[Solved] Bus 495 Quiz 3

Quiz Submissions - Quiz 3

Top of Form

Delmi Funez (username: DFUNEZ)

Attempt 1

Written: Sep 14, 2018 8:13 PM - Sep 14, 2018 9:43 PM

Submission View

Your quiz has been sub

...

[Solved] Bus 495 Quiz 3

Quiz Submissions - Quiz 3

Top of Form

Delmi Funez (username: DFUNEZ)

Attempt 1

Written: Sep 14, 2018 8:13 PM - Sep 14, 2018 9:43 PM

Submission View

Your quiz has been submitted successfully.

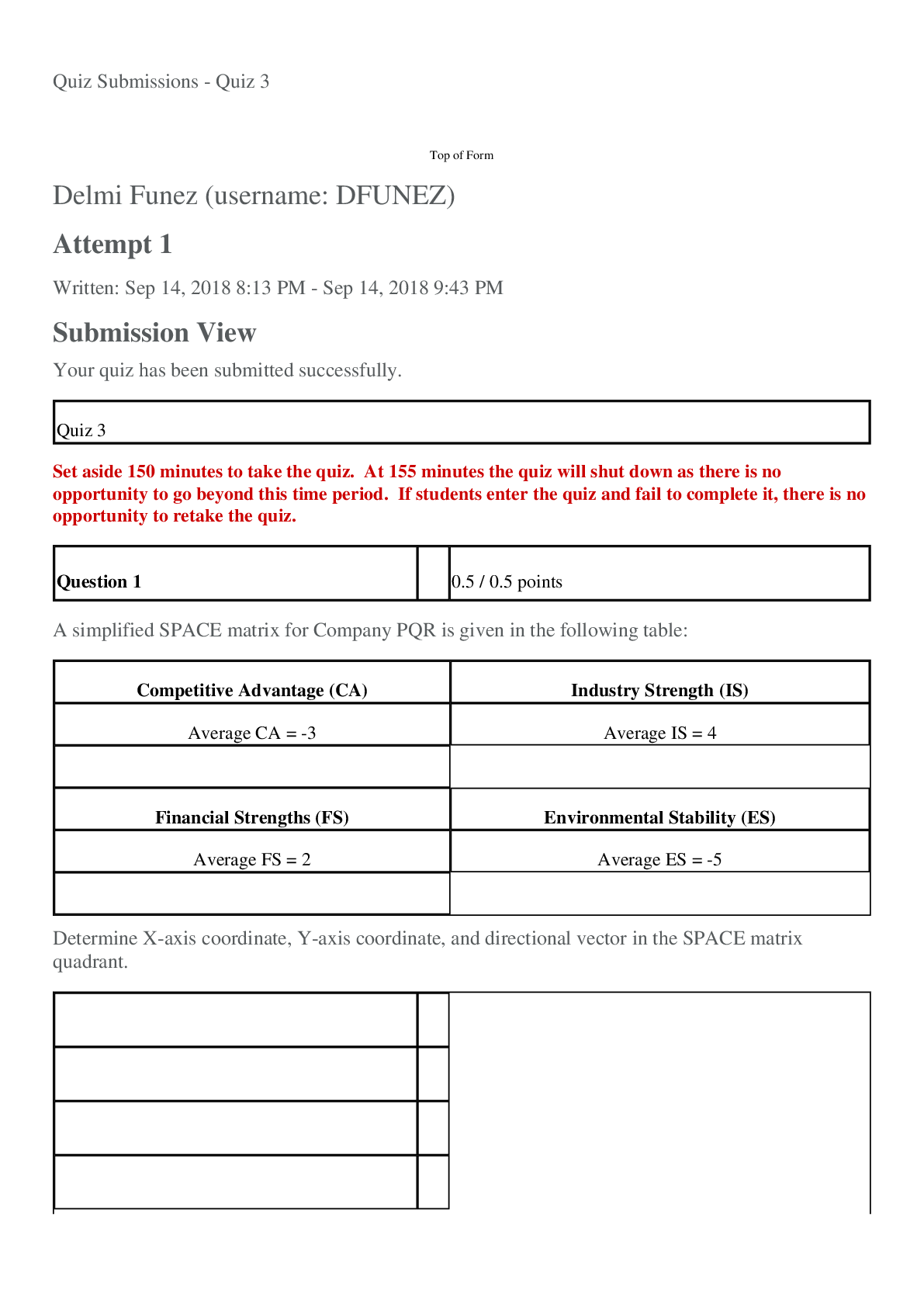

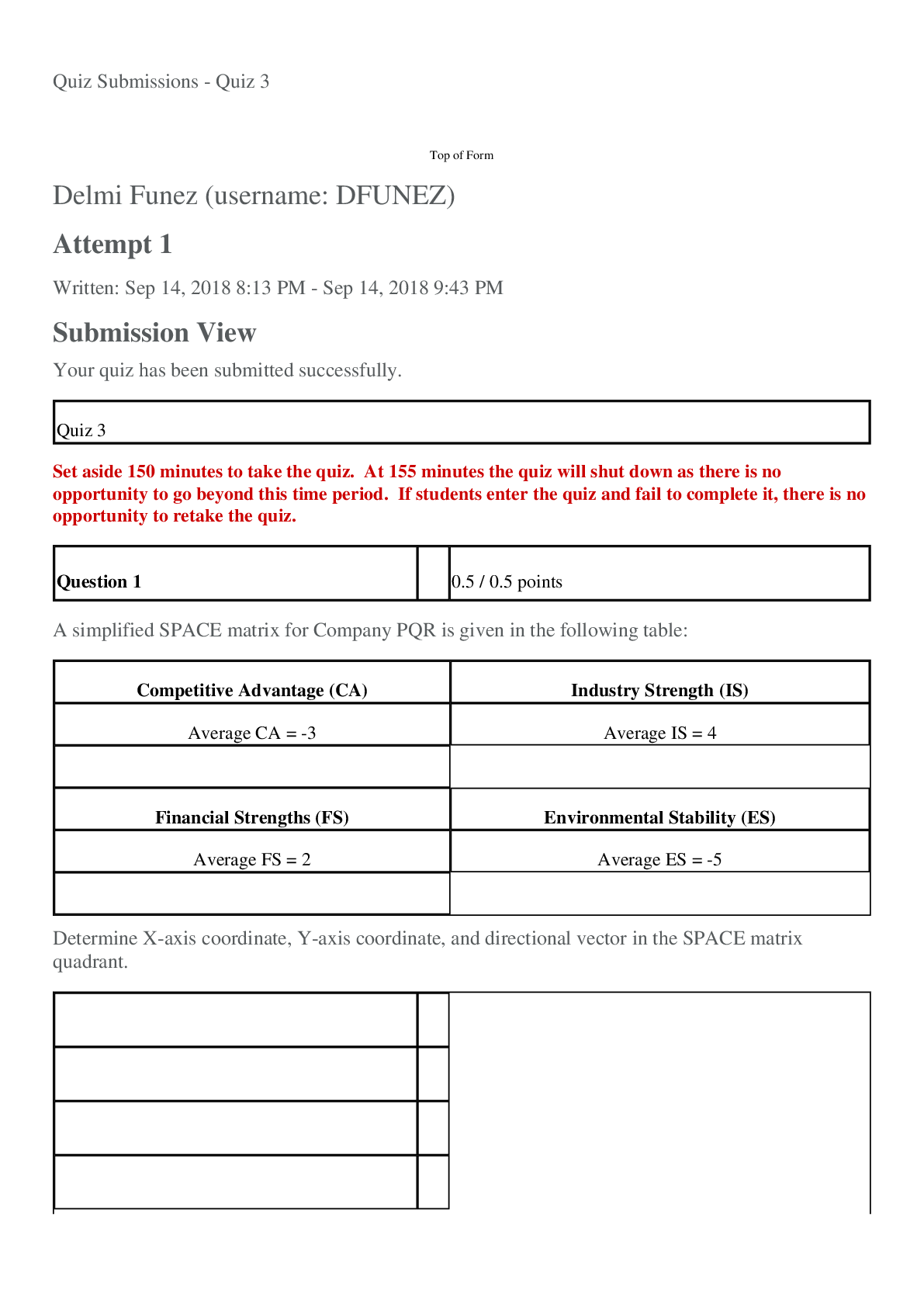

Quiz 3

Set aside 150 minutes to take the quiz. At 155 minutes the quiz will shut down as there is no opportunity to go beyond this time period. If students enter the quiz and fail to complete it, there is no opportunity to retake the quiz.

