Claims Adjuster > QUESTIONS & ANSWERS > Texas All Lines Adjuster Laws & Regulation Review Questions and Answers 100% Pass (All)

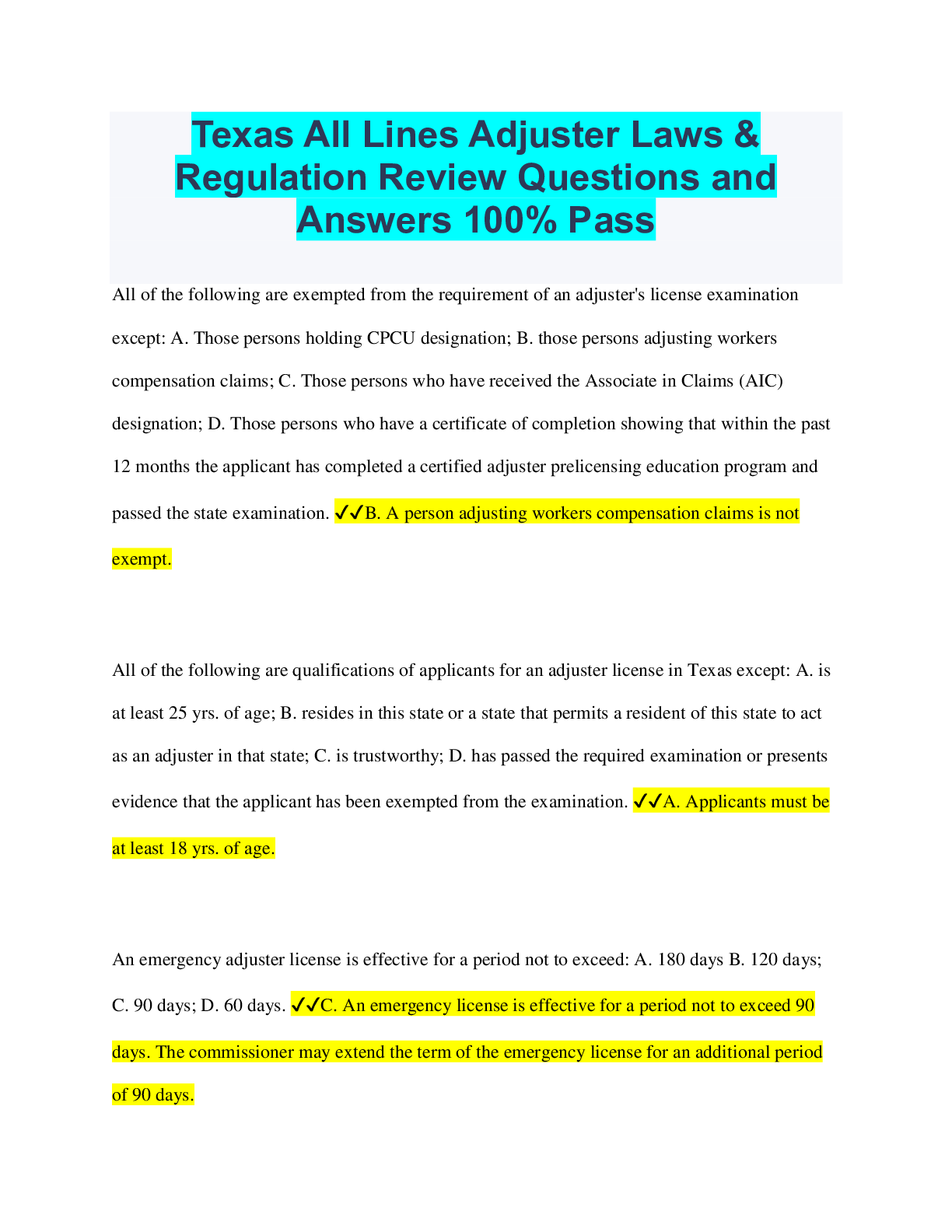

Texas All Lines Adjuster Laws & Regulation Review Questions and Answers 100% Pass All of the following are exempted from the requirement of an adjuster's license examination except: A. Those perso ... ns holding CPCU designation; B. those persons adjusting workers compensation claims; C. Those persons who have received the Associate in Claims (AIC) designation; D. Those persons who have a certificate of completion showing that within the past 12 months the applicant has completed a certified adjuster prelicensing education program and passed the state examination. ✔✔B. A person adjusting workers compensation claims is not exempt. All of the following are qualifications of applicants for an adjuster license in Texas except: A. is at least 25 yrs. of age; B. resides in this state or a state that permits a resident of this state to act as an adjuster in that state; C. is trustworthy; D. has passed the required examination or presents evidence that the applicant has been exempted from the examination. ✔✔A. Applicants must be at least 18 yrs. of age. An emergency adjuster license is effective for a period not to exceed: A. 180 days B. 120 days; C. 90 days; D. 60 days. ✔✔C. An emergency license is effective for a period not to exceed 90 days. The commissioner may extend the term of the emergency license for an additional period of 90 days. A licensed adjuster must notify the commissioner if the adjuster changes the location of the adjuster's place of business: A. Within 10 days; B. Within 20 days; C. Within 30 days; D. Notification must be made promptly ✔✔D. A licensed adjuster shall promptly notify the commissioner if the adjuster changes the location of the adjuster's place of business. All licensees must complete ________ hours of continuing education within each reporting period. A. 15; B. 20; C. 24; D. 30 ✔✔D. All licensees must complete 30 hours of continuing education within each reporting period. However, limited lines licensees, those selling life insurance not exceeding $15,000 and county mutual agents are required to comlete 10 hours of continuing education during each reporting period. Which one of the following is not an example of an unfair claim settlement practice? A. Knowingly misrepresenting pertinent facts to claimants; B. Failing to acknowledge communication within a reasonably prompt period; C. Failing to examine a claimant under oath; D. Not attempting in good faith to promptly settle a claim when liability is clear. ✔✔C. The right to examine policyholders under oath, in the case of questionable claims or potential fraud, is a right of an insurer during a claim investigation and is part of the contractural agreement between the insurer and the insured. Failing to do so does not constitute a violation of the state's unfair claims settlement practices. A contract that provides insurance coverage for up to 30 days, pending the issuance of the permanent policy, is called a: A. binder; B. endorsement; C. lender; D. remedy ✔✔A. A binder is a contract that provides temporary insurance coverage for up to 30 days, pending the issuance of the permanent policy. Lenders must accept binders issued by properly appointed and licensed agents. What happens when a married couple who jointly owns [Show More]

Last updated: 2 years ago

Preview 1 out of 19 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Can't find what you want? Try our AI powered Search

Connected school, study & course

About the document

Uploaded On

May 31, 2023

Number of pages

19

Written in

All

This document has been written for:

Uploaded

May 31, 2023

Downloads

0

Views

118

Scholarfriends.com Online Platform by Browsegrades Inc. 651N South Broad St, Middletown DE. United States.

We're available through e-mail, Twitter, Facebook, and live chat.

FAQ

Questions? Leave a message!

Copyright © Scholarfriends · High quality services·