Week 8 Final Exam

Week 8 : Final Exam - Final Exam

4. (TCO 4) Sandy mails a letter back to Andrea that she has signed; the letter makes reference to a car

6. (TCO 6)

...

Week 8 Final Exam

Week 8 : Final Exam - Final Exam

4. (TCO 4) Sandy mails a letter back to Andrea that she has signed; the letter makes reference to a car

6. (TCO 6) Explain the function and purpose of an administrative agency. At what level of government do we find agencies, and how and by whom or what are they empowered to do what they do? (Points : 20)

7. (TCO 7) SoftWorld Products, Inc. develops, patents, and markets a new software program that is I

8. (TCO 8) Your Company, Inc. wants to do business with My Company, LLC. Because our companies moves barriers to e-commerce by giving the same legal effect to e-records and e-signatures as to paper documents and signatures. The UETA it does not include rules for those transactions.

9. (TCO 9) Agency law plays a big part in corporate responsibility (and liability). Differentiate between an An employee works directly for a company or another person and answers to an employer/manager. An independent contractor may work for a company or another person (or multiple companies/people) and accept direction, but this worker ultimately has more control over the work he or she accepts and how, when, and where it is produced. Employees often stay with one employer for an extended period of time, while an independent contractor will usually only work for a company on a single project or for a short time, though there are exceptions. In the United States, freelancers, sole proprietors, and independent contractors are all considered self-employed and therefore subject to self-employment tax. Employers must withhold a portion of their employees' salaries/wages for payroll taxes.

An agent must obey reasonable instructions given by the Principal. The Agent must not do acts that have not been expressly or impliedly authorized by the Principal. The Agent must use reasonable care and skill in performing the duties. Most importantly, the Agent must be loyal to the Principal. The Agent must refrain from putting herself in a position that would ordinarily encourage a conflict between the agents own interests and those of the principal.

The principal-agent problem or agency dilemma treats the difficulties that arise under conditions of incomplete and asymmetric information when a principal hires an agent. Various mechanisms may be used to try to align the interests of the agent with those of the principal, such as piece rates/commissions, profit sharing, efficiency wages, performance measurement including financial statements, the agent posting a bond, or fear of firing. The principal-agent problem is found in most employer/employee relationships, for example, when stockholders hire top executives of corporations. Numerous studies in political science have noted the problems inherent in the delegation of legislative authority to bureaucratic agencies. The implementation of legislation (such as laws and executive directives is open to bureaucratic interpretation, creating opportunities and incentives for the bureaucrat-as-agent to deviate from the intentions or preferences of the legislators. Variance in the intensity of legislative oversight also serves to increase principal-agent problems in implementing legislative preferences.

10. (TCO 10) What are the main features of a traditional corporation? What are the main features of a Limited Liability Company? What are the similarities and differences we can look to when trying to determine which entity will best suit our needs in a given situation? In the context of entity selection, discuss the main features of these two entities and compare the liability that a corporation would be exposed to as it relates to shareholders/owners of a corporation as opposed to the members of a limited liability company (LLC). Would your choice change if the situation involved an act of fraud? Why or why not? (Points : 20)

Traditional Corporationis a separate entity that has its own rights and responsibilities. In forming a corporation, potential shareholders offer money and/or property in exchange for stock. The advantages of a corporation include limited liability for stockholders, unlimited life for the business, relative ease in raising capital, simple transfer of ownership through the sale of stock and tax-free benefits to the owner/employees. The disadvantages of a corporation include complexity, limitations on activities by the corporate charter, extensive regulation and record-keeping rules, and double taxation, once on corporate profits and again on dividends.

The LLC is an alternative type of business entity. An LLC is like a corporation regarding limited liability, and it’s like a partnership regarding the flexibility of dividing profit among the owners. An LLC can elect to be treated either as a partnership or as a corporation for federal income tax purposes. Consult a tax expert if you’re facing this choice. The key advantage of the LLC legal form is its flexibility, especially regarding how profit and management authority are determined. For example, an LLC permits the founders of the business to put up, say, only 10 or 20 percent of the money to start a business venturebut to keep all management authority in their hands. The other investors share in profit but not necessarily in proportion to their invested capital. LLCs have a lot more flexibility than corporations, but this flexibility can have a downside. The owners must enter into a very detailed agreement that spells out the division of profit, the division of management authority and responsibility, their rights to withdraw capital, and their responsibilities to contribute new capital as needed.

Well, it would be changed if the situation got bigger because of the fraud. However, if the company’s running well even if there is a fraud the company continues to venture and come up with a better plan for avoiding fraud.

