Florida Adjuster Licensing Practice

Exam with Complete Solutions

A claim in the property/casualty industry Is defined as: ✔✔an assertion of an alleged legal right

against a person, entity, company or insurer that carr

...

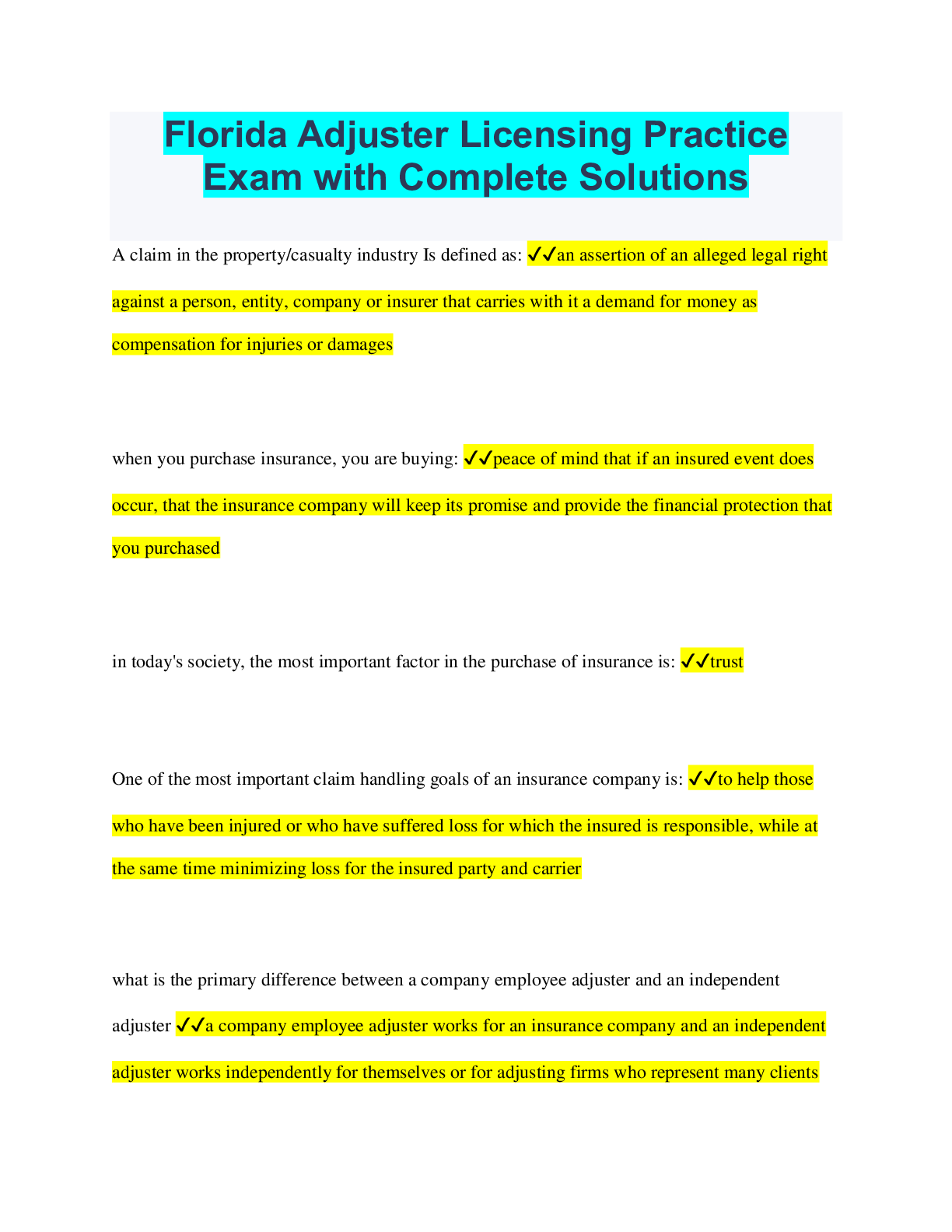

Florida Adjuster Licensing Practice

Exam with Complete Solutions

A claim in the property/casualty industry Is defined as: ✔✔an assertion of an alleged legal right

against a person, entity, company or insurer that carries with it a demand for money as

compensation for injuries or damages

when you purchase insurance, you are buying: ✔✔peace of mind that if an insured event does

occur, that the insurance company will keep its promise and provide the financial protection that

you purchased

in today's society, the most important factor in the purchase of insurance is: ✔✔trust

