ACC 201 Week 3 Quiz 3

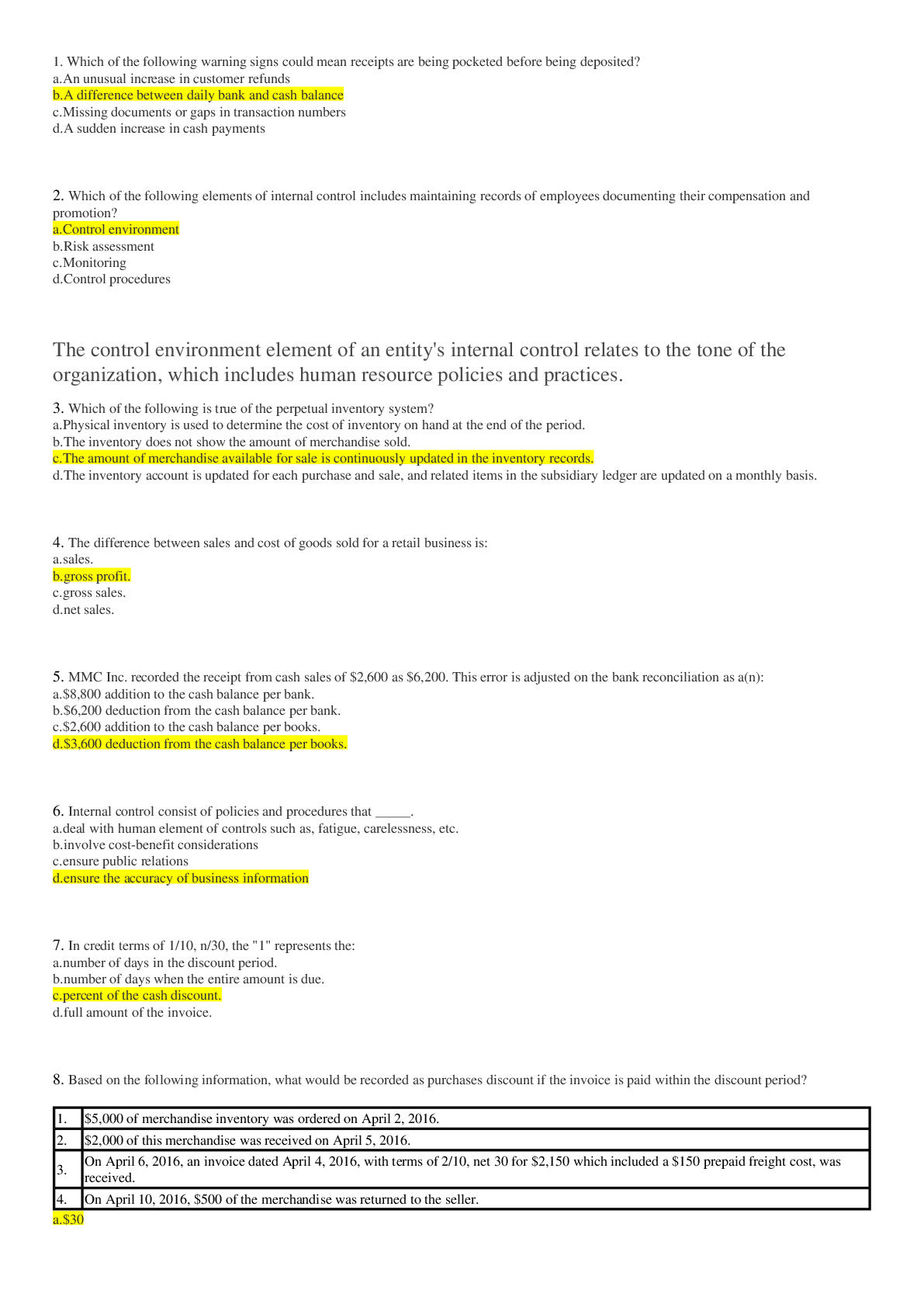

1. Which of the following warning signs could mean receipts are being pocketed before being deposited?

a.

2. Which of the following elements of internal control includes maintaining records

...

ACC 201 Week 3 Quiz 3

1. Which of the following warning signs could mean receipts are being pocketed before being deposited?

a.

2. Which of the following elements of internal control includes maintaining records of employees documenting their compensation and promotion?

a.

The control environment element of an entity's internal control relates to the tone of the organization, which includes human resource policies and practices.

3. Which of the following is true of the perpetual inventory system?

a.Physical inventory is used to determine the cost of inventory on hand at the end of the period.

4. The difference between sales and cost of goods sold for a retail business is:

5. MMC Inc. recorded the receipt from cash sales of $2,600 as $6,200. This error is adjusted on the

6. Internal control consist of policies and procedures that _____.

a

7. In credit terms of 1/10, n/30, the "1" represents the:

a

8. Based on the following information, what would be recorded as purchases discount if the invoice is paid within the discount period?

9. Which of the following is not considered when figuring net purchases?

11. Using a perpetual inventory system, the purchase of $30,000 of merchandise on account would

12. The Sarbanes-Oxley Act of 2002 requires companies and their independent accountants to:

a.report on the financial activities of the company.

13. The bank statement of Jade Co. shows a balance of $4,555 as of December 31. The following reconciling items were identified:

14. Merchandise purchased on account by a company has no effect on its working capital because:

15. Which of the following would be deducted from the cash balance per books on a bank reconciliation?

16. Merchandise is ordered on November 12; the merchandise is shipped by the seller and the invoice is prepared, dated, and mailed by the seller on November 15; the merchandise is received by the buyer on November 17; the transaction is recorded in the buyer's accounts on November 18. The credit period begins with what date?

17. Merchandise with an invoice price of $10,000 is purchased subject to terms of 2/10, n/30, FOB destination. Transportation costs paid by the seller totaled $300. What is the net cost of the merchandise?

18. Surist, Inc. purchased merchandise for $300,000, received credit for purchase returns of $20,000, availed purchase discounts of $5,000, and paid transportation in of $12,000.

Refer to Surist, Inc. If Surist, Inc. had $30,000 in beginning inventory, and sold goods costing $180,000, what is the ending inventory balance?

19. When there are major changes in strategy, senior management, business structure, or operations, evaluations of controls is usually performed by _____.

[Show More]

.png)