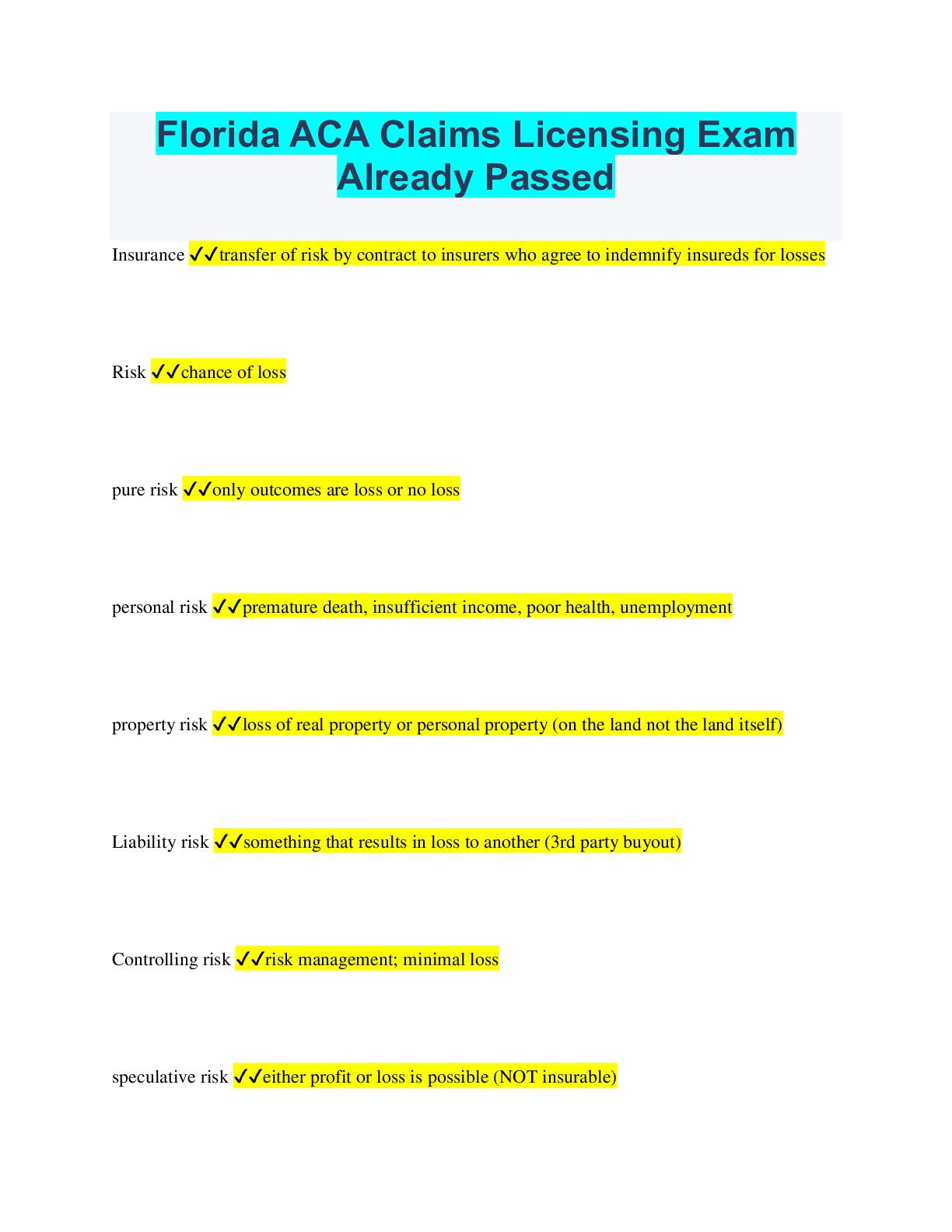

Florida ACA Claims Licensing Exam

Already Passed

Insurance ✔✔transfer of risk by contract to insurers who agree to indemnify insureds for losses

Risk ✔✔chance of loss

pure risk ✔✔only outcomes are loss or no loss

pe

...

Florida ACA Claims Licensing Exam

Already Passed

Insurance ✔✔transfer of risk by contract to insurers who agree to indemnify insureds for losses

Risk ✔✔chance of loss

pure risk ✔✔only outcomes are loss or no loss

personal risk ✔✔premature death, insufficient income, poor health, unemployment

property risk ✔✔loss of real property or personal property (on the land not the land itself)

Liability risk ✔✔something that results in loss to another (3rd party buyout)

Controlling risk ✔✔risk management; minimal loss

speculative risk ✔✔either profit or loss is possible (NOT insurable)

indemnify ✔✔compensate for loss, damage, or injury; reimburse; repay

Law of Large Numbers ✔✔must have a large pool of insureds to be able to predict losses so that

the outcomes will reflect the probability of the results

Direct loss ✔✔Results from the damage, destruction, or theft of property by a covered peril

indirect loss ✔✔a financial loss that results from the occurrence of a direct physical damage or

theft loss

When can there be a pay out on liability risk ✔✔negligence is proven

negligence ✔✔failure to use due care; otherwise known as the prudent person rule

Strict or Absolute Liability ✔✔Liability assigned by statute without regard for negligence (set by

the state or industry, no allowable defense)

Indemnity Principle ✔✔one should be in approximately the same position after a loss as he was

before the loss

Insurer ✔✔A person or company that underwrites an insurance risk; the party in an insurance

contract undertaking to pay compensation.