One of the most important claim handling goals of an insurance company is: ✔✔to help those

who have been injured or who have suffered loss for which the insured is responsible, while at

the same time minimizing loss for the insured party and carrier

what is the primary difference between a company employee adjuster and an independent

adjuster ✔✔a company employee adjuster works for an insurance company and an independent

adjuster works independently for themselves or for adjusting firms who represent many clients

an adjuster's responsibility as a fiduciary means: ✔✔the adjuster represents, and controls, the

property and financial interests of the client to whom he/she owes a high degree of loyalty and

good faith

the basic and primary functions of an adjuster are: ✔✔investigating, evaluating, reporting,

negotiating and disposing of claims

once an adjuster is licensed, he or she must maintain a continuing education requirement. What

is that adjuster's compliance requirement in order to retain a license? ✔✔an adjuster must

complete 24 hours of continuing education in every 2 year compliance period, of which 5 hours

must be taken in a properly certified 5 hour law and ethics update course

the adjuster's code of ethics starts with a basic premise which states: ✔✔the work of adjusting

engages the public trust

Which of the following would NOT be a preferred claims practice or behavior under FL Unfair

Insurance Trade Practices Act? ✔✔Not responding to an insured calls because you haven't made

up your mind

what are the four critical elements of a contract? ✔✔1. agreement to terms (must understand

what is given and received)

2. adequate consideration for the promises made

3. legal capacity of the parties to contract

4. contract must have legal purpose

an insurance policy is often referred to as a contract of adhesion which means: ✔✔if any of the

wording or language in the policy is vague or ambiguous, making it difficult to understand or

interpret, the law is well settled that the interpretation shall be in favor of the party who did not

control its terms (the policyholder)

breach of contract by a carrier or its adjuster through non-payment or on-compliance with policy

requirements, could have the following consequences for a carrier ✔✔if found guilty of a breach

of contract, the carrier could be punished with a "bad faith" verdict that would cost it millions of

dollars

what are the fundamental parts of an insurance policy? ✔✔1. Declarations Page

2. Insuring Agreement

3. Exclusions

4. Conditions

What is one of the duties of an insured following a loss? ✔✔giving prompt notice of loss to the

insurer

describe the difference between a peril and a hazard ✔✔a peril is a cause of loss, like fire. A

hazard is a condition that exists beforehand that increases the likelihood of such a loss, like a

messy storeroom or garage

the doctrine of proximate cause is defined as ✔✔if there is an unbroken chain of events, or series

of consequences, flowing from the initial loss caused by the insured peril to a subsequent loss,

the insured peril causing the initial loss will be considered the "proximate cause" of the

subsequent loss

A couple had Coverage A limits of $250K on their home located in FL. A tornado spawned by

Hurricane Ernesto damaged their roof resulting in estimated repair costs of $11,500. The adjuster

deducted the FL hurricane deductible of $5,000 from the estimate and paid them $6,500 in

settlement of their property claim. This is known as the application of: ✔✔a percentage

deductible (hurricane deductible)

A restaurant was damaged after a grease fire erupted in the kitchen. Damage to the structure

totaled $78,300. The owner's commercial property policy provided Coverage A limits of

$250,000 with a deductible of $1,000. How much would the policyholder be paid? ✔✔$$77,300

a couple has insured their home for $150,000. a fire ensues and guts their home, resulting in a

total loss. An appraisal of the home prior to loss results in a value of $120,000, yet the adjuster is

required by law to pay the couple $150,000. This is known as the application of: ✔✔valued

policy law

Assume that 5 years ago a couple insured their home for its then appraised value of $60,000. 2

weeks ago they had a stove fire resulting in an estimated loss of $15,000. The adjuster finds that

the value of their home is now $100,000 but the home is still only insured for $60K and there is a

deductible of $500. The policy has an 80% coinsurance clause. How much should the adjuster

pay to the couple? ✔✔($15,000-$500)($60,000/$100,000(.80))= $10,875

describe the coverage's provided in a split limit policy of 10/20/10 ✔✔the coverage provides up

to $10,000 of liability protection for bodily injury to any one individual, an aggregate of $20,000

for all bodily injuries regardless of how many individuals, and $10,000 for property damage

negligence is described as ✔✔fault that arises from doing something you shouldn't have done, or

not doing something you should have done

what are examples of "compensatory damages"? ✔✔tangible, documentable financial losses

such as medical expenses and lost wages (special damages)

intangible losses such as pain and suffering, mental anguish, permanent injury and disfigurement

(general damages)

What are the defenses to a claim of negligence ✔✔no negligence, contributory negligence,

comparative negligence and assumption of risk

what are the laws that affects one's legal liability ✔✔Statutes of Limitations, Wrongful Death

Act, Workers comp. and Auto No Fault, Waiver of Sovereign Immunity and Breach of Product

Warranty

What statement is NOT true? ✔✔if a question of coverage arises and can't be swiftly resolved in

favor of the insured, the carrier should immediately tender the claim to its attorney and deny the

claim

[Show More]

.png)

.png)