Webce > QUESTIONS & ANSWERS > WebCE Test 1 Questions And Answers Rated A+ with Latest Updates (All)

WebCE Test 1 Questions And Answers Rated A+ with Latest Updates

Document Content and Description Below

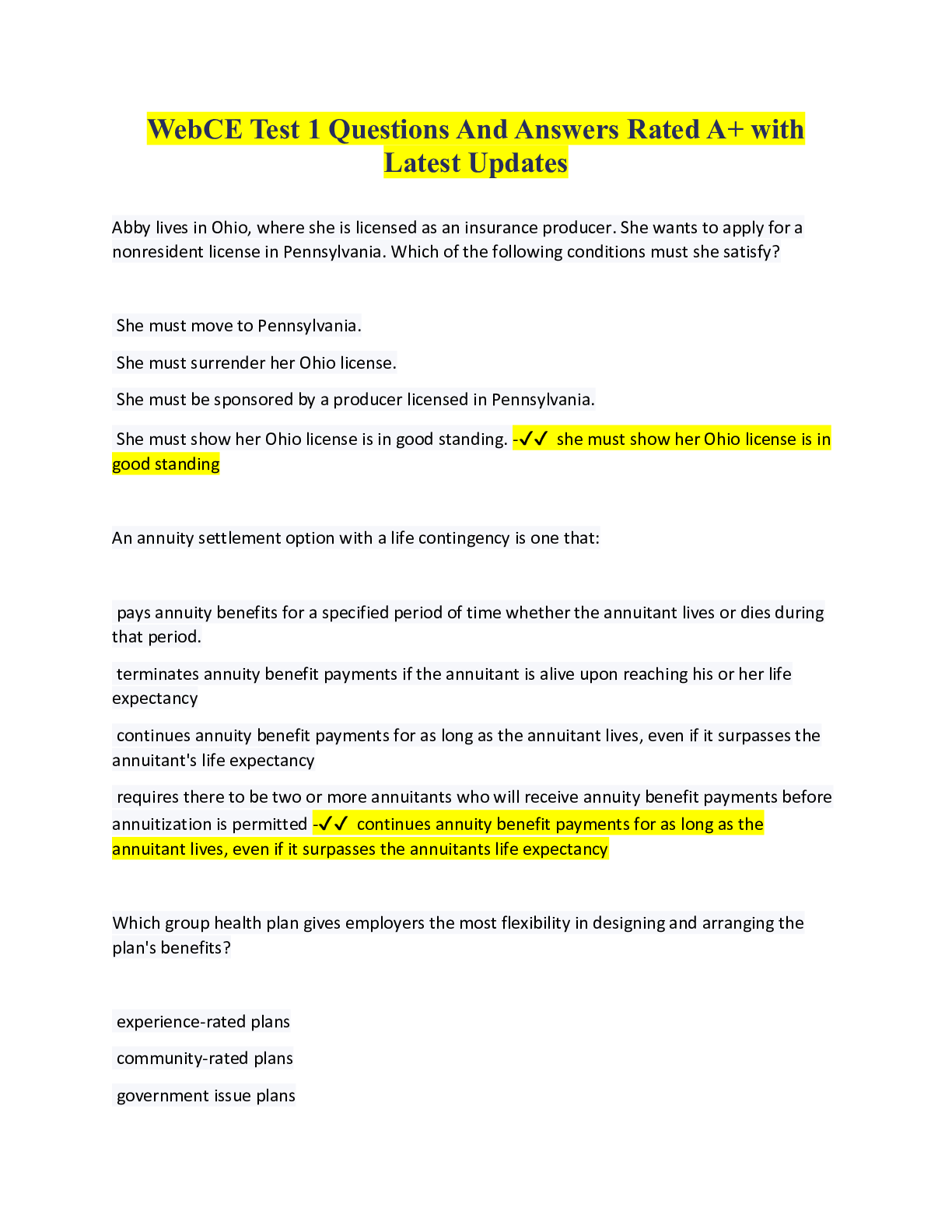

WebCE Test 1 Questions And Answers Rated A+ with Latest Updates Abby lives in Ohio, where she is licensed as an insurance producer. She wants to apply for a nonresident license in Pennsylvania. Whi ... ch of the following conditions must she satisfy? She must move to Pennsylvania. She must surrender her Ohio license. She must be sponsored by a producer licensed in Pennsylvania. She must show her Ohio license is in good standing. -✔✔ she must show her Ohio license is in good standing An annuity settlement option with a life contingency is one that: pays annuity benefits for a specified period of time whether the annuitant lives or dies during that period. terminates annuity benefit payments if the annuitant is alive upon reaching his or her life expectancy continues annuity benefit payments for as long as the annuitant lives, even if it surpasses the annuitant's life expectancy requires there to be two or more annuitants who will receive annuity benefit payments before annuitization is permitted -✔✔ continues annuity benefit payments for as long as the annuitant lives, even if it surpasses the annuitants life expectancy Which group health plan gives employers the most flexibility in designing and arranging the plan's benefits? experience-rated plans community-rated plans government issue plans participating plans -✔✔ experience-rated plans An insurer typically considers all of the following during the underwriting process EXCEPT: medical history educational background medical exams lab tests -✔✔ educational background Before delivering a health insurance policy to a client, the producer alters the insuring clause in a way that he believes will benefit the insurance company. Which of the following statements is correct regarding this alteration? It is required of a diligent producer. It is prohibited by the entire contract provision. It is permitted only when it is in the insurer's best interests. It is prohibited unless the insured agrees to it in writing. -✔✔ it is prohibited by the entire contract provision Terry, Bella, Raul, and Paulina each own a whole life insurance policy. Which person would not be able to accelerate the benefits under their policy? Terry, who has cancer and a six-month life expectancy Bella, who has multiple sclerosis Raul, who became permanently disabled following a work accident Paulina, who was injured in a car accident but is expected to return to work in a month -✔✔ Paulina, who was injured in a car accident but is expected to return to work in a month Horace buys a Medicare supplement insurance policy but decides not to keep it. How many days does he have to return it for a full refund of the premium? 10 14 21 30 -✔✔ 30 Medicare has a free-look period of 30 days All of the following statements about annuities are generally correct, EXCEPT: Annuities are not life insurance. Annuities are sold by life insurance agents and are issued by life insurance companies. The historic purpose of annuities is to create estates over a certain period. An annuity converts a sum of money into a series of income payments. -✔✔ the historic purpose of annuities is to create estates over a certain period If a retired worker's total combined income, including one-half of his or her Social Security benefit, exceeds a threshold amount, then up to what percentage of benefits exceeding the threshold are taxable? 