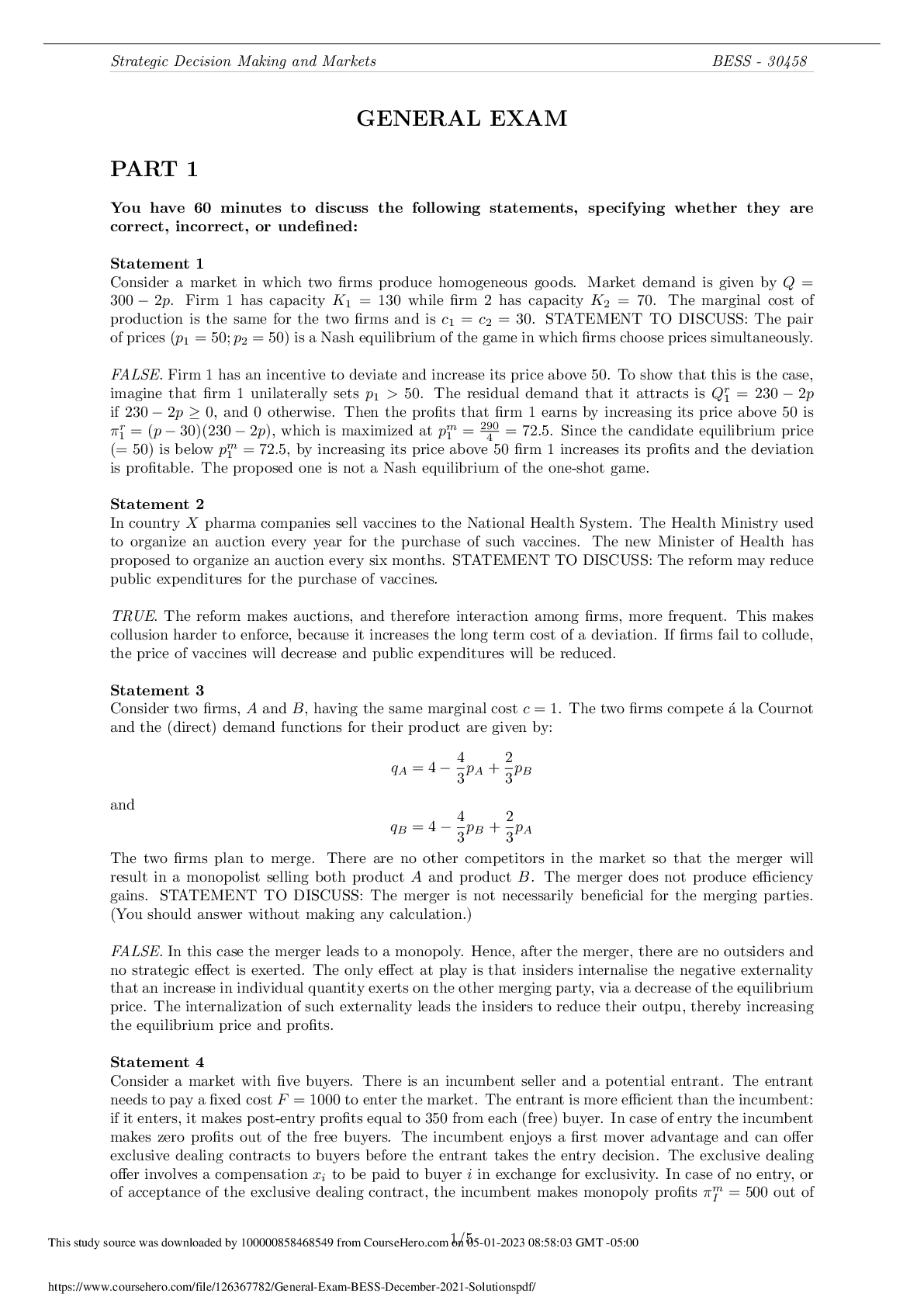

Statement 1

The European Commission has found evidence that manufacturers in market X agreed to

impose their retailers to abstain from making the manufacturers’ products appear in price

comparator websites. STATEMENT

...

Statement 1

The European Commission has found evidence that manufacturers in market X agreed to

impose their retailers to abstain from making the manufacturers’ products appear in price

comparator websites. STATEMENT TO DISCUSS: This agreement is likely to produce anticompetitive effects

Statement 2

Consider a market in which three firms produce homogeneous goods, have the same marginal

cost c and the same capacity. The capacity of each firm is insufficient to satisfy the entire

market demand at any price pÎ[c, pm ], but it suffices to satisfy one third of the demand at the

monopoly price. STATEMENT TO DISCUSS: The presence of capacity constraints facilitates

the enforcement of a collusive agreement.

Statement 3

In country X, there exist 4 firms active in the production of cement. Barriers to entry in this

market are very high due to environmental regulation. Demand of cement is predictable and

not subject to shocks. Each firm communicates to the Trade Association of Cement Producers

data concerning monthly sales, actual prices and privately negotiated discounts. The trade

association publishes these data on a monthly report available to all the firms active in the

industry. Firms 1 and 2 plan to merge. Before the merger, the market shares of the firms are

the following: Firm 1: 30%; Firm 2: 30%; Firm 3: 10%; Firm 4: 30%. The anti-trust agency

has decided to authorize the merger conditional to the fact that the involved firms sell part of

their capacity to firm 3. In such a case, the market shares of the firms active on the market after

the merger would be: Firm 1+2: 40%; Firm 3: 30%; Firm 4: 30%. STATEMENT TO

DISCUSS: Some commentators have criticized the decision, arguing that the required

divestiture of capacity will make the anti-competitive effect of the merger even more severe.

Statement 4

Consider firm X that produces two complementary products, A and B , at a constant marginal

cost cA=cB=10. There exists 100 consumers who enjoy utility U=50 from the joint consumption

of the two products. The consumption of product i alone (with i=A;B ) does not produce utility.

Firm X is a safe monopolist in market A, while in market B it faces competition from four

rivals that produce a perfectly homogeneous product B at a marginal cost c=0. In market B

firms compete à la Bertrand. STATEMENT TO DISCUSS: When it sells the two products

independently, firm X obtains the same profits as when it ties products A and B.

[Show More]