Question 1

0.5 / 0.5 points

A simplified SPACE matrix for Company PQR is given in the following table:

Competitive Advantage (CA)

Industry Strength (IS)

Average CA = -3

Average IS = 4

Financial Strengths (FS)

Environmental Stability (ES)

Average FS = 2

Average ES = -5

Determine X-axis coordinate, Y-axis coordinate, and directional vector in the SPACE matrix quadrant.

A)

X-axis coordinate = 0.5; y-axis coordinate = 1 ; Vector in Aggressive quadrant

B)

X-axis coordinate = -1; y-axis coordinate = 1 ; Vector in Conservative quadrant

C)

X-axis coordinate = -3 ; y-axis coordinate = 1; Vector in Competitive quadrant

D)

X-axis coordinate = 1; y-axis coordinate = -3; Vector in Competitive quadrant

Question 2

0.5 / 0.5 points

Financial Strength (FS) factors and Competitive Advantage (CA) factors are ___________ factors in a SPACE matrix, whereas Environmental Stability (ES) factors and Industry Strength (IS) factors are ________________ factors in a SPACE matrix.

A)

External, external

B)

External, internal

C)

Internal, external

D)

Internal, internal

Question 3

0.5 / 0.5 points

SPACE matrix is the acronym for:

A)

Statistical Process and Analytic Evaluation matrix

B)

Strategic Position and Action Evaluation matrix

C)

Scientific Process and Artistic Evaluation matrix

D)

Streaming Procedure and Assessment Evaluation matrix

Question 4

0 / 0.5 points

Company PQS has 5 product lines E, F, G, H and K. The industry growth rates of these product lines are given in the table. Assume that the growth rate of 8% is used as the base line in BCG analysis. Determine the industry growth rate relative to the baseline growth rate.

Product lines

Industry growth rate

Industry growth rate relative to base-line growth rate: Below or above

Product line E

5%

Product line F

12%

Product line G

9%

Product line H

13%

Product line K

7%

A)

Below, below, below, above, below

B)

Below, below, above, above, below

C)

Below, above, above, above, below

D)

Below, above, below, above, below

Question 5

0 / 0.5 points

A hunting accessory company, ABC has the product line xyz with a relative market share of 0.15. Assume that the industry growth rate is 5%. The strategic planner intends to evaluate the product line using a BCG. The strategic planner assumes the base-line growth rate is at 3%, and the medium market share is 0.5 in that industry.

In the BCG matrix for hunting accessory industry, product line xyz is located in the quadrant of __________.

A)

Dog

B)

Star

C)

Question mark

D)

Cash cow

Question 6

0 / 0.5 points

An electronic appliance company, EFG has 4 product lines with the relative market shares and industry growth rate given in the following table. The assumptions made by the strategic planner are: Base-line growth rate is at 5%, and the medium market share is set at 0.5 in the BCG matrix.

Determine the respective quadrants in the BCG analysis for these product lines.

Product lines

Relative market share

Industry growth rate

BCG quadrant

Product line 1

0.45

6%

Product line 2

0.65

4%

Product line 3

0.7

10%

Product line 4

0.3

2%

A)

Cash cow, question market, dog, star

B)

Question mark, star, cash cow, dog

C)

Question mark, cash cow, star, dog

D)

Dog, star, cash cow, question mark

Question 7

0 / 0.5 points

The strategic researcher uses the value of 0.5 to determine the medium level of the relative market share. Determine the quadrants in the BCG for the product lines (1), (2), (3) and (4) in their respective BCG matrices.