0 percent 50 percent 85 percent 100 percent -✔✔ 85% Gene is injured while on vacation. His employer's group disability plan pays benefits for over two years but reduces the amount paid by the benefits he receives under an individual disability policy. What kind of group coverage does Gene have? group short-term disability plan group occupational plan group long-term disability plan group partial disability plan -✔✔ group long-term disability plan these are occupational or non-occupational Nick's policy has been canceled and Nick has paid a premium that was not due. Under the cancellation provision, what must the insurer do? The insurer can apply the premium to other coverage owned by the insured. The insurer must return it to Nick. The insurer can keep it. Nothing unless the insured files a claim for the amount owed. -✔✔ the insurer must return it to Nick All of the following are prohibited insurer practices EXCEPT: accessing the MIB records on an applicant without the applicant's approval declining an application for life insurance based on genetic testing information obtained on the proposed insured. failing to notify a life insurance applicant that her application was declined because of information obtained in a credit report. investigating insurance applicants -✔✔ investigating insurance applicants The four shareholders of ABC Corporation each own a $1,000,000 interest in the company and enter into a stock redemption agreement. One of the shareholders dies six months later. All the following statements regarding this scenario are correct EXCEPT: The three remaining shareholders must negotiate the purchase of the deceased owner's interest from his estate. ABC Corporation will use the death benefit to buy the deceased owner's interest from his estate. Each of the surviving shareholders will then own a one-third share of ABC Corporation. The insurer will pay the $1,000,000 death benefit from the deceased owner's policy to ABC Corporation. -✔✔ the three remaining shareholders must negotiate the purchase of the deceased owner's interest from his estate An insured reports a claim for a covered loss more than three weeks after the loss occurred. What should the agent do when reporting the claim to the insurer? Send a notarized copy of the loss notice by registered mail to the insurer. Determine the reason for the delay and report it to the insurer. Advise the insured that the claim can no longer be paid. Backdate the report to the date of the loss. -✔✔ determine the reason for the delay and report it to the insurer normally, a covered loss must be reported in 20 days John's child must have his teeth straightened. His group dental policy covers 60 percent of orthodontic care, 100 percent of endodontic care, and 75 percent of periodontal care. What percentage of costs will the insurer pay for the child's care? 50 percent 60 percent 75 percent 100 percent -✔✔ 60% A return of premium rider is generally available only with: term life insurance policies whole life insurance policies adjustable life insurance policies variable life insurance policies -✔✔ term life insurance [Show More]

Last updated: 2 years ago

Preview 1 out of 46 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

WebCE Bundled Exams Questions and Answers (2022/2023) Full Solution Pack Complete

WebCE Bundled Exams Questions and Answers (2022/2023) Full Solution Pack Complete

By Crescent 2 years ago

$20

12

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

May 23, 2023

Number of pages

46

Written in

All

Additional information

This document has been written for:

Uploaded

May 23, 2023

Downloads

0

Views

141

Answered 2023.png)