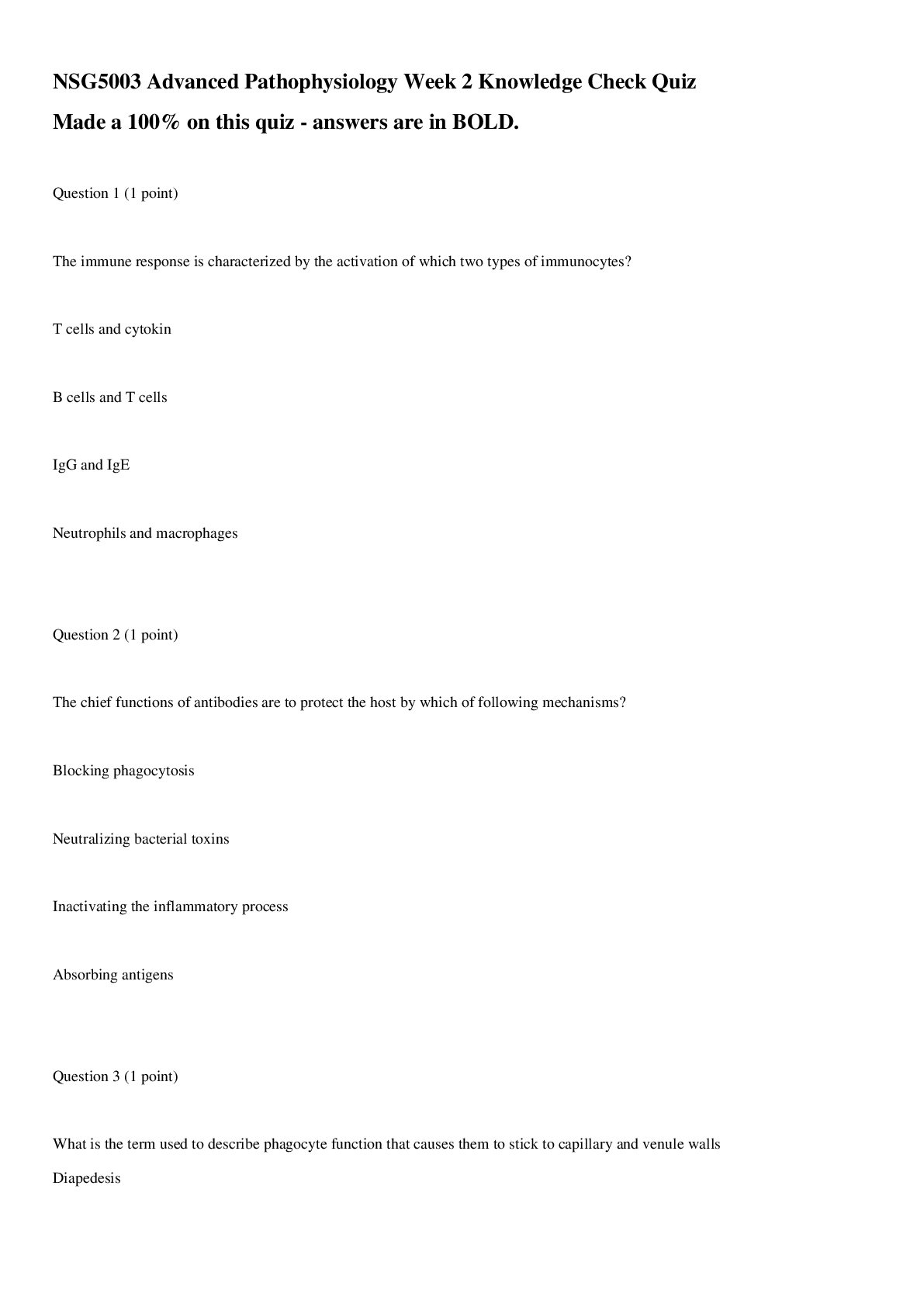

1. (TCO 5) An appliance seller promised a restaurant owner that a home dishwasher would fulfill the dishwashing requirements of a large restaurant. The dishwasher was purchased but it was not powerful enough for the restaurant. Under the Sales Article of the UCC, what warranty was violated? (Points : 10)

The implied warranty of marketability.

The implied warranty of merchantability.

The express warranty that the goods conform to the seller's promise.

The express warranty against infringement.

2. (TCO 5) EG Door Co., a manufacturer of custom exterior doors, verbally contracted with Art Contractors to design and build a $2,000 custom door for a house that Art was restoring. After EG had completed substantial work on the door, Art advised EG that the house had been destroyed by fire and Art was canceling the contract. EG finished the door and shipped it to Art. Art refused to accept delivery. Art contends that the contract cannot be enforced because it violated the Statute of Frauds by not being in writing. Under the Sales Article of the UCC, is Art's contention correct? (Points : 10)

Yes, because the contract was not in writing.

Yes, because the contract cannot be fully performed due to the fire.

No, because the goods were specially manufactured for Art and cannot be resold in EG's regular course of business.

No, because the cancellation of the contract was not made in writing.

3. (TCO 5) High sues the manufacturer, wholesaler, and retailer for bodily injuries caused by a power saw High purchased. Which of the following statements is correct under strict liability theory? (Points : 10)

Contributory negligence on High's part will always be a bar to recovery.

The manufacturer will avoid liability if it can show it followed the custom of the industry.

Privity will be a bar to recovery insofar as the wholesaler is concerned if the wholesaler did not have a reasonable opportunity to inspect.

High may recover even if he cannot show any negligence was involved.

4. (TCO 8) Second Best Buy, Inc., is a retailer of small appliances. Second Best Buy gives Chase Financial Corporation a security interest in the inventory owned by Second Best Buy, Inc. Chase files a financing statement to perfect its interest. Who has higher priority in the collateral than Chase? (Points : 10)

The stockholders of Second Best Buy.

A buyer in the ordinary course of Second Best Buy's business.

A subsequent lien creditor.

A subsequent trustee in bankruptcy.

5. (TCO 8) Mars, Inc. manufactures and sells VCRs on credit directly to wholesalers, retailers, and consumers. Mars can perfect its security interest in the VCRs it sells without having to file a financing statement or take possession of the VCRs if the sale is made to _____ (Points : 10)

retailers.

wholesalers that sell to distributors for resale.

consumers.

wholesalers that sell to buyers in the ordinary course of business.

[Show More]

.png)