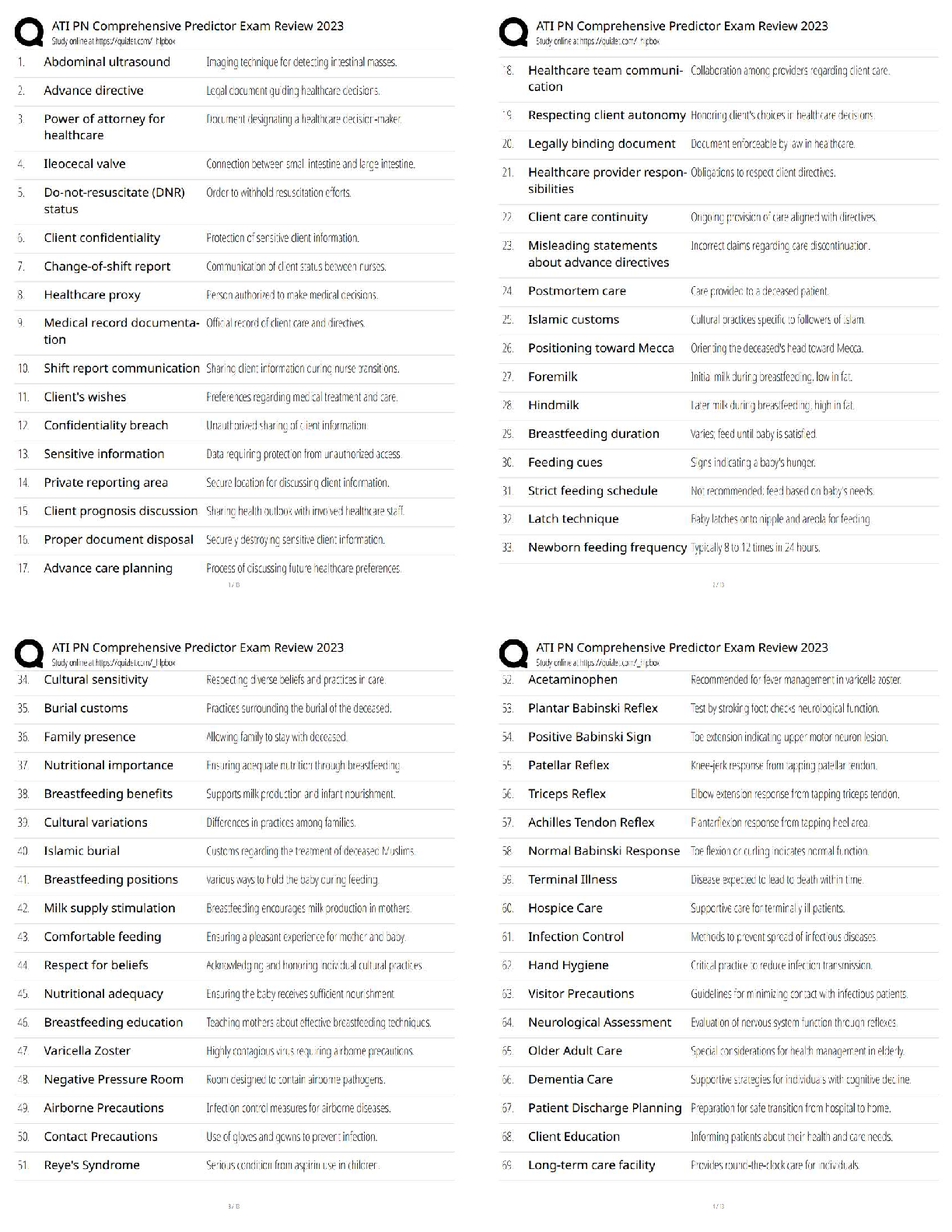

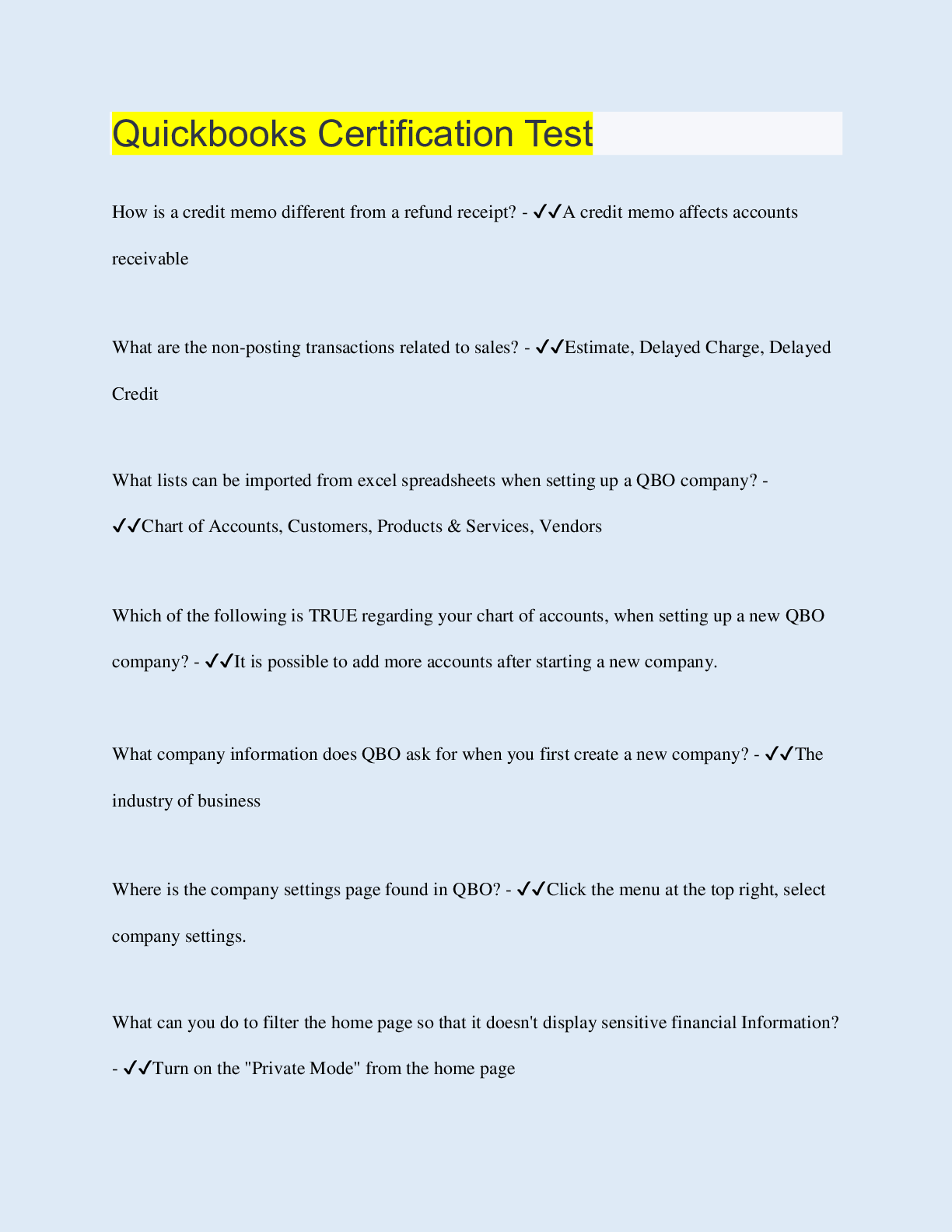

Quickbooks Certification Test

How is a credit memo different from a refund receipt? - ✔✔A credit memo affects accounts

receivable

What are the non-posting transactions related to sales? - ✔✔Estimate, Delayed Charge, D

...

Quickbooks Certification Test

How is a credit memo different from a refund receipt? - ✔✔A credit memo affects accounts

receivable

What are the non-posting transactions related to sales? - ✔✔Estimate, Delayed Charge, Delayed

Credit

What lists can be imported from excel spreadsheets when setting up a QBO company? -

✔✔Chart of Accounts, Customers, Products & Services, Vendors

Which of the following is TRUE regarding your chart of accounts, when setting up a new QBO

company? - ✔✔It is possible to add more accounts after starting a new company.

What company information does QBO ask for when you first create a new company? - ✔✔The

industry of business

Where is the company settings page found in QBO? - ✔✔Click the menu at the top right, select

company settings.

What can you do to filter the home page so that it doesn't display sensitive financial Information?

- ✔✔Turn on the "Private Mode" from the home page

Which of the following is TRUE regarding general Journal entries? - ✔✔General Journal entries

require a good understanding of debits and credits and a great deal of care should be taken by

non-accoutants when entering them.