Insured ✔✔one who is named or covered by insurance

Insurable interest ✔✔must exist at the time of loss and usually means an economic or other

interest in the event or in a particular property ex: bank loans or mortgage companies

What is the measure of insurable interest ✔✔the extent to which the insured might be damnified

by loss, injury, or impairment thereof

Policy ✔✔a written document containing coverage, exclusions, conditions and endorsements

Binder ✔✔can be oral or written and places the insurance "in effect"

Requirements of a valid contract ✔✔consent of all parties (offer and acceptance), valuable

consideration (monetary exchange), all parties must be of legal capacity (competent), and it must

be for legal purposes to be enforceable

Characteristics of an insurance contract ✔✔personal, conditional, contract of adhesion (gray

area, will side on the behalf of the insured), principle of indemnity, aleatory (exchange is not

equal), unilateral (payment for a promise)

Domestic insurance company ✔✔A company that resides and is incorporated under the laws of

the state in which it is operating

Foreign Insurance Company ✔✔An insurance company that is incorporated outside the state

where it is conducting business

Alien Insurance Company ✔✔An insurance company incorporated outside the country

Peril ✔✔something that causes a loss ex: Fire, lightening

Hazard ✔✔something that increases the probability a loss will occur or increases the severity

Physical hazard ✔✔A physical characteristic that may increase the likelihood of loss (wet floor,

icy roads)

Moral hazard ✔✔a conscious act that may cause a loss to occur (deliberate theft)

Morale hazard ✔✔an unconscious act that may cause a loss to occur (out of your control)

Proximate cause ✔✔if there is an unbroken chain of events from the occurrence and damage

from that occurrence, all damage is a result of that occurrence (water damage from a fire)

property insurance ✔✔A type of insurance that covers damage to property, such as a home.

Liability/Casualty Insurance ✔✔Payable to a third party on behalf of the insured (bodily injury

to another)

assumption of risk ✔✔A defense against negligence that can be used when the plaintiff was

aware of a danger and voluntarily assumed the risk of injury from that danger.

Comparative Negligence ✔✔the apportioning of blame in an accident (both parties are at fault)

actual cash value ✔✔current cost less depreciation

replacement cost ✔✔current cost (no depreciation)

valued policy ✔✔pays the face amount of insurance if a total loss occurs

Florida Valued Policy Law applies to ✔✔total loss of a building, home or manufactured home

based on insured value

Coinsurance ✔✔the sharing of expenses by the policyholder and the insurance company ex: a

homeowner fails to increase insurance policy after renovations, therefore the DID/Should model

is applied and the insurance company only pays out partially on the loss

specific insurance ✔✔When each property is named and specifically covered for a set amount

blanket insurance ✔✔When a single amount of coverage applies to any loss of property or injury

up to the single limit amount (one bucket for multiple properties)

mortgage clause ✔✔establishes rights of mortgagee (lender) in the policy. Generally used in

fixed property (real estate).

Loss Payable Clause ✔✔Establishes rights of a lender having interest in personal property.

Sometimes called loss payee clause

Subrogation ✔✔when insured transfers right to his company to collect damages ex: collecting

funds from an at fault driver's insurance company

severability ✔✔Insurance applies separately to each insured as if other insureds did not exist.

(usually applies to spouses)

liberalization ✔✔used when a company increases benefits with no additional premium (new

benefits extend to existing policy holders)

warranty ✔✔a guarantee of fact

representation ✔✔a material statement by applicant in an insurance situation

misrepresentation ✔✔A false statement or lie that can render the contract void.

primary coverage ✔✔must pay first

Excess Coverage ✔✔Coverage, which applies only after limits of primary insurance have been

exhausted. See Primary Insurance.

Part A (personal auto policy) ✔✔liability coverage

Part B (personal auto policy) ✔✔Medical Payments Coverage

Part C (personal auto policy) ✔✔Uninsured/Underinsured Motorist

Part D (personal auto policy) ✔✔Damage to your auto

Part E (personal auto policy) ✔✔Duties after an accident or loss

Part F (personal auto policy) ✔✔general provisions

where are loss payees listed on a personal auto policy ✔✔declarations page

owned vehicles ✔✔leased for six months or more

occupying ✔✔in, upon, getting in, on, out, or off

Personal auto eligibility ✔✔title must be to a person (not a corporation)

must be under 10,000 pounds

may not be used on a regular basis for delivery of goods and materials

"Your covered auto" ✔✔Any vehicle in the declarations

A newly acquired auto

Trailer owned by the named insured

Temporary substitute vehicle

Florida No-Fault Law ✔✔All vehicle owners must have PIP coverage, provides limited

immunity from tort action (torts may still be brought upon at fault persons in cases where

damages exceed the PIP limit), verbal threshold for noneconomic claims such as pain and

suffering

Tort Thresholds for PIP (allows for economic damage lawsuits) ✔✔death

significant and permanent scarring, disfigurement or loss of bodily function

permanent injury

Subject to No-fault law ✔✔owners of motor vehicles: title holders, debtor in possession, long

term lessee, lease option purchase, non resident auto in FL over 90 days cumulative

