ACC 577 WeeK 9 STUDY

ACC 577 WK 9 STUDY

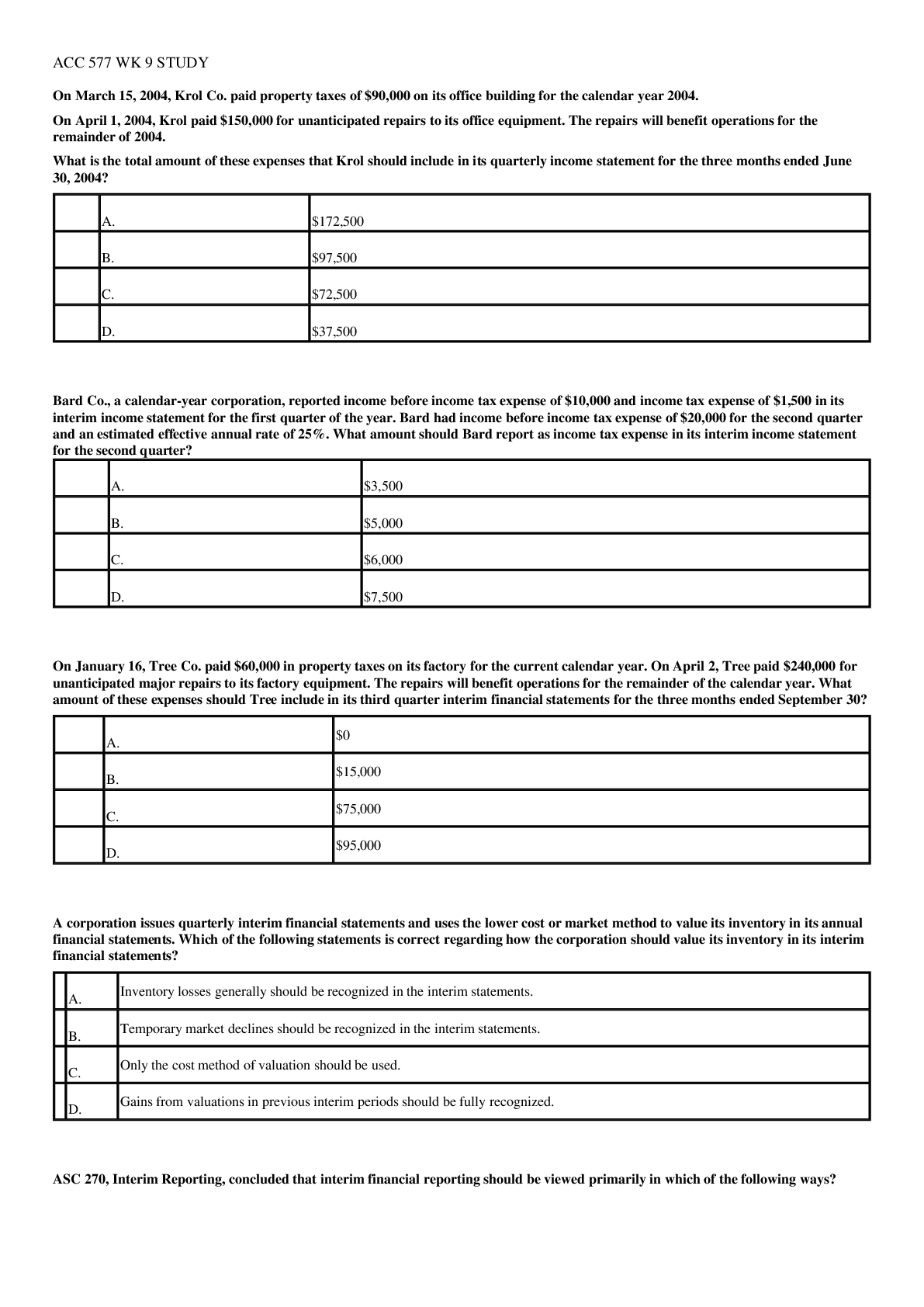

On March 15, 2004, Krol Co. paid property taxes of $90,000 on its office building for the calendar year 2004.