TRUE OR FALSE? When importing your data from desktop to QBO anything that is in your

QBO during import will be overwritten. - ✔✔TRUE

Your client users QBO simple start - How many accountant users can they have? - ✔✔TWO

Which of the forms are NOT customizable in QBO? - ✔✔Checks

How are sales reps tracked on sales forms? - ✔✔Navigate to company settings> In the Sales

category of settings, create custom field for sales rep.

What are 2 options in company settings, for categorizing sales and expenses into different

locations & departments of a business? - ✔✔Classes and Locations

How are invoices customized in QBO? - ✔✔Select company menu>Company menu>From the

menu to the left, click sales & "customize look and feel" >save

New users are set up with what type of access? - ✔✔All, None & Limited

What transactions can be recurring? - ✔✔1. General Journal Entries 2. Checks 3. Expenses

What is the primary reason for setting up a closing date in QBO? - ✔✔To restrict users from

deleting, editing, or adding transactions to a closed period, such as as fiscal year.

What report contains the sections: Assets, Liabilities, & Equity? - ✔✔Balance Sheet

When reconciling a bank account, which of the following could cause a difference or

discrepancy? - ✔✔One of the transactions you've made does not match the banks records.

Which report is also known as an income statement and summaries income & expenses for a

period of time? - ✔✔Profit and Loss

Which report tracks changes and deletions to transactions, as well as tracks which user made

those changes? - ✔✔The Audit Log report

How can yo tell QBO to email someone a copy of a report on a regular basis? - ✔✔Select

reports, go to my customized reports, select report and click edit, then click "set the email

schedule for this group".

If you have a customized report that you use each month, what feature let you run the report with

updated data each month? - ✔✔Save customizations

Which report shows you how much you owe for sales taxes? - ✔✔Sales tax liability

In QBO, what is the best method to enter a business lunch paid for with the company debit card?

- ✔✔Click global create button and select Expense, Fill out expense and use debit card as

payment method.

TRUE OR FALSE: You can merge an income account with another income account? -

✔✔TRUE

What does QBO do when you make a customer that has an open balance, inactive? - ✔✔QBO

creates a credit memo and applies it to any open invoices which makes the balance zero

How does QBO distinguish which income accounts should be affected when you use a product

on a sales form? - ✔✔When setting a product or service, you assign the income account. Later

when you use the product or sales form QBO uses that account to record income.

Entering a purchase order for inventory affects which accounts? - ✔✔None, because PO orders

are non-posting transactions.

Vendor credits reduce what you owe the vendor. TRUE or FALSE - ✔✔TRUE

What are posting transactions related to sales? - ✔✔1. Income 2. received payments 3. credit

memos 4 sales receipts 5. refunds

The Sales Center is found in the _________________________ in QuickBooks Online. -

✔✔Left Navigation Pane

How do you multiply screens to display over multiple monitors when working in QBO? -

✔✔Windows menu > Menu items > Open new windows

Where can you find the transfer function in QBO? - ✔✔Quick create

Which of the following lists can NOT be accessed froth left Navigation Pane? - ✔✔Classes

How many consecutive days can you re-import QB desktop data into QBO from the date the

QBO company is created? - ✔✔180 days

A non-profit client wants to change the heading for her customers to Donors. Where should she

go in QBO to change the setting? - ✔✔Gear Icon > Settings > Advance > Other preferences >

Customer Label

Which of the following steps are needed to track inventory? - ✔✔Signup for QB Plus > Go to

account Settings > Products and Services > Track inventory

Which of the following cannot be imported using the import data tool in QBO? - ✔✔Employees

Under which setting tab do you enable inventory tracking? - ✔✔Sales

How many regular users can access QB essentials subscription at one time> - ✔✔3

How do you change the report basis (accrual vs. cash) for just one report? - ✔✔Click customize

button on the report and then choose Accrual or cash in the accounting method.

How do you pay a health insurance company, after withholding employee funds for this? -

✔✔Click the global menu, select Bill, Expense or check. In the account details area of the form,

enter the appropriate payroll liability or sub account. Save

How do you enter your new employee's annual salary of 60,000 in QBO? - ✔✔When entered a

new employee, under "How much do you pay this employee, select salary, enter the amount, and

select year.

Entering time into QBO affects with accounts? - ✔✔Non, because time sheets are non-posing

entries.

