Cross Purchase Buy-Sell Agreement in place among its three founding partners. If the agreement is funded with individual life insurance, what would it require? ✔✔Each partner must own a policy on the other partners Why would the Insurance Commissioner examine the records of an insurance company? ✔✔To determine the solvency of the company Which of the following features of a group Term Life policy enables an individual to leave the group and continue his or her insurance without providing evidence of insurability? ✔✔Conversion privilege Taking receipt of premiums and holding them for the insurance company is an example of: ✔✔fiduciary responsibility K buys a policy where the premium stays fixed for the first 5 years. The premium then increases in year 6 and stays level thereafter, all the while the death benefit remains the same. What kind of policy is this? ✔✔Modified Whole Life What does a Face Amount Plus Cash Value Policy supposed to pay at the insured's death? ✔✔Face amount plus the policy's cash value In regards to representations or warranties, which of these statements is TRUE? ✔✔If material to the risk, false representations will void a policy What provision in a life insurance policy states that the application is considered part of the contract? ✔✔Entire Contract provision J is 35-years old and looking to purchase a whole life insurance policy. Which of the following types of policies will provide the most rapid growth of cash value? ✔✔20-pay life Which of the following statements about accumulated interest eared on dividends from an insurance policy is TRUE? ✔✔It is taxed as ordinary income A life insurance policy which ensures that the premium will be paid if the insured becomes disabled has what kind of rider attached? ✔✔Waiver of Premium Which of the following is a requirement for obtaining a Texas insurance agent's license? ✔✔Be honest, trustworthy, and reliable Which of the following groups may NOT be insured by a group life insurance policy? ✔✔Individuals who are related by blood The amount of coverage on a group credit life policy is limited to ✔✔the insured's total loan value D was actively serving in the Marines when he was killed in an automobile accident while on leave. His $100,000 Whole life policy contains a War Exclusion clause. How much will D's beneficiary's receive? ✔✔The full face amount The underwriting process involves all of these EXCEPT for ✔✔Policy loan Which of the following Dividend options results in taxable income to the policyowner? ✔✔Accumulation at interest [Show More]

Last updated: 2 years ago

Preview 1 out of 22 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

Texas Life and Health Insurance Bundled Exams (2022/2023) Already Passed

Texas Life and Health Insurance Bundled Exams (2022/2023) Already Passed

By Nutmegs 2 years ago

$22

13

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 23, 2023

Number of pages

22

Written in

All

Additional information

This document has been written for:

Uploaded

Apr 23, 2023

Downloads

0

Views

127

.png)