On April 1, 2004, Krol paid $150,000 for unanticipated repair

...

ACC 577 WeeK 9 STUDY

ACC 577 WK 9 STUDY

On March 15, 2004, Krol Co. paid property taxes of $90,000 on its office building for the calendar year 2004.

On April 1, 2004, Krol paid $150,000 for unanticipated repairs to its office equipment. The repairs will benefit operations for the remainder of 2004.

What is the total amount of these expenses that Krol should include in its quarterly income statement for the three months ended June 30, 2004?

A.

$172,500

B.

$97,500

C.

$72,500

D.

$37,500

Bard Co., a calendar-year corporation, reported income before income tax expense of $10,000 and income tax expense of $1,500 in its interim income statement for the first quarter of the year. Bard had income before income tax expense of $20,000 for the second quarter and an estimated effective annual rate of 25%. What amount should Bard report as income tax expense in its interim income statement for the second quarter?

A.

$3,500

B.

$5,000

C.

$6,000

D.

$7,500

On January 16, Tree Co. paid $60,000 in property taxes on its factory for the current calendar year. On April 2, Tree paid $240,000 for unanticipated major repairs to its factory equipment. The repairs will benefit operations for the remainder of the calendar year. What amount of these expenses should Tree include in its third quarter interim financial statements for the three months ended September 30?

A.

$0

B.

$15,000

C.

$75,000

D.

$95,000

A corporation issues quarterly interim financial statements and uses the lower cost or market method to value its inventory in its annual financial statements. Which of the following statements is correct regarding how the corporation should value its inventory in its interim financial statements?

A.

Inventory losses generally should be recognized in the interim statements.

B.

Temporary market declines should be recognized in the interim statements.

C.

Only the cost method of valuation should be used.

D.

Gains from valuations in previous interim periods should be fully recognized.

ASC 270, Interim Reporting, concluded that interim financial reporting should be viewed primarily in which of the following ways?

A.

As useful only if activity is spread evenly throughout the year.

B.

As if the interim period were an annual accounting period.

C.

As reporting for an integral part of an annual period.

D.

As reporting under a comprehensive basis of accounting other than GAAP.

On June 30, 2005, Mill Corp. incurred a $100,000 net loss from disposal of a business segment. Also, on June 30, 2005, Mill paid $40,000 for property taxes assessed for the calendar year 2005.

What amount of the foregoing items should be included in the determination of Mill's net income or loss for the six-month interim period ended June 30, 2005?

A.

$140,000

B.

$120,000

C.

$90,000

D.

$70,000

For interim financial reporting, a company's income tax provision for the second quarter of 2004 should be determined using the:

A.

Effective tax rate expected to be applicable for the full year of 2004 as estimated at the end of the first quarter of 2004.

B.

Effective tax rate expected to be applicable for the full year of 2004 as estimated at the end of the second quarter of 2004.

C.

Effective tax rate expected to be applicable for the second quarter of 2004.

D.

Statutory tax rate for 2004.

In general, an enterprise preparing interim financial statements should:

A.

Defer recognition of seasonal revenue.

B.

Disregard permanent decreases in the market value of its inventory.

C.

Allocate revenues and expenses evenly over the quarters, regardless of when they actually occurred.

D.

Use the same accounting principles followed in preparing its latest annual financial statements.

An inventory loss from a market price decline occurred in the first quarter, and the decline was not expected to reverse during the fiscal year.

However, in the third quarter, the inventory's market price recovery exceeded the market decline that occurred in the first quarter.

For interim financial reporting, the dollar amount of net inventory should:

A.

Decrease in the first quarter by the amount of the market price decline and increase in the third quarter by the amount of the decrease in the first quarter.

B.