How do you deduct money from an employee's paycheck for health insurance? - ✔✔When

setting up an employee, click edit the deductions and contributions. Then add information for the

deductions and it will automatically be deducted during each pay period.

If you are setting up a product/service. What happens if you select the box next to "I purchase

this product/service from a vendor? - ✔✔QB provides filed so you can track purchases and sales

information.

In which situation should you use the Item details on a bill, check or expense? - ✔✔To record

the purchase of products or services, such as inventory parts

What is the proper procedure for entering a sale in which a customer purchased something from

you and paid for the entire balance of the sale right away? - ✔✔Click the Global create button,

click sales receipt, fill out info, save sales receipt

How do delayed changes affect a customers balance? - ✔✔Delayed changes have no effect on a

customers balance.

When creating a statement for customers, which of the following options is NOT available with

QBO? - ✔✔Overdue Balance statement

(1)Accounts and Settings is an option available by clicking on the gear icon in the upper right

side of QBO screen. What is the difference between chart of accounts and recurring transactions?

- ✔✔The Chart of Accounts is a list of accounts the company uses and Recurring transactions

are transactions saved for future reuse.

(2)Which of following statements are NOT true regarding QBO Chart of Accounts? - ✔✔A)

QBO automatically creates a Chart of Accounts when a new company is set up.

B) QBO Chart of Accounts is customized by a user to fit its company's needs.

C) QBO CHARTS OF ACCOUNTS is customized to fit a company's needs and is not overly

useful regarding tax return preparation since it is completed by using an IRS form.

D) QBO Chart of Accounts is aligned with a company's tax return since QBO is used to organize

financial information for tax preparation.

(3)Which of the following is correct regarding a company's legal entity type and the tax form it

must file with the IRS? - ✔✔Sole Proprietor - Form 1040 Schedule C

(4)In QBO, account numbers are: - ✔✔a combination of being randomly assigned and assigned

alphabetically buy the user of QBO.

(5)Which of the following is incorrect regarding the type of tax form related to legal form of

organization? - ✔✔A) Sole Proprietorship - Form 1040 Schedule S

B) C Corporation - Form 1120

C) Partnership - Form 1065

D) SOLE PARTNERSHIP - Form 1140 Schedule C

(6)What is the primary objective of accounting and how does QBO assist in achieving this

objective? - ✔✔The primary objective of accounting is to provide information for decision

making and QBO is used to capture, track, sort, summarize, and communicate financial

information.

(7)Which of the following is false regarding updating QBO Lists? - ✔✔QBO does not encourage

updating While entering a transaction since it can lead to disorganization.

There are two basic ways to update QBO Lists: - ✔✔Before entering transactions and While

entering transactions.

(8)QBO groups transactions into the following different types? - ✔✔Banking and Credit Card,

Customers and Sales, Vendors and Expenses, and Employees and Payroll.

(9) Revenues are: - ✔✔Increased with credits and decreased with debits.

(10)What determines whether a company can pay its bills on time? - ✔✔Adequate cash flow

(11)What is the correct process to record a Bank Deposit (not related to customer sales)? -

✔✔Select the Create (+) icon, select Bank Deposit under Other, click on Bank and enter the

date, select Received Form in Add New Deposits, then select the appropriate Account and enter

in the information necessary. Use Attachments to add a file or photo of the source document.

(12)Which statement best describes a bank reconciliation? - ✔✔It is the process of comparing, or

reconciling, the bank statement with a company's accounting records for the cash account.

(13)Which two QBO lists will be used when entering customer sales related transactions? -

✔✔Customers List, and Products and Services List.

(14)All of the following are true regarding the Products and Services List except: - ✔✔A) It

collects information about the products and services sold to customers.

B) NEW PRODUCTS MUST be entered twice to confirm the initial information is correct.

C) It is a time-saving feature.

D) QBO uses four types of products and services: Inventory, Non-inventory, Service, and

Bundle.

(15)Which of the following is NOT true regarding the Allowance method? - ✔✔A) The

uncollectible accounts expense is estimated in advance of the write-off.

B) The estimate can be calculated as a percentage of sales or as a percentage of accounts

receivable.

C) The method should be used if uncollectible accounts have a material effect on a company's

financial statements.

D) THIS METHOD IS USED for tax purposes.

(16)When is the Bill onscreen form used to record a vendor transaction in QBO? - ✔✔It is used

to record services for which a company has been billed for and agreed to pay later.