What constitutes a motor vehicle ✔✔four or more wheels, licensed and designed for highway

use, includes trailer or semi trailers

PIP percentages ✔✔Medical: 80%

work loss: 60%

Replacement services: 100%

Death: $5,000

Calculating PIP coverage ✔✔apply deductible, apply percentage, look at policy limit

PIP is always collected from ✔✔the insured's policy.

exclusions under PIP ✔✔self-inflicted injury

injury during a felony

only works in insured vehicles

PIP territory ✔✔In FL in any insured car

outside FL in the policy holders car

PIP coverage applies as ✔✔a per person per occurrence policy

PIP is in excess to ✔✔Workers' Compensation payments.

medical PIP coverage ✔✔basic: 80%

Extended: up to $100,000

Additional: above $100,000

Loss PIP coverage ✔✔basic: 60%

Extended: 80%

Additional: 100%

Replacement coverage ✔✔Basic: 100%

Extended: Up to 100,000

Additional: above 100,000

Does PIP apply to those driving work vehicles ✔✔No, workers comp

Does PIP extend to other people's children if they have their own PIP policy ✔✔no

Does PIP extend to those passengers in a car without PIP insurance ex: Grandma ✔✔Yes

Minimum requirement for liability insurance in FL ✔✔10/20/10 insurance

Intent of the Florida Financial Responsibility law ✔✔to make owners and operators financially

responsible for damage they cause others

Triggers of FL financial responsibility law ✔✔accident involving bodily injury

accident rendering vehicle inoperative

serious traffic violations or DUI

Penalties of FL financial responsibility law ✔✔suspension of drivers license and registration

responsible for damages up to 10/20/10

SR-22 with DMV for 3 years

DUI- 100/300/50 for 3 years (FR44)

Governing body of the Florida financial responsibility law ✔✔DMV

Named non-owner coverage ✔✔Provides coverage for the use of non-owned autos to individuals

who do not own a car.

Vicarious Liability ✔✔responsibility for the damage done by others

Single Limit Liability ✔✔minimum florida limit is $30,000

Split Limit Liability ✔✔minimum in FL is 10/20/10

defense costs are paid ✔✔in excess of liability limits

supplementary payments paid in excess of the liability payments ✔✔Bail bonds up to 250

Appeal bond premiums and bonds to release attachments

Interest accruing after a judgement

Loss of wages up to 200 per diem incurred at the request of the insurance company

expenses incurred at the request of the insurance company

exclusions to liability limit insurance ✔✔intentional acts

property owned or transported

workers comp

non permissive users

business parking or selling auto

vehicles with less than 4 wheels

vehicles owned by insured but not covered

Med pay ✔✔responds regardless of fault or liability

per person per occurrence

covers occupants or pedestrians struck

Primary in owned vehicles, excess in non owned

exclusions of med pay ✔✔less than 4 wheels

if in excess of PIP or workers comp

non permissive users

Owned by not insured

Order of insurance pay outs in an auto accident ✔✔personal PIP, med pay of car owner, liability

of at fault driver. Any excess can be paid by civil action or out of pocket

uninsured motorist coverage ✔✔covers:

at fault drivers

Underinsured motorists

at fault drivers insurance company is insolvent

hit and run

at fault driver's insurance denies coverage

Methods of purchasing UM ✔✔bodily injury only in FL

Single or split limit

UM will be provided at the same limits as BI unless otherwise rejected IN WRITING

Stacked or unstacked (will be stacked unless rejected in writing)

Physical damage has two segments ✔✔comprehensive and collision

comprehensive coverage ✔✔missiles, falling objects, explosions, earth quakes, fire, theft,

vandalism, hitting an animal, glass breaking, flood, rising water, riot and civil commotion

collision coverage ✔✔colliding with an object, upset or impact with another vehicle or object

exclusions to physical damage policies ✔✔electronic equipment not permanently installed or

exceeding 1,000

tapes, records, and CDS

Camper bodies no designated in declarations

awnings, cabanas, custom furnishings

radar detection devices

confiscations by governmental bodies

Duties after an accident or loss ✔✔give prompt notice of claim

cooperate with insurer

provide police information and names of any witnesses

Endorsements of a personal auto policy ✔✔PIP

extended PIP

Additional PIP

extended non owned coverage

named non own coverage

towing and labor

coverage for excluded equipment

miscellaneous type vehicle

joint ownership coverage

increased limits transportation coverage

Mechanical breakdown coverage ✔✔covers cost and labor for part to a limit

may have rental reimbursement

Policy term and territory (new car, 36,000 miles or 36 months; used car 12,000 miles or 12

months)

[Show More]

.png)

.png)