Product line

Expected revenues

Company NPQ relative market share

Industry growth rate

Base-line growth line

Quadrant in respective BCG matrix

Company NPQ

Largest competitor

Product line (1)

$15,000

$32,000

0.47

12%

10.00%

Product line (2)

$40,000

$45,000

0.89

8%

5.00%

Product line (3)

$38,000

$40,000

0.95

7%

10.00%

Product line (4)

$14,000

$32,000

0.44

6%

7.00%

A)

Product line (3): Cash cow, and product line (4) Dog

B)

Product line (3) and product line (4): Dogs

C)

Product line (2) and product line (3): cash cow

D)

Product line (1): Star

Question 8

0.5 / 0.5 points

The following table is a partial SPACE matrix. Determine the average (FS), the average (ES), and coordinate for the Y axis.

Financial Strengths (FS)

Environmental Stability (ES)

Return on equity

3

Technological changes

-5

Liquidity ratios

2

Inflation rate

-2

Cash flow

3

Price elasticity of demand

-3

Inventory turnover

4

Risk involved in business

-4

Average of FS

Average of ES

Sum for Y axis coordinate:

A)

Average FS = 3; Average ES = -3.5; Sum for Y axis = -0.5

B)

Average FS = 3; Average ES = -2; Sum for Y axis = 1

C)

Average FS = -1 ; Average ES = 2; Sum for Y axis = 1

D)

Average FS = 2; Average ES = -2.5; Sum for Y axis = -0.5

Question 9

0 / 0.5 points

Factors that can be classified as "Industry strengths" factors in a SPACE matrix may include:

A)

Inventory turnover ratios, barriers to entry, productivity, labor force utilization

B)

Capacity utilization, inventory turnover ratios, product life cycle, leverage ratios

C)

Resource utilization, capacity utilization, ease of entry into market, growth potential

D)

Inventory turnover ratios, product life cycle, growth potential, barriers to entry

Question 10

0.5 / 0.5 points

Company XYZ that manufactures TV's has three key competitors and a group of relatively small competitors in that industry.

Per BCG matrix conceptual requirements, what are the relative market shares of Company XYZ, ABC, DEF, GHK and remaining group of companies?

Companies

Market share

Relative market share per BCG conceptual requirement

Company XYZ

15%

Company ABC

23%

Company DEF

25%

Company GHK

28%

Remaining group of companies

9%

Total

100%

A)

0.54; 0.82; 0.87; 1.25; 0.30

B)

0.54; 0.82; 0.89; 1.12; 0.32

C)

0.54; 0.80; 0.91; 1.03; 0.32

D)

0.60; 0.82; 0.88, 1.2; 0.32

Question 11

0.5 / 0.5 points

Factors that can be classified as "Competitive advantage" factors in a SPACE matrix may include:

A)

Market share, product quality, product life cycle, control over suppliers

B)

Product quality, ease of entry into market, risk involved in business, technological change

C)

Market share, price elasticity of demand, risk involved in business, liquidity ratios

D)

Product quality, product life cycle, risk involved in business, rate of inflation

Question 12

0.5 / 0.5 points

Company ABC has 5 product lines M, N, Q, R and S. The industry growth rates for each of these product lines are given in the table below. Assume a growth rate of 10% is used as the base line in a BCG analysis. Determine the industry growth rate relative to the baseline growth rate.

Product lines

Industry growth rate

Industry growth rate relative to base-line growth rate: Below or above

Product line M

3%

Product line N

12%

Product line Q

6%

Product line R

15%

Product line S

20%

A)

Above; below; above; above; below

B)

Below; above; below; above; above

C)

Below; above; above; above; below

D)

Below; below; above; below; above

Question 13

0 / 0.5 points

Company X has 4 key competitors and a group of relatively small competitors in the steel industry. The revenues of the companies in the steel industry are given in the following table.

Companies

Corporate revenues

Relative market share per BCG conceptual requirement

Company XYZ

$150,000

Company ABC

$200,000

Company DEF

$180,000

Company GHK

$170,000

Remaining companies in the steel industry

$100,000

Total

$800,000

A)

0.75; 1.11; 0.90; 0.85; 0.50

B)

0.75; 0.90; 0.98; 0.82; 0.65

C)

0.06; 0.25; 0.22; 0.21; 0.12

D)

0.72; 0.90; 0.85; 0.80; 0.45

Question 14

0.5 / 0.5 points

The following table is a partial SPACE matrix. Determine the average (CA), the average (IS) and coordinate on the X axis.