(17)In QBO, what is the difference between a Bill form and an Expense form? - ✔✔A Bill form

records a service the company has received and has an obligation to pay the vendor later. An

Expense form records expenses paid for at the time the product or service is received via paying

cash, check or credit card.

(18)How does an account payable arise with a vendor? - ✔✔When our business purchases on

credit, it promises to pay that amount in the future.

(19)Place the following QBO Customer transactions in the proper order: - ✔✔1) Receive

payment to record collection of the customer's payment.

2) Invoice to record the resale of product to customer and the customer's promise to pay later.

3) Bank deposit to record the customer's payment in the bank account.

A) 2, 1, and 3. CORRECT

B) 1, 2, and 3.

C) 3, 2, and 1.

D) 3, 1, and 2.

(20)What are the four types of products and services QBO uses? - ✔✔Inventory, Non-inventory,

Service, and Bundle.

(21)If Undeposited Funds was selected during Receive Payment, then which of the following is

true? - ✔✔A company must create a bank deposit to transfer the funds from the Undeposited

Funds account to the appropriate bank account.

(22)What is true regarding FUTA? - ✔✔It is a payroll tax owed by the business and reported

annually on a tax form 940.

(23)What is NOT true regarding QBO time tracking? - ✔✔A) A user must turn on QBO time

tracking preferences before entering time.

B) QBO provides two different ways to track time: Single Time Activity and Weekly Timesheet.

C) SINGLE TIME ACTIVITY... is not automatically added to an employee's Weekly Timesheet.

Usually, Single Time Activity is used by subcontractors vs. employees.

D) A Weekly Timesheet is used to enter time worked by each employee during the week and

includes time billable to customers.

(24)Which of the following describes the QBO Mobile Payroll app? - ✔✔It offers employers the

convenience of running payroll from their device (Apple or Android) and is synced with QBO.

(25)Which selection below is FALSE regarding Adjustments? - ✔✔A) Adjustments bring

accounts up to date and show the correct account balances on financial reports.

B) ADJUSTING ENTRIES.... are dated the first day of the accounting period.

C) Adjustments are typically made at the end of the accounting period to up date accounts before

year-end reports are prepared.

D) Adjustments are also called Adjusting Entries since we enter Adjustments by making entries

into a Journal.

(26) In QBO, Recurring transactions can be classified as: 1. Scheduled 2. Unscheduled 3.

Reminder. Which of the following statements is NOT true regarding these three classifications? -

✔✔A) SCHEDULED TRANSACTIONS.....are a great option to use for Recurring adjusting

entry transactions since adjustments generally are for a constant amount each time.

B) Scheduled transactions mean QBO automatically enters the transaction on the date the user

specifies.

C) Unscheduled transactions appear in the Recurring Transactions list but QBO will not

automatically enter the transaction.

D) Reminder transactions mean QBO will alert us with a reminder when we should use a

recurring transaction to enter in an adjustment.

(27)What is the difference between a correcting entry and an adjusting entry? - ✔✔Correcting

entries fix mistakes in the accounting system. Adjusting entries are not mistakes but updates

required to bring accounts to the correct balances as of a certain date.

(28)What is NOT true regarding QBO reports? - ✔✔A) QBO OFFERS LIMITED NUMBER OF

REPORTS... to ensure its users are not overwhelmed with information they do not need.

B) Most QBO reports are accessed from the Navigation Bar.

C) QBO offers numerous reports to meet the needs of a wide array of users.

D) From the Navigation Bar, Dashboard can be selected which summarizes key financial

information.

(29)The financial statements must be prepared in a specific order. What is that order and why do

financial statements need to be prepared in that order? - ✔✔Profit and Loss, Balance Sheet and

Statement of Cash Flows. This order is required since the net income obtained from the Profit

and Loss statement is used to increase owners' equity on the Balance Sheet. The Balance Sheet's

updated accounts are needed to prepare the Statement of Cash Flows.

(30)What is NOT true regarding Tax forms? - ✔✔A) The objective of the tax form is to provide

information to federal and state tax authorities.

B) WHEN PREPARING TAX RETURNS... a company uses the same rules as those used to

prepare financial statements.

C) When preparing tax returns, a company uses different rules from those used to prepare

financial statements.

D) Tax forms include: Federal and State income tax returns, Federal Payroll Forms and Federal

Form 1099.

[Show More]

.png)