Joint Forces Staff College > SEJPME - Pre-Test SEJPME ii Questions & Answers (2021) Latest. All Answers Correct.

$ 8

Texas Master Plumbing Actual Exam with 200 Questions and 100% Correct Answers

$ 18.5

Properties of Probability Distributions Quiz 2022.

$ 5

Advanced Practice Nursing in the Care of Older Adults 2nd by Kennedy-Malone TEST BANK

$ 15

week_6_assignment_SOCW_6301_QUALITATIVE ANALYSIS AND EVIDENCE-BASED PRACTICE

$ 10

eBook [PDF] Environmental Journalism By D. S. Poornananda

$ 25

eBook [PDF] Precalculus 11th Edition Metric Version By Ron Larson

$ 25

Psychosocial Integrity -CLNS 101 Client Needs| Contains 50 Psychosocial Integrity Quizes| Correct Answers Highlighted

$ 14

Wind Turbine Lab Report

$ 40

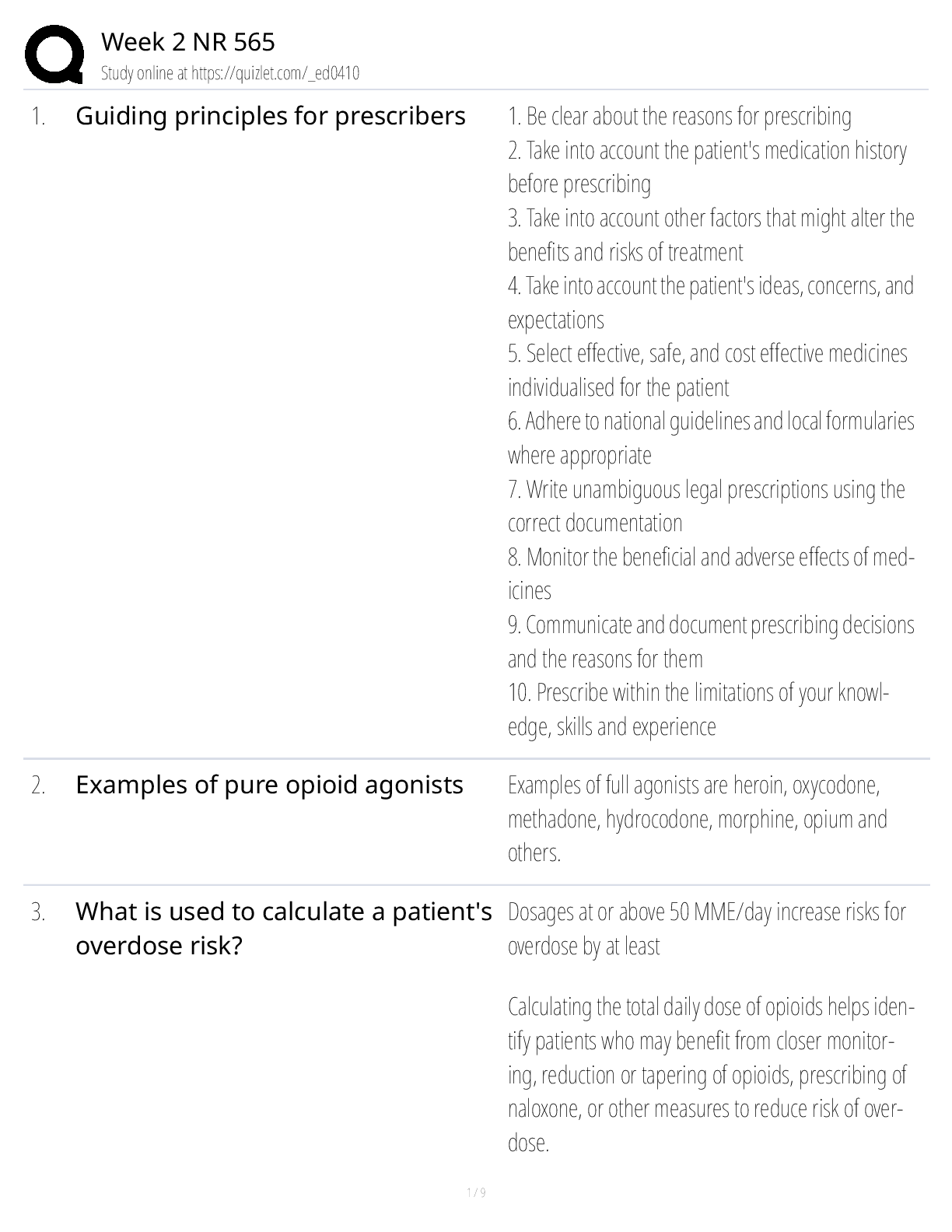

Week 2 NR 565

$ 14

NSG 6420 Mid Term Exam. Contains 100 Q&A | Correct Answers Highlighted

$ 9

MODULE CODE: ABF300 TITLE OF PAPER: Advanced Management Accounting. REVISION AND STUDY QUESTIONS