Internal Strategic Position

External Strategic Position

Competitive Advantage (CA)

Industry Strength (IS)

Product quality

-1

Growth potential

3

Market share

-3

Profit potential

4

Product life cycle

-2

Capacity utilization

2

Control over suppliers

-2

Barriers to entry into market

3

Average of CA

Average of IS

Sum for X axis coordinate:

A)

Average of CA = + 2; Average of IS = -4; Sum for X axis coordinate = 2

B)

Average of CA = - 2 ; Average of IS = 3; sum for X axis coordinate = 1

C)

Average of CA = +3; Average of IS = - 2; Sum for X axis coordinate = 1

D)

Average of CA = -4 ; Average of IS = 3 ; sum for X axis coordinate = -1

Question 15

0 / 0.5 points

Company NPQ has 4 product lines in the industry. The following data is found in the corporate reports and the expected growth is based on the corporate forecast. The strategic planner at Company NPQ is tasked to prepare the BCG matrix in the appropriate quadrants to illustrate the relative positioning of the product lines.

Determine the expected revenues of these product lines for the NPQ and that of its largest competitor so that you can help the strategic planner to predict:

Product line

Last year's revenues

Expected growth rate in revenue

Expected revenues

Company NPQ

Largest competitor

Company NPQ

Largest competitor

Company NPQ

Largest competitor

Product line (1)

$200,000

$250,000

10%

12%

Product line (2)

$150,000

$160,000

8%

7%

Product line (3)

$120,000

$100,000

5%

10%

Product line (4)

$80,000

$85,000

6%

5%

A)

Expected revenues of Product (4): Company NPQ = $84,000; Largest competitor = $89,000

B)

Expected revenues of Product (3): Company NPQ = $125,000; Largest competitor = $110,000

C)

Expected revenues of Product (1): Company NPQ = $210,000; Largest competitor = $300,000

D)

Expected revenues of Product (2): Company NPQ = $162,000; Largest competitor = $171,000

Question 16

0 / 0.5 points

The combined values of Financial Strengths (FS) factors and Environmental Stability (ES) factors are used to determine the coordinates on the ______________ axis, while the combined values of Competitive Advantage (CA) factors and Industry Strength (IS) factors are used to determine the coordinates on the ______________ axis.

A)

Y axis (also known as horizontal axis), X axis (also known as vertical axis)

B)

X axis (also known as vertical axis), Y axis (also known as horizontal axis)

C)

X axis (also known as horizontal axis), Y axis (also known as vertical axis)

D)

Y axis (also known as vertical axis), X axis (also known as horizontal axis)

Question 17

0.5 / 0.5 points

Factors that can be classified as "Environmental stability" factors in a SPACE matrix may include:

A)

Technological change, working capital, corporate market share, profit potential

B)

Technological change, demand variability, leverage ratios, product quality

C)

Inflation, technological change, demand variability, price elasticity of demand

D)

Inflation, taxation, barriers to entry, return on investment

Question 18

0.5 / 0.5 points

Financial Strength (FS) factors and Industry Strength (IS) factors are assigned using ____________ values in a SPACE matrix, while Competitive Advantage (CA) factors and Environmental Stability (ES) factors are assigned using ___________ values.

A)

Negative, positive

B)

Negative, negative

C)

Positive, negative

D)

Positive, positive

Question 19

0.5 / 0.5 points

Factors that can be classified as "Financial strengths" factors in a SPACE matrix may include:

A)

Return on assets, customer loyalty, technological change, cash flow

B)

Return on assets, working capital, cash flow, leverage ratios

C)

Return on investment, working capital, technological change, product quality

D)

Leverage ratios, inventory turnover ratios, working capital, product life cycle

Question 20

0 / 0.5 points

A SPACE matrix is a ____________ analytic tool whereas SWOT analysis is a ____________ analytic tool.

A)

Quantum; qualitative

B)

Quantitative; quantitative

C)

Quantitative; qualitative

D)

Qualitative; quantitative

Bottom of Form

[Show More]