Decrease in the first quarter by the amount of the market price decline and increase in the third quarter by the amount of the market price recovery.

C.

Decrease in the first quarter by the amount of the market price decline and not be affected in the third quarter.

D.

Not be affected in either the first quarter or the third quarter.

An inventory loss from a permanent market decline of $360,000 occurred in May 2006. Cox Co. appropriately recorded this loss in May 2006 after its March 31, 2006, quarterly report was issued.

What amount of inventory loss should be reported in Cox's quarterly income statement for the three months ended June 30, 2006?

A.

$0

B.

$90,000

C.

$180,000

D.

$360,000

How are discontinued operations that occur at midyear initially reported?

A.

Disclosed only in the notes to the year-end financial statements.

B.

Included in net income and disclosed in the notes to the year-end financial statements.

C.

Included in net income and disclosed in the notes to interim financial statements.

D.

Disclosed only in the notes to interim financial statements.

Due to a decline in market price in the second quarter, Petal Co. incurred an inventory loss. The market price is expected to return to previous levels by the end of the year. At the end of the year, the decline had not reversed. When should the loss be reported in Petal's interim income statements?

A.

Ratably over the second, third, and fourth quarters.

B.

Ratably over the third and fourth quarters.

C.

In the second quarter only.

D.

In the fourth quarter only.

Farr Corp. had the following transactions during the quarter ended March 31, 2005:

Loss on early extinguishment of debt

$ 70,000

Payment of fire insurance premium for calendar year 2005

100,000

What amount should be included in Farr's income statement for the quarter ended March 31, 2005?

Extinguishment loss

Insurance expense

$70,000

$100,000

$70,000

$25,000

$17,500

$25,000

$0

$100,000

A planned volume variance in the first quarter, which is expected to be absorbed by the end of the fiscal period, ordinarily should be deferred at the end of the first quarter if it is:

Favorable

Unfavorable

Yes

No

No

Yes

No

No

Yes

Yes

Kell Corp. reported $111,000 of net income for the quarter ended September 30, 2005. Additional information for the quarter:

A $60,000 gain from discontinued operation, realized on April 30, 2005, was allocated equally to the second, third, and fourth quarters of 2005.

A $16,000 cumulative-effect adjustment (dr.) resulting from a change in inventory valuation method was recognized on August 2, 2005. The new method was used for the quarter ended September 30. The $111,000 earnings amount does not reflect the cumulative effect.

In addition, Kell paid $48,000 on February 1, 2005, for 2005 calendar-year property taxes. Of this amount, $12,000 was allocated to the third quarter of 2005.

For the quarter ended September 30, 2005, Kell should report net income of:

A.

$91,000

B.

$75,000

C.

$111,000

D.

$95,000

Wall Co. leased office premises to Fox, Inc. for a 5-year term beginning January 2, 2005.

Under the terms of the operating lease, rent for the first year was $8,000 and rent for years 2 through 5 was $12,500 per annum. However, as an inducement to enter the lease, Wall granted Fox the first 6 months of the lease rent free.

In its December 31, 2005 income statement, what amount should Wall report as rental income?

A.

$12,000

B.

$11,600

C.

$10,800

D.

$8,000

Rapp Co. leased a new machine to Lake Co. on January 1, 2006. The lease expired on January 1, 2011. The annual rental was $90,000.

Additionally, on January 1, 2006, Lake paid $50,000 to Rapp as a lease bonus and $25,000 as a security deposit to be refunded upon expiration of the lease.

In Rapp's 2006 income statement, the amount of rental revenue should be

A.

$140,000.

B.

$125,000.

C.

$100,000.

D.

$90,000.

Green Co. incurred leasehold improvement costs for its leased property. The estimated useful life of the improvements was 15 years. The remaining term of the nonrenewable lease was 20 years. These costs should be

A.

Expensed as incurred.

B.

Capitalized and depreciated over 20 years.

C.

Capitalized and expensed in

[Show More]

.png)